|

市场调查报告书

商品编码

1689809

环氧固化剂:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Epoxy Curing Agent - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

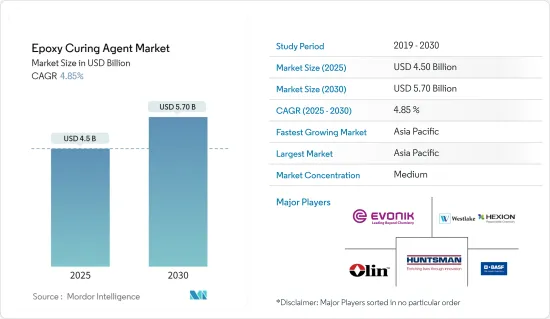

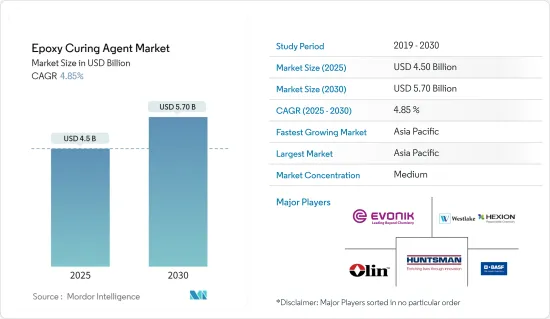

环氧硬化剂市场规模预计在 2025 年为 45 亿美元,预计到 2030 年将达到 57 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.85%。

关键亮点

- 2020 年,新冠疫情对市场产生了负面影响。不过,目前市场已恢復至疫情前的水平,预计在预测期内将稳定成长。

- 建筑业需求的不断增长、新兴市场对轻质复合材料的需求以及电子行业对环氧硬化剂的需求不断增长是推动所调查市场需求的关键因素。

- 然而,针对胺基硬化剂的环境法规预计会阻碍市场成长。预计在预测期内,新型环保环氧硬化剂的开发将为製造商提供大量机会。

- 预计亚太地区将主导市场,其中中国和印度等国家将出现最显着的消费趋势。

环氧固化剂市场趋势

油漆和涂料行业需求增加

- 环氧硬化剂用于与环氧基发生反应来固化环氧树脂。环氧树脂广泛用于生产黏合剂和密封剂、油漆和被覆剂以及复合材料。

- 由于汽车、建筑等领域的需求不断增长,油漆和涂料行业在过去几年中一直经历着积极的增长。

- 需求的成长导致全球和国内公司在多个国家开展了多个扩张计划,以缩小供需缺口。例如

- 2023 年 5 月,日本涂料控股公司透过其子公司日本涂料船舶涂料公司宣布将把涂料生产扩展到越南,以满足不断增长的市场需求。这些工厂位于越南北部、南部和中部工业带,预计今年将开始生产船舶防腐和防护涂料。同时,预计2024-2025年船体和防污产品将加入生产线。

- 2022年7月,BASF涂料业务扩大了其位于中国南方广东省江门市涂料基地的汽车修补被覆剂产能。随着扩建工程的完成,BASF汽车修补漆的年产能将提升至3万吨。

- 建筑业的成长在增加油漆和被覆剂的需求方面发挥着重要作用。建设活动的增加将增加对油漆和被覆剂的需求,最终促进环氧硬化剂市场的发展。

- 根据英国土木工程师学会的数据,预计到2025年,中国、印度和美国将贡献全球建筑业扩张的近60%,推动该产业对环氧树脂的市场需求。

- 预计所有上述因素都将在预测期内推动该行业的成长。

亚太地区占市场主导地位

- 在亚太地区,中国凭藉其庞大的油漆和被覆剂生产基地,继续在需求市场占据主导地位。

- 根据欧洲涂料报告显示,中国约有1万家涂料製造商。儘管国内油漆和涂料製造商实力雄厚,但外资公司和合资企业也占有相当大的市场占有率。

- 截至2022年12月,中国涂料製造业市场规模为940亿美元。 22 财年,印度涂料产业及相关产品出口额约 229.6 亿印度卢比(2.8 亿美元),高于一年前的 174.3 亿印度卢比(2.1 亿美元)。

- 据国家发展和改革委员会称,中国政府已核准26 个基础设施项目,总价值约 1,420 亿美元,预计将于 2023 年完工。预计这将增加建筑业对油漆和涂料的需求,从而推动环氧硬化剂市场的扩张。

