|

市场调查报告书

商品编码

1689879

N-Methyl Pyrrolidone:市场占有率分析、产业趋势与成长预测(2025-2030)N-Methyl Pyrrolidone - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

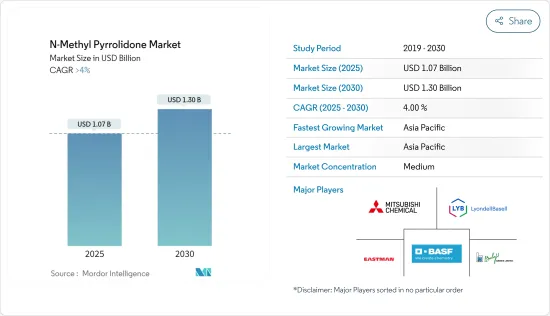

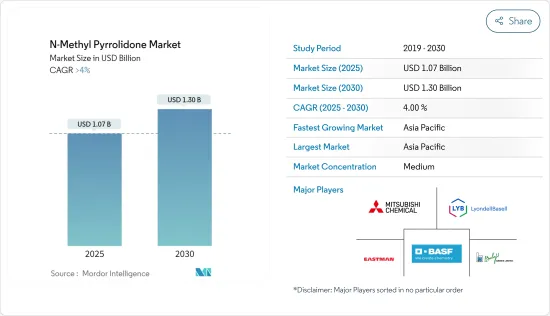

预计 2025 年N-Methyl Pyrrolidone市场规模为 10.7 亿美元,预计到 2030 年将达到 13 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 4%。

主要亮点

- 电子产业对 NMP 的需求不断增加以及製药业使用量的增加预计将推动市场的发展。石油和天然气、製药和电子产业是 N-甲基吡咯烷酮的主要消费者。

- 然而,过度使用和政府监管导致的健康问题预计将在预测期内阻碍市场成长。

- N-Methyl Pyrrolidone在新应用和新製造方法中的使用量不断增加,为市场创造了机会。

- 亚太地区占市场主导地位,其中消费量最高的国家是中国、印度、日本和韩国。

N-Methyl Pyrrolidone市场趋势

电子产业需求增加

- N-Methyl Pyrrolidone是一种有机化合物,在工业由酯转化为酰胺而生产。它由五元内酰胺环组成,是一种无色液体,可与水和常见的有机溶剂混溶。

- N-甲基吡咯烷酮在电子工业中的应用越来越广泛,它可用于生产电动车的锂离子电池、製造半导体装置以及漆包线漆涂层等。它也用于去除各种电子元件製造过程中多余的毛边。

- N-Methyl Pyrrolidone广泛用作生产印刷电路基板(PCB)上的环氧和聚氨酯涂层等三防胶的溶剂。它也可用作脱脂剂、清洗和光阻剂剥离剂。

- 预计2022年全球电子和IT产业产值将达到34,368亿美元,较2021年的34,159亿美元与前一年同期比较增1%。

- 在北美,美国于2022年8月推出《晶片与科学法案》,支持半导体产业的国内生产与技术创新。

- 根据德国电气电子工业协会(ZVEI)的预测,2023年全球电子数位产业规模预计将达到2,390亿欧元(约2,614.1亿美元),与前一年同期比较增长6.6%。此外,2023 年该产业的生产收入与 2022 年相比成长了 0.4%。由于德国电子工业的兴起,这可能会推动对 n-甲基吡咯烷酮的需求。

- 在亚太地区,印度已启动一项全面计划,以发展其国内半导体和显示器製造生态系统。政府宣布支出 76,000 亿印度卢比(约 100 亿美元)。政府将为建造显示器和半导体工厂的计划成本提供50%的资金支持,为建造化合物半导体工厂的资本支出提供50%的资金支持。

