|

市场调查报告书

商品编码

1689895

富马酸-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Fumaric Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

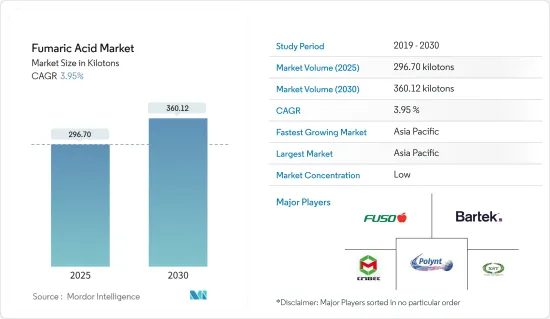

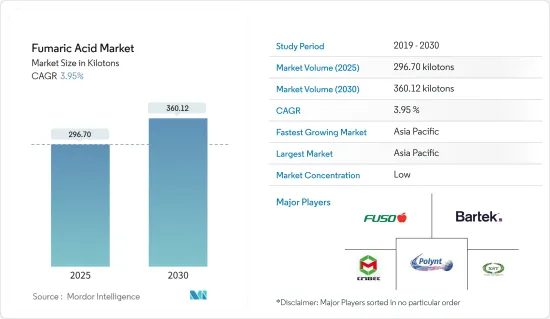

富马酸市场规模预计在 2025 年为 296.70 千吨,预计到 2030 年将达到 360.12 千吨,预测期内(2025-2030 年)的复合年增长率为 3.95%。

2020 年,COVID-19 疫情爆发导致全国封锁、製造活动和供应链中断以及全球生产停顿,对市场产生了负面影响。然而,情况在 2021 年开始復苏,市场在预测期内恢復成长轨迹。

主要亮点

- 食品和饮料行业应用的不断增加是市场研究的主要驱动力。

- 与富马酸相关的健康危害是研究市场的主要限制因素之一。

- 新的潜在应用领域的出现可能会为所研究的市场带来机会。

- 亚太地区在市场中占据主导地位,预计在预测期内将继续占据主导地位。

富马酸市场趋势

食品和饮料占据主导地位

- 富马酸是一种固体有机食品酸,广泛用作食品和饮料工业的添加剂。它被认为是一种无毒食品添加剂,可用作食品和食品饮料中的调味剂、pH调节剂、抗菌剂或酸味剂。

- 富马酸广泛用于烘焙、饮料和甜点,如小麦和玉米饼、冷藏饼干麵团、酸麵团和黑麦麵包、果汁、葡萄酒、果冻和果酱、明胶甜点、藻酸盐甜点和派饼馅料。

- 根据联合国粮食及农业组织 (FAO) 的数据,预计 2022/23 年度全球谷物贸易量为 4.696 亿吨,较 7 月的预测增加 200 万吨,但仍比 2021/22 年度低 1.9%。

- 根据粮农组织预测,2022/23 年度(7 月/6 月)世界小麦贸易量为 1.913 亿吨,与 7 月持平,比 2021/22 年度(7 月/6 月)水准下降 1.8%。

- 粮农组织预测,2022/23年度世界稻米产量为5.126亿吨(精米),比2021年的最高峰低2.4%。

- 据印度农业和农民福利部称,印度粮食产量预计达到创纪录的3.1451亿吨,比2020-21年度产量高出377万吨。

- 预计2021-22年度印度油籽产量将达到创纪录的3850万吨,比2020-21年度的3595万吨高出255万吨。

- 由于上述原因,预计市场在预测期内将出现积极增长。

亚太地区占市场主导地位

- 由于印度、中国和日本等国家的需求,亚太地区可能会主导全球富马酸市场。

- 根据联合国粮食及农业组织(FAO)预测,2022年亚洲谷物产量将达到14.71亿吨,比五年平均高出2.2%。

- 在中国,加工水果、猪肉、乳製品以及一些特殊谷物和豆类都是有潜力推动该国食品加工产业成长的食品。因此,食品和饮料行业正在提供投资机会,并有望进一步产生对此类工厂使用的新设备的需求。

