|

市场调查报告书

商品编码

1689896

铝 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Aluminum - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

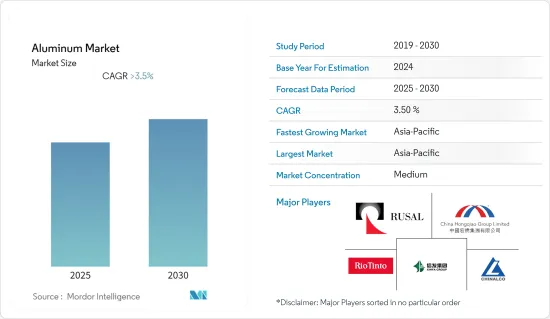

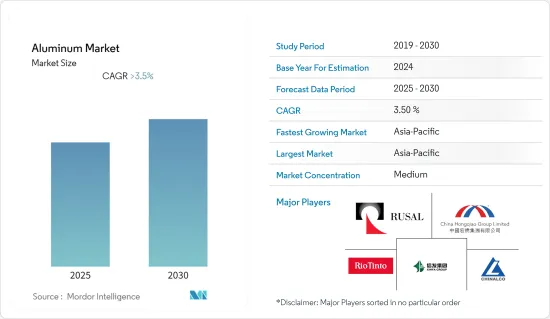

预计预测期内铝市场复合年增长率将超过 3.5%。

主要亮点

- 2020 年,新冠疫情对市场产生了负面影响。建筑业是铝的主要消耗产业,受到重创,尤其是住宅房地产受到抑制,导致住宅登记暂停,房屋抵押贷款发放放缓。然而,自从限制解除以来,该行业已经恢復良好。受建筑、包装等各类终端用户产业消费成长的推动,铝市场在 2021-22 年显着復苏。

- 市场研究的主要驱动力是亚太地区建设活动的增加。食品、包装和製药业对铝的需求不断增加可能会有利于市场成长。

- 然而,有关铝加工的严格法规和环境问题可能会阻碍市场成长。

- 电动车市场的成长可能会提供新的成长机会。

- 亚太地区占据了最高的市场占有率,预计在预测期内将占据市场主导地位。

铝市场趋势

建筑和建设产业的需求增加

- 铝是建设产业中第二大广泛使用的金属。广泛应用于窗户、帷幕墙、屋顶、覆层、遮阳、太阳能板、栏桿、架子和其他临时结构。

- 预计未来几年全球建设产业收益将稳定成长。预计到 2022 年底将达到约 8.2 兆美元。

- 中国是全球最大的建筑市场,占全球整体建筑投资的20%。预计到2030年,中国在建筑方面的支出将达到约13兆美元。根据中国国家统计局的数据,2022年第四季中国建设业总产值约为人民币2,760亿元(约400亿美元),较上一季(约276亿美元)成长约50%。

- 根据美国人口普查局和美国住房与城市发展部发布的数据,2021年12月获准建造的私人住宅单元数量经季节性已调整的后年率为187.3万套。每年发放的独栋住宅许可证总数总合112.8万张。拥有五个或五个以上单元的建筑的单元年审批率为 675,000。 2021 年,将有 1,724,700住宅获得建筑许可。这一数字比预计的 2020 年 1,471,100 套住房高出 17.2%。

- 预计印度未来七年将在住宅方面投资约 1.3 兆美元,并将建造 6,000 万套住宅。到2024年,经济适用住宅供应量预计将增加约70%。印度政府的「2022年全民住宅计画」对该产业来说也是一个重大变化。

- 英国新建房屋价值(以当前价格计算)在 2020 年下降 15.9% 至 1001.99 亿英镑(约 1286.2212 亿美元)之后,2021 年强劲增长 15.3%,至 1155.79 亿英镑(约 15 亿美元)。