- 根据电子情报技术产业协会(JEITA)预测,2023年全球电子和IT产业产量将下降3%,但预计2024年将成长9%。

- 预计所有这些因素都将在预测期内推动 N-甲基吡咯烷酮市场的发展。

亚太地区占市场主导地位

- 预计预测期内亚太地区将主导 N-甲基吡咯烷酮市场。由于石油和天然气、製药和电子等各个终端用户行业的显着增长,中国、日本和印度等国家对 N-甲基吡咯烷酮的需求正在增加。

- 由于 N-甲基吡咯烷酮在 BTX 提取、润滑油精製和丁二烯回收等多种应用中用作提取介质,其在石油和天然气工业中的使用量正在增加。截至2023年,全球共有825座原油精製投入运作,另有190座精製正在规划中。根据国际能源总署 (IEA) 2022 年 6 月的石油市场报告,预计 2022 年全球净精製能力将增加 100 万桶/日,到 2028 年将进一步增加 440 万桶/日。

- 在电子工业中,N-甲基吡咯烷酮用作製造柔性聚酰亚胺覆铜板(FCCL)的溶剂,以及生产用于製造印刷电路基板、平板液晶显示器、微机电系统(MEM)和积体电路(IC)设备(包括微处理器和储存晶片)的光阻剂的溶剂。

- 中国在全球电子产品生产市场上占据主导地位。中国的电子产品产量多年来一直稳定成长,但最近由于美国贸易战持续而出现放缓,迫使各电子产品製造商将基地从中国迁至亚太地区的其他国家。

- 根据世界半导体贸易统计组织(WSTS)的数据显示,截至2023年11月,中国是亚洲最大的市场,占该地区市场的55%,占全球市场的31%。然而,截至 2024 年 1 月,根据中华人民共和国海关总署的数据,2023 年半导体进口量正在下降,这反映了美国的出口限制、中国努力实现国内生产以及电子设备需求低迷。

- 在製药领域,中国不断增长的人口和医疗保健行业正在推动对 NMP 作为药物製剂中的溶剂、载体和药物传输系统的需求。中国是最大的医药市场之一。根据Astra Zeneca的报告,预计到 2026 年,中国的药品销售额将达到 1,890 亿美元。

- 由于政府的优惠政策,例如 100% 外国直接投资 (FDI)、无需工业许可证以及从手动到自动化生产过程的技术转换,印度的电子製造业正在稳步扩张。 2023年8月,印度推出了新的激励措施,例如修改后的激励特别方案(M-SIPS)和电子发展基金(EDF),预算为1.14亿美元用于国内电子製造业。

- 根据日本电子情报技术产业协会(JEITA)发布的资料,2023年日本电子产业总产值约10.7兆日圆。该产业包括家用电子电器、工业电子产品以及电子元件和设备。

- 所有上述因素,加上政府的支持,都导致了对N-Methyl Pyrrolidone的需求不断增加。

N-Methyl Pyrrolidone市场概况

N-Methyl Pyrrolidone市场部分整合,主要企业占大部分市场份额。市场的主要企业包括(不分先后顺序)三菱化学、利安德巴塞尔工业控股公司、伊士曼化学公司、巴拉吉胺业、BASFSE 等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 电子产业需求不断成长

- 在製药业的使用日益增多

- 市场限制

- N-Methyl Pyrrolidone的危害及环保替代品

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按应用

- 石油和天然气

- 製药

- 油漆和涂料

- 电子产品

- 农药

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯联合大公国(UAE)

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 市场排名分析

- 主要企业策略

- 公司简介

- Ashland

- BALAJI AMINES

- BASF SE

- Binzhou City Zhanhua District Ruian Chemical Co. Ltd

- BYN Chemical Co. Ltd

- Eastman Chemical Company

- Ganzhou Zhongneng Industrial Co. Ltd

- Hefei TNJ Chemical Industry Co. Ltd

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Corporation

- Prasol Chemicals Limited

- Puyang Guangming Chemical Co. Ltd

- Santa Cruz Biotechnology Inc.

