|

市场调查报告书

商品编码

1689773

量子密码学(QC) -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Quantum Cryptography (QC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

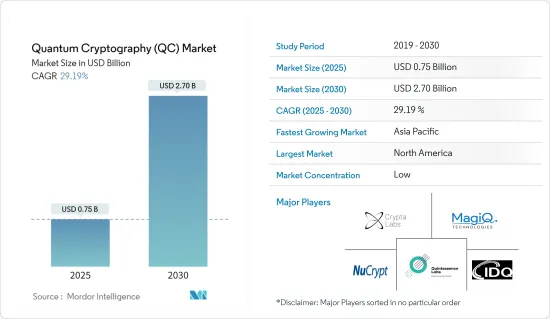

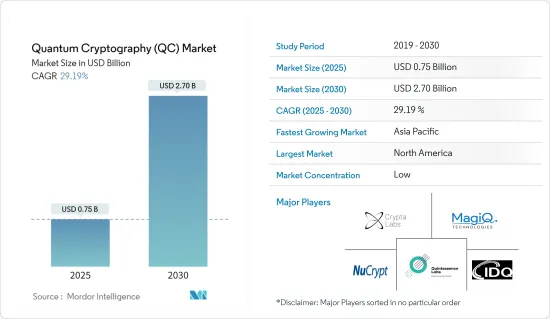

量子密码市场规模预计在 2025 年为 7.5 亿美元,预计到 2030 年将达到 27 亿美元,预测期内(2025-2030 年)的复合年增长率为 29.19%。

随着数位化程度的提高,全球网路攻击数量增加等导致资料密集型方法和决策采用率提高的关键驱动因素可能会破坏各国政府和私营企业的网路数位基础设施,从而大幅提高市场成长率。

关键亮点

- 后疫情时代,商业向线上化、资料化发展的趋势,增加了各国企业和政府机构对网路安全的需求,从而刺激了量子密码解决方案的采用,即利用动态对敏感资讯进行加密。

- 随着对技术数位化的依赖日益增加,银行、投资银行和保险公司等 BFSI参与企业近年来增加了对一流安全解决方案的使用。此外,如图所示,BFSI 领域的攻击非常严重,从而促进了市场成长率。鑑于网路空间暴露的规模,量子密码学已成为主要观点。如图所示,发生了多种攻击,包括恶意软体、网路和应用程式原则违规。

- 市场上量子技术引发的网路攻击风险日益增加,对使用传统基于密码学的网路安全措施的终端用户网路和资料平台构成威胁,这可能会推动市场对量子密码学网路安全解决方案的需求。

- 量子密码技术以其高安全性、可网路侦测等独特特性,成为保障通讯与资料储存安全的最佳选择。然而,这带来了高昂的安装、维护和支援基础设施成本,限制了市场的成长。

- 疫情增加了对网路解决方案的需求,以保护企业和国家数位化所引发的恶意网路攻击。此外,国际付款银行表示,在新冠疫情期间,金融机构面临的网路攻击风险增加,而远距工作条件则加剧了这种风险。

量子密码学(QC)市场趋势

BFSI 产业强劲成长

- 数位银行服务的出现和全球金融科技生态系统的发展,导致银行及其客户的电子金融资料量不断增加,使其容易受到网路犯罪事件的攻击。银行越来越多地在资料管理中采用量子加密解决方案,因为它们可以保护银行网路、应用程式和资料免受基于量子运算的网路攻击。

- 数位付款用户数量呈指数级增长,尤其是自新冠疫情爆发以来。据印度储备银行称,2023 财年印度共发生约 114 笔数位付款。数位付款的成长以及无现金社会的趋势正在推动银行业对量子密码市场的需求,因为电子付款依靠加密来保护客户和企业免受网路攻击。在处理付款资料时将传统加密技术升级为量子加密技术可以进一步提高安全性,并支持未来的市场成长。

