|

市场调查报告书

商品编码

1689880

聚氯三氟乙烯:市场占有率分析、产业趋势与成长预测(2025-2030)Polychlorotrifluoroethylene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

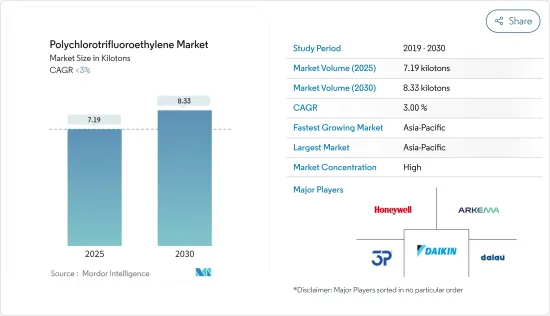

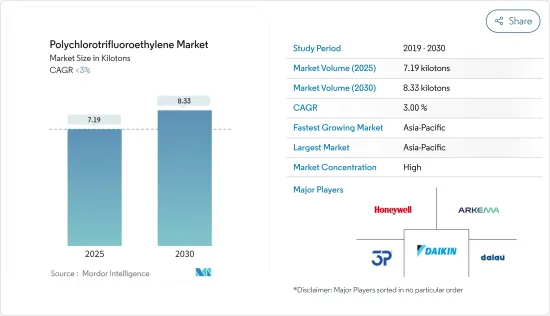

聚氯三氟乙烯市场规模预计在 2025 年为 7.19 千吨,预计在 2030 年达到 8.33 千吨,预测期间(2025-2030 年)的复合年增长率低于 3%。

2020年新冠疫情期间,生产受到衝击,部分时段需求受到影响,以及供不应求导致原料价格波动,影响了整体聚氯三氟乙烯市场的成长。然而,製药业消费的增加正在推动市场成长。

主要亮点

- 市场成长的主要因素是电气和电子产业的广泛应用,利用了聚氯三氟乙烯的特性,以及在製药业的不断扩大的使用。

- 另一方面,预计预测期内 PEEK、聚酰亚胺和 FEP 等替代品的存在将限制市场成长。

- 航太工业的不断扩大的应用可能会在未来几年提供新的成长机会。

- 由于各种终端用户产业的存在以及中国、印度和东南亚国协的成长,亚太地区预计将成为最大的聚氯三氟乙烯市场。

聚氯三氟乙烯市场趋势

电气和电子领域正在成为快速发展的行业

- 聚氯三氟乙烯因其适当的电气特性而被广泛应用于半导体。聚氯三氟乙烯具有优异的机械性能,特别是硬度和耐化学性,可以在最极端的温度条件下使用。

- 聚氯三氟乙烯不易燃、耐化学腐蚀、光学透明度高且吸湿性接近零。冷却后,它变得透明、有弹性且轻盈。由 PCTFE 製成的薄膜可用作水蒸气屏障,以保护磷光体致发光灯中的萤光粉涂层。

- 电子产业不断发展。可携式电脑、行动电话、游戏系统和其他个人电子设备的生产预计将继续刺激对电子元件的需求。

- 根据美国国际贸易委员会的数据,2022年全球半导体销售额约为5,740亿美元。中国是全球领先的半导体製造国,2022年占全球半导体销售额的32%以上。

而且

- 根据半导体产业协会介绍,欧盟委员会于2023年4月通过了《欧盟晶片法案》,计划调动470亿美元的公共和私人投资,到2030年使欧洲大陆在全球晶片产量中的份额翻倍。此外,日本政府于2023年2月核准在年度预算中额外拨款28亿美元,用于津贴私人对晶片製造设备、原料、电源晶片和微控制器的投资。 2022年美国将成为全球最大的消费国,市场占有率为48%,其次是韩国,市占率19%。

- 根据世界半导体贸易统计资料,2023 年半导体产业总收入约为 572.5 亿美元,而 2022 年为 538.5 亿美元。

- 在预测期内,聚氯三氟乙烯市场可能会受到上述所有因素的推动。

亚太地区主导聚氯三氟乙烯市场

- 预计预测期内聚氯三氟乙烯市场将由亚太地区主导,原因是各行各业(主要在中国、日本和印度)的需求量很大。

- 中国生产大量PCTFE。有几家中国公司在国内外生产和销售这些产品。上海三爱富新材料有限公司和浙江舒华是中国两家知名的PCTFE生产公司。

- 中国是全球第二大医药市场,也是全球成长最快的医药市场。根据中国国家统计局的报告,2022年中国医药产业销售额将超过3.36兆元(5,280亿美元),而2021年为3.3兆元(5,100亿美元)。

