|

市场调查报告书

商品编码

1689807

有机颜料:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Organic Pigments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

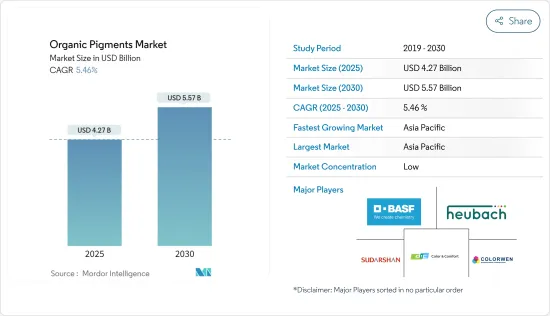

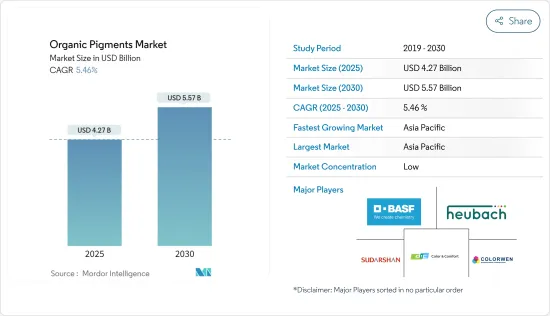

有机颜料市场规模预计在 2025 年为 42.7 亿美元,预计到 2030 年将达到 55.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.46%。

关键亮点

- 新冠疫情严重打击了全球有机市场。有机颜料产业受到全球供应链中断和终端用户产业(尤其是油漆和涂料产业)需求减少的影响。製造商在停工期间停止生产,导致需求下降。目前,市场已从疫情中恢復,并正在以相当快的速度成长。

- 短期内,油漆和涂料行业不断增长的需求以及纺织业不断增长的需求正在推动市场的发展。

- 另一方面,严格的环境法规导致的生产成本上升以及无机颜料优于有机颜料的性能阻碍了有机颜料市场的成长。

- 家具业预计将具有巨大的成长潜力。有机颜料有助于保护木材免受潮湿和食物溢出的影响。这些自然的色彩可以为家具提供持久的美感和装饰吸引力。预计这种潜在的扩张将提高市场的总供应率。

- 亚太地区在全球有机颜料市场中占据主导地位,其中中国、印度和日本的消费率最高。

有机颜料市场趋势

在油漆和涂料行业的使用日益增多

- 有机颜料广泛应用于油漆和涂料行业,预计在预测期内将成为成长最快的市场。

- 油漆不仅可以保护建筑物、桥樑、汽车和电子产品的表面,还可以美化它们。有机颜料分散性优良,颜料颗粒细腻,色泽鲜艳,分散性好,着色力强。

- 根据美国涂料协会的数据,2022年美国油漆和涂料行业的产量约为13.6亿加仑,预计到2023年将超过13.87亿加仑。

- 油漆和涂料在汽车工业中用于装饰和保护汽车内部和外部部件。所施加的涂层必须能够保护外部免受紫外线的伤害,并具有耐热、耐晒、耐刮擦、耐水、耐碱和耐酸的功能。

- 根据国际汽车工业协会(OICA)预测,2022年全球汽车产量将达8,502万辆,与前一年同期比较增加6%。到2022年,中国、美国、德国将成为世界三大汽车和商用车製造商。

- 在建筑业中,家具和建筑涂料是涂料消费量最大的领域。油漆和被覆剂可保护家具和木材免受潮湿和其他溢出物的侵害。木材传达了自然感,融合了方面的传统和现代方面。油漆赋予家具装饰美感和耐用性。

- 根据联合国商品贸易统计资料库,2021年美国家具进口额约814亿美元,家具出口额约93亿美元。

- 建筑业对油漆和涂料的需求不断增长,预计将推动有机颜料市场的发展。

亚太地区占市场主导地位

- 由于印度和中国等国家的需求不断增长,预计亚太地区将在预测期内主导有机颜料市场。

- 一些最大的有机颜料生产商位于亚太地区。该市场中的一些公司包括印度化学工业公司、Sudarshan Chemical Industries Limited、Koel Colours Pvt Ltd、杭州汉彩化工有限公司和Origo Chemical。