- 例如,2023 年 7 月,汇丰银行成为第一家加入英国电信和东芝公司量子安全都会区网路的银行,使用量子金钥分发 (QKD) 连接其在英国的两个分支机构,并为其全球业务做好应对未来网路威胁的准备。使用 AWS Snowball Edge 设备,该技术将在多种场景中试验,包括金融交易、安全视讯通讯、一次性密码垫片加密和 AWS 边缘运算功能,这表明未来几年 BFSI 领域对量子密码解决方案的需求将持续增长。

- 按地区划分,预计在预测期内,亚太地区将为 BFSI 领域的市场成长做出重大贡献,这得益于亚洲和东南亚国家的数位付款和网路银行业务的成长。

- 银行业越来越意识到基于量子运算的安全资讯传输解决方案,预计这将为 BFSI 领域的量子密码解决方案创造机会,从而推动市场成长。

亚太地区预计将创下最快成长

- 随着网路威胁的增加,亚太地区的企业正在优先采取网路安全措施来保护敏感资料和通讯。量子密码学利用动态原理提供先进的安全性,使其成为希望加强网路安全态势的组织的解决方案。

- 此外,量子技术的进步使得量子密码学在亚洲更加实用和普及。此外,该地区的研究人员和公司正在大力投资开发量子金钥分发(QKD) 系统、量子随机数产生器 (QRNG) 和其他量子强化安全解决方案。

- 例如,2023年8月, Sky Perfect JSAT Corporation宣布推出一种量子密码光纤通讯设备,该设备结合了基于卫星的量子金钥分发(QKD)和加密技术。此项开发是卫星通讯量子密码学研究和开发的一部分。

- 同样在2023年3月,中国研究机构宣布,他们正致力于利用低地球轨道和中高地球轨道卫星建设量子通讯网路。在此之下,中国利用动态的方面来加密和安全传输讯息。该任务进行了量子金钥分发(QKD)、量子纠缠分发和量子隐形传态实验。

- 此外,亚太地区IT和通讯领域对量子密码技术的需求正在快速成长。 IT和通讯部门处理大量机密资料,包括个人资讯、金融交易和其他业务资料。随着网路攻击的频率和威胁不断增加,这些领域的组织正致力于透过采用量子密码技术来强化资料安全措施。量子密码学利用动态原理来确保通讯安全,并提供先进的安全性来保护资料免受此类网路威胁。

量子密码学(QC)市场概览

量子密码市场较分散,主要参与者包括 QuintessenceLabs Pty Ltd、Crypta Labs Limited、ID Quantique SA、MagiQ Technologies Inc. 和 Nucrypt LLC。市场参与企业正在实施联盟、创新和收购等策略,以增强其产品供应并获得可持续的竞争优势。

- 2023 年 10 月:1touch.io 宣布与 QuintessenceLabs 建立策略性独立软体供应商 (ISV) 合作伙伴关係,以加强企业对量子运算带来的加密威胁的防御能力。该公司与 QuintessenceLabs 的合作将使企业能够全面了解其整个加密环境,从而让他们能够找出漏洞并采取有针对性的行动。

- 2023 年 10 月:Crypta Labs 与 Blueshift Memory 合作开发可以应对量子运算威胁的网路安全记忆体解决方案。 Blueshift Memory 也将把 QOM 整合到其剑桥架构 FPGA 模组中,以建立可以应对量子运算威胁的网路安全记忆体解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 网路攻击增加

- 对云端和物联网技术的下一代安全解决方案的需求日益增长

- 无线网路技术的演进

- 市场限制

- 引进和安装成本高

- 缺乏熟练的专家和技术挑战

第六章市场区隔

- 按组件

- 解决方案

- 按服务

- 按应用

- 网路安全

- 应用程式安全

- 资料库安全

- 按最终用户

- 资讯科技/通讯

- BFSI

- 政府和国防

- 医疗保健

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- QuintessenceLabs Pty Ltd

- Crypta Labs Limited

- ID Quantique SA

- MagiQ Technologies, Inc.

- Nucrypt Llc

- PQ Solutions Limited

- ISARA Corporation

- QuantumCTek Co. Ltd

- Quantum Xchange Inc.

