|

市场调查报告书

商品编码

1689745

农业润滑油:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Agriculture Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

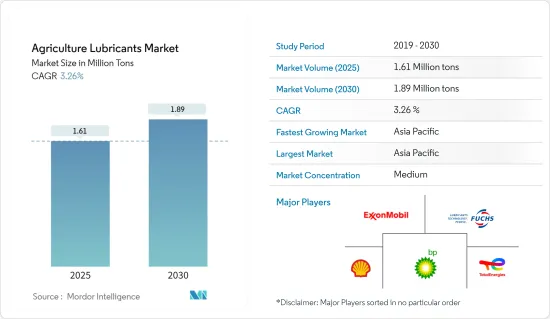

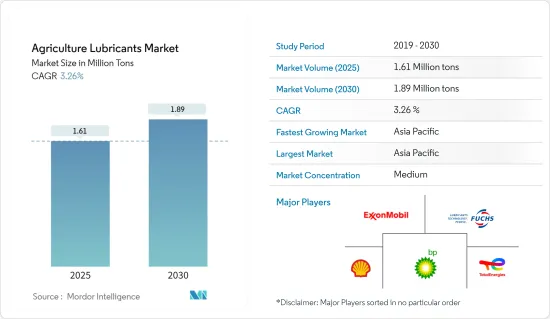

预计2025年农业润滑油市场规模为161万吨,预计2030年将达到189万吨,预测期内(2025-2030年)的复合年增长率为3.26%。

2020 年,农业润滑油市场受到 COVID-19 病毒爆发的不利影响,导致全球实施封锁和各种政府监管。因此,农业机械产业面临挑战,有些公司因疫情而难以维持营运。不过,2021年和2022年,由于疫苗接种增加,各国逐渐解除了封锁和其他限制措施。这也标誌着农业机械产业以及农业润滑油产业的復苏。

印度和中国政府对农业机械的补贴、新兴国家农业机械化率的提高以及农业劳动力成本的上升等因素预计将成为市场的重要驱动力。

然而,预计合成润滑油和生物基润滑剂的高成本将在预测期内阻碍市场成长。

预计生物分解性润滑剂的日益普及将成为预测期内市场成长的机会。

预计预测期内亚太地区将主导全球农业润滑油市场。

农业润滑油市场趋势

机油占据市场主导地位

- 机油或马达油广泛用于润滑内燃机,主要由75%至90%的基础油和10%至25%的添加剂组成。机油可保护引擎免受腐蚀并在使用时保持引擎冷却。

- 在农业领域,机油用于拖拉机、收割机和饲料机械,以减少维护、防止磨损和腐蚀、提高引擎可靠性并提高燃油经济性。

- 据太平洋燃料解决方案公司称,农业润滑油和油有多种用途,其中最突出的例子之一是机油。拖拉机和收割机等农业机械需要有效的润滑,以保持零件良好的工作状态,同时适合在各种条件下使用。

- 道达尔、荷兰皇家壳牌公司、雪佛龙润滑油、康达特集团和谢弗製造公司是一些重要的润滑油製造商,它们为农业机械提供各种类型的机油。

- 一些领先的供应商正在投资研发,以开发创新设备并巩固其在拖拉机市场的地位。 Case IH 和 New Holland 等公司已经推出了新型自动驾驶拖拉机。

- 随着农业工作自动化程度的提高,加上粮食产量的增加和农地面积的扩大,新旧农业机械二手的需求预计将逐年增加。随着引擎开始老化,机油消费量开始增加,从而确保设备更长的使用寿命,从而显着增加全球农业润滑油市场对机油的需求。

- 例如,国际谷物理事会预测2023-24年度粮食产量为22.94亿吨,比2022-23年度的22.54亿吨增加1.77%。

- Lemken 执行长 Anthony van der Ley 表示,过去 12 个月所有国际市场的通膨上升及其对利率的影响可能会导致 2024 年国际农业机械销量下降 6-7%。

- 此外,Progressive Dairy 表示,由于利率上升,加拿大二手农用设备市场预计将在 2023 年大部分时间和 2024 年保持强劲。使用旧引擎的趋势将推动对机油的需求。

- 预计所有上述因素都将在预测期内影响机油在农业润滑油市场的主导地位。

亚太地区发展迅速

- 中国是世界上最大的润滑油消费国。中国约占全球整体面积的7%,养活了全球22%的人口。

- 该国是多种作物的最大生产国,包括大米、棉花和马铃薯。由于该国农业活动规模庞大,对各种类型的农业机械的需求很高,而且很可能还会继续增加。这也将增加对农业润滑油的需求。

