|

市场调查报告书

商品编码

1689718

超低温冷冻机:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Ultra-Low Temperature Freezers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

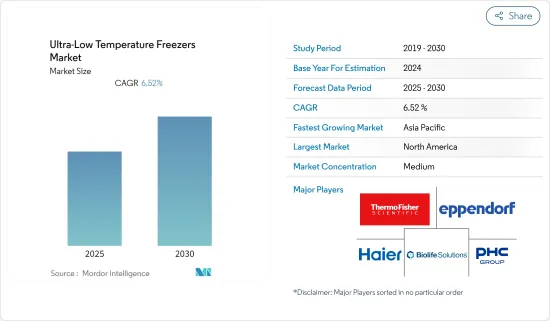

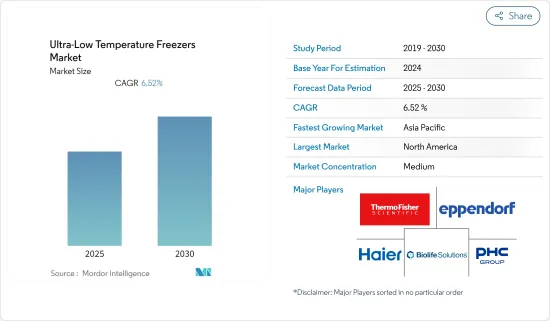

预计超低温 (ULT) 冷冻机市场在预测期内的复合年增长率将达到 6.52%。

超低温冰箱在大量 COVID-19 疫苗的储存和分发中发挥了关键作用,这些疫苗需要超低温条件,因此 COVID-19 对市场成长的影响很大。例如,根据2022年2月发表在《人类疫苗与治疗学杂誌》上的一篇论文,食品药物管理局(FDA)的指南规定,辉瑞-BioNTech的mRNA COVID-19疫苗BNT162b2在接受后应在-80°C至-60°C的超低温冷冻库中保存长达六个月。因此,建议将 COVID-19 疫苗储存在超低温冷冻库中的指南对市场成长产生了重大影响。因此,COVID-19 在疫情初期就影响了超低温冰箱的使用。不过,疫情目前已经消退,超低温冰箱的采用率已恢復到疫情前的水准。因此,预计研究市场在研究预测期内将经历疫情前的成长水准。

推动市场成长的因素包括生物库、药物发现和生命科学研究中的应用不断增加,以及超低温冰箱的技术进步。

生物库中越来越多地使用超低温冰箱来储存生物样本是推动市场成长的一个主要因素。例如,根据《快速透明出版杂誌》2022 年 9 月发表的报导,乌干达马凯雷雷大学的 H3Africa 乌干达综合生物库 (IBRH3AU) 是东非首批拥有 20 台超低温 (ULT)冷冻库柜的冷冻库农场的生物库之一。此生物库的超低温冰箱可将样本保存在-70°C至-80°C之间,容量为50,400个2毫升管瓶,确保生物样本得到妥善保存。因此,生物库中超低温冷冻机的采用有望促进市场成长。

此外,2021年6月,赛默飞世尔科技推出了赛默飞世尔科技TSX系列超低温冰箱。这些冷冻库的另一个好处是,它为研究、製药、临床、生物检体资料库和工业实验室提供了安全保障,以环境永续的方式保护疫苗、细胞培养基、生技药品和试剂等材料。同样,2022年10月,赛默飞世尔科技也宣布推出赛默飞世尔科技TDE系列-80°C立式冷冻柜。因此,主要市场参与企业推出的各种技术先进的超低温冷冻机也有望透过增加其使用量来推动市场发展。

因此,由于上述因素,例如生物库中超低温冰箱的采用率不断提高以及主要市场参与企业推出的产品不断增加,预计市场在预测期内将呈现成长。然而,超低温冷冻机的高成本以及超低温冷冻机的严格监管问题可能会阻碍市场成长。

