|

市场调查报告书

商品编码

1689724

汽车温度控管:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Automotive Thermal Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

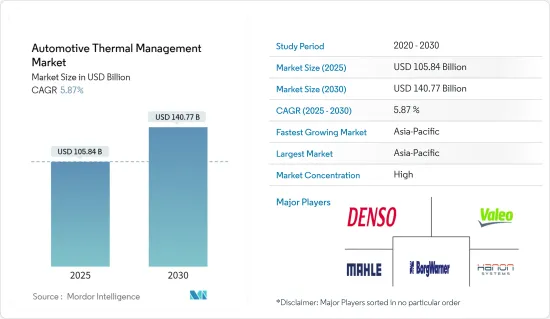

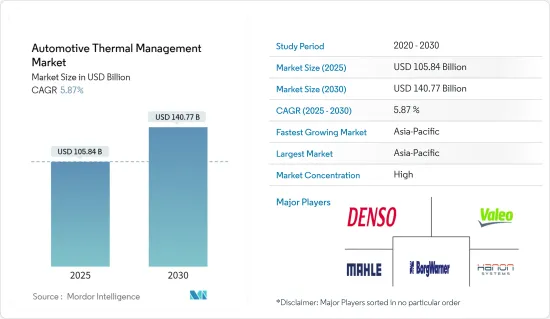

预计2025年汽车温度控管市场规模为1,058.4亿美元,2030年将达到1,407.7亿美元,预测期间(2025-2030年)的复合年增长率为5.87%。

新冠疫情期间的製造业停工、封锁和贸易限制对汽车温度控管产业产生了不利影响。此外,汽车产量下降和劳动力短缺也对市场产生了重大影响。例如,2019年全球汽车产量下降了15.69%。 2021年,全球汽车产量与受疫情影响的2020年相比大幅成长,但仍远低于2019年的数据,主要原因是半导体短缺。

在汽车产业,人们越来越重视对隔热材料的需求,以提高乘坐舒适度和内部舒适度,这大大增加了对温度控管系统的需求。车辆内部电气和电子元件数量的不断增加也推动了对更好的温度控管系统进行散热的需求。

从长远来看,随着汽车产业向电动车转型,内燃机的温度控管系统预计将完全过时。然而,随着重型电池和大电流马达等重型电气元件的兴起,预计这方面的需求仍将保持高位。随着自动化和动力传动系统电气化的不断提高,汽车产业对乘用车和商用车的电气和电子元件的需求呈指数级增长。

领先的目标商标产品製造商正专注于开发温度控管系统,为电动车提供最佳行驶里程。例如

关键亮点

- 2021 年 12 月,沃尔沃测试了一种新的温度控管系统,该系统使用电气元件和电控系统来预热卡车的电池。该热感系统即使在极端天气条件下也能可靠地保持温度,这产生了巨大的需求。

随着汽车电气化进程的推进,汽车供应商正在加快步伐,加强在热能管理市场的国际竞争力。例如

关键亮点

- 2022年2月,博格华纳公司签署合同,为宝马集团的iX和i4全电动架构供应高压冷却液加热器(HVCH)。此解决方案控制电池的温度控管系统和车辆的内部加热,显着提高电池的续航里程和可靠性。

由于亚太地区拥有主要的汽车温度控管系统OEM、中国、印度、日本和韩国等大型汽车市场以及发达的汽车製造业,预计该地区将成为最大的市场。

由于汽车持有量高、电动和自动驾驶汽车销量不断增长以及汽车製造业发达,北美和欧洲预计将成为下一个最大的市场。

因此,上述因素的结合有望推动汽车温度控管系统的成长。

汽车温度控管市场趋势

电池温度控管显着成长

采用动力传动系统的车辆动力传动系统电池温度控管系统。电池在特定温度下运行,以最大限度地提高电荷储存和利用率。因此,在研究期间,电池电动车和插电式混合动力汽车的兴起可能会推动汽车温度控管市场的发展。例如

- 2021年,欧洲多个国家的电动车销量均达到两位数成长,欧洲占全球电动车销量的34%左右,而2020年这一比例为43%。 2021年插电式汽车总销量约227万辆,而2020年为137万辆。

