|

市场调查报告书

商品编码

1689769

乙烯基酯:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Vinyl Ester - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

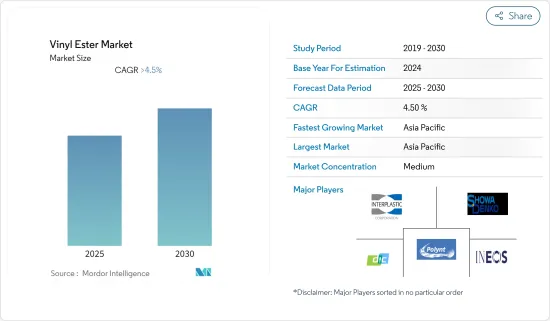

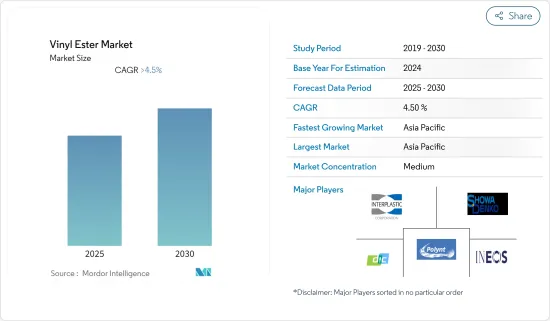

预测期内,乙烯基酯市场预计将以超过 4.5% 的复合年增长率成长。

儘管COVID-19疫情在2020年对市场产生了负面影响,但据估计和预测,市场规模已达到疫情前的水平,预计在预测期内(2022-2027年)将实现稳定增长。

推动市场发展的首要因素是纤维增强塑胶在製造罐体和容器中的应用日益增多以及在製造耐腐蚀设备中的应用日益增多。

然而,乙烯基酯树脂的毒性阻碍了市场的成长。

预计预测期内排烟脱硫应用的不断扩大将为市场成长提供各种机会。

亚太地区占据乙烯基酯市场主导地位,其中中国、印度和日本对市场需求贡献巨大。

乙烯基酯市场趋势

管道和储罐行业有望主导市场

为了避免耗时的维护和维修,各行各业都在选择能够抗腐蚀和耐高温且不会失去强度和耐久性的复合材料。

近年来,纤维增强塑胶(FRP)在管道和储存槽中的使用增加。乙烯基酯树脂因具有优异的耐化学性和低渗透性而广泛应用于许多行业。

它广泛用于製造纤维增强塑料(FRP)储存槽、管道和鸭系统。据估计,管道和储罐部分占据乙烯基酯市场的最大份额。

乙烯基酯基玻璃钢管道及储槽广泛应用于氯碱及化学工业、发电工业、矿山冶金工业、工业用水及污水工业、食品加工业、纸浆工业等。

乙烯基酯玻璃钢管道在电力工业中有广泛的应用。例如,浆液管路、脱硫喷淋集管、储存槽等。

乙烯基酯管道在工业污水应用中也很受欢迎,因为它可以降低长期维护和泵浦的营业成本。

考虑到上述因素,管道和储罐部分预计将占据市场主导地位。

中国可望主导亚太市场

在亚太地区,中国是GDP最大的经济体。

根据中国石油天然气集团公司预测,2020年中国天然气消费量预计将增加至3,200亿立方米,到2040年将激增至约6,000亿立方米。为了满足日益增长的天然气需求,该计划在2040年将天然气产量翻一番,达到3,250亿立方公尺。

未来五年,该国计划建造多家化工厂。BASF已开始在中国南部广东省建设一个投资 100 亿美元的综合石化计划。该工厂一期预计将于 2022年终运作。

中国是世界上最大的汽车生产国。 2021年1-9月产量与2020年同期相比成长了53%。

鑑于上述情况,预计中国将主导亚太市场。

乙烯基酯产业概况

乙烯基酯市场部分整合,主要企业占有相当大的份额。前五大企业合计占60%以上的市占率。主要参与者(不分先后顺序)包括 Polynt、INEOS、DIC CORPORATION、Interplastic Corporation 和 Showa Denko K.K.

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 扩大在纤维增强塑胶罐和容器製造的应用

- 在製造耐腐蚀设备的应用日益广泛

- 限制因素

- 树脂毒性

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争程度

- 进出口趋势

- 原料分析

- 技术简介

- 定价分析

第五章 市场区隔

- 类型

- 双酚 A 二缩水甘油醚(DGEBA)

- 环氧PHENOLIC NOVOLAC(EPN)

- 其他类型

- 应用

- 管道和储罐

- 油漆和涂料

- 运输

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- AOC

- Bkdj Polymers India

- DIC CORPORATION

- INEOS

- Interplastic Corporation

- Poliya

- Polynt

- Scott Bader Company Ltd

- SHOWA DENKO KK

- Sino Polymer Co. Ltd

- Swancor

第七章 市场机会与未来趋势

- 排烟脱硫应用的成长

The Vinyl Ester Market is expected to register a CAGR of greater than 4.5% during the forecast period.

