|

市场调查报告书

商品编码

1689882

聚醚胺:市场占有率分析、产业趋势与成长预测(2025-2030)Polyetheramine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

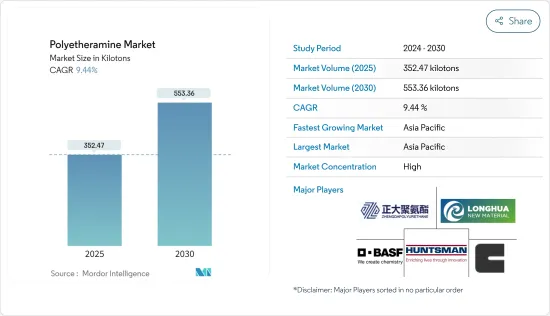

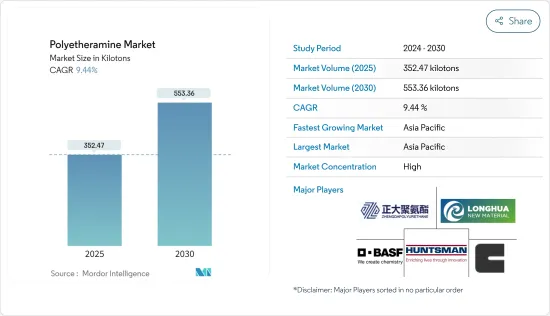

聚醚胺市场规模预计在 2025 年为 352.47 千吨,预计在 2030 年达到 553.36 千吨,预测期内(2025-2030 年)的复合年增长率为 9.44%。

聚醚胺市场受到了 COVID-19 疫情的负面影响。不过,2021年市场已经明显復苏。预计到 2022 年和 2023 年,市场将恢復到接近疫情前的水平,这得益于汽车、建筑和航太等各个终端用户产业的消费成长。

主要亮点

- 在预计预测期内,黏合剂和密封剂行业投资的增加以及复合材料对聚醚胺的需求的增加将推动市场成长。

- 然而,预计与聚醚胺相关的环境问题和健康危害将在预测期内阻碍市场成长。

- 此外,锂离子电池产业的新商机有望创造市场机会。

- 亚太地区是最大的市场,预计未来几年将成长最快,这得益于中国、印度和日本等国家的消费不断增长。

聚醚胺市场趋势

复合材料应用需求不断成长

- 聚醚胺是一种典型的固化剂,由聚醚和胺分子组成,用于增强最终产品,例如柔韧性、疏水性、亲水性和韧性。

- 聚醚胺广泛应用于复合材料应用,因为其独特的性能提供了强度和柔韧性之间的关键平衡。

- 此外,聚醚胺基复合材料正在被设计为木材、金属和混凝土的替代品。其轻量化设计、高介电强度和高抗环境劣化性能使其可用于航太、汽车零件和风力发电机叶片等要求严格的应用。

- 汽车产业是复合材料领域的主要贡献者。根据国际汽车製造商协会(OICA)报告,预计2023年全球汽车产量将达到约9,354万辆,高于2022年的8,483万辆,成长率约10.26%。

- 中国仍然是全球汽车市场的主导者,在销售和製造方面都处于领先地位。根据预测,2025年国内产量将达3,500万辆。根据中国工业协会的资料,2023年中国汽车产量将超过3,016万辆,与前一年同期比较增加11.6%。

- 美国是世界第二大汽车生产国。该国拥有主要的汽车製造商,不仅生产汽车,还向美洲、欧洲和亚太地区出口汽车。国际汽车工业组织(OICA)指出,美国汽车产量将从2022年的10,052,958辆增加到2023年的10,611,555辆。

- 根据美国能源局的数据,到 2022 年,风电将占美国新增电力容量的 22%。拜登总统的通膨控制法案将使 2026 年陆上风电装置容量预计成长近 60%,从 11.5 吉瓦增至 18 吉瓦,足以为另外 200 万户家庭供电。

- 总体而言,预计这些因素将在预测期内推动该应用对聚醚胺的需求。

亚太地区占市场主导地位

- 预计预测期内亚太地区将主导聚醚胺市场。由于风力发电、建筑和建筑应用的需求不断增加,中国和印度等国家对聚醚胺的需求也在增加。

- 聚醚胺广泛用作黏合剂,将叶片的两个部分黏合在一起,并用作风力发电机叶片复合材料的添加剂。预计在预测期内,风力发电应用对聚醚胺的高需求将推动市场发展。

- 中国电力委员会预测,到2024年,中国的风电装置容量将达到530吉瓦(GW)。透过在内蒙古、新疆、甘肃和沿海地区计划,中国的目标是到2025年增加371吉瓦的装置容量,将使全球风电容量增加近50%。

- 根据中国电力企业联合会预测,2023年中国风电装置容量将达440吉瓦,与前一年同期比较增加16.9%。这一成长不仅凸显了中国在风力发电的领导地位,也增加了涡轮叶片製造对聚醚胺的需求。

