|

市场调查报告书

商品编码

1689785

沼气厂:市场占有率分析、产业趋势与成长预测(2025-2030 年)Biogas Plant - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

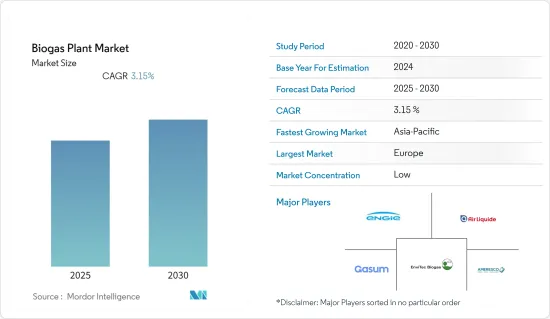

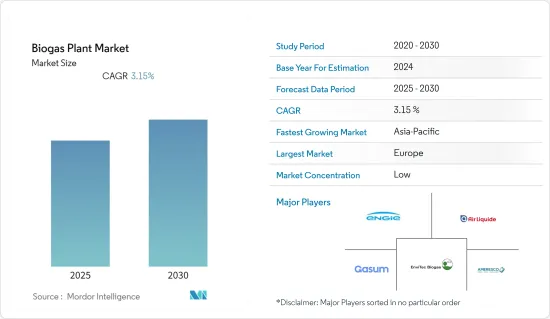

预测期内沼气厂市场预计复合年增长率为 3.15%

关键亮点

- 预计小型消化器在预测期内将显着成长,这主要归因于资本需求和成长型经济体的需求降低。

- 沼气产业的技术进步和创新也可能为市场提供机会。 Dendro 液体能源 (DLE)、家用沼气和 BioBang 等技术正在吸引新参与企业并进一步推动市场发展。

- 截至 2021 年,欧洲是最大的沼气生产国,因为它拥有庞大的沼气设施基础,其中大部分位于德国和义大利。

沼气厂市场趋势

小型沼气池预计将显着成长

- 小型沼气池是指功率低于 250 千瓦的沼气池,由于投资少、基础设施要求低,在全球市场的份额越来越大。小型沼气池在开发中国家的农村地区扮演着重要角色。由于缺乏现代技术,沼气池大多被用作烹饪和取暖的炉灶。

- 小型消化器提供环保能源,减少对天然气和液化石油气等碳氢化合物燃料的依赖。小型沼气池也为经济落后的人们提供了粮食保障。

- 2020 年小型消化池的份额约为 24%,预计在预测期内这一份额将逐步增加。小型消化池通常在印度、泰国和中国等亚洲国家很常见。其在欧洲国家和美国的份额也逐渐增加。根据美国环保署的数据,截至2021年9月,美国畜牧场运作的厌氧消化器计划超过317个。

- 由于政府的倡议,预计预测期内国内沼气使用量将会增加。例如,印度政府启动了一项名为「国家沼气和粪便管理计画」(NBMMP)的倡议,为建立家庭沼气厂提供补贴,主要针对农村和半都市区/家庭。

- 总体而言,预计预测期内,较低的资本投资需求、成长型经济体不断增长的需求以及政府的支持倡议将推动小型消化器市场的成长。

预计欧洲将主导市场

- 欧洲拥有最大的沼气生产能力,并主导沼气工厂市场。截至 2020 年,该地区是最大的沼气生产地,拥有约 18,943 个沼气厂。

- 根据欧洲沼气协会 (EBA) 预测,到 2050 年,欧洲沼气产量将达到 980 亿立方公尺 (bcm),比目前产量增加 4,800%。

- 增加沼气产量的计画预计将吸引对沼气生产设施建设的投资,预计这将在不久的将来促进沼气厂的成长。

- 德国在该地区沼气厂建设方面处于领先地位。过去几年,我们一直在开发新的沼气基础设施,为不断成长的沼气市场提供进一步的支援。例如,2020年6月,我们与生物甲烷产业的工业合作伙伴以及德国能源署合作,建造了一条新的沼气管道,可以将原始沼气捆绑供应给德国各地的48个沼气厂。

- 此外,2021 年 6 月,Nordsall 与 DBG Bioenergy BV 签署了一项协议,合作在荷兰开发新的生物液化天然气设施。 DBG Bio Energy BV 采用取得专利的製程将含有纤维素的工业废弃物流转化为沼气。 Nordsols iLNG 技术可以以节能的方式将这种沼气加工成生物液化天然气。该技术还可以透过捕获和液化沼气中的生物二氧化碳并将其用作化石二氧化碳的替代品来提供额外的绿色价值。

- 因此,由于上述几点、投资活动的增加以及与该地区绿色倡议的一致性,预计欧洲沼气厂市场在预测期内将呈现显着成长。

沼气厂产业概况

沼气厂市场是细分的。沼气厂市场的主要企业包括 Engie SA、Air Liquide SA、Ameresco Inc.、Gasum Oy 和 EnviTec Biogas AG。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概述

- 介绍

- 沼气厂装置容量及2027年预测(单位:MW)

- 主要国家沼气计划数量

- 现有和即将建成的主要沼气厂详细清单

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 应用

- 发电

- 生质燃料

- 发热

- 沼气厂类型

- 小型沼气池

- 中型和大型消化池

- 地区

- 北美洲

- 亚太地区

- 欧洲

- 南美洲

- 中东和非洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Engie SA

- Air Liquide SA

- Scandinavian Biogas

- Gasum Oy

- Ameresco

- A2A SpA

- AB Holding SpA(Gruppo AB)

- EnviTec Biogas AG

- BTS Biogas SRL/GmbH

- FWE GmbH

- Agraferm GmbH

第七章 市场机会与未来趋势

简介目录

Product Code: 68237

The Biogas Plant Market is expected to register a CAGR of 3.15% during the forecast period.