- 随着企业扩大投资建立多元化涂料生产设施,对环氧固化剂的需求正在蓬勃发展。 PPG最近决定投资1,300万美元在中国嘉定建立一家油漆和涂料厂。投资包括安装八条新的粉末涂料生产线和扩建粉末涂料技术中心。结果,该工厂的生产能力每年增加了8,000多吨。

- 此外,环氧树脂广泛用于涂覆和封装电路元件和电子设备。根据日本电子情报技术产业协会(JEITA)统计,2022年11月电子产业总产值飙升至70.9834亿美元。 2022年12月,日本电子设备出口总合达83.9545亿美元。

- 在印度,对电子设备的需求激增,导致市场规模迅速扩大。 2022 年 12 月,印度电子产品出口额为 166.7 亿美元,而 2021 年 12 月为 109.9 亿美元。印度和中国快速发展的电子和家用电子电器产业有潜力进一步推动亚太地区的市场成长。

- 因此,预计上述因素将在预测期内推动该国环氧硬化剂市场的成长。

环氧固化剂产业概况

环氧硬化剂市场已部分整合,主要跨国公司均参与其中。研究涉及的市场主要企业包括赢创工业股份公司、亨斯迈国际有限责任公司、奥林公司、西湖公司、BASF公司等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 建筑和建筑业的需求增加

- 轻质复合材料的新开发

- 电子业对环氧固化剂的需求不断增长

- 限制因素

- 胺类固化剂的环境法规

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 类型

- 胺

- 聚酰胺

- 无水

- 其他类型(酰胺胺、苯胺)

- 应用

- 复合材料

- 画

- 黏合剂和密封剂

- 电气和电子

- 其他用途(修理)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Atul Ltd.

- BASF SE

- Cardolite Corporation

- Epochemie-Epoxy Curing Agents

- Epoxy Division Aditya Birla Chemicals (Thailand) Limited (Aditya Birla Group)

- Evonik Industries AG

- Huntsman International LLC

- Kukdo Chemical Co. Ltd.

- Kumho P& B Chemicals Inc.

- Mitsubishi Chemical Corporation

- Olin Corporation

- Shandong Deyuan Epoxy Resin Co. Ltd.

- Toray Industries Inc.

- Westlake Corporation(Hexion)

第七章 市场机会与未来趋势

- 新型环保低VOC或无VOC环氧固化剂的开发

- 其他机会

简介目录

Product Code: 68509

The Epoxy Curing Agent Market size is estimated at USD 4.50 billion in 2025, and is expected to reach USD 5.70 billion by 2030, at a CAGR of 4.85% during the forecast period (2025-2030).

Key Highlights

- The COVID-19 pandemic had a negative impact on the market in 2020. However, the market has now reached pre-pandemic levels, and it is expected to grow at a steady pace in the forecast period.

- The increasing demand from the building and construction industry, new developments in lightweight composite materials, and growing demand for epoxy curing agents in the electronics industry are the major factors driving the demand for the studied market.

- However, environmental regulations on amine-based curing agents are expected to hinder the market's growth. Developing new eco-friendly epoxy curing agents will provide numerous opportunities for manufacturers over the forecast period.

- The Asia-Pacific region is expected to dominate the market, with the most prominent consumption trends registered in countries such as China and India.

Epoxy Curing Agent Market Trends

Increasing Demand from the Paints and Coatings Industry

- Epoxy-curing agents are used to cure epoxy resins by reacting with the epoxide groups. Epoxy resins are extensively used to manufacture adhesives and sealants, paints and coatings, and composites.

- The paints and coatings industry has been witnessing positive growth over the years owing to the increased demand from sectors like automotive, building and construction, and others.

- Such increased demand has led to several expansion projects by global and domestic players in several countries to reduce the demand and supply gap. For instance -

- In May 2023, Nippon Paint Holdings Company Ltd. announced that through its subsidiary Nippon Paint Marine Coatings Co., Ltd., the company is expanding its coatings production to Vietnam in response to the growing market demand. The facilities located in industrial zones in the north, south, and central regions of Vietnam are likely to begin the production of marine anticorrosion and protective coatings by this year. At the same time, the hull and antifouling products are set to be added to production lines by 2024-2025.

- In July 2022, BASF Coatings expanded the production capacity of automotive refinish coatings at its coatings site in Jiangmen, Guangdong Province, in South China. With the completion of the expansion, BASF's annual production capacity of automotive refinish coatings increased to 30,000 metric tons.