超低温冷冻机的市场趋势

预计在预测期内,立式超低温冷冻机将占据相当大的市场占有率。

直立式超低温冰箱具有开启后快速冷却、方便取用和可单独定制隔间以供常规使用等特点。然而,卧式超低温冷冻机可以安全地长期储存不常用的物品,让您可以将卧式超低温冷冻机用于特定目的。直立式超低温冰箱(ULT 冰箱)的温度范围通常为 -40°C 至 -86°C,用于储存药品、酵素、化学物质、病毒、细菌、细胞製剂、组织样本等。立式 ULT 冰箱的这些优势预计将在不久的将来推动此类冷冻库的普及。

此外,生物库的增加和与直立式 ULT冷冻相关的技术进步预计将促进该领域的成长。例如,2023 年 3 月,南非推出了一个中央生物库网路—南非生物多样性生物库 (BBSA)。该网路旨在将先前分布在南非各地的 7 个机构和 22 个不同的生物库联合起来,以储存和管理生物多样性样本。同样,沙乌地阿拉伯于2022年12月推出了国家生物库,以加强其公共卫生系统。这有望加强国家卫生安全,提高感染疾病和非感染疾病控制计画和控制的有效性,并有效促进沙乌地阿拉伯的研究、开发和创新议程的推进。

此外,药物和疫苗研发活动的激增也推动了该领域的成长。例如,根据 ClinicalTrials.Gov 于 2023 年 5 月 30 日更新的资料,估计有 1,946 项针对该疫苗的活跃临床试验。预计未来几年将推出几种处于临床试验阶段的疫苗,这些疫苗可能需要超低温条件来储存和运输成分。

因此,所有上述因素,例如生物库的增加、垂直超低温冷冻机的技术进步以及药物临床测试的增加,预计都将增加对立式超低温冷冻机的需求,从而促进该领域的成长。

预计北美将在预测期内占据主要市场份额

由于生物库、製药公司和生物技术公司的存在,北美预计将占据超低温冷冻机市场的很大份额。

预计活性化的研发活动和政府对细胞治疗方法和疫苗的支持将推动市场成长。例如,2023 年 3 月,Jubilant HollisterStier 从加拿大政府获得 2,380 万美元的策略创新资金,用于提高其包括 mRNA 在内的各种疫苗的生产能力和年度填充能力。因此,随着该国疫苗研发的活跃,以及疫苗研发早期阶段通常需要超低温,预计对超低温冰箱的需求将会增加。

此外,技术先进的超低温冷冻机的高采用率和主要市场参与企业推出的产品预计将推动整个区域市场的成长。例如,2022 年 10 月,赛默飞世尔科技宣布将把 ThermoScientific TDE 系列 -80°C 直立式冷冻机添加到其超低温 (ULT) 绿线中。

预计在预测期内,市场参与企业在 ULTF 供应方面的合作将不断加强,从而推动市场向前发展。例如,2021 年 2 月,北美 PHC 公司 (PHCNA) 和 Middleby 公司旗下的 Follett Products, LLC (Follett) 宣布建立伙伴关係,向 Follett 的医疗保健客户分销 PHCbiline 医药级冰箱和生物医学冷冻库(超低温 (ULT)冷冻库)。

因此,所有上述因素,例如疫苗研发活动的活性化、市场参与企业向新兴国家扩张等,预计都将增加对超低温冷冻库的需求,从而在预测期内推动市场成长。

超低温冷冻机产业概况

市场竞争激烈,多家公司参与竞争。市场的主要企业包括赛默飞世尔科技公司、PHC Holdings Corporation、海尔智慧家居(海尔生物医疗)、Eppendorf SE 和 BioLife Solutions, Inc.

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 在生物库、药物研发和生命科学研究的应用日益增多

- 超低温冷冻机的技术进步

- 市场限制

- 超低温冷冻机高成本

- 超低温冷冻机的严格监管问题

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 依产品类型

- 直立式超低温冰箱

- 卧式超低温冰箱

- 按最终用户

- 生物样本库

- 製药和生物技术公司

- 学术和研究机构

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会国家

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章竞争格局

- 公司简介

- Thermo Fisher Scientific Inc.

- PHC Holdings Corporation

- Haier Smart Home Co., Ltd(Haier Biomedical)

- Arctiko

- Helmer Scientific Inc

- Eppendorf SE

- Abzil Telstar SL

- Labcold Ltd.

