|

市场调查报告书

商品编码

1689899

氯碱:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Chlor-alkali - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

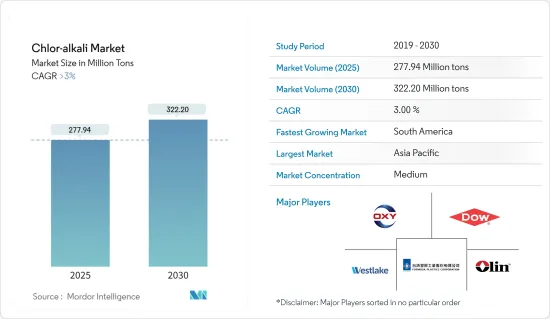

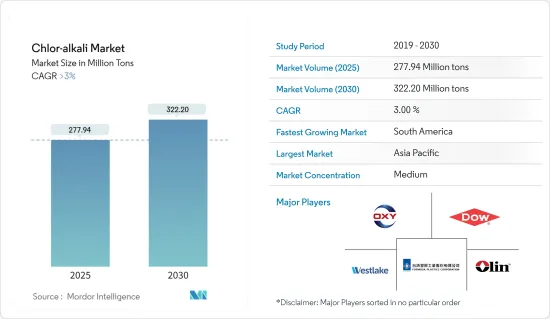

预计2025年氯碱市场规模为2.7794亿吨,到2030年将达到3.222亿吨,预测期间(2025-2030年)复合年增长率将超过3%。

新冠疫情对全球氯碱需求产生了负面影响。疫情期间,封锁、供应链中断和经济活动减少导致建筑、汽车和製造业等产业对氯碱产品的需求减少。需求的下降影响了 PVC 生产中的氯消耗。然而,随着各国放鬆封锁限制并开始重启经济,氯碱产品的需求开始恢復。受阻的行业逐渐恢復运营,导致对氯和氢氧化钠的需求增加。

主要亮点

- 推动市场成长的关键因素是化学品製造需求的激增和聚氯乙烯(PVC)需求的增加。

- 然而,环境影响和严格的环境法规预计会阻碍氯碱市场的发展。

- 加大对氯碱研发和新应用的开发投入预计将为产业提供新的成长机会。

- 由于氯碱产品及其衍生物的生产和消费量庞大,预计亚太地区将占据最大的市场占有率。

氯碱市场趋势

有机化学品领域占市场主导地位

- 氯是氯碱生产过程中透过电解盐水生成的产物,是生产许多有机化学产品的重要原料。氯是有机合成中用途广泛的组成部分,是生产氯化溶剂、塑胶、农药、药物和其他有机化合物的基础。

- 氯的最大消费者是塑胶产业,特别是聚氯乙烯(PVC)的生产。 PVC广泛应用于建筑材料、包装、汽车零件及各种消费品。 PVC 的需求推动了氯的高消耗,使得有机化学品领域成为氯碱市场的主要贡献者。

- 各终端用户产业的氯产量和消费量持续增加。根据欧洲氯气协会预测,到2023年12月底,欧洲氯气产量将增加至609,418吨。 2023 年 12 月的平均日产量与 2023 年 11 月(19,659 吨)相比下降了 1.7%,但与 2022 年 12 月(16,573 吨)相比增加了 18.6%。

- 根据欧洲氯气协会发布的资料,2022年德国氯气产量为540万吨,占国内氯气产能的最大份额。

- 根据BASF2023报告,预计2024年全球化学製造业(不包括製药业)将成长2.7%,超过前一年(2023年:+1.7%)。中国是全球领先的化学品市场,预计 2023 年将大幅成长 4.0%,儘管这一成长率低于前一年强劲的成长(+7.5%)。

- 因此,受上述因素影响,未来氯碱需求预计会增加。

亚太地区占市场主导地位

- 亚太地区包括中国、印度和东南亚等几个快速成长的经济体,这些地区正在经历强劲的工业成长。这种成长将推动建筑、製造、化学品和纺织等各行业对氯碱产品的需求。

- 亚太地区拥有庞大的製造地,许多产业都是氯碱产品的重要消费者,尤其是聚氯乙烯、纺织品和化学品。该地区的製造业占全球氯碱消费量的很大一部分。

- 此外,根据中国国务院新闻办公室消息,2023年中国主要纺织企业利润与前一年同期比较成长7.2%。同年,中国纺织品服饰出口额达2,936亿美元。纺织品服饰出口2023年12月开始再次增加,与前一年同期比较去年同期成长2.6%。