- 印度食品加工产业主要以出口为主。然而,由于都市化和消费者偏好,国内市场也在成长。印度加工食品出口额约为37.701亿美元,主要包括加工水果、蔬菜和肉类(包括鱼贝类),酒精饮料也占了相当大的一部分。

- 根据粮农组织预测,2022年该地区谷物总产量将达到13.69亿吨(稻米当量),略高于过去五年的平均水准。预计北韩、尼泊尔、缅甸,尤其是斯里兰卡的产量将低于平均值。

- 印度农业部预计,今年稻米产量为1.3029亿吨。小麦产量可能增加至1.0684亿吨,比过去五年平均产量1.0388亿吨高出296万亿吨。

- 日本化学工业是继运输机械之后该国第二大製造业。运输机械包括日本最引人注目的产业——汽车,严重依赖化学工业供应的原料。三菱化学公司、三井化学公司、住友化学公司、东丽株式会社和工业株式会社均位列全球化学品销售额前 30 名。

- 因此,预计上述因素将在未来几年对市场产生重大影响。

富马酸产业概况

富马酸产业市场高度分散,主要企业占约30%的市占率。市场上的知名公司包括 Bartek Ingredients Inc.、XST Biological、昌茂生化工程有限公司、Fuso Chemical、Polynt 等(排名不分先后)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 扩大食品和饮料产业的应用

- 其他驱动因素

- 限制因素

- 富马酸的健康危害

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 类型

- 食品级

- 工业级

- 应用

- 食品和饮料加工

- 松香纸施胶

- 不饱和聚酯树脂

- 醇酸树脂

- 个人护理和化妆品

- 其他用途

- 最终用户产业

- 食品和饮料

- 化妆品

- 製药

- 化学

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Anmol Chemicals

- Bartek Ingredients Inc.

- Changmao Biochem

- ESIM Chemicals

- Fuso Chemical Co. Ltd

- Merck KGaA

- Polynt

- Thirumalai Chemicals Ltd

- UPC Group

- Yongsan Chemicals Inc.

- XST Biological Co. Ltd

第七章 市场机会与未来趋势

- 新应用领域的出现

The Fumaric Acid Market size is estimated at 296.70 kilotons in 2025, and is expected to reach 360.12 kilotons by 2030, at a CAGR of 3.95% during the forecast period (2025-2030).

Due to the COVID-19 outbreak, nationwide lockdowns around the globe, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory during the forecast period.

Key Highlights

- The growing application in the food and beverage industry is a major factor driving the market studied.

- Health hazard related to fumaric acid is one of the major restraining factors for the market studied.

- The emergence of new potential application areas will likely act as an opportunity for the market studied.

- Asia-Pacific dominated the market and is expected to continue its dominance during the forecast period.

Fumaric Acid Market Trends

Food and Beverage to Dominate the Demand

- Fumaric acid is solid organic food acid extensively used as an additive in the food and beverage industry. It is considered a non-toxic food additive, which can be used as a flavoring agent, a pH control agent, an antimicrobial agent, or a pickling agent in food products and beverages.

- Fumaric acid is widely used in bakeries, beverages, and desserts, like wheat, corn tortillas, refrigerated biscuit doughs, sourdough and rye bread, fruit juice, wine, jellies and jams, gelatin desserts, alginate-based desserts, pie fillings, etc.

- According to the Food and Agriculture Organization of the United Nations (FAO), world trade in cereals in 2022/23 is forecast at 469.6 million tonnes, up by 2 million tonnes since the July forecast but still 1.9 percent below the 2021/22 level.

- According to FAO, at 191.3 million tonnes, the forecast for world wheat trade in 2022/23 (July/June) remains nearly unchanged since July and still points to a 1.8 percent decline from 2021/22 (July/June) level.