- Bionics Scientific Technologies(P)Ltd

- BioLife Solutions, Inc.

第七章 市场机会与未来趋势

The Ultra-Low Temperature Freezers Market is expected to register a CAGR of 6.52% during the forecast period.

The impact of COVID-19 on the market's growth was substantial as ultra-low temperature freezers played a crucial role in the storage and distribution of large amounts of COVID-19 vaccines that required ultra-cold conditions. For instance, according to the article published in the Journal of Human Vaccines and Therapeutics in February 2022, according to the Food and Drug Administration (FDA) guidelines, the Pfizer-BioNTech mRNA COVID-19 vaccine BNT162b2 required to be stored in ultra-low temperature-freezers -80°C to -60°C for up to six months after receiving. Thus, the guidelines suggesting the storage of COVID-19 vaccines in ultra-low temperature freezers significantly impacted the market growth. Thus, COVID-19 has impacted the usage of ultra-low temperature freezers during the initial pandemic. However, as the pandemic has currently subsided, the adoption of ultra-low temperature freezers is taking place at pre-pandemic levels. Thus, the studied market is expected to have pre-pandemic levels of growth during the forecast period of the study.

Factors that are responsible for the market growth includes rising applications in bio-banks, drug discovery and life-sciences research, and technological advancement in ultra-low temperature freezers.

The increased usage of ultra-low temperature freezers to store biological samples in bio-banks is a major factor propelling the market's growth. For instance, according to an article published by the Journal of Rapid and Transparent Publishing in September 2022, the Integrated Biorepository of H3Africa Uganda (IBRH3AU) at Makerere University in Uganda is one of the first biobanks of its kind in Eastern Africa which has freezer firm that is equipped with 20 ultra-low temperature (ULT) freezers. The source also stated that the biobank's ultra-low temperature freezers were capable of storage from -70°C to -80°C and had a capacity of 50,400 2 ml vials each which allowed them to store biological samples properly. Thus, the adoption of ultra-low temperature freezers in biobanks is expected to increase market growth.

Additionally, in June 2021, ThermoFisher Scientific Inc. launched the ThermoScientific TSX Series Ultra-Low Temperature (ULT) Freezers. These freezers included additional functionality to provide research, pharmaceutical manufacturing, clinical, biorepository, and industrial laboratories with safeguards to deliver environmentally sustainable protection of materials, such as vaccines, cell culture media, biologics, and reagents. Similarly, In October 2022, ThermoFisher Scientific Inc. also announced the launch of Thermo Scientific TDE Series -80°C Chest Freeze in the market. Thus, the launch of various technologically advanced ultra-low temperature freezers by key market players is also expected to boost the market, as it would increase their usage.

Thus, owing to the abovementioned factors such as the increasing adoption of ultra-low temperature freezers in biobanks, and the rising product launches by major market players, the market is expected to show growth over the forecast period. However, high costs associated with ultra-low temperature freezers and stringent regulatory issues regarding ultra-low temperature freezers may hinder the growth of the market.

Ultra Low Temperature Freezer Market Trends

Upright ULT Freezers Segment is Expected to Hold a Significant Market Share Over the Forecast Period

The upright ULT freezer enables quick cooling after opening, simple access, and individually customizable inner compartments for regular usage. However, less used items can be stored in a chest ULT freezer safely for an extended period of time that, allows the usage of the chest ULT for specific purposes. Upright ultra-low temperature freezers (ULT freezers) typically have a temperature range of -40°C to -86°C and are used to store drugs, enzymes, chemicals, viruses, bacteria, cell preparations, and tissue samples. Such advantages offered by upright ULTs are anticipated to boost the adoption of these freezers in the near future.