销售量激增是由于各个组织和政府收紧监管标准以控制排放气体水平并促进零排放汽车的采用。

该公司正在投资为即将推出的电池式电动车生产更有效率的电池解决方案。例如

- 2022年9月,马勒在德国汉诺威IAA交通展上发表了商用电动车的新型温度控管系统。

因此,预计上述因素将在预测期内显着扩大汽车热感系统市场。

亚太地区继续占据主要市场占有率

随着印度和中国逐渐成为西方汽车巨头的汽车零件製造地,亚太地区汽车产业的成长预计将推动该地区温度控管系统市场的发展。

政府法规不断加强,鼓励采用电动车,该地区的OEM和供应商为满足中国汽车行业日益增长的需求而采取的强劲业务扩张,预计将为预测期内的市场增长带来积极的前景。例如

- 2022年8月,舍弗勒集团庆祝在中国的第500万个温度控管模组下线。

印度汽车工业规模排名世界第四,商用车产量高居世界第七。过去五年来,该国的汽车零件业务也出现了显着成长。

- 2022 年 3 月,总部位于艾哈默德巴德、专注于提供面向未来的永续解决方案的科技创新Start-UpsMatter 揭露了新型高速中扭力电动马达的开发情况。根据该公司介绍,MatterDrive 1.0马达是一种新型智慧动力传动系统,包含多项关键突破,其中包括整合式智慧温度控管系统。

此外,中国、印度、日本和韩国等国家的电动和混合动力汽车销量正在成长,这可能会进一步扩大亚太汽车热感系统市场。

因此,预计亚太地区在预测期内仍将是最大的汽车热感系统市场。

汽车温度控管产业概况

汽车温度控管市场适度整合,大型企业占市场主导地位。这些参与企业包括电装公司、法雷奥、马勒有限公司、翰昂系统和博格华纳公司。这些参与企业正在积极推出新产品、建立合资企业和扩大产能,以扩大其业务活动并巩固其市场地位。

- 2022年11月,电装公司在澳洲雪梨举行的客车博览会上推出了用于客车和长途客车的新型LD9电动零排放温度控管装置。

- 2022年3月,Hanon Systems在中国湖西开设了一家新工厂,生产电动车的暖气、通风和空调(HVAC)模组。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 应用

- 引擎冷却

- 座舱温度控管

- 变速箱温度控管

- 废热回收/废气再循环(EGR)温度控管

- 电池温度控管

- 马达和电力电子的温度控管

- 汽车模型

- 搭乘用车

- 商用车

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 其他的

- 南美洲

- 中东和非洲

- 北美洲

第六章竞争格局

- 供应商市场占有率

- 公司简介

- Robert Bosch GmbH

- Dana Incorporated

- MAHLE GmbH

- Gentherm Incorporated

- Hanon Systems

- Denso Corporation

- BorgWarner Inc.

- Valeo Group

- Modine Manufacturing Company

- Schaeffler Technologies AG & Co. KG

- Kendrion NV

- ZF Friedrichshafen

- Aptiv Inc.

第七章 市场机会与未来趋势

The Automotive Thermal Management Market size is estimated at USD 105.84 billion in 2025, and is expected to reach USD 140.77 billion by 2030, at a CAGR of 5.87% during the forecast period (2025-2030).

Manufacturing shutdowns, lockdowns, and trade restrictions during the COVID-19 pandemic negatively affected the automotive thermal management industry. Furthermore, the fall in automotive production and lack of labor significantly impacted the market. For instance, worldwide automobile production fell by 15.69% in 2019. Although in 2021, global automotive production increased significantly compared to the pandemic hit 2020, it was well below the figures of 2019, primarily attributed to the semiconductor shortage.

The rising need for better ride quality and heat insulation for cabin comfort is greatly emphasized in the automotive industry, leading to a much higher demand for thermal management systems. The ever-increasing number of electrical and electronic components inside vehicles also drives the need for better thermal management systems due to heat dissipation.

Over the long term, as the automotive industry moves to electric mobility, thermal management systems for IC engines are expected to go completely obsolete. However, the increasing number of heavy-duty electrical components, such as heavy-duty batteries and high-current motors, is expected to continue keeping the high demand in these aspects. With increasing automation and powertrain electrification, the demand for electrical and electronic components exponentially increased, in both passenger cars and commercial vehicles, in the automotive industry.

Major original equipment manufacturers are focusing on the development of thermal management systems to offer the best possible travel range for their electric fleet. For instance,

Key Highlights

- In December 2021, Volvo tested its new thermal management system that pre-heats a truck's batteries using electrical components and electronic control units. The thermal system ensures the temperature is maintained under extreme weather conditions, thus increasing their demand to a large extent.

Auto parts suppliers are accelerating efforts to strengthen their global competitiveness in the thermal energy management market with the advancement of vehicle electrification. For instance,

Key Highlights

- In February 2022, Borgwarner Inc. secured an agreement to supply High-Voltage Coolant Heater (HVCH) to be used in BMW Group's iX and i4 fully electric architecture. The solution controls the battery's thermal management system and cabin heating and significantly increases the driving range and reliability of the battery.