- The growing construction industry plays a keen role in the increasing demand for paints and coatings. The greater the increase in the number of construction activities, the greater the demand for paints and coatings, which will eventually boost the market for epoxy-curing agents.

- As per the Institution of Civil Engineers, China, India, and the United States are projected to contribute to nearly 60% of the worldwide expansion in the construction sector by 2025, consequently boosting the market demand for epoxy resins within the industry.

- All the factors mentioned above are expected to increase the industry's growth during the forecast period.

Asia-Pacific Region to Dominate the Market

- In the Asia-Pacific region, China continues to dominate in terms of demand in the market studied, which is attributed to its vast production base for paints and coatings.

- As reported by European Coatings, China hosts approximately 10,000 coatings manufacturers. Despite the significant presence of domestic paint and coatings producers, foreign companies and joint ventures also command a considerable market share.

- As of December 2022, the paint manufacturing industry in China had a market size of USD 94 billion. In FY 2022, the export value of India's paint industry and allied products was around INR 22.96 billion (USD 280 million), which increased from INR 17.43 billion (USD 210 million) in the previous year.

- As per the National Development and Reform Commission of China, the Chinese government has greenlit 26 infrastructure initiatives valued at approximately USD 142 billion, slated for completion by 2023. This is expected to drive up the need for paints and coatings in construction, consequently propelling the market expansion of epoxy curing agents.

- As companies ramp up investments in the construction of diverse coatings manufacturing facilities, the demand for epoxy curing agents is experiencing a surge. PPG recently finalized a USD 13 million investment in its paint and coatings plant situated in Jiading, China. This investment encompasses the installation of eight new powder coating production lines and the expansion of the Powder Coatings Technology Center. Consequently, the plant's capacity has been bolstered by over 8,000 metric tons annually.

- Furthermore, epoxy resins find extensive application in coating and encapsulating electrical circuit components and electronic devices. As per the Japan Electronics and Information Technology Industries Association (JEITA), the electronics industry's total production surged to USD 7,098.34 million in November 2022. Japan also exported a total of USD 8,395.45 million worth of electronics in December 2022.

- In India, the electronics market experienced a surge in demand, leading to a rapid expansion in market size. Electronic goods exports from India amounted to USD 16.67 billion in December 2022, compared to USD 10.99 billion in December 2021. The burgeoning electronics and appliances sector in both India and China has the potential to further propel market growth in the Asia-Pacific region.

- Therefore, the above-mentioned factors will provide a growing market for epoxy curing agents in the country during the forecast period.

Epoxy Curing Agent Industry Overview

The epoxy curing agents market is partially consolidated, with the presence of majorly multi-national players. The major companies of the market studied include Evonik Industries AG, Huntsman International LLC, Olin Corporation, Westlake Corporation, and BASF SE, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Building and Construction Industry

- 4.1.2 New Developments in Lightweight Composite Materials

- 4.1.3 Growing Demand for Epoxy Curing Agents in the Electronics Industry

- 4.2 Restraints

- 4.2.1 Environmental Regulations on Amine-based Curing Agents

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Amines

- 5.1.2 Polyamides

- 5.1.3 Anhydrides

- 5.1.4 Other Types (Amidoamine, Phenalkamine )

- 5.2 Application

- 5.2.1 Composites

- 5.2.2 Paints and Coatings

- 5.2.3 Adhesives and Sealants

- 5.2.4 Electrical and Electronics

- 5.2.5 Other Applications (Repairs)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Atul Ltd.

- 6.4.2 BASF SE

- 6.4.3 Cardolite Corporation

- 6.4.4 Epochemie - Epoxy Curing Agents

- 6.4.5 Epoxy Division Aditya Birla Chemicals (Thailand) Limited (Aditya Birla Group)

- 6.4.6 Evonik Industries AG

- 6.4.7 Huntsman International LLC

- 6.4.8 Kukdo Chemical Co. Ltd.

- 6.4.9 Kumho P&B Chemicals Inc.

- 6.4.10 Mitsubishi Chemical Corporation

- 6.4.11 Olin Corporation

- 6.4.12 Shandong Deyuan Epoxy Resin Co. Ltd.

- 6.4.13 Toray Industries Inc.

- 6.4.14 Westlake Corporation (Hexion)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of New Environmental Friendly Low or Non-VOC Epoxy Curing Agents

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219