Additionally, an increasing number of biobanks and technological advancements related to upright ULT freezers are expected to enhance segment growth. For instance, in March 2023, South Africa launched a central biobank network, Biodiversity Biobanks South Africa (BBSA). This network aims to bring together 7 institutions and 22 different biobanks previously scattered across South Africa to conserve and manage biodiversity samples. Similarly, in December 2022, Saudi Arabia launched National Biobank to enhance the public health system. This is expected to strengthen national health security, increase the effectiveness of control programs and control of communicable and non-communicable diseases, as well as effectively contribute to the promotion of Saudi Arabia's research, development, and innovation agenda.

Moreover, the segment's growth is driven by a surge in research and development activities for pharmaceutical drugs and vaccines. For instance, according to the data updated by ClinicalTrials.Gov on 30th May 2023, there were an estimated 1,946 active clinical trials for vaccines. Several vaccines under clinical trial are expected to be launched over the coming years that may require ultra-cold conditions for storage and transportation of raw materials.

Thus, all the above factors such as the increasing number of biobanks, technological advancements in upright ultra-low temperature freezers, and the rising clinical trials for drugs are expected to increase demand for upright ULT freezers, thereby boosting the segment's growth.

North America is Expected to Hold a Significant Share in the Market Over the Forecast Period

North America is expected to hold a significant market share in the ultra-low temperature freezers market due to the presence of several biobanks, pharmaceuticals, and biotechnology companies within the region.

The growing research and development activities on cell-based therapies and vaccines and government support are expected to boost the market growth. For instance, in March 2023, Jubilant HollisterStierreceived a USD 23.8 million Strategic Innovation Fund from the government of Canada's commitment to boost its capacity for a variety of vaccines, including mRNA, as well as its yearly fill and finish capacity. Thus, with significant vaccines development activities in the country, the demand for ultra-low temperature freezers is expected to increase as ultra-low temperatures are often required in the initial stages of vaccine development.

Furthermore, the high adoption of technologically advanced ultra-low temperature freezers and product launches by major market players are expected to propel the growth of the overall regional market. For instance, in October 2022, ThermoFisher Scientific announced the addition of the ThermoScientific TDE Series -80°C Chest Freezer to their ultra-low temperature (ULT) green line.

The rising collaboration between the market players for the supply of ULTF is expected to put forward the market over the forecast period. For instance, in February 2021, PHC Corporation of North America (PHCNA) and Follett Products, LLC (Follett), a division of The MiddlebyCorporation, announced the formation of a partnership to market and sell the PHCbiline of ultra-low temperature (ULT) freezers pharmaceutical grade refrigerators, and biomedical freezers to Follett's healthcare customers.

Thus, all the factors mentioned above such as the increasing research and development activities for vaccine developments, and the rising developments by market players are expected to increase demand for ultra-low temperature freezers and boost market growth over the forecast period.

Ultra Low Temperature Freezer Industry Overview

The market studied is moderately competitive, and several companies are operating in this market. Some of the major players operating in the market include Thermo Fisher Scientific, Inc., PHC Holdings Corporation, Haier Smart Home Co., Ltd (Haier Biomedical), Eppendorf SE, and BioLife Solutions, Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Applications in Bio-Banks, Drug Discovery and Life-Sciences Research

- 4.2.2 Technological Advancement in Ultra-Low Temperature Freezers

- 4.3 Market Restraints

- 4.3.1 High Costs Associated with Ultra-Low Temperature Freezers

- 4.3.2 Stringent Regulatory Issues Regarding Ultra-Low Temperature Freezers

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product Type

- 5.1.1 Upright ULT freezers

- 5.1.2 Chest ULT freezers

- 5.2 By End User

- 5.2.1 Bio-Banks

- 5.2.2 Pharmaceutical and Biotechnology Companies

- 5.2.3 Academic and Research Laboratories

- 5.2.4 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Thermo Fisher Scientific Inc.

- 6.1.2 PHC Holdings Corporation

- 6.1.3 Haier Smart Home Co., Ltd (Haier Biomedical)

- 6.1.4 Arctiko

- 6.1.5 Helmer Scientific Inc

- 6.1.6 Eppendorf SE

- 6.1.7 Abzil Telstar S.L

- 6.1.8 Labcold Ltd.

- 6.1.9 Bionics Scientific Technologies (P) Ltd

- 6.1.10 BioLife Solutions, Inc.