|

市场调查报告书

商品编码

1689794

浸渍树脂:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Impregnating Resins - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

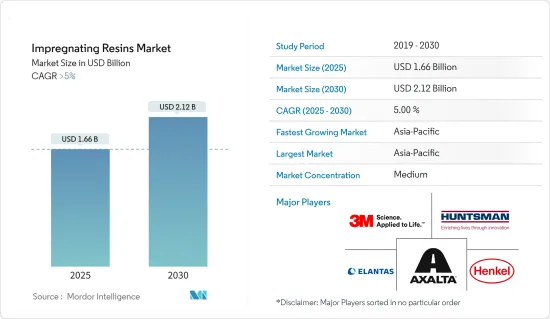

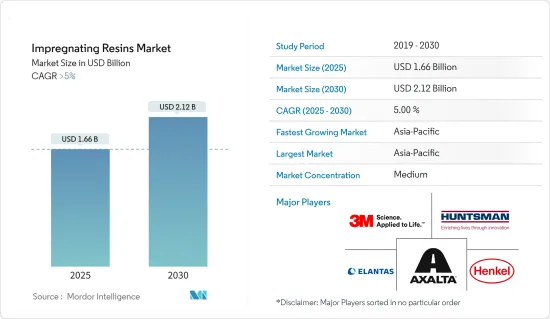

浸渍树脂市场规模预计在 2025 年为 16.6 亿美元,预计到 2030 年将达到 21.2 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 5%。

由于封锁、社交隔离和贸易制裁导致全球供应链网路大规模中断,COVID-19 疫情阻碍了市场成长。所有主要终端用户产业均因活动停止而出现衰退。不过,预计 2021 年情况将会復苏,这将有利于预测期内的市场。

关键亮点

- 电气和电子领域中浸渍树脂的使用日益增长以及电动车产量的增加推动了市场的发展。

- 然而,溶剂型树脂的效率低下正在抑制市场的成长。

- 环保配方的开发为可再生能源、航太和先进电气系统等应用领域的成长和创新指明了方向。

- 亚太地区占市场主导地位,其中印度、中国和日本的消费量最大。

浸渍树脂市场趋势

电气和电子元件需求不断成长

- 浸渍树脂被认为是次级绝缘体,作为提供电绝缘、防止环境变化和确保机械稳定性的液态树脂占有重要地位。

- 绕组和铜线都浸渍了树脂,以提高绝缘性,提供防振保护,并增加正常运行期间对应力、温度负荷和热交换的抵抗力,降低绕组短路的风险。

- 树脂因其阻碍电流的能力而被广泛应用于电子和电气领域,使其成为绝缘积体电路、电晶体和印刷电路基板的理想选择。

- 浸渍树脂在电脑及其配件中非常重要,它为印刷电路基板、电连接器、电源、电子设备和电路组件等组件提供绝缘和保护,有助于提高它们的可靠性和耐用性。

- 根据美国人口普查局的数据,2022年美国电脑及电脑配件出口额达184.3亿美元,较2021年的175.7亿美元成长。

- 同样,根据加拿大广播电视和通讯委员会的预测,2022年加拿大电视总收入将达到65.72亿加元(48.4182亿美元),与上一年的资料相比有所增长。

- 受全球对尖端消费性电子产品需求激增的推动,浸渍树脂市场具有扩张的潜力。尤其是在德国,根据ZVEI报道,2023年电子和数位产业创造了2,390亿欧元的产值,占该国工业总产值的10%。

- 德国是世界最大的发电机、变压器和马达生产国,根据德国联邦统计局的预测,到2025年,德国马达、发电机和变压器的製造收益预计将达到约195.1亿美元,高于去年的185亿美元。

- 此外,根据电子情报技术产业协会(JEITA)的资料,2022年11月电子产业总产值达70.9834亿美元,2022年12月日本电子产品出口额达83.9545亿美元。

- 由于这些因素,预计未来几年对电气和电子元件的需求不断增长将推动对浸渍树脂的需求。

亚太地区占市场主导地位

- 预计预测期内亚太地区将占据浸渍树脂市场的很大份额。由于中国、印度和日本的电气和汽车製造设施不断增长,预测期内浸渍树脂的需求和利用可能会扩大市场范围。

- 中国是全球最大的电子产品製造基地。电视、智慧型手机、电线电缆、可携式运算设备、游戏系统和其他个人电子设备等电子产品在家用电子电器领域实现了最高成长。

- 根据中国国家统计局的数据,2023年12月中国家用电子电器及家用电子电器零售额约为人民币772.5亿元(107.3亿美元)。

- 近年来,印度对电子产品的需求不断增加。印度是全球第二大行动电话生产国,网路普及率较高。印度政府对电子硬体非常感兴趣,因为它是「印度製造」、「数位印度」和「创业印度」计画最重要的部分之一。

