|

市场调查报告书

商品编码

1689897

硼 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Boron - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

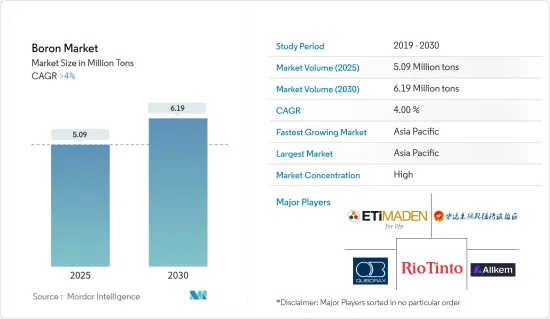

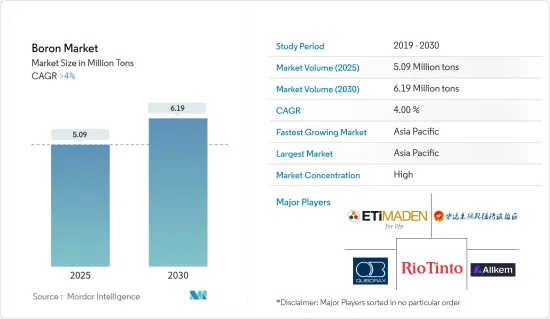

预计2025年硼市场规模为509万吨,2030年将达到619万吨,预测期间(2025-2030年)的复合年增长率将超过4%。

由于所有行业都停止了生产流程,COVID-19 对市场产生了负面影响。封锁、社交隔离和贸易制裁已对全球供应链网路造成严重破坏。不过,2021年情况开始好转,市场恢復成长轨迹。

主要亮点

- 推动市场研究的主要因素之一是各终端使用者产业对玻璃纤维的应用日益广泛。此外,预测期内农业产业需求的增加可能会推动对硼的需求。

- 然而,人们对化合物稀缺性的日益担忧可能会抑制市场的发展。

- 陶瓷行业需求的不断增长可能为未来的市场成长提供机会。

- 由于汽车、建筑等各行各业对硼的需求量大,亚太地区在硼市场占据主导地位。

硼市场趋势

玻璃领域占市场主导地位

- 在玻璃工业中,硼主要应用于硼硅酸玻璃、编织玻璃纤维和绝缘玻璃纤维。添加硼会使玻璃製品变成耐热和耐化学腐蚀的材料。在熔融玻璃中间体中添加硼可以提高最终产品的流动性、表面硬度和耐久性。

- 玻璃製造商在硅基中添加 5% 至 20% 的硼酸盐,以显着降低熔化温度和黏度、防止玻璃结晶、调节热膨胀并防止脱硝。最终产品足够坚固,可以承受巨大的机械和热衝击,并且耐用且耐化学腐蚀。

- 根据国际玻璃年(2022),全球共有 650 家容器玻璃製造商,在 1,200 家工厂中运营,每年生产 9500 万吨玻璃;320 家平板玻璃製造商,在 560 家工厂中运营,每年生产约 1.06 亿吨平板玻璃;230 家工厂,在 400 万吨工厂中营运餐具约 400 万。

- 全球 1,200 家公司、2,160 家机构每年生产 2.09 亿吨玻璃。但这些数字并不包括第二产业、玻璃纤维製造、美术、特殊玻璃製品和第二产业。

- 因此,在预测期内,玻璃产业很可能继续占据市场主导地位。

亚太地区占市场主导地位

- 由于中国和印度等终端用户行业的成长,预计亚太地区将在预测期内成为最大的硼市场。

- 受中产阶级家庭清洁意识不断增强的推动,亚太地区预计将拥有全球最大的清洁剂产业。中国和印度等国家是全球最大的清洁剂生产国之一。

- 硼酸、硼酸盐等硼化合物可延长水泥的水化期。因此,硼化合物在建设产业中得到了有效的应用。

- 建筑业是中国持续经济发展的关键因素。中国正在经历建筑业的蓬勃发展。根据中国国家统计局的数据,建筑业产值将从2021年的29.3兆元(4.2兆美元)成长到2022年的31.2兆元(4.5兆美元)。预计到2030年,中国的建筑业支出将达到约13兆美元,硼的前景一片光明。

- 此外,印度拥有庞大的建筑业,预计将成为世界第三大建筑市场。印度政府实施的智慧城市计划、全民住宅等各项政策预计将为印度建设产业提供急需的动力。

- 此外,中国是世界领先的陶瓷生产国和消费国之一。它是世界上最大的瓷砖生产商之一,年产量约84.7亿平方公尺瓷砖。国内和出口市场的激烈竞争迫使陶瓷製造商改善生产过程和产品品质。

- 根据印度储备银行预测,受瓷砖和卫浴设备需求激增的推动,印度陶瓷和玻璃器皿出口额将在2022年创下2,580亿印度卢比(31.5亿美元)的历史新高。

- 因此,由于亚太国家终端用户产业的蓬勃发展,预测期内对硼的需求预计也将增加。

硼行业概况

硼市场高度整合,领先公司占据相当大的市场占有率。市场的主要企业(不分先后顺序)包括 Eti Maden、力拓、Quiborax、Allkem Limited 和青海中天硼锂矿业。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 玻璃纤维在各终端用户产业的应用日益广泛