- 到2024年,印度的经济适用住宅预计将增加70%。据投资印度 (Invest India) 称,到 2025 年,建筑业的估值预计将达到 1.4 兆美元。预计到 2030 年,超过 30% 的人口将成为居住者,因此迫切需要超过 2,500 万套中型和经济适用住宅。最近的改革,如《房地产法》、《商品及服务税》和《房地产投资信託》旨在加快审批速度、加强建设产业并刺激市场成长。

- 财政部长宣布将 Pradhan Mantri Awas Yojana 计画的支出增加 66%,达到 7,900 亿印度卢比(约 218.1 亿美元),为 2023-2024 年预算中的经济适用住宅提供大力推动。

- 亚洲是世界上最大的汽车製造地。特别是在中国,由于各种环境问题,许多政府计画正在推动摆脱石化燃料,因此电动车的发展预计将继续获得动力。

- 汽车产业越来越注重减轻车辆重量,以提高燃油效率和排放气体。聚醚胺用于复合材料中,以取代较重的传统材料,支持汽车轻量化设计的趋势。随着中国汽车产量的成长,此类复合材料应用的需求预计将激增,进一步推动聚醚胺市场的发展。

- 根据国际贸易管理局(ITA)的数据,中国仍然是全球最大的汽车市场,无论按年销售量或产量计算。预计2025年本土产量将达3,500万辆。 2023年,中国汽车製造业取得了重要里程碑,创下了汽车产销新高。根据中国工业协会的报告,2023年中国汽车产量将超过3,016万辆,与前一年同期比较去年同期成长11.6%。

- 上述因素加上政府的支持,将推动预测期内对聚醚胺的需求增加。

聚醚胺产业概况

聚醚胺市场本质上是整合的。市场的主要企业(不分先后顺序)包括亨斯迈国际有限责任公司、BASF欧洲公司、科莱恩、山东龙华新材料和淄博正大聚氨酯。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 增加对黏合剂和密封剂产业的投资

- 复合材料对聚醚胺的需求不断成长

- 限制因素

- 过量使用聚醚胺引发的环境问题

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 类型

- 单胺

- 二胺

- 三胺

- 应用

- 聚脲

- 燃料添加剂

- 复合材料

- 环氧漆

- 黏合剂和密封剂

- 其他用途(杀虫剂、印刷油墨添加剂、颜料分散体)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- BASF SE

- Clariant

- Huntsman International LLC

- Qingdao IRO Surfactant Co., Ltd.

- Shandong Longhua New Materials Co., Ltd.

- Wuxi Akeli Technology Co., Ltd.

- Yangzhou Chenhua New Materials Co., Ltd.

- Yantai Dasteck Chemicals Co., Ltd.

- Zibo Zhengda Polyurethane Co., Ltd.

第七章 市场机会与未来趋势

- 锂离子电池产业的新机会

The Polyetheramine Market size is estimated at 352.47 kilotons in 2025, and is expected to reach 553.36 kilotons by 2030, at a CAGR of 9.44% during the forecast period (2025-2030).

The polyetheramine market was negatively impacted by the COVID-19 pandemic. However, the market recovered significantly in 2021. In 2022 and 2023, the market has almost returned to pre-pandemic levels, owing to rising consumption from various end-user industries such as automotive, construction, aerospace, and others.

Key Highlights

- The increasing investments in the adhesive and sealant industry and the growing demand for polyetheramine from composites are expected to drive market growth during the forecast period.

- On the other hand, environmental concerns and health hazards associated with polyetheramine are expected to hinder the growth of the market during the forecast period.

- Further, emerging opportunities in the lithium-ion battery industry are projected to create market opportunities.

- The Asia-Pacific region is the biggest market and is expected to grow the fastest over the next few years owing to the increasing consumption from countries such as China, India, and Japan.

Polyetheramine Market Trends

Increasing Demand from Composite Application

- Polyetheramines are typical curing agents that comprise polyether and amine molecules and are used to enhance the properties of end products, such as flexibility, hydrophobicity, hydrophilicity, and toughness.

- Due to their unique properties, polyetheramines are widely used in composite applications as they provide a critical balance between strength and flexibility.

- Furthermore, polyether amine-based composites are designed to replace wood, metal, and concrete. Owing to their lightweight design, high dielectric strength, and high resistance to environmental degradation, they are useful in highly demanding applications such as aerospace, automotive parts, and wind turbine blades.

- The automotive industry significantly contributes to the composites segment. The Organisation Internationale des Constructeurs d'Automobiles (OICA) reported that global vehicle production in 2023 reached approximately 93.54 million, up from ~84.83 million in 2022, marking a growth rate of about 10.26 percent.

- China remains the dominant player in the global vehicle market, leading in both sales and manufacturing. Projections indicate domestic production will hit 35 million vehicles by 2025. Data from the China Association of Automobile Manufacturers shows that in 2023, China's car output surpassed 30.16 million units, reflecting an 11.6 percent year-on-year increase.

