|

市场调查报告书

商品编码

1940626

企业员工交通服务:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Corporate Employee Transportation Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

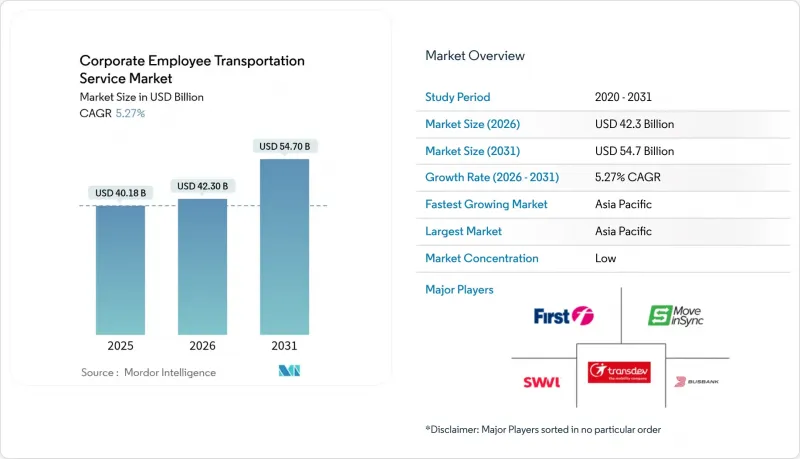

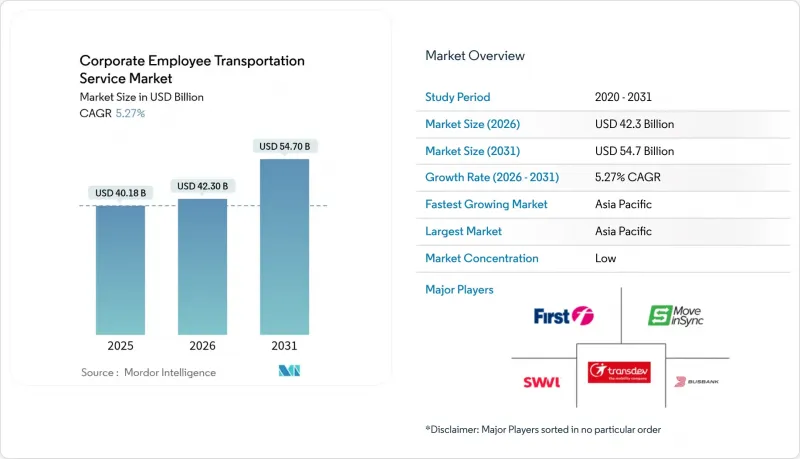

企业员工交通服务市场预计将从 2025 年的 401.8 亿美元成长到 2026 年的 423 亿美元,到 2031 年达到 547 亿美元,2026 年至 2031 年的复合年增长率为 5.27%。

企业为吸引人才、遵守范围 3排放法规以及实施数位化平台以简化路线规划,纷纷将通勤福利计画纳入正式流程,这推动了通勤产业的成长。自动驾驶班车的商业化运作、政府对零排放车辆日益增长的支持以及区域城市交通拥堵加剧,都促进了通勤行业的扩张。分散的区域运营商和创业投资的平台运营商并存,使得市场竞争仍然温和;而司机短缺和保险费上涨带来的成本压力则推动了技术整合。同时,雇主们正将通勤福利定位为策略性福利,并将交通政策与多元化、公平性和包容性 (DEI) 目标相结合,以提高员工留任率并降低缺勤率。

全球企业员工交通服务市场趋势与洞察

数位化按需接送平台拓展全球业务

各国政府正在为叫车公司(TNC)制定保险、许可和无障碍设施方面的规定,使企业使用基于应用程式的班车服务合法化。加州的按次付费保险和纽约州的许可费制度有利于资金雄厚的现有企业,让企业风险负责人更加安心。西雅图的集体谈判条例提高了驾驶人薪资,同时提升了服务可靠性,从而为雇主带来了更高的服务水准。随着合规性标准的日益明确,企业员工通勤市场正在经历数位化路线规划、动态定价和自动费用编码的普及,推动了平台的使用。

亚洲和非洲二线都会区的城市快速扩张

印度的智慧城市计画和AMRUT计画将基础设施投资重点放在快速发展的二线城市,这与亚洲开发银行预测的到2050年印度城市人口将达到4亿的目标完全吻合。撒哈拉以南非洲也呈现类似的趋势,世界银行的数据显示,该地区的城市人口预计将在15年内翻倍。经合组织倡导的公私合营将使市政当局能够制定财务计划,并使企业班车营运商能够融入城市层面的出行即服务(MaaS)生态系统。这些趋势将增加员工通勤需求,并为企业员工交通市场中基于路线、技术驱动的服务提供者开闢新的市场机会。