- 印度商工部数据显示,2022年4月至12月,电子产品出口额达66.7亿美元,较去年同期的109.9亿美元成长51.56%。

- 半导体也用于汽车工业。随着全球电动车销售的不断增长,电动车製造对半导体的需求也不断增加,对浸渍树脂的需求产生正面影响。

- 根据国际能源总署的数据,2021年至2022年间,日本的电动车销量将成长1.2%至3%。

- 同样,根据国土交通省的数据,2022 年,在韩国註册的 389,960 辆电动车中,约有 303,300 辆被归类为乘用车,同期还註册了约 81,240 辆电动货车。

- 因此,由于各种应用的需求不断增长,亚太地区很可能成为未来几年浸渍树脂最重要的市场。

浸渍树脂产业概况

浸渍树脂市场部分整合,由国际和参与企业组成。排名前五的公司占据了相当大的市场份额。主要企业(不分先后顺序)有 Elantas GmbH、Henkel AG & Co. KGaA、Axalta Coating Systems、Huntsman International LLC 和 3M。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 扩大电气和电子领域的应用

- 电动车产量增加

- 其他驱动因素

- 限制因素

- 溶剂型树脂效率降低

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 依技术

- 无溶剂树脂

- 溶剂型树脂

- 依树脂类型

- 聚酯纤维

- 环氧树脂

- 聚酯酰亚胺

- 其他的

- 按应用

- 马达和发电机

- 家用电子电器产品

- 变形金刚

- 电气和电子元件

- 车

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)分析**/市占分析

- 主要企业策略

- 公司简介

- 3M

- AEV Ltd

- Axalta Coating Systems LLC

- Borger GmbH

- Chetak Manufacturing Company

- ELANTAS GmbH

- Henkel AG & Co. KGaA

- Huntsman International LLC

- NIPPON RIKA INDUSTRIES CORPORATION

- Momentive

- Polycast Industries Inc.

- Wacker Chemie AG

第七章 市场机会与未来趋势

- 开发环保配方

The Impregnating Resins Market size is estimated at USD 1.66 billion in 2025, and is expected to reach USD 2.12 billion by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

The COVID-19 pandemic hindered market growth due to massive disruptions to global supply chain networks resulting from lockdowns, social distances, and trade sanctions. All major end-user industries witnessed a decline due to the halt in activities. However, the condition was expected to recover in 2021 and benefit the market during the forecast period.

Key Highlights

- The market is driven by the growing use of impregnating resins in the electrical and electronics sectors and the increasing electric vehicle production.

- However, the low efficiency of solvent-based resins is restraining the growth of the market.

- Nevertheless, the development of eco-friendly formulations presents avenues for growth and innovation in applications such as renewable energy, aerospace, and advanced electrical systems.

- Asia-Pacific dominates the market studied, with India, China, and Japan recording primary consumption.

Impregnating Resins Market Trends

Increasing Demand for Electrical and Electronics Components

- Impregnating resins, recognized as secondary insulators, hold significance as liquid resins that offer electrical insulation, safeguard against environmental variations, and ensure mechanical stability.

- Impregnating windings and copper wires with resin enhances insulation, prevents vibration, and increases resistance to stresses, temperature loads, and heat exchange during regular operation, thereby reducing the risk of short circuits in the windings.

- Resins are extensively employed in the electronics and electrical sectors due to their efficacy in impeding the flow of electricity, serving as the predominant choice for insulating integrated circuits, transistors, and printed circuit boards.

- Impregnating resins are crucial in computers and accessories, providing insulation and protection for components such as printed circuit boards, electrical connectors, power supplies, electronic devices, and circuit assemblies, contributing to reliability and durability.

- According to the US Census Bureau, the export value of computers and computer accessories from the United States reached USD 18.43 billion in 2022 and registered growth when compared to USD 17.57 billion in 2021.