- QuNu Labs Pvt Ltd

- Qutools GmbH

- AUREA Technology

- Infineon Technologies AG

- Toshiba Corporation

- Kets Quantum Security Ltd

- IBM Corporation

- Qrypt Inc.

第八章投资分析

第九章:市场的未来

The Quantum Cryptography Market size is estimated at USD 0.75 billion in 2025, and is expected to reach USD 2.70 billion by 2030, at a CAGR of 29.19% during the forecast period (2025-2030).

The key drivers contributing to the increase in the adoption of data-intensive approaches and decisions with the growth, including the rise in the number of cyber-attacks globally with the growing digitalization, have the potential to damage the internet-linked digital infrastructure of various government or private sector enterprises, thereby significantly driving the market's growth rate.

Key Highlights

- The need for cybersecurity majors in enterprises and government entities of various countries increased in the post-pandemic period due to the trend of online and data-driven businesses, fueling the implementation of quantum cryptography solutions by encrypting sensitive information through quantum mechanics.

- With the growing dependence on technology and digitalization, BFSI players such as banks, investment banks, and insurance firms have increased their use of best safety solutions over recent years. Further, as indicated in the graph, the attacks in the BFSI sector have been significant, thereby contributing to the market's growth rate. Quantum cryptography has become a major point of view, given the scale of exposure to cyberspace. As indicated in the graph, there have been several malware, network, and application policy violations, among other attacks.

- The increasing risk of cyberattacks based on quantum technology is emerging in the market, which can create threats to the network and data platform of the end users using traditional cryptography-based cyber security measures and can drive the demand for quantum cryptography cyber security solutions in the market.

- Quantum cryptography has emerged as the optimal choice for securing communication and data storage, given its unique features, including high security and cyber detection. However, this comes with high installation, maintenance, and supporting infrastructure costs, limiting the market's growth.

- The pandemic has raised the demand for cyber solutions to protect businesses and countries from malicious cyber-attacks supported by increasing digitalization. Additionally, the Bank for International Settlements stated that, during the COVID-19 pandemic, financial institutions faced an increasing risk of cyberattacks, which were accelerated by remote working conditions.

Quantum Cryptography (QC) Market Trends

BFSI Sector to Witness Major Growth

- The emergence of digital banking services and the development of Fintech ecosystems worldwide have raised the number of electronic financial data about banks and their customers, which are vulnerable to cybercrime incidents. These drive the adoption of quantum cryptography solutions in data management among the banks due to their applications in protecting the bank's network, applications, and data from quantum computing-based cyberattacks.

- The volume of digital payment users is increasing exponentially, especially since the COVID-19 pandemic. According to the RBI, around 114 digital payments were made in India in FY 2023. The growth of digital payments in line with the trend of a cashless society is raising the demand for the quantum cryptography market in banks because electronic payments rely on encryption to protect customers and businesses from cyberattacks. This can be further secured by upgrading traditional encryption to quantum encryption in processing the payment data, which would support the market's growth in the future.

- For instance, in July 2023, HSBC was the first bank to join BT and Toshiba's quantum-secured metro network, connecting two UK sites using Quantum Key Distribution (QKD) to prepare its global operations against future cyber threats. Using an AWS Snowball Edge device, this technology would be trialed in multiple scenarios, including financial transactions, secure video communications, one-time pad encryption, and AWS edge computing capabilities, showing the increasing demand for quantum cryptography solutions in the BFSI sector in the future.

- By geography, the Asia-Pacific region is expected to contribute significantly to the growth of the market in the BFSI sector, supported by the growth in the digital payment and online banking landscape in the Asian and Southeast Asian countries during the forecast period.

- The increasing awareness of quantum computing-based solutions in the banking sector for secured information transfer would support the market's growth by creating an opportunity for quantum cryptography solutions in the BFSI sector.