- 农业领域需求不断成长

- 其他驱动因素

- 限制因素

- 对化合物稀缺性的担忧日益加剧

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 应用

- 玻璃

- 陶瓷

- 农业

- 清洁剂和清洁剂

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- ALLKEM Limited

- Boron Molecular

- ETI Maden

- Gujarat Boron Derivatives Pvt. Ltd

- Minera Santa Rita SRL(MSR)

- Qinghai Zhongtian Boron Lithium Mining Co. Ltd

- Quiborax

- Rio Tinto

- SB Boron Corporation

- Searles Valley Minerals

第七章 市场机会与未来趋势

- 陶瓷产业需求不断成长

- 其他机会

The Boron Market size is estimated at 5.09 million tons in 2025, and is expected to reach 6.19 million tons by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

COVID-19 negatively impacted the market as all the industries halted their manufacturing processes. Lockdowns, social distances, and trade sanctions triggered massive disruptions to global supply chain networks. However, the conditions started recovering in 2021, restoring the market's growth trajectory.

Key Highlights

- One of the major factors driving the market study is the growing adoption of fiberglass in various end-user industries. Also, increasing demand from the agriculture industry will likely boost the demand for boron during the forecast period.

- However, rising concerns regarding the scarcity of the compound are likely to restrain the market.

- The growing demand from the ceramics industry is likely to act as an opportunity for market growth in the future.

- Asia-Pacific dominated the boron market, owing to high demand from various industries like automobiles, buildings, and construction in the region.

Boron Market Trends

Glass Segment to Dominate the Market

- In the glass industry, boron is particularly employed in borosilicate glass, textile-type fiberglass, and insulation-type fiberglass. With the addition of boron, glass goods are changed into materials that are resistant to heat and chemicals. The final product's fluidity, surface hardness, and durability enhance when boron is added to the intermediate molten glass product.

- In order to drastically lower the melting temperature and viscosity, prevent the glass from crystallizing, regulate thermal expansion, and prevent devitrification, glass producers add 5-20% boric oxide to the silica basis. The end products are strong enough to endure significant mechanical or thermal shock and have built-in durability and chemical resistance.

- According to the International Year of Glass 2022, around the world, there are 650 glass container manufacturers operating on 1200 sites, producing 95 million tonnes of glass annually; 320 flat glass manufacturers operating on 560 sites, producing about 106 million tonnes of flat glass annually; and 230 manufacturers operating on over 400 sites, melting nearly 8 million tonnes of glass annually for household glass/tableware.

- An astonishing 209 million tonnes of glass are produced worldwide each year by 1200 businesses across 2160 sites. Yet, these numbers do not account for secondary industries, glass fiber production, art, specialty glassware, or secondary industries.

- Hence, the glass segment will continue dominating the market during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to be the largest market for boron during the forecast period owing to the growing end-user industries in China, and India, among others.

- Asia-Pacific is expected to include the largest detergent industry globally, owing to the increased awareness regarding cleanliness among middle-class families. Countries such as China and India are the top detergent producers globally.

- Boron compounds such as boric acid and borates extend the cement hydration period. Therefore, boron compounds are used effectively in the construction industry.

- The construction sector is a key player in China's continued economic development. China is amid a construction mega-boom. According to the National Bureau of Statistics of China, The value of construction output accounted for CNY 31.2 trillion (USD 4.5 trillion) in 2022, up from CNY 29.3 trillion (USD 4.2 trillion) in 2021. China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive outlook for boron.

- Furthermore, India has a huge construction sector and is expected to become the world's third-largest construction market. Various policies implemented by the Indian government, such as the Smart Cities project, Housing for All, etc., are expected to bring the needed impetus to the Indian construction industry.

- In addition, China is the leading producer and consumer of ceramics worldwide. It is one of the largest producers of ceramic tiles countries in the world and has produced around 8.47 billion square meters of ceramic tiles. The fierce competition in the domestic and export markets forces ceramic producers to improve their production process and product quality in the region.

- According to the Reserve Bank of India, the export of ceramics and glassware products in India for 2022 hit a record at INR 258 billion (~USD 3.15 billion) due to a surge in demand for ceramic tiles and sanitary wares.

- Hence, with the rapidly growing end-user industries in countries of the Asia-Pacific region, the demand for boron is also expected to increase over the forecast period.

Boron Industry Overview

The boron market is highly consolidated, with the major players accounting for a major market share. Some of the major companies in the market (not in any particular order) include Eti Maden, Rio Tinto, Quiborax, Allkem Limited, and Qinhai Zhontian Boron Lithium Mining Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Adoption of Fiberglass in Various End-user Industries

- 4.1.2 Increasing Demand From the Agriculture Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Rising Concerns Regarding the Scarcity of the Compound

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Glass

- 5.1.2 Ceramics

- 5.1.3 Agriculture

- 5.1.4 Detergent and Cleaning

- 5.1.5 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 ALLKEM Limited

- 6.4.3 Boron Molecular

- 6.4.4 ETI Maden

- 6.4.5 Gujarat Boron Derivatives Pvt. Ltd

- 6.4.6 Minera Santa Rita SRL (MSR)

- 6.4.7 Qinghai Zhongtian Boron Lithium Mining Co. Ltd

- 6.4.8 Quiborax

- 6.4.9 Rio Tinto

- 6.4.10 SB Boron Corporation

- 6.4.11 Searles Valley Minerals

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand from Ceramics Industry

- 7.2 Other Opportunities