- 此外,根据Invest India的数据,印度占全球纺织品和服饰贸易的4%。预计到 2030 年,纺织品製造业产值将达到 2,500 亿美元,出口额将达 1,000 亿美元。

- 此外,根据中国国家统计局发布的资料,2023年12月中国塑胶製品产量为698万吨。

- 因此,预计上述因素将增加亚太地区氯碱市场的需求。

氯碱产业概况

氯碱市场部分分散。市场的主要企业(不分先后顺序)包括 Olin Corporation、西方石油公司、台塑股份有限公司、陶氏化学、Westlake Vinnolit GmbH &Co.KG 等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 化学製造需求激增

- 聚氯乙烯(PVC)需求不断增加

- 限制因素

- 环境影响和严格的环境法规

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 进出口趋势

第五章 市场区隔

- 产品

- 苛性钠

- 氯

- 碱灰

- 製造过程

- 膜细胞

- 隔膜电池

- 其他製造工艺

- 应用

- 纸浆和造纸

- 有机化学

- 无机化学品

- 肥皂和清洁剂

- 氧化铝

- 纺织品

- 其他用途(食品工业)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 土耳其

- 俄罗斯

- 北欧的

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 埃及

- 卡达

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- ANWIL SA(ORLEN SA)

- BorsodChem(Wanhua)

- Ciner Group

- Covestro AG

- Dow

- Ercros SA

- Formosa Plastics Corporation

- Genesis Energy LP

- Hanwha Solutions Chemical Division Corporation

- INEOS

- KEM ONE

- Kemira

- Micro Bio Ireland Limited

- NIRMA

- Nouryon(NOBIAN)

- Occidental Petroleum Corporation

- Olin Corporation

- PCC SE

- Shandong Haihua Group Co. Ltd

- Solvay

- Spolchemie(Euro Chlor)

- Tata Chemicals Ltd

- Tosoh Asia Pte Ltd

- Vynova Group

- Westlake Vinnolit GmbH & Co. KG

第七章 市场机会与未来趋势

- 开发氯碱的新用途

The Chlor-alkali Market size is estimated at 277.94 million tons in 2025, and is expected to reach 322.20 million tons by 2030, at a CAGR of greater than 3% during the forecast period (2025-2030).

The COVID-19 pandemic negatively affected the demand for chlor alkali across the world. During the pandemic, demand for chlor alkali products decreased in sectors such as construction, automotive, and manufacturing due to lockdowns, supply chain disruptions, and reduced economic activity. This decline in demand affected the consumption of chlorine for PVC production. However, as countries began to ease lockdown restrictions and reopen their economies, the demand for chlor alkali products rebounded. Industries that had experienced disruptions gradually resumed operations, leading to increased demand for chlorine and sodium hydroxide.

Key Highlights

- The major factors driving the market's growth are the surging demand in chemical manufacturing and the growing demand for polyvinyl chloride (PVC).

- However, the environmental impact and stringent environmental regulations are expected to hinder the chlor alkali market.

- The increasing investment in research and development and exploration of new applications of chlor alkali are expected to offer new growth opportunities to the industry.

- Asia-Pacific is likely to hold the largest market share due to the large-scale production and consumption of chlor alkali products and their derivatives.

Chlor Alkali Market Trends

The Organic Chemical Segment to Dominate the Market

- Chlorine, produced as a co-product in the electrolysis of brine during chlor alkali production, serves as a crucial feedstock in producing numerous organic chemicals. Chlorine is a versatile building block in organic synthesis, forming the basis for the production of chlorinated solvents, plastics, agrochemicals, pharmaceuticals, and other organic compounds.

- The largest consumer of chlorine is the plastics industry, particularly the production of polyvinyl chloride (PVC). PVC is widely used in construction materials, packaging, automotive parts, and various consumer goods. The demand for PVC drives significant consumption of chlorine, making the organic chemicals segment a major contributor to the chlor alkali market.

- Chlorine production and consumption continue to increase in its various end-user industries. According to Euro Chlor, by the end of December 2023, chlorine production in Europe climbed to 609,418 tonnes. On average, in December 2023, there was a decrease of 1.7% in daily production compared to November 2023 (which saw 19,659 tonnes) but an increase of 18.6% compared to December 2022 (with 16,573 tonnes).