Asia-Pacific Is Expected to Register the Fastest Growth

- With the increasing incidence of cyber threats, organizations in the Asia-Pacific region are prioritizing cybersecurity measures to protect their sensitive data and communications. Quantum cryptography offers advanced security by leveraging the principles of quantum mechanics, making it a solution for those organizations looking to enhance their cybersecurity posture.

- Further, advances in quantum technology are making quantum cryptography more practical and accessible in Asia. Also, regional researchers and companies are investing significantly in developing quantum key distribution (QKD) systems, quantum random number generators (QRNGs), and other quantum-enhanced security solutions.

- For instance, in August 2023, SKY Perfect JSAT Corporation announced the launch of a Quantum Cryptography Optical Communication Device with built-in satellite-based Quantum Key Distribution (QKD) and Cryptography Technology. The development was implemented as part of the research and development of quantum encryption technology regarding satellite communications.

- Again, in March 2023, Chinese research institutes announced that the country is working to build a quantum communications network utilizing satellites in low and medium-to-high Earth orbits. Under this, China has used aspects of quantum mechanics to encrypt and secure the transmission of information. The mission executed experiments in quantum key distribution (QKD), quantum entanglement distribution, and quantum teleportation.

- Moreover, the demand for quantum cryptography in the IT and telecom sector in the Asia-Pacific region is rising rapidly. The IT and telecom sectors handle vast volumes of sensitive data, including personal information, financial transactions, and other business data. With the increasing frequency and threat of cyberattacks, organizations in these sectors are focusing on their data security measures with the adoption of quantum cryptography, as it offers advanced security by using the principles of quantum mechanics to secure communications and protect data against such cyber threats.

Quantum Cryptography (QC) Market Overview

The quantum cryptography market is fragmented, with the presence of major players like QuintessenceLabs Pty Ltd, Crypta Labs Limited, ID Quantique SA, MagiQ Technologies Inc., and Nucrypt LLC. Market players are implementing strategies such as partnerships, innovations, and acquisitions to improve their product offerings and gain sustainable competitive advantage.

- October 2023: 1touch.io announced a strategic Independent Software Vendor (ISV) partnership with QuintessenceLabs to strengthen enterprise defenses against the cryptographic threats posed by quantum computing. The company's collaboration with QuintessenceLabs provides enterprises with a comprehensive view of their entire cryptographic landscape, enabling them to pinpoint vulnerabilities and take targeted action.

- October 2023: Crypta Labs partnered with Blueshift Memory to create a cybersecurity memory solution capable of countering threats from quantum computing. Also, Blueshift Memory will integrate the QOM into its Cambridge Architecture FPGA module to establish a cybersecurity memory solution resistant to threats, even those from quantum computing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Number of Cyberattacks

- 5.1.2 Growing Need for Next Generation Security Solutions for Cloud and IoT Technologies

- 5.1.3 Evolution of Wireless Network Technologies

- 5.2 Market Restraints

- 5.2.1 High Implementation and Installation Costs

- 5.2.2 Absence of Skilled Expertise and Technological Challenges

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Application

- 6.2.1 Network Security

- 6.2.2 Application Security

- 6.2.3 Database Security

- 6.3 By End Users

- 6.3.1 IT and Telecommunication

- 6.3.2 BFSI

- 6.3.3 Government and Defence

- 6.3.4 Healthcare

- 6.3.5 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 South America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 QuintessenceLabs Pty Ltd

- 7.1.2 Crypta Labs Limited

- 7.1.3 ID Quantique SA

- 7.1.4 MagiQ Technologies, Inc.

- 7.1.5 Nucrypt Llc

- 7.1.6 PQ Solutions Limited

- 7.1.7 ISARA Corporation

- 7.1.8 QuantumCTek Co. Ltd

- 7.1.9 Quantum Xchange Inc.

- 7.1.10 QuNu Labs Pvt Ltd

- 7.1.11 Qutools GmbH

- 7.1.12 AUREA Technology

- 7.1.13 Infineon Technologies AG

- 7.1.14 Toshiba Corporation

- 7.1.15 Kets Quantum Security Ltd

- 7.1.16 IBM Corporation

- 7.1.17 Qrypt Inc.