- 基础设施领域是印度政府重点关注的领域。为确保国家经济持续成长,印度计画在2019年至2023年期间投资1.4兆美元用于基础建设。政府提案在2018年至2030年期间投资7,500亿美元用于铁路基础建设。智慧城市和「全民住房」等计划的发展预计将增加对油漆和涂料的需求。

- 据印度统计和计划实施部(MOSPI)称,印度和中国的基础设施和建设活动蓬勃发展,推动了家具消费。预计到 2024 年,印度家具製造业收益将超过 40.3 亿美元。

- 透过「印度製造」等措施和增加对电动车(EV)的投资,汽车产业的成长正在扩大油漆和涂料中有机颜料的范围。

- 除了油漆和涂料之外,有机颜料由于其不透明性和热稳定性,也在塑胶工业中广泛应用。有机颜料比染料更受欢迎,因为它们对基材没有亲和性。目前有机颜料主要用于聚烯。

- 亚太地区生产了全球一半以上(52%)的塑胶。由于创新和改进,塑料的需求预计会增长。预计有机颜料市场的需求将受到技术进步和塑胶使用量增加的推动。

- 上述因素加上政府支持,将推动预测期内有机颜料市场需求的增加。

有机颜料产业概况

全球有机颜料市场部分细分,主要参与者占有少量份额。市场上的一些主要企业包括BASF SE、Sudarshan Chemical Industries Limited、DIC Corp.、Colorwem Int.Corp. 和 Heubach GmbH。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 涂料产业需求不断成长

- 纺织业需求增加

- 其他驱动因素

- 限制因素

- 严格的环境法规导致生产成本上升

- 无机颜料的性能优于有机颜料

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 颜料类型

- 偶氮

- 酞菁

- Quinacridones

- 蒽醌

- 其他颜料类型

- 最终用户产业

- 油漆和涂料

- 塑胶和聚合物

- 印刷和包装

- 纤维

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- BASF SE

- Clariant

- COLORWEN INTERNATIONAL CORP.

- DIC CORPORATION

- Hangzhou Han-Color Chemical CO. LTD

- Heubach GmbH

- Indian Chemical Industries

- Koel Colours Pvt Ltd

- Origo Chemical

- Sudarshan Chemical Industries Limited

- Trust Chem Co. Ltd

- VIBFAST PIGMENTS PVT LTD

- Vipul Organics Ltd

- VOXCO India

第七章 市场机会与未来趋势

- 家具业利润丰厚的成长机会

- 其他机会

简介目录

Product Code: 68426

The Organic Pigments Market size is estimated at USD 4.27 billion in 2025, and is expected to reach USD 5.57 billion by 2030, at a CAGR of 5.46% during the forecast period (2025-2030).

Key Highlights

- The COVID-19 pandemic harmed the global organic market. The organic pigments industry was impacted by a disrupted global supply chain and reduced demand from end-user sectors, particularly the paints and coatings sector. Manufacturers suspended output during lockdowns, leading to a decrease in demand. Currently, the market has recovered from the pandemic and is growing at a significant rate.

- Over the short term, growing demand in the paints and coatings industry and an increase in the demand from the textile industry are driving the market.

- On the flip side, higher production costs due to stringent environmental regulations and the superior performance of inorganic pigments to organic pigments are hindering the growth of the organic pigments market.

- Nevertheless, the furniture industry is anticipated to have significant growth potential. Organic pigments aid in the protection of wood against moisture and spills. These natural colors can provide long-lasting beauty and decorative appeal to this furniture. Its potential for expansion is expected to boost the market's total supply rate.

- The Asia-Pacific region dominates the global organic pigment market, with the highest consumption rates being registered in China, India, and Japan.

Organic Pigments Market Trends

Increasing Application in the Paints and Coatings Industry

- Organic pigments are extensively used in the paints and coatings industry and are expected to be the fastest-growing market during the forecast period.

- Paints not only protect but also beautifies surfaces from buildings to bridges to automotive to electronics. Organic pigments, through fine pigmentation processing, provide bright color, good dispersion, and high tinting strength.

- According to the American Coatings Association, the manufacture of paint and coatings industry in the United States was around 1.36 billion gallons in 2022. In 2023, the industry's output is expected to exceed 1.387 billion gallons.