执照商业司机短缺

美国疾病管制与预防中心(CDC)的模型预测,到2030年,由于退休人数超过新入行人数,美国将出现16万名驾驶人。联邦汽车运输安全管理局(FMCSA)的「安全驾驶员学徒试验计画」招收18至20岁的年轻人,但要求提供三年的数据以检验其安全驾驶能力。随着薪资上涨,企业员工通勤市场正转向无需商业驾驶执照的小型车辆以及减少对人工依赖的自动驾驶试点计画。为了巩固员工基础并提高员工满意度,营运商提供诱人的留任奖金和灵活的轮班竞标选项。这些措施不仅创造了更稳定的职场环境,还有助于促进州际商业驾驶执照(CDL)的核准,扩大候选人才库,并吸引拥有不同技能的专业人才。

细分市场分析

截至2025年,外包运输服务将占企业员工运输市场的45.05%,反映出企业正透过外包车辆维护、驾驶人管理和合规监管等方式,转向轻资产策略。租赁将成为成长最快的所有权模式,复合年增长率将达到7.08%。租赁模式提供灵活的运力,能够适应混合办公模式,并允许在季节性需求高峰期快速扩张。虽然在安全要求高的行业中,车辆所有权仍然占据主导地位,但资本密集和即将推出的排放法规限制了企业的扩张意愿。

随着企业员工交通服务市场的日益成熟,外包供应商提供的承包解决方案整合了预测性维护、路线分析和行动预订API,使其成为人力资源和采购部门专注于自身核心竞争力的理想选择。联邦机构在GSA采购计画下的第三方车辆合约中也展现出类似的趋势,证实了这种方法在公共部门的有效性。由此形成的生态系统有助于大量采购、简化绩效指标,并在跨国部署中实现一致的服务水准协定。

到2025年,巴士和长途客车将占企业员工交通市场收入的40.95%,这主要得益于连接郊区停车换乘设施和大型园区的高密度、高性价比线路的推动。同时,厢型车和多用途汽车(MPV)正以8.21%的复合年增长率快速增长,因为车队运力正在适应灵活工作安排下每日员工人数的波动。预计厢型车在企业员工交通市场的份额将迅速扩大,因为车队电气化的激励措施降低了总体拥有成本(TCO)。德国目前的税收制度对价值高达9.5万欧元(10万美元)的电动厢型车提供补贴,有利于提高车辆的全生命週期经济效益。自动驾驶试验计画更倾向于中型车辆,因为它们重量更轻、宽度更窄,更容易获得路线认证。

小型巴士和轿车将继续扮演各自的特定角色:小型巴士填补郊区环线客流量的不足,而轿车则服务于高阶主管和有医疗需求的乘客。从自动紧急煞车到车道维持辅助等安全功能的广泛应用将缩小营运成本差距。随着企业采用排放仪錶板,车辆类型的选择将成为实现范围3排放目标的关键因素,从而推动电池货车和燃料电池公车的发展。

区域分析

预计到2025年,亚太地区将占企业员工交通服务市场39.05%的份额,并在2031年之前以8.44%的复合年增长率成长。这主要得益于印度智慧城市投资和东南亚多模态走廊规划的进展。中国的城市丛集策略已在大型区域环带内建立了首末一公里接驳服务体系,为出行即服务(MaaS)的整合提供了沃土。经合组织引入的公私合营特许经营模式允许透过用户付费实现资本回收,并降低了营运商的准入风险。该地区年轻的人口结构和较高的智慧型手机普及率进一步强化了行动预订的优势。

北美地区的自动驾驶汽车普及率已趋于稳定,联邦政府提供的通勤补贴(每月最高可达325美元)有助于维持计画资金。遍布八个州的20多条自动驾驶测试路线巩固了北美在自动驾驶技术领域的领先地位,而驾驶人则促使运营商尝试多班次和轮班制。保险费上涨持续构成成本压力,挤压小规模业者的利润空间,并推动产业整合。