- 总体而言,预计预测期内全球建设活动的復苏将推动建设产业的铝需求。

亚太地区可望主导市场

- 预计预测期内亚太地区将成为最大的铝市场。中国、印度和日本等国家在电子、建筑和航太等行业正在经历成长。

- 中国汽车製造业规模位居世界第一。根据中国工业协会预测,2022年汽车产量将达2,702万辆,比2021年的2,608万辆成长约3.4%。

- 预计印度未来七年将在住宅方面投资约 1.3 兆美元,并将建造 6,000 万套住宅。印度联邦内阁已核准设立 35.8 亿美元的另类投资基金 (AIF),以重启全国各大城市约 1,600 个停滞的住宅计划。

- 预计到2025年,印度电子市场规模将达到4,000亿美元,并有望成为全球第五大家电和电子产业大国。

- 据印度包装产业协会(PIAI)称,预测期内印度包装产业预计将成长 22%。此外,预计到 2025 年印度包装市场规模将达到 2,048.1 亿美元,2020 年至 2025 年期间的复合年增长率为 26.7%。

- 在日本,预计到 2025 年包装食品零售额将达到 2,045 亿美元,成长 3.6% 或 70 亿美元。预计包装行业的这一增长将在预测期内推动铝箔的需求。

- 因此,由于亚太国家终端用户产业的快速成长,预计该地区将在预测期内主导全球市场。

铝业概况

从本质上来说,铝市场是部分分散的。主要企业包括(排名不分先后)中国铝业股份有限公司(CHINALCO)、中国宏桥集团有限公司、俄罗斯铝业公司、信发集团和力拓。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 亚太地区建设活动不断增加

- 其他驱动因素

- 限制因素

- 铝加工相关的严格法规与环境问题

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 进出口趋势

- 定价分析

第五章市场区隔

- 加工类型

- 铸件

- 挤压

- 锻件

- 轧延产品

- 颜料和粉末

- 最终用户产业

- 车

- 航太与国防

- 建筑与施工

- 电气和电子

- 包装

- 工业

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)分析

- 主要企业策略

- 公司简介

- Alcoa Corporation

- Aluminum Bahrain BSC(Alba)

- Aluminum Corporation of China Limited(CHINALCO)

- China Hongqiao Group Limited

- East Hope Group

- Emirates Global Aluminum PJSC

- Novelis Inc.

- Norsk Hydro ASA

- Rio Tinto

- RusAL

- State Power Investment Corporation(SPIC)

- Xinfa Group Co. Ltd

第七章 市场机会与未来趋势

- 电动车市场正在成长

- 其他机会

简介目录

Product Code: 69206

The Aluminum Market is expected to register a CAGR of greater than 3.5% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. Building and construction, a major sink for aluminum, was badly hit, especially due to curtailment in residential real estate resulting in the suspension of home registrations and slow home loan disbursements. However, the sector is recovering well since restrictions were lifted. The aluminum market recovered significantly in 2021-22, owing to rising consumption from various end-user industries such as building and construction, packaging, and others.

- A major factor driving the market studied is the increasing construction activities in the Asia-Pacific region. The rising demand for aluminum from the food, packaging, and pharmaceutical industries will likely favor the market's growth.

- However, strict regulations and environmental concerns about aluminum processing will likely hamper the market's growth.

- Growth in the electric vehicles market will likely provide new growth opportunities.

- The Asia-Pacific accounts for the highest market share and is expected to dominate the market during the forecast period.

Aluminum Market Trends

Increasing Demand from the Building and Construction Industry

- In the building and construction industry, aluminum is the second most widely used metal. It is extensively used in windows, curtain walls, roofing and cladding, solar shading, solar panels, railings, shelves, and other temporary structures.

- The revenue of the global construction industry is expected to grow steadily over the next few years. At the end of 2022, it is projected to be around USD 8.2 trillion.

- China includes the largest construction market in the world, encompassing 20% of all construction investments globally. China is expected to spend nearly USD 13 trillion on buildings by 2030. According to the National Bureau of Statistics of China, the total output value of construction businesses in China in the fourth quarter of 2022 was approximately CNY 276 billion (~USD 40 billion), a growth of approximately 50% when compared with the previous quarter (~USD 27.6 billion).