- FAO predicted the world rice production in 2022/23 to be 512.6 million tonnes (milled basis), 2.4 percent below the 2021 all-time peak.

- According to the Ministry of Agriculture & Farmers Welfare, the production of food grains in India is estimated at a record 314.51 million tonnes, which is higher by 3.77 million tonnes than the production of foodgrain during 2020-21.

- Total Oilseeds production in India during 2021-22 is estimated at a record 38.50 million tonnes which is higher by 2.55 million tonnes than the production of 35.95 million tonnes during 2020-21.

- Due to the above reasons, the market is expected to have positive growth in the forecasted period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region may dominate the global fumaric acid, owing to demand from countries like India, China, and Japan.

- According to the Food and Agriculture Organization of the United Nations (FAO), Forecast at 1,471 million tonnes, the aggregate 2022 cereal output in Asia is 2.2 percent above the five-year average.

- In China, processed fruits, pork, dairy, and some specialty grains and legumes are the food products that may drive the growth of the food processing industry in the country. Thus, the food and beverage industry is offering opportunities for investment, which is further expected to create demand for new equipment used in such plants.

- The food processing sector in India has been primarily export-oriented. However, the local market is also growing, owing to urbanization and consumer preferences. India exported processed food valued at around USD 3770.1 million which mainly consists of processed fruits, vegetables, and meats, including seafood, along with a sizeable chunk of alcoholic beverages.

- According to FAO, the far east Asia subregional aggregate cereal output is forecast at 1,369 million tonnes (rice in paddy equivalent) in 2022, slightly above the previous five-year average. Below-average outputs are expected in the Democratic People's Republic of Korea, Nepal, Myanmar and especially in Sri Lanka,

- According to the agriculture ministry of India, rice production is expected to be 130.29 million tonnes. Wheat production could increase to 106.84 million tonnes, 2.96 million tonnes higher than the past five years' average of 103.88 million tonnes.

- The Japanese chemical industry is the country's 2nd largest manufacturing industry behind transportation machinery. Transportation machinery includes Japan's most notable industry, automotive, which is highly dependent on raw materials provided by the chemical industry. Mitsubishi Chemical Corp., Mitsui Chemicals Inc., Sumitomo Chemical Co. Ltd, Toray Industries Inc., and Shin-Etsu Chemical Co. rank among the world's top 30 chemical companies measured in chemical sales.

- Thus, the aforementioned factors are projected to significantly impact the market in the coming years.

Fumaric Acid Industry Overview

The fumaric acid industry market is highly fragmented, with the top five players accounting for around ~30% of the market. Some prominent players in the market include (not in any particular order) Bartek Ingredients Inc., XST Biological Co. Ltd., Changmao Biochemical Engineering Company Limited, Fuso Chemical Co. Ltd, and Polynt

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Application in the Food and Beverage Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Health Hazard Related to Fumaric Acid

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Food Grade

- 5.1.2 Technical Grade

- 5.2 Application

- 5.2.1 Food & Beverage Processing

- 5.2.2 Rosin Paper Sizing

- 5.2.3 Unsaturated Polyster Resin

- 5.2.4 Alkyd Resin

- 5.2.5 Personal Care & Cosmetics

- 5.2.6 Other Applications

- 5.3 End-user Industry

- 5.3.1 Food and Beverage

- 5.3.2 Cosmetics

- 5.3.3 Pharmaceutical

- 5.3.4 Chemical

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anmol Chemicals

- 6.4.2 Bartek Ingredients Inc.

- 6.4.3 Changmao Biochem

- 6.4.4 ESIM Chemicals

- 6.4.5 Fuso Chemical Co. Ltd

- 6.4.6 Merck KGaA

- 6.4.7 Polynt

- 6.4.8 Thirumalai Chemicals Ltd

- 6.4.9 UPC Group

- 6.4.10 Yongsan Chemicals Inc.

- 6.4.11 XST Biological Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emergence of New Potential Application Areas