|

市场调查报告书

商品编码

1689741

MBE(基于模型的企业):市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Model-based Enterprise - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

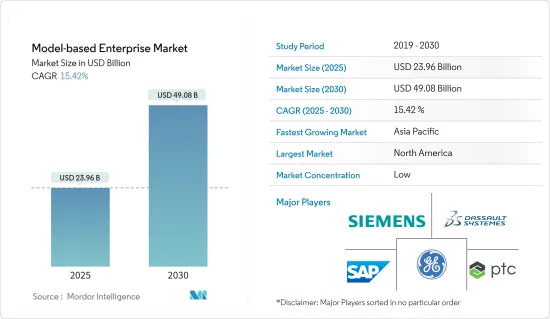

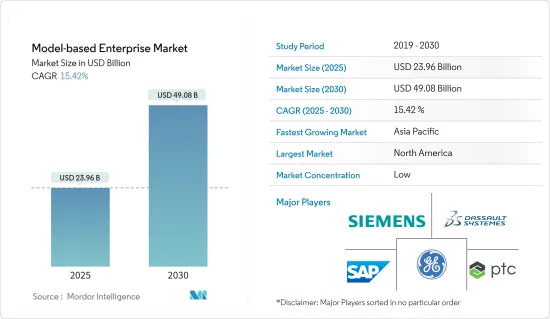

基于模型的企业 (MBE) 市场规模预计在 2025 年为 239.6 亿美元,预计到 2030 年将达到 490.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 15.42%。

多个工业领域对 3D 技术的应用日益广泛,推动了基于模型的企业解决方案的开发和采用,以便即时测量产品几何形状,满足从形状分析到 3D 建模等各种新兴应用日益增长的需求。这项技术为设计、製造和执行新颖的建筑形式和建筑系统提供了许多机会。这是一种创新、更快捷、更灵活的产品开发和生产方式。

各种製造业都在采用数位技术,随着所用软体的功能迅速提升,推动市场成长。随着 CAD 的引入,3D 模型已成为设计产品、模具和製造流程的新行业标准。

工业 4.0 采用数位技术来增强、自动化和现代化流程。不同技术(例如 3D 技术)的整合正变得越来越流行,因为这些技术具有独特的优势,尤其是在离散製造领域。消费品製造业正从大规模生产为主转向大规模客製化为主转变。产品设计和交付的过程需要更高层次的复杂指标,以分析复杂的资料集以获得深入的见解。

逆向工程因其能够快速原型製作并高精度地製造新零件的能力,越来越多地被工业界所采用。逆向工程需要强大且稳健的影像撷取系统来准确撷取资料。

采用3D技术和解决方案将使製造商能够实现这些目标,有助于推动市场成长。大多数OEM和许多大型供应商现在都采用以模型为中心的方法来创建 3D 模型供下游使用。随着汽车产业转向 3D 环境,虚拟产品模式为整个企业提高重复使用率、改善设计效率、提高品质和降低成本提供了机会。

市场面临的挑战包括熟练劳动力短缺、资料安全担忧以及阻碍业务运作的初始投资成本。如果公司要充分实现基于模型的企业 (MBE) 的优势并在当今的数位化製造环境中保持竞争力,应对这些挑战至关重要。

全球经济状况将对所有行业基于模型的企业 (MBE) 解决方案的需求产生重大影响。公司对数位转型计划的投资决策(包括采用 MBE 实务)受到 GDP 成长、工业生产和资本支出等经济因素的影响。在经济扩张期间,人们更倾向于投资创新和效率计划,从而对 MBE 解决方案的需求更大。

例如,根据世界银行估计,2023年北美的GDP为32.32兆美元,预计2023-24年将成长1.5%,这有望促进企业活动和对基于模型的企业(MBE)解决方案的投资。

MBE(以模型为基础的企业)市场趋势

汽车产业强劲成长

- 汽车产业是最早广泛推动基于模型的系统技术应用和发展的产业之一。该行业已经生产出一些最先进的原型和产品。根据欧洲汽车工业协会(ACEA)的数据,2023年6月欧盟(EU)乘用车销量较去年同期成长17.8%。欧洲市场客户总合购买了约127万台,除一个国家外,其他所有国家都实现了正成长。