Key Highlights

- Small-scale digesters are expected to witness significant growth during the forecast period, mainly owing to the low capital requirement and demand in growing economies.

- Technological advancements and innovations in the biogas industry are also likely to serve as an opportunity for the market. Dendro Liquid Energy (DLE), Home Biogas, and BioBang are a few technologies that have attracted new players and driven the market further.

- As of 2021, Europe was the largest biogas producer owing to a large base of biogas facilities, with the majority situated in Germany and Italy.

Biogas Plants Market Trends

Small-scale Digesters Expected to Witness Significant Growth

- The small-scale digestors are digesters with a capacity lesser than 250kW, and due to the lower investment and infrastructure requirement, their share in the global market is growing. Small-scale digesters play an essential role in rural areas of developing nations. Due to inaccessibility to modern technology, digesters are most often used in stoves for cooking and heating purposes.

- Small-scale digesters provide greener energy and reduce the dependency on hydrocarbon fuels, such as natural gas or liquefied petroleum gas. Small-scale digesters also offer food security to economically backward populations.

- Although the share of small-scale digesters was around 24% in 2020, this share is expected to increase gradually during the forecast period. Small-scale digesters are usually prominent in Asian countries like India, Thailand, and China. Gradually the share in the European countries and the United States has also increased. According to the United States Environmental Protection Agency, as of September 2021, more than 317 anaerobic digester projects were operating on livestock farms in the United States.

- With government initiatives, usage of biogas for domestic purposes is expected to increase during the forecast period. For instance, the Government of India launched a policy named National Biogas and Manure Management Programme (NBMMP), which provides subsidies to set up biogas plants for domestic uses, mainly for rural and semi-urban/households.

- Overall, low capital investment requirements, rising demand in growing economies, and supporting government initiatives are expected to propel the growth of the small-scale digester segment during the forecast period.

Europe is Expected to Dominate the Market

- Europe is dominating the biogas plant market with the maximum volume of biogas production. As of 2020, the region was the largest biogas producer, with around 18,943 biogas plants.

- According to the European Biogas Association (EBA), biogas production in Europe is expected to reach 98 billion cubic meters (bcm) of biomethane by 2050, a 4,800% increase in current levels of production.

- The plan to increase biogas production is expected to attract investments to build biogas production facilities, which is expected to promote the growth of biogas plants in the near future.

- Germany has been the frontier of biogas plant development in the region. For the past years, it has been developing a new biogas infrastructure that can provide additional support to the growing biogas market. For instance, in June 2020, a collaboration of industry partners in the biomethane industry and the Deutsche Engergie-Agentur built a new biogas pipeline that can bundle the raw biogas supplies up to 48 biogas plants across Germany.

- Moreover, in June 2021, Nordsol and DBG Bio Energy BV signed an agreement to collaborate on the development of a new bio-LNG installation in the Netherlands. DBG Bio Energy BV is using a patented process to convert cellulose-containing industrial waste streams into biogas. Nordsols iLNG technology can process this biogas into bio-LNG in an energy-efficient way. This technology can also provide additional green value through the capture and liquefaction of bioCO2 from the biogas to replace fossil CO2.

- Therefore, owing to the above points, increased investment activity, and alignment with the green policies of the region, Europe is expected to witness significant growth in the biogas plant market during the forecast period.

Biogas Plants Industry Overview

The biogas plant market is fragmented. Some of the major players in the biogas plant market include Engie SA, Air Liquide SA, Ameresco Inc., Gasum Oy, and EnviTec Biogas AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Biogas Plant Installed Capacity and Forecast in MW, till 2027

- 4.3 Number of Biogas Projects, by Key Countries

- 4.4 Detailed List of Key Existing and Upcoming Biogas Plants

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.2 Restraints

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitute Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Electricity Generation

- 5.1.2 Biofuel

- 5.1.3 Heat Generation

- 5.2 Biogas Plant Type

- 5.2.1 Small-scale Digesters

- 5.2.2 Medium- to Large-scale Digesters

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Asia-Pacific

- 5.3.3 Europe

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Engie SA

- 6.3.2 Air Liquide SA

- 6.3.3 Scandinavian Biogas

- 6.3.4 Gasum Oy

- 6.3.5 Ameresco

- 6.3.6 A2A SpA

- 6.3.7 AB Holding SpA (Gruppo AB)

- 6.3.8 EnviTec Biogas AG

- 6.3.9 BTS Biogas SRL/GmbH

- 6.3.10 FWE GmbH

- 6.3.11 Agraferm GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219