- The privately-owned residential units permitted by building permits were at a seasonally adjusted annual rate of 1,873,000 in December 2021, according to figures published by the US Census Bureau and the US Department of Housing and Urban Development. A total of 1,128,000 single-family permits were issued each year. The yearly rate of unit authorizations in structures with five or more units was 675,000. In 2021, 1,724,700 housing units were scheduled to be granted through building permits. This figure was 17.2% more than the 1,471,100 predicted for 2020.

- India will likely witness an investment of around USD 1.3 trillion in housing over the next seven years, during which it will likely witness the construction of 60 million new homes. The availability rate of affordable housing is expected to rise by around 70% in 2024. The Indian government's 'Housing for All by 2022' is also a major game-changer for the industry.

- The value of construction new work in current prices in Great Britain in 2021 experienced strong growth (15.3%) to GBP 115,579 million (~USD 1,59,008.77 million) after a 15.9% fall to GBP 100,199 million (~ USD 1,28,622.12 million) in 2020.

- Overall, the recovering construction activities worldwide are expected to drive the demand for aluminum from the building and construction industry during the forecast period.

Asia-Pacific Region Expected to Dominate the Market

- The Asia-Pacific region is expected to be the largest market for aluminum during the forecast period. Industries such as electronics, building and construction, aerospace, etc., are growing in countries such as China, India, and Japan.

- The Chinese automotive manufacturing industry is the largest in the world. According to the China Association of Automobile Manufacturers, in 2022, automotive production in the country reached 27.02 million units, which increased by about 3.4%, compared to 26.08 million vehicles produced in 2021.

- India will likely witness an investment of around USD 1.3 trillion in housing over the next seven years, during which it will likely witness the construction of 60 million new homes. The Union Cabinet of India approved the setting up a USD 3.58 billion alternative investment fund (AIF) to revive around 1,600 stalled housing projects across the top cities in the country.

- The Indian electronics market is expected to reach USD 400 billion by 2025. Additionally, India is expected to become the world's fifth-largest consumer electronics and appliances industry by 2025.

- According to the Packaging Industry Association of India (PIAI), the Indian packaging industry is expected to grow at 22% during the forecast period. Moreover, the Indian packaging market is expected to reach USD 204.81 billion by 2025, registering a CAGR of 26.7% between 2020 and 2025.

- In Japan, it is estimated that by 2025, the retail sales in the packaged food market are expected to reach USD 204.5 billion, a growth of 3.6% or USD 7 billion. Such projected growth in the packaging industry will likely drive the demand for aluminum used as foils during the forecast period.

- Hence, with the rapidly growing end-user industries in countries of the Asia-Pacific region, the region is expected to dominate the global market during the forecast period.

Aluminum Industry Overview

The aluminum market is partially fragmented in nature. The major companies include (not in any particular order) Aluminum Corporation of China Limited (CHINALCO), China Hongqiao Group Limited, RusAL, Xinfa Group Co. Ltd., and Rio Tinto, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Construction Activities in the Asia-Pacific Region

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Strict Regulations and Environmental Concerns Related to Aluminum Processing

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Import-Export Trends

- 4.6 Price Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Processing Type

- 5.1.1 Castings

- 5.1.2 Extrusions

- 5.1.3 Forgings

- 5.1.4 Flat Rolled Products

- 5.1.5 Pigments and Powders

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace and Defense

- 5.2.3 Building and Construction

- 5.2.4 Electrical and Electronics

- 5.2.5 Packaging

- 5.2.6 Industrial

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alcoa Corporation

- 6.4.2 Aluminum Bahrain B.S.C. (Alba)

- 6.4.3 Aluminum Corporation of China Limited (CHINALCO)

- 6.4.4 China Hongqiao Group Limited

- 6.4.5 East Hope Group

- 6.4.6 Emirates Global Aluminum PJSC

- 6.4.7 Novelis Inc.

- 6.4.8 Norsk Hydro ASA

- 6.4.9 Rio Tinto

- 6.4.10 RusAL

- 6.4.11 State Power Investment Corporation (SPIC)

- 6.4.12 Xinfa Group Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth in Electric Vehicles Market

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219