- 例如,耕地面积的增加正在推动中国对农业机械的需求。例如,到2022年,中国玉米种植面积将增加至5%,产量将增加至4.6%。

- 印度是该地区第二大润滑油消费国,也是继美国和中国之后全球第三大润滑油消费国。

- 印度是严重依赖农业的经济体之一。农业仍是该国55%以上人口的主要生计来源。

- 2022年,印度拖拉机出口成长6%,达131,850辆。这一数字高于 2021 年的 124,901 辆,是印度有史以来最高的年度出口量。印度约占全球拖拉机销量的2.1%。

- 此外,日本政府计划在2025年将农业产量从2013年的5,000万吨提高到5,400万吨。此外,政府还计划透过提高农业产量和收益、降低成本,使生产者收入在同一时期增加约21%,从290亿美元增加到350亿美元。

- 预计亚太地区农业的这些趋势将在预测期内推动农业润滑油市场以全球最快的速度成长。

农业润滑油产业概况

农业润滑油市场本质上是部分整合的。研究涵盖的市场主要企业(不分先后顺序)包括壳牌公司、福斯公司、埃克森美孚公司、道达尔能源公司和英国石油公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 印度和中国政府补贴农业机械

- 新兴国家农业机械化率不断提高

- 农业劳动成本上升

- 限制因素

- 合成和生物性润滑剂高成本

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 产品类型

- 机油

- 传动液和液压油

- 润滑脂

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 其他的

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- BP plc

- Chevron Corporation

- CLASS KGaA mbH

- CONDAT

- Cougar Lubricants International Ltd.

- Exol Lubricants Limited

- Exxon Mobil Corporation

- FRONTIER PERFORMANCE LUBRICANTS, INC.

- Fuchs

- Gulf Oil International Ltd.

- Hf Sinclair Corporation

- Lubrication Engineers

- Morris Lubricants

- Pennine Lubricants

- Phillips 66 Company

- Repsol

- Rymax Lubricants

- Schaeffer Manufacturing Co.

- Shell plc

- TotalEnergies SE

- Unil

- Witham Group

第七章 市场机会与未来趋势

- 生物分解性润滑剂的重要性日益增加

- 其他机会

The Agriculture Lubricants Market size is estimated at 1.61 million tons in 2025, and is expected to reach 1.89 million tons by 2030, at a CAGR of 3.26% during the forecast period (2025-2030).

In 2020, the agricultural lubricants market was affected negatively due to the outbreak of the COVID-19 virus, which resulted in lockdowns and different government restrictions worldwide. As a result, the agriculture equipment industry witnessed challenges as several companies struggled to remain operational because of the pandemic. However, in 2021 and 2022, the increased number of vaccinations helped the countries to gradually uplift restrictions like lockdowns. This also marked the recovery of the agriculture equipment industry and, thus, of the agricultural lubricants.

Factors such as the provision of subsidies for farm machinery by the Indian and Chinese governments, increasing farm mechanization rates in developing countries, and increasing cost of farm labor are projected to be the prominent drivers of the market.

However, the high cost of synthetic and bio-based lubricants will likely hinder market growth during the forecast period.

The growing prominence of biodegradable lubricants will likely act as an opportunity for market growth during the forecast period.

Asia-Pacific is expected to dominate the global agricultural lubricants market during the forecast period.

Agricultural Lubricants Market Trends

Engine Oil Dominates the Market

- Engine or motor oils are widely used for lubricating internal combustion engines and are mainly composed of 75% to 90% base oils and 10% to 25% additives. They protect the engines from corrosion and keep them cool while in use.

- In the agricultural sector, engine oils are used in tractors, harvesters, and forage equipment to reduce maintenance, enhance wear and corrosion protection, improve engine reliability, and improve fuel efficiency.

- According to Pacific Fuel Solutions, Agricultural lubricants or oils can be used for plenty of different functions, but one of the most noticeable examples is engine oil. Farm machinery such as tractors and harvesters need to be effectively lubricated to maintain the parts in good working order while still being appropriate for use in the circumstances.

- Total, Royal Dutch Shell Plc, Chevron Lubricants, CONDAT Group, and Schaeffer Manufacturing Co. are some of the significant lubricant manufacturers offering various types of engine oils for agricultural equipment.

- Several leading vendors are investing in research and development to develop innovative equipment and maintain a strong tractor market foothold. Companies like Case IH and New Holland launched new autonomous tractors.