- Shandong Qingyun Changxin Chemical Science-Tech Co. Ltd

- Tokyo Chemical Industry Co. Ltd

第七章 市场机会与未来趋势

- NMP的新用途和生产方法

- 其他机会

简介目录

Product Code: 69089

The N-Methyl Pyrrolidone Market size is estimated at USD 1.07 billion in 2025, and is expected to reach USD 1.30 billion by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

Key Highlights

- The growing demand for NMP in the electronics industry and increasing usage in the pharmaceutical industry are expected to drive the market. Oil and gas, pharmaceuticals, and electronics industries are the major consumers of n-methyl pyrrolidone.

- However, health issues due to excess usage and government regulations are expected to hinder the market's growth during the forecast period.

- The rising usage of N-methyl pyrrolidone in new applications and new methods of manufacturing creates an opportunity in the market.

- Asia-Pacific dominates the market with the largest consumption from countries such as China, India, Japan, and South Korea.

N-Methyl Pyrrolidone Market Trends

Increasing Demand from Electronics Segment

- N-methyl pyrrolidone is an organic compound that is produced industrially by ester-to-amide conversion. It consists of 5-membered lactam and is a colorless liquid that is miscible with water and with most common organic solvents.

- The application of n-methyl pyrrolidone in the electronics industry is increasing owing to its usage in the production of lithium-ion batteries for electric vehicles, semiconductor device fabrication, and wire enamel coating. It is also used for the removal of excess burr at the time of production of various electronic parts.

- N-methyl pyrrolidone is widely used as a solvent in the production of conformal coatings such as epoxy and polyurethane coatings in printed circuit boards (PCB). It is also used for degreasing, cleaning, and as a photoresist stripper.

- The production by the global electronics and IT industry was estimated at USD 3,436.8 billion in 2022, registering a growth rate of 1% year on year, compared to USD 3,415.9 billion in 2021.

- In North America, the United States launched the CHIPS and Science Act in August 2022 to support domestic production and innovation in the semiconductor industry.

- According to the German Electrical and Electronic Manufacturers Association (ZVEI), the global electro and digital industry reached EUR 239 billion (USD 261.41 billion) in 2023, an increase of 6.6% compared to the previous year. Furthermore, the production revenue of the same industry increased by 0.4% in 2023 compared to 2022. This is likely to raise the demand for n-methyl pyrrolidone owing to the rising electronics industry in Germany.

- In the Asia-Pacific, India launched a comprehensive program for the development of semiconductors and display manufacturing ecosystems in the country. The government announced an outlay of INR 76,000 crore (~USD 10 billion). Fiscal support of 50% of the project cost is provided by the government to set up display fabs and semiconductor fabs, and fiscal support of 50% of capital expenditure for compound semiconductors fab.

- According to the Japan Electronics and Information Technology Industries Association (JEITA), the production by the global electronics and IT industries in the year 2024 is expected to achieve 9% growth after an estimated decline of 3% in the year 2023

- All such factors are expected to drive the market for n-methyl pyrrolidone over the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the market for n-methyl pyrrolidone during the forecast period. In countries like China, Japan, and India, the demand for n-methyl pyrrolidone is increasing owing to significant growth in various end-user industries, such as oil and gas, pharmaceutical, and electronics industries.

- The usage of n-methyl pyrrolidone in the oil and gas industry is increasing as it is used as an extraction medium in several applications, like BTX extraction, lube oil purification, and butadiene recovery. There are nearly 825 operational crude oil refineries worldwide and 190 planned refineries as of 2023. According to the International Energy Agency's (IEA) oil market report of June 2022, net global refining capacity expanded by 1.0 million b/d in 2022 and is expected to expand by an additional 4.4 million b/d by 2028.

- In the electronics industry, n-methyl pyrrolidone is used as a solvent in the production of flexible polyimide copper clad board (FCCL) and in the production of photoresists, which are used in the production of printed circuit boards, flat panel liquid crystal displays, micro electro mechanical systems (MEMs), and integrated circuit (IC) devices including microprocessors and memory chips.

- China dominates electronics production in the global market. The country's electronics production, which has steadily increased over the years, has recently suffered from deceleration owing to the ongoing trade war between China and the United States, forcing various electronics producers to shift their base from China to other countries in Asia-Pacific.