- According to the data published by the Euro Chlor, Germany produced 5.4 million metric tons of chlorine in 2022, accounting for the country's largest chlorine production capacity.

- As per the BASF Report 2023, chemical manufacturing worldwide, not including the pharmaceutical industry, is anticipated to expand by 2.7% in 2024, a rate higher than the year before (2023: +1.7%). In China, which holds the top position in the global chemical market, a decrease in growth but still significant expansion of 4.0% compared to the robust growth in the year prior (2023: +7.5%) is anticipated.

- Thus, the factors mentioned above are expected to increase the demand for chlor alkali in the upcoming period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is home to rapidly growing economies such as China, India, and Southeast Asia, which are experiencing robust industrial growth. This growth drives the demand for chlor alkali products in various industries, including construction, manufacturing, chemicals, and textiles.

- Asia-Pacific has a large manufacturing base, particularly in industries that are significant consumers of chlor alkali products such as PVC, textiles, and chemicals. The region's manufacturing sector accounts for a significant portion of global chlor alkali consumption.

- Additionally, as per China's State Council Information Office, the total profits of China's leading textile companies increased by 7.2% Y-o-Y in 2023. In the same year, China's exports of textiles and clothing reached USD 293.6 billion. The exports of textiles and clothing began to grow again in December 2023, showing a 2.6% increase from the previous year.

- Moreover, according to Invest India, India accounts for 4% of the worldwide textile and clothing trade. It is projected to reach USD 250 billion in textile manufacturing and USD 100 billion in exports by 2030.

- Furthermore, according to the data released by the National Bureau of Statistics of China, 6.98 million metric tons of plastic products were produced in December 2023 in China.

- Thus, the factors mentioned above are expected to increase the market demand for chlor alkali in Asia-Pacific.

Chlor-alkali Industry Overview

The chlor alkali market is partially fragmented. The major players in the market (not in any particular order) include Olin Corporation, Occidental Petroleum Corporation, Formosa Plastics Corporation, Dow, and Westlake Vinnolit GmbH & Co. KG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Surging Demand in Chemical Manufacturing

- 4.1.2 Growing Demand for Polyvinyl Chloride (PVC)

- 4.2 Restraints

- 4.2.1 Environmental Impact and Stringent Environmental Regulations

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Import and Export Trends

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product

- 5.1.1 Caustic Soda

- 5.1.2 Chlorine

- 5.1.3 Soda Ash

- 5.2 Production Process

- 5.2.1 Membrane Cell

- 5.2.2 Diaphragm Cell

- 5.2.3 Other Production Processes

- 5.3 Application

- 5.3.1 Pulp and Paper

- 5.3.2 Organic Chemical

- 5.3.3 Inorganic Chemical

- 5.3.4 Soap and Detergent

- 5.3.5 Alumina

- 5.3.6 Textile

- 5.3.7 Other Applications (Food Industry)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Turkey

- 5.4.3.7 Russia

- 5.4.3.8 NORDIC

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Egypt

- 5.4.5.5 Qatar

- 5.4.5.6 UAE

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ANWIL SA (ORLEN SA)

- 6.4.2 BorsodChem (Wanhua)

- 6.4.3 Ciner Group

- 6.4.4 Covestro AG

- 6.4.5 Dow

- 6.4.6 Ercros SA

- 6.4.7 Formosa Plastics Corporation

- 6.4.8 Genesis Energy LP

- 6.4.9 Hanwha Solutions Chemical Division Corporation

- 6.4.10 INEOS

- 6.4.11 KEM ONE

- 6.4.12 Kemira

- 6.4.13 Micro Bio Ireland Limited

- 6.4.14 NIRMA

- 6.4.15 Nouryon (NOBIAN)

- 6.4.16 Occidental Petroleum Corporation

- 6.4.17 Olin Corporation

- 6.4.18 PCC SE

- 6.4.19 Shandong Haihua Group Co. Ltd

- 6.4.20 Solvay

- 6.4.21 Spolchemie (Euro Chlor)

- 6.4.22 Tata Chemicals Ltd

- 6.4.23 Tosoh Asia Pte Ltd

- 6.4.24 Vynova Group

- 6.4.25 Westlake Vinnolit GmbH & Co. KG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Exploring New Applications of Chlor Alkali