- The United States ranks as the second-largest automobile manufacturer worldwide. The nation boasts major automakers that not only produce but also export vehicles across the Americas, Europe, and the Asia-Pacific. The International Organization of Motor Vehicle Manufacturers (OICA) noted that U.S. vehicle production rose from 10,052,958 units in 2022 to 10,611,555 in 2023.

- According to the U.S. Department of Energy, wind power constituted 22% of the nation's new electricity capacity in 2022. Due to President Biden's Inflation Reduction Act, projections for land-based wind energy installations in 2026 have jumped nearly 60%, from 11,500 MW to 18,000 MW, enough to power an extra two million homes.

- Overall, all such factors are expected to boost the demand for polyetheramine in this application over the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for polyetheramine during the forecast period. In countries like China and India, owing to the increasing demand for wind energy and construction & building applications, the demand for polyetheramine has been increasing in the region.

- Polyetheramine is widely used as an additive in adhesives to adhere to two parts of blades and in composites used in wind turbine blades. A high demand for polyetheramine in wind energy applications will propel its market during the forecast period.

- China Electricity Council (CEC) forecasts that China will reach a wind power capacity of 530 gigawatts (GW) by 2024. With projects in Inner Mongolia, Xinjiang, Gansu, and coastal regions, China aims to add 371 GW by 2025, potentially expanding the global wind fleet by nearly 50%.

- In 2023, China's wind power capacity hit 440 GW, marking a 16.9% growth from the prior year, as reported by the CEC. This surge not only underscores the nation's leadership in wind energy but also amplifies the demand for polyetheramine in turbine blade manufacturing.

- In 2024, India is set to witness a 70% surge in the availability of affordable housing. According to Invest India, the construction sector is projected to attain a valuation of USD 1.4 trillion by 2025. With forecasts suggesting that over 30% of the population will be urban dwellers by 2030, there's a pressing need for 25 million more mid-end and affordable housing units. Recent reforms, such as the Real Estate Act, GST (Goods and Services Tax), and REITs (Real Estate Investment Trusts), aim to expedite approvals and strengthen the construction industry, driving market growth.

- The Finance Minister announced a significant 66% increase in the outlay for Pradhan Mantri Awas Yojana, raising it to over INR 7,90,000 million (~USD 21,810 million), marking a substantial boost for affordable housing in the 2023-2024 Budget.

- Asia is the largest automotive manufacturing hub in the world. The development of electric vehicles is expected to continue to gain momentum in the future, especially in China, where many government programs are promoting the move away from fossil fuels owing to various environmental concerns.

- The automotive industry is increasingly focused on reducing vehicle weight to improve fuel efficiency and reduce emissions. Polyetheramines are used in composite materials that replace heavier traditional materials, thus supporting the trend toward lightweight automotive designs. With vehicle production on the rise in China, the demand for these composite applications is set to surge, further propelling the polyetheramine market.

- According to the International Trade Administration (ITA), China remains the world's biggest car market, both in terms of yearly sales and production. Local manufacturing is anticipated to hit 35 million vehicles by 2025. In 2023, China's car manufacturing sector achieved a significant milestone, setting new car production and sales records. In 2023, China's car production surpassed 30.16 million vehicles, marking an increase of 11.6% compared to the previous year, as reported by the China Association of Automobile Manufacturers (CAAM).

- The aforementioned factors, coupled with government support, are contributing to the increasing demand for polyetheramine during the forecast period.

Polyetheramine Industry Overview

The polyetheramine market is consolidated in nature. Some of the major players in the market (not in any particular order) include Huntsman International LLC, BASF SE, Clariant, Shandong Longhua New Materials Co., Ltd., and Zibo Zhengda Polyurethane Co., Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Investments in the Adhesives and Sealants Industry

- 4.1.2 Growing Demand for Polyetheramine from Composites

- 4.2 Restraints

- 4.2.1 Environmental Concern Due to Excessive Use of Polyetheramines

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Monoamine

- 5.1.2 Diamine

- 5.1.3 Triamine

- 5.2 Application

- 5.2.1 Polyurea

- 5.2.2 Fuel Additives

- 5.2.3 Composites

- 5.2.4 Epoxy Coatings

- 5.2.5 Adhesives and Sealants

- 5.2.6 Other Applications (agrochemicals, printing ink additives, and pigment dispersions)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Clariant

- 6.4.3 Huntsman International LLC

- 6.4.4 Qingdao IRO Surfactant Co., Ltd.

- 6.4.5 Shandong Longhua New Materials Co., Ltd.

- 6.4.6 Wuxi Akeli Technology Co., Ltd.

- 6.4.7 Yangzhou Chenhua New Materials Co., Ltd.

- 6.4.8 Yantai Dasteck Chemicals Co., Ltd.

- 6.4.9 Zibo Zhengda Polyurethane Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Opportunity In The Lithium-ion Battery Industry