Asia-Pacific is anticipated to be the largest market due to the presence of large OEMs for automotive thermal management systems, large markets for automobiles like China, India, Japan, and South Korea, and a well-developed automobile manufacturing industry.

North America and Europe are projected to be the next biggest markets due to high vehicle ownership rates, growing electric and autonomous vehicle sales, and extensive automobile manufacturing industries.

Thus, the confluence of the aforementioned factors is anticipated to drive the growth of automotive thermal management systems.

Automotive Thermal Management Market Trends

Battery Thermal Management to Witness Significant Growth

Vehicles that run on an all-electric powertrain or hybrid powertrain require a battery thermal management system. The battery is operated under a specific temperature for maximum charge storage and utilization efficiency. Hence, the increase in battery electric vehicles or plug-in hybrid vehicles is likely to drive the automotive thermal management market during the study period. For instance,

- In 2021, many European countries witnessed double-digit growth in EV sales, whereas the European region captured around 34% of global EV sales in 2021 compared to 43% in 2020. The overall plug-in vehicle sales reached about 2.27 million units in 2021 compared to 1.37 million in 2020.

This spike in sales is the result of an increase in regulatory norms by various organizations and governments to control emission levels and propagate zero-emissions vehicles.

Companies are investing in making more efficient battery solutions for the upcoming battery electric vehicles. For instance,

- In September 2022, Mahle launched its new thermal management systems for commercial electric vehicles at IAA Transportation in Hannover, Germany.

Thus, the above factors are estimated to significantly expand the market for automotive thermal systems during the forecast period.

Asia-Pacific Continues to Capture Major Market Share

The growing automobile sector in Asia-Pacific (with India and China emerging as automotive part manufacturing hubs for the western automobile giants) is expected to drive the market for thermal management systems in this region.

The growing government regulations improving electric vehicle adoption and robust expansion adopted by OEMs and suppliers in the region to accommodate the rising demand from the automotive industry in China are expected to create a positive outlook for market growth during the forecast period. For instance,

- In August 2022, Schaeffler Group celebrated the production of five million thermal management modules in China.

The Indian automotive industry is the fourth-largest in the world, and in terms of commercial vehicle production, the country ranks seventh globally. The auto component business in the country has also increased significantly over the past five years. For instance,

- In March 2022, the development of a new high-speed mid-torque electric motor was revealed by Matter, an Ahmedabad-based technological innovation start-up focusing on delivering futuristic sustainable solutions. The company says that Matter Drive 1.0 Motor is a new intelligent drive train that includes a variety of significant breakthroughs, such as the Integrated Intelligent Thermal Management System.

In addition, rising sales of electric and hybrid vehicles in counties like China, India, Japan, and South Korea will further augment the market for automotive thermal systems in the Asia-Pacific region.

Thus, the Asia-Pacific region is predicted to remain the largest market for automotive thermal systems in the world during the forecast period.

Automotive Thermal Management Industry Overview

The automotive thermal management market is moderately consolidated, with the major players dominating the market. Some of these players include Denso Corporation, Valeo, Mahle GmbH, Hanon System, and BorgWarner Inc. These payers engage in new product launches, joint ventures, and capacity expansions to expand their business activities and cement their market position. For instance,

- In November 2022, Denso Corp. launched a new LD9 electric zero emissions thermal management unit for buses and coaches at Bus & Coach Expo in Sydney, Australia.

- In March 2022, Hanon Systems inaugurated a new plant located in Huchai, China, to manufacture heating, ventilation, and air conditioning (HVAC) modules for electrified vehicles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Engine Cooling

- 5.1.2 Cabin Thermal Management

- 5.1.3 Transmission Thermal Management

- 5.1.4 Waste Heat Recovery/ Exhaust Gas Recirculation (EGR) Thermal Management

- 5.1.5 Battery Thermal Management

- 5.1.6 Motor and Power Electronics Thermal Management

- 5.2 Vehicle Type

- 5.2.1 Passenger Car

- 5.2.2 Commercial Vehicle

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Robert Bosch GmbH

- 6.2.2 Dana Incorporated

- 6.2.3 MAHLE GmbH

- 6.2.4 Gentherm Incorporated

- 6.2.5 Hanon Systems

- 6.2.6 Denso Corporation

- 6.2.7 BorgWarner Inc.

- 6.2.8 Valeo Group

- 6.2.9 Modine Manufacturing Company

- 6.2.10 Schaeffler Technologies AG & Co. KG

- 6.2.11 Kendrion NV

- 6.2.12 ZF Friedrichshafen

- 6.2.13 Aptiv Inc.