- According to the World Semiconductor Trade Statistics (WSTS), as of November 2023, China is the largest market in Asia, accounting for 55% of the region's market and 31% of the total global market. However, as of January 2024, according to the General Administration of Customs of the People's Republic of China, the country saw semiconductor import value drop in 2023, signaling the US export curbs, China's indigenization efforts, and a low demand for electronics.

- In the pharmaceutical sector, China's growing population and healthcare industry drive the demand for NMP as a solvent and carrier for pharmaceutical formulations, as well as drug delivery systems. China is one of the largest markets for pharmaceutical products. In 2026, according to the AstraZeneca report, the estimated pharmaceutical sales in the country are expected to be worth USD 189 billion.

- In India, the domestic electronics manufacturing sector has been expanding steadily, owing to favorable government policies, such as 100% foreign direct investment (FDI), no requirement for an industrial license, and the technological transformation from manual to automatic production processes. New incentives, such as the Modified Incentive Special Package Scheme (M-SIPS) and Electronics Development Fund (EDF), were started in India in August 2023 with a budget of USD 114 million for domestic electronics manufacturing.

- According to the data released by the Japanese Electronics and Information Technology Industries Association (JEITA), in 2023, the total production value of the electronics industry in Japan accounted for around JPY 10.7 trillion. The industry encompasses consumer electronic equipment, industrial electronic equipment, as well as electronic components and devices.

- All aforementioned factors, coupled with government support, are contributing to the increasing demand for n-methyl pyrrolidone.

N-Methyl Pyrrolidone Market Overview

The n-methyl pyrrolidone market is partly consolidated, with top players accounting for a major share of the market. Major companies in the market include (not in particular order) Mitsubishi Chemical Corporation, LyondellBasell Industries Holdings BV, Eastman Chemical Company, Balaji Amines, and BASF SE, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Demand From the Electronics Industry

- 4.1.2 Increasing Usage in the Pharmaceutical Industry

- 4.2 Market Restraints

- 4.2.1 N-methyl Pyrrolidone Hazards and Its Greener Alternatives

- 4.3 Industry Value Chain Analysis

- 4.4 Porters Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Oil and Gas

- 5.1.2 Pharmaceuticals

- 5.1.3 Paints and Coatings

- 5.1.4 Electronics

- 5.1.5 Agrochemicals

- 5.1.6 Other Applications

- 5.2 By Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Malaysia

- 5.2.1.6 Thailand

- 5.2.1.7 Indonesia

- 5.2.1.8 Vietnam

- 5.2.1.9 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Spain

- 5.2.3.6 Nordic Countries

- 5.2.3.7 Turkey

- 5.2.3.8 Russia

- 5.2.3.9 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 Qatar

- 5.2.5.3 United Arab Emirates (UAE)

- 5.2.5.4 Nigeria

- 5.2.5.5 Egypt

- 5.2.5.6 South Africa

- 5.2.5.7 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Ranking Analysis

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Ashland

- 6.3.2 BALAJI AMINES

- 6.3.3 BASF SE

- 6.3.4 Binzhou City Zhanhua District Ruian Chemical Co. Ltd

- 6.3.5 BYN Chemical Co. Ltd

- 6.3.6 Eastman Chemical Company

- 6.3.7 Ganzhou Zhongneng Industrial Co. Ltd

- 6.3.8 Hefei TNJ Chemical Industry Co. Ltd

- 6.3.9 LyondellBasell Industries Holdings BV

- 6.3.10 Mitsubishi Chemical Corporation

- 6.3.11 Prasol Chemicals Limited

- 6.3.12 Puyang Guangming Chemical Co. Ltd

- 6.3.13 Santa Cruz Biotechnology Inc.

- 6.3.14 Shandong Qingyun Changxin Chemical Science-Tech Co. Ltd

- 6.3.15 Tokyo Chemical Industry Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 New Applications and Production Methods of NMP

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219