The COVID-19 pandemic impacted the market negatively in 2020; however, it has been estimated to have reached pre-pandemic levels and is expected to grow at a steady rate during the forecast period (2022-2027).

The major factors driving the market are growing application in the manufacture of fiber-reinforced plastic tanks and vessels and increasing application in making corrosion-resistant equipment.

On the flip side, the toxicity of vinyl ester resin is hindering the growth of the market studied.

The growing application in flue gas desulphurization is expected to offer various opportunities for the growth of the market studied over the forecast period.

The Asia-Pacific region dominated the market for vinyl ester, with China, India, and Japan being the major contributors to the market demand.

Vinyl Ester Market Trends

The Pipes and Tanks Segment is Expected to Dominate the Market

To avoid losing a large amount of time to maintenance and repairs, the corrosion industry is choosing composite materials that are resistant to corrosion and can withstand high temperatures without losing their strength or durability.

The fiber-reinforced plastic (FRP) application in pipes and tanks has been rising in recent years. Vinyl ester resins are widely used in many industries due to their superior chemical resistance and low permeability.

They are being extensively used to fabricate fiber-reinforced plastic (FRP) storage tanks, pipelines, and duck systems. The pipes and tanks segment is estimated to have the largest share in the vinyl ester market.

Vinyl ester-based FRP pipes and tanks are widely used in industries such as the chlor-alkali and chemical industry, power generation industry, mining and metal industry, industrial water and wastewater industry, food processing industry, and pulp and paper industry.

Vinyl ester-based FRP pipings are used for many applications in the power industry. Some of these include slurry piping, FGD absorber spray headers, and storage tanks.

Vinyl ester-based pipes are also popular in industrial wastewater applications as they reduce long-term maintenance and pump operating costs.

Based on the above-mentioned aspects, the pipes and tanks segment is expected to dominate the market.

China is Expected to Dominate the Asia-Pacific Market

In the Asia-Pacific region, China is the largest economy in terms of GDP.

According to China National Petroleum Corp. (CNPC), the gas consumption in China was expected to rise to 320 billion cubic meters (BCM) in 2020; gas consumption is expected to surge to around 600 BCM by 2040. In order to meet the growing gas demand, the country is planning to double its gas production to 325 BCM by 2040.

There are numerous chemical plants lined up for construction within the period of the next five years in the country. BASF started the construction of its USD 10 billion integrated petrochemicals project, located in the southern province of Guangdong in China. The first phase of this plant is scheduled to come online by the end of 2022.

China is the world's largest automotive producer. The production increased by 53% in the first nine months of 2021 in comparison to the same period of 2020.

Based on the aforementioned aspects, China is expected to dominate the Asia-Pacific market.

Vinyl Ester Industry Overview

The vinyl ester market is partially consolidated, with the top players holding a significant share. The top five players account for a share of more than 60% of the total market. Some of the major players (in no particular order) include Polynt, INEOS, DIC CORPORATION, Interplastic Corporation, and SHOWA DENKO K.K., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Application in the Manufacture of Fiber Reinforced Plastic Tanks and Vessels

- 4.1.2 Increasing Application in Making Corrosion-resistant Equipment

- 4.2 Restraints

- 4.2.1 Toxicity of the Resin

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

- 4.5 Import-export Trends

- 4.6 Feedstock Analysis

- 4.7 Technological Snapshot

- 4.8 Price Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Bisphenol A Diglycidyl Ether (DGEBA)

- 5.1.2 Epoxy Phenol Novolac (EPN)

- 5.1.3 Other Types

- 5.2 Application

- 5.2.1 Pipes and Tanks

- 5.2.2 Paints and Coatings

- 5.2.3 Transportation

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AOC

- 6.4.2 Bkdj Polymers India

- 6.4.3 DIC CORPORATION

- 6.4.4 INEOS

- 6.4.5 Interplastic Corporation

- 6.4.6 Poliya

- 6.4.7 Polynt

- 6.4.8 Scott Bader Company Ltd

- 6.4.9 SHOWA DENKO K.K

- 6.4.10 Sino Polymer Co. Ltd

- 6.4.11 Swancor

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Application in Flue Gas Desulphurization