- 就服务产品而言,预计解决方案部分将在预测期内成长。随着电脑辅助设计 (CAD) 的引入,3D 模型已成为设计产品、模具和製造流程的行业标准。目前,汽车产业的大多数OEM和大型供应商都采用以 3D 模型为中心,不再以 2D 图纸作为主要设计依据。

- 3D虚拟模型使汽车製造商能够提高设计效率、降低成本并提高整个企业的品质。 3D 产品设计、基于模型的定义 (MBD) 以及在扩展企业或 MBE(基于模型的企业)中使用这些模型的结合有望彻底改变全球汽车行业。

- 近年来,MBE技术在欧洲汽车产业中得到越来越多的应用。 2023 年 10 月,总部位于柴郡的 Autentica Car Parts 推出了一个平台,使汽车设计师和製造商能够向经销商、经销商和维修中心出售备件设计。 Autentica 平台可协助设计拥有者和OEM(目的地设备製造商)使用按需 3D 列印服务销售本地生产的备用零件。 MBE 旨在使用包含与製造产品相关的所有产品和製造资讯 (PMI) 的基于 3D 模型的定义 (MBD) 来阐明製造过程中的设计。

北美占有最大市场占有率

- 北美预计将占据全球基于模型的企业 (MBE) 市场的大部分份额,该地区的主要企业包括 GE、PTC、Autodesk 和 Aras。这些公司采取了注重加强其市场地位的策略。数位製造与设计创新研究所 (DMDII) 等机构正在利用其能力和专业知识协助企业进行数位转型,从而改变北美製造业。

- 北美汽车终端用户产业对 MBE 解决方案的采用正在增加。美国是世界上最大的汽车市场之一。主要汽车製造商有 13 多家。汽车製造业是美国最大的收益来源之一。

- 美国国家标准与技术研究所 (NIST) 是一家致力于促进美国创新和工业竞争力的机构,它正在主办基于模型的企业 (MBE)高峰会,以确定产品和流程的设计、製造、品质保证和永续性方面的实施挑战。在此背景下,数位模型为整个产品生命週期中的各项活动提供了权威的资讯来源。

- NIST 的 MBE 和 QIF高峰会计划于 2024 年 4 月在其芝加哥 MxD 设施举行。 MBE高峰会主题将包括从 MBE 标准、使用者和实施者观点的产品和製造细节。 QIF高峰会将重点介绍 QIF 4.0、培训和认证计划、基于模型的特性描述 (MBC 1.0) 等方面的最新进展。

- 由于智慧城市计划和工业 4.0 计划的采用不断增加,解决方案部门预计将经历强劲增长。在美国,英特尔正在与加州圣荷西市合作部署英特尔的物联网智慧城市展示平台,以推进其绿色愿景计画。预计在这些平台上使用基于模型的企业解决方案将刺激市场。

- 加拿大也正在采取重要措施,采用工业4.0,到2030年将製造业销售额提高50%,出口额达5,400亿美元。这被认为将促进当地製造业的发展。因此,MBE(基于模型的企业)的渗透有望提高市场成长率。

基于模型的企业 (MBE) 产业概述

由于各种营业单位选择长期合作,基于模型的企业 (MBE) 市场变得分散。合约被授予能够提供更快安全更新的公司,这增加了基于模型的企业 (MBE) 解决方案的需求。市场的主要企业包括西门子股份公司、通用电气公司、达梭系统公司、SAP 公司和 PTC 公司。

2024 年 2 月,Autodesk 宣布推出 Autodesk Informed Design。此云端基础的解决方案连接设计和製造工作流程,以简化建筑设计和施工过程。它还允许建筑师使用可自订的、预先定义的建筑产品来提供有效的结果,并允许製造商与设计相关人员共用产品。

2024 年 2 月,Aras 宣布 Johnson Matthey (JM) 选择 Aras Innovator 来实现其全球 PLM 基础设施的现代化并支持其数位化转型策略。 Aras Innovator SaaS 预计将于 2024 年第一季开始分多个阶段推出。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估市场的宏观经济因素

第五章 市场动态

- 市场驱动因素

- 不断发展的软体功能

- 物联网和云端基础平台的采用率不断提高

- 市场限制

- 技术纯熟劳工短缺、资料安全问题和前期投资成本阻碍了业务运营

第六章 市场细分

- 按服务

- 解决方案

- 按服务

- 依部署方式

- 本地

- 云

- 按最终用户

- 航太和国防

- 车

- 建造

- 电力和能源

- 零售

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Siemens AG

- General Electric Company

- PTC Inc.