- 中国政府推出政策支持并鼓励国内医疗设备创新,预计将促进市场成长。作为仅次于美国的世界第二大医疗保健市场,该市场变得越来越艰难,尤其是自新冠疫情爆发以来。预计到2030年中国将占全球医疗设备产业收益占有率的25%。

- 此外,印度也从美国、中国和欧洲等多个国家进口PCTFE。国内製药和电子产业对 PCTFE 的需求不断增长,推动了全部区域的经济成长。随着政府开始加强向人民提供医疗设施的活动,该国的医疗保健产业可能会扩大业务。

- 电子业也是亚太地区聚氯三氟乙烯的主要消费产业。根据日本电子情报技术产业协会发布的资料,预计2023年日本电子设备总产值约为106,992.67亿日圆(约758.357亿美元),2022年约为109,772.29亿日圆(约832.28亿美元)。

- 因此,预计预测期内各行业不断增长的需求和政府支持将推动该地区的市场研究。

聚氯三氟乙烯产业概况

聚氯三氟乙烯市场本质上是整合的。所研究的市场参与者(无特定顺序)包括大金工业有限公司、霍尼韦尔国际公司、阿科玛、3P Performance Plastics Products、Dalau Ltd. 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 电气电子产业推动市场

- 製药业应用的成长

- 其他驱动因素

- 限制因素

- 替代产品的可用性

- 其他阻碍因素

- 价值链分析

- 波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按应用

- 薄膜和片材

- 电线电缆

- 涂层

- 其他应用(阀门、垫圈、化学加工设备、化学品运输等)

- 按最终用户产业

- 製药

- 航太

- 电气和电子

- 其他终端用户产业(化工、汽车等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 土耳其

- 俄罗斯

- 北欧国家

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- 3P Performance Plastics Products

- AFT Fluorotec Ltd

- Arkema

- Daikin Industries Ltd

- Dalau Ltd

- Dechengwang

- FCS

- Honeywell International Inc.

- MCP Engineering

第七章 市场机会与未来趋势

- 航太业的成长机会

- 其他机会

The Polychlorotrifluoroethylene Market size is estimated at 7.19 kilotons in 2025, and is expected to reach 8.33 kilotons by 2030, at a CAGR of less than 3% during the forecast period (2025-2030).

During the COVID-19 outbreak in 2020, the prices of raw materials witnessed volatility due to affected production, affected demand for a particular period, and a supply shortage, which impacted the overall growth of the polychlorotrifluoroethylene market. However, rising consumption in the pharmaceutical industry has propelled market growth.

Key Highlights

- The primary factor driving the market studied is its broad range of applications in the electrical and electronics industries, owing to its properties and growing applications in the pharmaceutical industry.

- On the other hand, the presence of substitutes like PEEK, polyimide, and FEP is expected to restrict market growth during the forecast timeline.

- Growing applications in the aerospace industry are likely to offer new growth opportunities in the coming years.

- Asia-Pacific is expected to be the largest polychlorotrifluoroethylene market owing to the presence of various end-user industries and growth in China, India, and ASEAN countries.

Polychlorotrifluoroethylene Market Trends

Electrical and Electronics Segment to be the Fastest-growing Industry

- Polychlorotrifluoroethylene is extensively used in semiconductors because of its suitable electrical properties. It has excellent mechanical properties, especially hardness and chemical resistance, and can also operate in the most extreme temperature conditions.

- Polychlorotrifluoroethylene is non-flammable and has chemical resistance, high optical transparency, and near-zero moisture absorption. It becomes transparent, elastic, and lighter when cooled. Films made of PCTFE are used as a water-vapor barrier to protect phosphor coatings in electroluminescent lamps.

- The electronics industry is continuously progressing. The production of portable computing devices, cellular phones, gaming systems, and other personal electronic devices is expected to continue to fuel the demand for electronic components.