- Similarly, according to the Canadian Radio-television and Telecommunications Commission, the total television revenue in Canada was valued at CAD 6,572 million (USD 4841.82 million ) in 2022 and registered a hike when compared to the previous year's data.

- The impregnating resins market has the potential for expansion, driven by the surging demand for cutting-edge consumer electronics on a global scale; notably, in Germany, the electronics and digital industry generated EUR 239 billion in 2023, constituting 10% of the country's total industrial output, as reported by the ZVEI.

- Germany stands as a prominent global producer of generators, transformers, and electric motors, with projections from the Statistisches Bundesamt indicating that the revenue from manufacturing electric motors, generators, and transformers in Germany is expected to reach around USD 19.51 billion by 2025, showing an increase from the previous year's USD 18.5 billion.

- Further, as per JEITA (Japan Electronics and Information Technology Industries Association) data, the electronics industry achieved a total production of USD 7,098.34 million in November 2022, while Japan exported electronics valued at USD 8,395.45 million in December 2022.

- Owing to these factors, the escalating demand for electrical and electronic components is anticipated to drive the demand for impregnating resins in the forthcoming years.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to capture a high share of the impregnating resins market during the forecast period. Due to growing electrical and automobile manufacturing facilities in China, India, and Japan, the demand for and utilization of impregnating resins may increase the scope of the market during the forecast period.

- China is the largest base for electronics production in the world. Electronic products like TVs, smartphones, wires, cables, portable computing devices, gaming systems, and other personal electronic devices recorded the highest growth in the consumer electronics segment.

- According to the National Bureau of Statistics of China, in December 2023, retail sales of household appliances and consumer electronics in China accounted for about CNY 77.25 billion (USD 10.73 billion).

- India has witnessed a rise in demand for electronic goods in recent years. This is because India is the world's second-largest maker of mobile phones and registers a high internet penetration rate. The Indian government gives electronics hardware a lot of attention because it is one of the most important parts of the Make in India, Digital India, and Start-up India programs.

- In India, according to the Commerce and Industry Ministry, the exports of electronic goods recorded USD 6.67 billion from April to December 2022, compared to USD 10.99 billion during the same period last year, registering a growth of 51.56%.

- Semiconductors are also used in the automotive industry. The demand for semiconductors in manufacturing electric vehicles is increasing with the growing number of electric vehicles sold worldwide, therefore positively impacting the demand for impregnating resins.

- According to the International Energy Agency, sales of electric vehicles in Japan increased from 1.2% to 3% from 2021 to 2022.

- Likewise, according to the Ministry of Land, Infrastructure and Transport, in 2022, around 303.3 thousand out of the 389.96 thousand registered electric vehicles in South Korea were categorized as passenger cars, with an additional approximately 81.24 thousand electric vans registered during the same period.

- Therefore, Asia-Pacific is likely to be the most significant market for impregnating resins over the next few years because of the growing demand from different applications.

Impregnating Resins Industry Overview

The impregnating resins market is partially consolidated and consists of international and regional players. The top five players account for a notable share of the market. The major companies (not in any particular order) are Elantas GmbH, Henkel AG & Co. KGaA, Axalta Coating Systems, Huntsman International LLC, and 3M.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage in the Electrical and Electronics Segment

- 4.1.2 Increasing Electric Veichles Production

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Less Efficiency of Solvent-based Resin Systems

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Technology

- 5.1.1 Solventless Resins

- 5.1.2 Solvent-based Resins

- 5.2 By Resin Type

- 5.2.1 Polyester

- 5.2.2 Epoxy

- 5.2.3 Polyesterimide

- 5.2.4 Other Resin Types

- 5.3 By Application

- 5.3.1 Motors and Generators

- 5.3.2 Home Appliances

- 5.3.3 Transformer

- 5.3.4 Electrical and Electronics Components

- 5.3.5 Automotive

- 5.3.6 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 United Arab Emirates

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis**/Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 AEV Ltd

- 6.4.3 Axalta Coating Systems LLC

- 6.4.4 Borger GmbH

- 6.4.5 Chetak Manufacturing Company

- 6.4.6 ELANTAS GmbH

- 6.4.7 Henkel AG & Co. KGaA

- 6.4.8 Huntsman International LLC

- 6.4.9 NIPPON RIKA INDUSTRIES CORPORATION

- 6.4.10 Momentive

- 6.4.11 Polycast Industries Inc.

- 6.4.12 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Development of Eco-Friendly Formulations