- Dassault Systemes SE

- SAP SE

- Autodesk Inc.

- HCL Technologies Limited

- Oracle Corporation

- Aras Corporation

- Anark Corporation

第八章投资分析

第九章 市场机会与未来趋势

The Model-based Enterprise Market size is estimated at USD 23.96 billion in 2025, and is expected to reach USD 49.08 billion by 2030, at a CAGR of 15.42% during the forecast period (2025-2030).

The increasing adoption of 3D technology across multiple industry verticals to cater to the increasing demand for emerging applications, varying from shape analysis to 3D modeling, has given rise to developing and adopting model-based enterprise solutions that gauge product shapes in real-time. The technology offers many opportunities to design, produce, and perform novel architectural forms, construction systems, etc. It is an innovative, faster, and more agile product development and production method.

Diverse manufacturing industries are adopting digital technologies due to the rapidly growing capabilities of the software used, boosting market growth. With the introduction of CAD, 3D models have become the new industry standard for designing products, tooling, and manufacturing processes.

Industry 4.0 adopted digital technologies to enhance, automate, and modernize processes. Integrating different technologies, such as 3D technologies, is prevalent, as these technologies provide exceptional benefits, especially in the discrete manufacturing sector. The consumer product manufacturing industry is transforming from mass production to an industry indicated by mass customization. The process of how products are designed and delivered needs a new level of sophistication and metric that analyzes a complex set of data for deep insights.

Industries are witnessing increased adoption of reverse engineering for its fast-rapid prototyping abilities and accuracy associated with producing new parts. Reverse engineering requires a strong, robust image acquisition system to acquire data accurately.

Deployment of 3D technology and solutions could enable manufacturers to achieve such objectives, boosting market growth. Most OEMs and many larger suppliers are now model-centric, where 3D models are created and used downstream. As the automotive industry transitions to the 3D environment, virtual product models offer them the opportunity to promote reuse, improve design efficiency, improve quality, and reduce cost across the enterprise.

Some challenges the market faces are a shortage of skilled workers, data security concerns, and the initial investment costs hindering business operations. Addressing these challenges is essential for companies to fully realize the benefits of model-based enterprise and stay competitive in today's digital manufacturing landscape.

The state of the world economy significantly shapes the demand for model-based enterprise (MBE) solutions across industries. Businesses' decisions to invest in digital transformation projects, including adopting MBE practices, are influenced by economic factors such as GDP growth, industrial production, and capital expenditure. Businesses are more inclined to devote money to innovation and efficiency improvement projects during economic expansion, which raises the need for MBE solutions.

For instance, according to a World Bank estimate, the North American GDP, which was USD 32.32 trillion in 2023, is predicted to increase by 1.5% in 2023-24, suggesting that corporate activity and possible model-based enterprise solutions investments are projected to flourish.

Model-Based Enterprise Market Trends

Automotive Sector to Witness Major Growth

- The automotive industry is one of the first to promote the development of applications of model-based systems technology on a broad scale. The industry has produced some of the most advanced prototypes and products. According to the European Automobile Manufacturers' Association (ACEA), in June 2023, passenger car sales in the European Union increased Y-o-Y at a rate of 17.8%. Customers in the European market purchased around 1.27 million units in total, and all but one of the countries experienced positive growth.

- In terms of the offering, the solutions segment is estimated to grow during the forecast period. With the introduction of computer-aided design (CAD), 3D models have become the industry standard for designing products, tooling, and manufacturing processes. Most OEMs and larger suppliers in the automotive industry are now model-centric, using 3D models, and are transitioning from 2D drawings as the master design authority.

- 3D virtual models allow automakers to improve design efficiency, reduce cost, and improve quality across the extended enterprise. The 3D design of the product, model-based definition (MBD), combined with the use of these models throughout the extended enterprise, or the model-based enterprise (MBE), is expected to transform the global automotive industry significantly.