欧洲在永续性和隐私保护政策方面取得了显着进展。德国的加速折旧制度和西班牙的MOVES III补贴计画缩短了电动车队的投资回收期,并鼓励快速更新换代。荷兰的自行车补贴政策,加上低税率的企业自行车计划,正在推动积极通勤方式的普及。一般资料保护规则(GDPR)和《职工委员会法》强制执行严格的资料处理通讯协定,并鼓励供应商建构以隐私为中心的解决方案。这些法规提高了进入门槛,同时提升了服务质量,增强了欧洲供应商在企业员工交通运输市场的声誉。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 数位化按需接送平台拓展全球业务

- 雇主越来越关注环境、社会和治理 (ESG) 以及范围 3 的排放。

- 企业间人才竞争加剧,通勤补贴增加

- 亚洲和非洲二线城市的快速都市化进程

- 自动驾驶班车测试进入商业化阶段

- 欧洲共用旅游税收优惠政策

- 市场限制

- 执照商业司机短缺

- 商用车保险费上涨

- 现有工会反对共乘模式

- 员工追踪应用程式引发资料隐私反弹

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方(员工)的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依所有权类型

- 本公司自有运输服务

- 外包运输服务

- 出租/租赁

- 接驳车服务(定时接驳车)

- 按车辆类型

- 搭乘用车

- 厢型车和多用途车辆(MPV)

- 小巴

- 公车和长途客车

- 按服务模式

- 出游即服务 (MaaS)

- 软体即服务 (SaaS)/旅游规划

- 监护权转移服务

- 混合模式(出游即服务 + 车队管理)

- 透过预订平台

- 行动应用

- 基于网路的门户

- 客服中心/线下

- 按最终用户行业划分

- 资讯科技与资讯科技相关服务 (ITES)

- 银行、金融服务和保险(BFSI)

- 製造业和工业部门

- 医疗保健和生命科学

- 能源与公共产业

- 其他(教育机构、政府机构等)

- 按地区

- 北美洲

- 我们

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 波兰

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 澳洲

- 纽西兰

- 泰国

- 印尼

- 越南

- 新加坡

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 埃及

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Transdev Group

- FirstGroup plc

- Swvl Holdings Corp

- MoveInSync Technology Solutions Private Limited

- Shuttl(Chalo Mobility Chalo Mobility Private Limited)

- Busbank(Global Charter Services Inc.)

- Janani Tours and Resorts Pvt Ltd.

- Sun Telematics

- Via Transportation Inc.

- Lyft Inc.

- Uber Technologies Inc.

- Enterprise Holdings Inc.

- Addison Lee Limited

- Prairie Bus Lines Ltd.

- Eco Rent A Car

- Zum Services Inc.

- BusUp Technologies SL

- Ridecell Inc.

- Fleet Complete

第七章 市场机会与未来展望

The corporate employee transportation services market is expected to grow from USD 40.18 billion in 2025 to USD 42.3 billion in 2026 and is forecast to reach USD 54.7 billion by 2031 at 5.27% CAGR over 2026-2031.

Growth rests on corporations formalizing commuter-benefit programs to secure talent, comply with Scope-3 emission mandates, and adopt digital platforms that streamline route planning. Autonomous shuttle pilots entering commercial service, widening government incentives for zero-emission fleets, and rising urban congestion across Tier-2 cities collectively reinforce expansion momentum. Competitive intensity remains moderate because fragmented regional operators coexist with venture-backed platform players, while cost pressures tied to driver shortages and escalating insurance premiums encourage technology integration. In parallel, employers treat commuter offerings as a strategic benefit, aligning transportation policies with diversity, equity, and inclusion (DEI) objectives to boost retention and shrink absenteeism.

Global Corporate Employee Transportation Service Market Trends and Insights

Digital On-Demand Shuttle Platforms Are Scaling Globally

Governments have codified insurance, licensing, and accessibility rules for Transportation Network Companies, legitimizing corporate use of app-based shuttles. California mandates coverage per active ride while New York applies a licensing fee, moves that favor capitalized incumbents and reassure corporate risk managers. Seattle's collective-bargaining ordinance pushes driver wages up but lifts reliability, translating into higher employer service levels. As compliance clarity spreads, the corporate employee transportation services market embeds digital routing, dynamic pricing, and automated expense coding, deepening platform stickiness.

Rapid Urban Sprawl in Tier-2 Cities of Asia and Africa

India's Smart Cities Mission and AMRUT funnel infrastructure outlays toward rising Tier-2 hubs, dovetailing with Asian Development Bank projections of 400 million new urbanites by 2050 . Similar patterns occur in Sub-Saharan Africa where World Bank data track city populations that will double inside 15 years. Public-private partnerships championed by the OECD give municipalities financial blueprints, allowing corporate shuttle operators to integrate with city-level mobility-as-a-service ecosystems. These trends swell employee commuting demand and open white space for route-based, tech-enabled providers in the corporate employee transportation services market.