- According to the United States International Trade Commission, global semiconductor sales in 2022 were around USD 574 billion. China is the world's major semiconductor manufacturer, and it accounted for more than 32% of global semiconductor sales in 2022.

- Furthermore, the European Commission passed the "EU Chips Act" in April 2023, a plan to double the continent's share in global chip production by 2030 through mobilizing USD 47 billion in public and private investment, according to the Semiconductor Industry Association.

Additionally, in February 2023, the Japanese government approved a USD 2.8 billion supplement to the annual budget to subsidize private investments in chipmaking equipment, raw materials, power chips, and microcontrollers.

The United States accounted for a total market share of 48% in 2022, making it the largest consumer worldwide, followed by Korea with a market share of 19%. - According to the World Semiconductor Trade Statistics data, the total revenue from the semiconductor industry in 2023 was around USD 57.25 billion compared to USD 53.85 billion in 2022.

- During the forecast period, the polychlorotrifluoroethylene market is likely to be driven by all of the above factors.

Asia-Pacific to Dominate Polychlorotrifluoroethylene Market

- Asia-Pacific is expected to dominate the polychlorotrifluoroethylene market during the forecast period due to the high demand from various industries, mainly in China, Japan, and India.

- China manufactures PCTFE in large volumes. Several Chinese companies manufacture it and sell it domestically and internationally. Shanghai 3F New Material Co. Ltd and Zhejiang Juhua Co. Ltd are two well-known Chinese companies that manufacture PCTFE.

- China is the world's second-largest pharmaceutical market and the fastest-emerging market in the sector. As per the report of the National Bureau of Statistics of China, the pharmaceutical industry in China generated revenues of more than CNY 3.36 trillion (USD 0.528 trillion) in 2022 compared to CNY 3.3 trillion (USD 0.51 trillion) in 2021.

- The Chinese government has implemented policies to support and encourage domestic innovation in medical devices, which is expected to boost market growth. As the world's second-largest healthcare market, after the United States, the country's market has become more strict, especially since the COVID-19 pandemic. China is expected to have 25% of the global medical device industry's revenue share by 2030.

- Furthermore, India imports PCTFE from various countries, including the United States, China, and Europe. Increasing demand for PCTFE from the pharmaceutical and electronics industries within the country has propelled overall regional growth. The healthcare industry in the country is likely to upscale its operations as the government has initiated enhancement activities to provide healthcare facilities to its population.

- The electronic industry is another major consumer of polychlorotrifluoroethylene in Asia-Pacific. Japan is one of the largest producers of consumer electronics in recent times. According to the data released by the Japan Electronics and Information Technology Industries Association, the total production of electronics in the country was around JPY 10,699,267 million (USD 75,835.7 million) in 2023 and JPY 10,977,229 million (USD 83,228 million) in 2022.

- Thus, rising demand from various industries, coupled with government support, is expected to drive the market studied in the region during the forecast period.

Polychlorotrifluoroethylene Industry Overview

The polychlorotrifluoroethylene market is consolidated in nature. Some of the players in the market studied (not in any particular order) include Daikin Industries Ltd, Honeywell International Inc., Arkema, 3P Performance Plastics Products, and Dalau Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Electrical and Electronics Segment to Boost the Market

- 4.1.2 Growing Applications in Pharmaceutical Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Application

- 5.1.1 Films and Sheets

- 5.1.2 Wires and Cables

- 5.1.3 Coatings

- 5.1.4 Other Applications (Valves, Gaskets, Chemical Processing Equipment, Chemical Transport etc.)

- 5.2 By End-user Industry

- 5.2.1 Pharmaceutical

- 5.2.2 Aerospace

- 5.2.3 Electrical and Electronics

- 5.2.4 Other End-user Industries (Chemical Industry, Automotive, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC Countries

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 Egypt

- 5.3.5.4 United Arab Emirates

- 5.3.5.5 South Africa

- 5.3.5.6 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3P Performance Plastics Products

- 6.4.2 AFT Fluorotec Ltd

- 6.4.3 Arkema

- 6.4.4 Daikin Industries Ltd

- 6.4.5 Dalau Ltd

- 6.4.6 Dechengwang

- 6.4.7 FCS

- 6.4.8 Honeywell International Inc.

- 6.4.9 MCP Engineering

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Opportunity in the Aerospace Industry

- 7.2 Other Opportunities