- There has been a rising adoption of MBE technology in the European automotive sector in recent years. In October 2023, Cheshire-based Autentica Car Parts introduced its platform that allows car designers and manufacturers to sell spare parts designs to dealers, distributors, and repair centers. The Autentica platform will help design owners and original equipment manufacturers (OEMs) sell spare parts produced locally using an on-demand 3D printing service. MBE aims to clarify design during the manufacturing process using the 3D model-based definition (MBD) that includes all the product and manufacturing information (PMI) related to the product's manufacturing.

North America Holds Largest Market Share

- North America is anticipated to hold a significant share in the global model-based enterprise (MBE) market, owing to prominent players in the region, such as GE, PTC, Autodesk, and Aras. These companies are adopting strategies focusing on strengthening their market position. Institutes such as the Digital Manufacturing and Design Innovation Institute (DMDII) utilize their ability and expertise to transform the North American manufacturing sector by aiding organizations in the digital revolution.

- The automotive end-user industry vertical in North America is witnessing a growing adoption of MBE solutions. The United States is one of the biggest automotive markets in the world. It is home to more than 13 major automotive manufacturers. Automotive manufacturing has been one of the largest revenue generators for the country.

- The National Institute of Standards and Technology (NIST), an agency that promotes US innovation and industrial competitiveness, hosts the model-based enterprise summit to identify challenges in implementation during product and process design, manufacturing, quality assurance, and sustainment. In this context, digital models provide an authoritative source of information for various activities across a product's lifecycle.

- NIST's MBE and QIF Summit will be held at the Chicago MxD facility in April 2024. Topics for the MBE Summit include product and manufacturing details from the MBE standards, users, and implementors' perspectives. QIF Summit is expected to include QIF 4.0 updates, training, certification initiatives, and Model-Based Characteristics (MBC 1.0).

- The solution segment is anticipated to witness robust growth due to its growing adoption in smart city projects and Industry 4.0 initiatives. In the United States, Intel is collaborating with the city of San Jose, California, to implement Intel's IoT Smart City Demonstration Platform to further the Green Vision initiative. Using model-based enterprise solutions in these platforms is set to boost the market.

- Canada is also taking significant steps toward implementing Industry 4.0 to increase manufacturing sales by 50% and export to USD 540 billion by 2030. This is analyzed to boost the regional manufacturing sector. Therefore, the penetration of model-based enterprises is expected to increase the market's growth rate.

Model-Based Enterprise Industry Overview

The model-based enterprise market is fragmented as various entities opt for long-term collaborations. Contracts are awarded to companies that can provide faster security updates, which has increased demand for model-based enterprise solutions. Some major players in the market are Siemens AG, General Electric Company, Dassault Systemes SE, SAP SE, and PTC Inc., among others.

In February 2024, Autodesk Inc. announced that the company had launched Autodesk Informed Design. This cloud-based solution connects design and manufacturing workflows to streamline the building design and construction process. It also allows architects to work with customizable, pre-defined building products that yield valid results and manufacturers to share their products with design stakeholders.

In February 2024, Aras announced that Johnson Matthey (JM) selected Aras Innovator to modernize its global PLM infrastructure and support its digital transformation strategy. Aras Innovator SaaS will be deployed as part of a multi-stage rollout beginning in the first quarter of 2024.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolving Software Capabilities

- 5.1.2 Rising Adoption of IoT and Cloud-based Platforms

- 5.2 Market Restraints

- 5.2.1 Shortage of Skilled Workers, Data Security Concerns, and the Initial Investment Costs Hinder Business Operations

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Deployment Mode

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By End User

- 6.3.1 Aerospace and Defense

- 6.3.2 Automotive

- 6.3.3 Construction

- 6.3.4 Power and Energy

- 6.3.5 Retail

- 6.3.6 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens AG

- 7.1.2 General Electric Company

- 7.1.3 PTC Inc.

- 7.1.4 Dassault Systemes SE

- 7.1.5 SAP SE

- 7.1.6 Autodesk Inc.

- 7.1.7 HCL Technologies Limited

- 7.1.8 Oracle Corporation

- 7.1.9 Aras Corporation

- 7.1.10 Anark Corporation