Labor Shortages in Licensed Commercial Drivers

CDC modeling foresees a 160,000-driver gap by 2030 as retirements outpace new entrants. FMCSA's Safe Driver Apprenticeship Pilot accepts 18- to 20-year-olds but needs three-year data to validate safety . With wages escalating, the corporate employee transportation services market pivots to smaller vehicles that do not require commercial driver's licenses and to autonomous pilots that reduce human dependency. To fortify their operations and enhance employee satisfaction, providers are rolling out enticing retention bonuses and offering flexible shift bidding options. These initiatives not only create a more stable work environment but also help them advocate for interstate CDL reciprocity, which would broaden their candidate pools and attract a diverse range of skilled professionals.

Other drivers and restraints analyzed in the detailed report include:

- Growing Employers' Focus on ESG and Scope-3 Emission Cuts

- Autonomous Shuttle Pilots Entering Commercial Phase

- Data-Privacy Backlash Against Employee Tracking Apps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Outsourced transportation service held a 45.05% slice of the corporate employee transportation service market in 2025, underscoring a corporate pivot toward asset-light strategies that offload fleet upkeep, driver management, and regulatory compliance. Rental and leasing follow as the fastest-growing ownership mode with a 7.08% CAGR, offering flex capacity for hybrid work schedules and allowing rapid scaling during seasonal demand spikes. Company-owned operations persist in industries with elevated security needs, but capital intensity and looming emission regulations curb expansion appetite.

As the corporate employee transportation services market matures, outsourced vendors bundle predictive maintenance, route analytics, and mobile booking APIs, forming turnkey solutions attractive to HR and procurement teams focused on core-business concentration. Federal agencies mirror the trend by contracting third-party fleets under GSA schedules, signaling public-sector validation. The resulting ecosystem fosters consolidated purchasing, streamlined performance metrics, and consistent service-level agreements across multinational footprints.

Buses and coaches retained 40.95% of the corporate employee transportation service market revenue in 2025, thanks to cost-efficient high-density corridors linking suburban park-and-ride to mega campuses. Yet vans and MPVs are racing at an 8.21% CAGR, aligning vehicle capacity to volatile daily headcounts under flexible-work regimes. The corporate employee transportation services market size booked for vans will expand rapidly as fleet electrification incentives improve the total cost of ownership. Germany's tax rules now cover electric vans priced up to EUR 95,000 (USD 100,000), tilting lifecycle economics in their favor. Autonomous pilot programs favor mid-size formats because lower curb weights and narrower footprints simplify route certification.

Minibuses and passenger cars sustain niche roles: minibuses bridge passenger-density gaps on suburban circulators, while sedans cater to executives and medically sensitive riders. From automated emergency braking to lane-keeping assist, safety equipment migrates downmarket, narrowing operating-cost gaps. As employers adopt emissions dashboards, vehicle-type choice becomes a lever for meeting Scope-3 targets, reinforcing momentum for battery vans and fuel-cell buses.

The Corporate Employee Transportation Services Market Report is Segmented by Ownership (Company-Owned Transportation Service, and More), Vehicle Type (Passenger Cars, and More), Service Model (Mobility-As-A-Service, and More), Booking Platform (Mobile Application, and More), End-User Industry (IT and ITES, BFSI, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific exercised 39.05% control of the corporate employee transportation services market size in 2025 and is charting an 8.44% CAGR through 2031, propelled by Smart Cities investments in India and multimodal corridor plans across Southeast Asia. China's urban-cluster strategy institutionalizes first-mile/last-mile shuttles inside megaregional rings, providing fertile ground for MaaS integration. Public-private concession models seeded by the OECD permit capital recovery via availability payments and de-risking operator entry. The region's young demographic and smartphone penetration reinforce mobile-booking dominance.

North America reflects a mature adoption curve, with federal commuter subsidies of up to USD 325 monthly underpinning sustained program budgets. Over 20 autonomous pilot corridors across eight states cement technology leadership, while driver shortages spur experimentation with multi-shifts and split-duty rosters. Insurance inflation remains an ongoing cost headwind, compressing margins for small providers and nudging consolidation.