- Paints and coatings are used in the automotive industry for both interior and exterior parts for decorative as well as protective purposes. The coatings applied should protect the exteriors from UV radiation and provide resistance against heat, sunlight, scratches, water, alkaline, and acids.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), the world motor vehicle output in 2022 was 85.02 million, a 6% increase over the previous year. In 2022, China, the United States, and Germany were the top three manufacturers of cars and commercial vehicles.

- In the construction industry, furniture and architectural coatings account for the largest consumption of paints. Paints and coatings protect furniture and wood from moisture and other spillages. The wood conveys naturalness, which unites traditional and modern aspects of architecture. Coatings provide decorative beauty and long-lastingness for furniture.

- According to the UN Comtrade, in 2021, the value of furniture imports into the United States was around USD 81.4 billion, while furniture exports were roughly USD 9.3 billion.

- The increase in demand for paints and coatings in the construction industry is expected to drive the organic pigments market.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the organic pigment market during the forecast period due to increased demand from countries like India and China.

- Some of the largest producers of organic pigments are located in the Asia-Pacific region. The companies operating in the market include Indian Chemical Industries, Sudarshan Chemical Industries Limited, Koel Colours Pvt Ltd, Hangzhou Han-Color Chemical Co. Ltd, Origo Chemical, and many others.

- The infrastructure sector is the key focus of the Indian government. To ensure sustained national growth, India plans to invest USD 1.4 trillion in infrastructure between 2019 and 2023. The government has proposed investing USD 750 billion in railway infrastructure from 2018 to 2030. The development of smart cities and other schemes like 'household for all' are expected to increase the demand for paints and coatings.

- The infrastructure and construction activities in India and China have been growing rapidly, which increases the consumption of furniture, according to the Ministry of Statistics and Program Implementation (MOSPI). The revenue from furniture manufacturing in India is expected to be over USD 4.03 billion by 2024.

- The growth in the automotive sector with initiatives like 'Make in India' and the increase in investments in electric vehicles (EVs) is increasing the scope for organic pigments in paints and coatings.

- Apart from paints and coatings, organic pigments offer a wide range of applications in the plastics industry due to their opacity and stability to heat. Organic pigments are preferred over dyes as they have no affinity to the substrate. Currently, organic pigments are mainly used in polyolefins.

- The Asia-Pacific region is responsible for manufacturing more than half (52 percent) of the world's plastic. The demand for plastics is expected to grow as a result of innovations and improvements. The Organic Pigments Market has foreseen demand due to innovations and an increase in the use of plastic.

- The aforementioned factors, coupled with government support, are contributing to the increasing demand for the organic pigments market during the forecast period.

Organic Pigments Industry Overview

The global organic pigments market is partially fragmented, with the major players accounting for a marginal share. A few key companies operating in the market include BASF SE, Sudarshan Chemical Industries Limited, DIC Corp., Colorwem Int. Corp., and Heubach GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Paints and Coatings Industry

- 4.1.2 Increase in Demand from the Textile Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Higher Production Costs Due to Stringent Environmental Regulations

- 4.2.2 Superior Performance of Inorganic Pigments to Organic Pigments

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Pigment Type

- 5.1.1 Azo

- 5.1.2 Phthalocyanine

- 5.1.3 Quinacridone

- 5.1.4 Anthraquinone

- 5.1.5 Other Pigment Types

- 5.2 End-user Industry

- 5.2.1 Paints and Coatings

- 5.2.2 Plastics and Polymer

- 5.2.3 Printing and Packaging

- 5.2.4 Textile

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Clariant

- 6.4.3 COLORWEN INTERNATIONAL CORP.

- 6.4.4 DIC CORPORATION

- 6.4.5 Hangzhou Han-Color Chemical CO. LTD

- 6.4.6 Heubach GmbH

- 6.4.7 Indian Chemical Industries

- 6.4.8 Koel Colours Pvt Ltd

- 6.4.9 Origo Chemical

- 6.4.10 Sudarshan Chemical Industries Limited

- 6.4.11 Trust Chem Co. Ltd

- 6.4.12 VIBFAST PIGMENTS PVT LTD

- 6.4.13 Vipul Organics Ltd

- 6.4.14 VOXCO India

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Lucrative Growth Opportunities from the Furniture Industry

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219