- Due to growing automation in farming practices combined with the increasing production of food and farmland expansions, the demand for new and used farm machinery or agriculture equipment is projected to increase year-on-year. This will substantially increase demand for engine oil in the agricultural lubricants market worldwide as it ensures longer life of the equipment because when the engine starts getting old, its engine oil consumption starts to increase.

- For instance, the International Grains Council projected that about 2.294 billion metric tons of grains were to be produced globally in the 2023-24 season, a 1.77% increase from a forecast of 2.254 billion tons for the 2022-23 season.

- According to Lemken CEO Anthony van der Ley, a 6-7% drop in international farm machinery sales will likely occur in 2024 due to the rise in inflation witnessed across all international markets over the past 12 months and the accompanying impact this has had on interest rates.

- Furthermore, according to Progressive Dairy, the used farm equipment market of Canada was expected to stay robust for most of 2023 and into 2024 because of the rising interest rates. Such trends of using aging engines propel the demand for engine oil.

- During the forecast period, all the factors mentioned above are projected to influence the dominance of engine oil in the agricultural lubricants market.

Asia-Pacific to witness Fastest Growth

- China is the largest lubricant consumer globally. China accounts for around 7% of the overall agricultural acreage globally, thus feeding 22% of the world population.

- The country is the largest producer of various crops, including rice, cotton, potatoes, and others. Owing to the large-scale agricultural activities in the country, a high demand for various types of agricultural machinery is present and will likely grow in the future. This will subsequently increase the demand for agricultural lubricants.

- For instance, the increasing area under cultivation enhanced the demand for agricultural machinery in China. For instance, corn acreage in China rose to 5% in 2022, and the output rose to 4.6%.

- India is the second-largest lubricant consumer in the region and the third-largest globally, after the United States and China.

- India is one of the economies that are largely dependent on agriculture. Agriculture is still the primary source of livelihood for more than 55% of the country's population.

- In 2022, tractor exports from India increased by 6%, reaching 131,850 units. It is the highest annual export in Indian history, up from 124,901 units in 2021. India accounts for nearly 2.1% of global tractor sales.

- Moreover, the Japanese government plans to increase agricultural production to 54 million tons by 2025, from 50 million tons in 2013. Additionally, the government plans to increase the producer income from USD 29 billion to USD 35 billion, an increase of approximately 21% over the same period, by enhancing agricultural output quantity and revenue and cutting costs.

- Such trends in the agriculture industry of the Asia-Pacific are expected to drive agricultural lubricants market growth at the fastest rate globally during the forecast period.

Agricultural Lubricants Industry Overview

The agricultural lubricants market is partially consolidated in nature. Some of the major players (not in any particular order) in the market studied include Shell plc, Fuchs, Exxon Mobil Corporation, TotalEnergies SE, and BP p.l.c., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Provision of Subsidy for Farm Machinery by the Indian and Chinese Governments

- 4.1.2 Increasing Farm Mechanization Rates in Developing Countries

- 4.1.3 Increasing Cost of Farm Labor

- 4.2 Restraints

- 4.2.1 High Cost of Synthetic and Bio-based Lubricants

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Engine Oil

- 5.1.2 Transmission and Hydraulic Fluid

- 5.1.3 Grease

- 5.1.4 Other Product Types

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Spain

- 5.2.3.6 Rest of Europe

- 5.2.4 Rest of the World

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BP p.l.c.

- 6.4.2 Chevron Corporation

- 6.4.3 CLASS KGaA mbH

- 6.4.4 CONDAT

- 6.4.5 Cougar Lubricants International Ltd.

- 6.4.6 Exol Lubricants Limited

- 6.4.7 Exxon Mobil Corporation

- 6.4.8 FRONTIER PERFORMANCE LUBRICANTS, INC.

- 6.4.9 Fuchs

- 6.4.10 Gulf Oil International Ltd.

- 6.4.11 Hf Sinclair Corporation

- 6.4.12 Lubrication Engineers

- 6.4.13 Morris Lubricants

- 6.4.14 Pennine Lubricants

- 6.4.15 Phillips 66 Company

- 6.4.16 Repsol

- 6.4.17 Rymax Lubricants

- 6.4.18 Schaeffer Manufacturing Co.

- 6.4.19 Shell plc

- 6.4.20 TotalEnergies SE

- 6.4.21 Unil

- 6.4.22 Witham Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Prominence of Biodegradable Lubricants

- 7.2 Other Opportunities