Europe showcases policy sophistication around sustainability and privacy. German accelerated depreciation and Spanish MOVES III grants compress payback on electric fleets, stimulating rapid replacement cycles. The Netherlands combines bicycle allowances with low-tax company-bike schemes to mainstream active commuting. GDPR and works council statutes impose strict data-handling protocols, prompting vendors to architect privacy-centric solutions. Such regulation simultaneously raises barriers to entry and elevates service quality, enhancing the reputation of European providers within the corporate employee transportation services market.

- Transdev Group

- FirstGroup plc

- Swvl Holdings Corp

- MoveInSync Technology Solutions Private Limited

- Shuttl (Chalo Mobility Chalo Mobility Private Limited)

- Busbank (Global Charter Services Inc.)

- Janani Tours and Resorts Pvt Ltd.

- Sun Telematics

- Via Transportation Inc.

- Lyft Inc.

- Uber Technologies Inc.

- Enterprise Holdings Inc.

- Addison Lee Limited

- Prairie Bus Lines Ltd.

- Eco Rent A Car

- Zum Services Inc.

- BusUp Technologies S.L.

- Ridecell Inc.

- Fleet Complete

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Digital On-Demand Shuttle Platforms are Scaling Globally

- 4.2.2 Growing Employers Focus on ESG And Scope-3 Emission Cuts

- 4.2.3 Corporate War for Talent, Boosting Commuter Benefits

- 4.2.4 Rapid Urban Sprawl in Tier-2 Cities of Asia and Africa

- 4.2.5 Autonomous Shuttle Pilots Entering Commercial Phase

- 4.2.6 Tax Incentives for Shared Mobility in Europe

- 4.3 Market Restraints

- 4.3.1 Labor Shortages in Licensed Commercial Drivers

- 4.3.2 Rising Insurance Premiums for Corporate Fleets

- 4.3.3 Legacy Union Opposition to Ride-Sharing Models

- 4.3.4 Data-Privacy Backlash Against Employee Tracking Apps

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Employees

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Ownership

- 5.1.1 Company-owned Transportation Service

- 5.1.2 Outsourced Transportation Service

- 5.1.3 Rentals / Leasing

- 5.1.4 Pick & Drop (Scheduled Shuttle)

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Vans and MPVs

- 5.2.3 Minibuses

- 5.2.4 Buses & Coaches

- 5.3 By Service Model

- 5.3.1 Mobility-as-a-Service (MaaS)

- 5.3.2 Software-as-a-Service (SaaS) / Trip-Planning

- 5.3.3 Managed Transportation Services

- 5.3.4 Hybrid (MaaS + Managed Fleet)

- 5.4 By Booking Platform

- 5.4.1 Mobile Application

- 5.4.2 Web-based Portal

- 5.4.3 Call-center / Offline

- 5.5 By End-user Industry

- 5.5.1 IT and IT-enabled Services (ITES)

- 5.5.2 Banking, Financial Services and Insurance (BFSI)

- 5.5.3 Manufacturing and Industrial

- 5.5.4 Healthcare and Life Sciences

- 5.5.5 Energy and Utilities

- 5.5.6 Others (Education, Government, etc.)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Spain

- 5.6.3.5 Italy

- 5.6.3.6 Netherlands

- 5.6.3.7 Poland

- 5.6.3.8 Russia

- 5.6.3.9 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 India

- 5.6.4.2 China

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 New Zealand

- 5.6.4.7 Thailand

- 5.6.4.8 Indonesia

- 5.6.4.9 Vietnam

- 5.6.4.10 Singapore

- 5.6.4.11 Rest of Asia-Pacific

- 5.6.5 Middle-East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 Egypt

- 5.6.5.5 South Africa

- 5.6.5.6 Rest of Middle-East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Transdev Group

- 6.4.2 FirstGroup plc

- 6.4.3 Swvl Holdings Corp

- 6.4.4 MoveInSync Technology Solutions Private Limited

- 6.4.5 Shuttl (Chalo Mobility Chalo Mobility Private Limited)

- 6.4.6 Busbank (Global Charter Services Inc.)

- 6.4.7 Janani Tours and Resorts Pvt Ltd.

- 6.4.8 Sun Telematics

- 6.4.9 Via Transportation Inc.

- 6.4.10 Lyft Inc.

- 6.4.11 Uber Technologies Inc.

- 6.4.12 Enterprise Holdings Inc.

- 6.4.13 Addison Lee Limited

- 6.4.14 Prairie Bus Lines Ltd.

- 6.4.15 Eco Rent A Car

- 6.4.16 Zum Services Inc.

- 6.4.17 BusUp Technologies S.L.

- 6.4.18 Ridecell Inc.

- 6.4.19 Fleet Complete