|

市场调查报告书

商品编码

1689901

低摩擦涂层:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Low Friction Coating - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

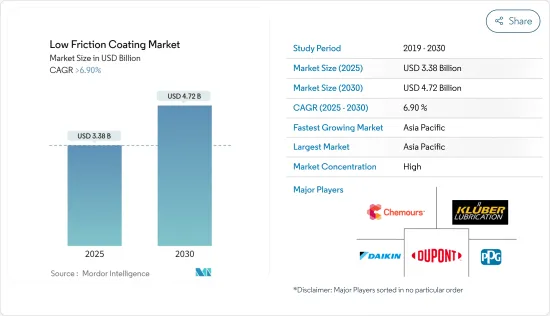

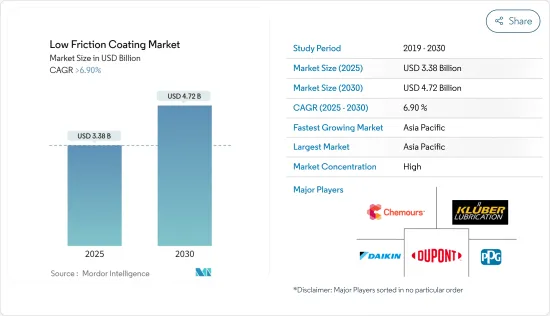

低摩擦涂层市场规模预计在 2025 年达到 33.8 亿美元,预计到 2030 年将达到 47.2 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 6.9%。

主要亮点

- 推动市场发展的因素包括航太工业对低摩擦涂层的需求不断增加,以及主要国家汽车工业的应用不断扩大。

- 然而,政府关于 PTFE(聚四氟乙烯)毒性的法规预计会阻碍市场成长。

- 医疗保健行业对流体摩擦涂层的需求不断增长,预计将在未来几年为市场提供机会。

- 在预测期内,低摩擦涂料市场预计将实现最快的成长并在亚太地区占据主导地位。

低摩擦涂层市场趋势

汽车和运输业对低摩擦涂层的需求不断增加

- 低摩擦涂层具有极低的摩擦係数 (COF)、出色的抗咬、抗微动磨损和抗粘连性能、高耐腐蚀性和许多其他优点。

- 因此,由于需要提高燃油效率、减少排放气体和提高性能,以及采用电气化和自动驾驶汽车等新技术,汽车和运输业对低摩擦涂层的需求正在增加。

- 此外,全球汽车产量的成长也进一步刺激了需求。例如,根据国际汽车製造商组织(OICA)的预测,全球汽车产量将从2022年的8,483万辆增加到2023年的9,354万辆,与前一年同期比较增长17%。

- 此外,根据欧洲汽车工业协会的数据,2023 年前三个季度(2023 年 1 月至 9 月)欧洲汽车总产量与 2022 年同期相比成长了近 14%。这大大促进了低摩擦涂料市场的需求。

- 预计未来几年汽车产业将经历显着成长。不断发展的数位技术、不断变化的客户情绪和经济健康状况在汽车製造的非商业性业务实践中发挥关键作用。

- 例如,现代汽车集团、宝马集团、丰田、本田、福特汽车公司和通用汽车等多家汽车製造商已宣布在北卡罗来纳州、密西根州、俄亥俄州、密苏里州和堪萨斯州等州投资电动车製造。预计这将促进汽车製造业的发展并增加对低摩擦涂层的需求。

- 因此,预计汽车和运输业在预测期内对低摩擦涂层的需求最高,从而增强其在市场上的主导地位。

亚太地区发展迅速

- 预计在预测期内亚太地区将占据市场主导地位。低摩擦涂料需求的不断增长,加上中国和印度等国家汽车和医疗保健行业的成长,预计将推动该地区对低摩擦涂料的需求。

- 低摩擦涂层的最大生产地是亚太地区。低摩擦涂层领域的主要企业包括 VITRACOAT、大金工业、科慕公司、陶氏和 ASV Multichemie Private Limited。

- 中国是全球产销最大的汽车市场。根据中国工业协会预测,2023年中国汽车产量将达3,016万辆,与前一年同期比较增加11.6%。

- 此外,根据印度汽车製造商协会(SIAM)的资料,印度23财年的汽车产量将达到458万辆,较22财年的365万辆有大幅成长。

- 根据波音公司《2021-2040年商业展望》,到2040年中国将交付约8,700架新飞机,市场服务价值达1.8兆美元。

- 此外,公共工程部长拿督斯里亚历山大·南塔·林奇表示,马来西亚的建筑业将在2023年实现成长,截至2023年9月,总合9,144个计划成功实施。此外,该国对各种商业建筑计划的投资也有所增加。例如,2024年5月,Google投资约20亿美元开发全国首个资料中心和Google云端中心。新中心将建在马来西亚中部雪兰莪州的一个商业园区,以满足马来西亚学生和教育工作者对 IT 服务和人工智慧素养计划日益增长的需求。

- 考虑到上述事实和因素,预计预测期内亚太市场对低摩擦涂层的需求将以最快的速度成长。

低摩擦涂层产业概况

全球低摩擦涂料市场正在整合。市场的主要企业包括(不分先后顺序)PPG Industries Inc.、Chemours Company、杜邦、克鲁勃润滑剂和大金工业有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 扩大在汽车产业的应用

- 航太工业对低摩擦涂层的需求不断增加

- 限制因素

- 关于加热聚四氟乙烯毒性的政府法规

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按类型

- 二硫化钼

- 二硫化钨

- 聚四氟乙烯(PTFE)

- 其他的

- 按最终用户产业

- 汽车与运输

- 航太与国防

- 卫生保健

- 建造

- 石油和天然气

- 其他的

- 按应用

- 轴承

- 汽车零件

- 传动部件

- 阀门零件和致动器

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- AFT Fluorotec Ltd

- ASV Multichemie Private Limited

- Carl Bechem GmBH

- DAIKIN INDUSTRIES Ltd

- DuPont

- Endura Coatings

- Curtiss-Wright Corporation

- FUCHS

- GGB

- IHI HAUZER TECHNO COATING BV

- IKV Tribology Ltd

- Impreglon UK Limited

- Indestructible Paint Limited

- Kluber Lubrication(Freudenberg SE)

- Micro Surface Corp.

- Poeton

- PPG Industries Inc.

- The Chemours Company

- VITRACOAT

第七章 市场机会与未来趋势

- 医疗保健产业对低摩擦涂层的需求不断增长

简介目录

Product Code: 69226

The Low Friction Coating Market size is estimated at USD 3.38 billion in 2025, and is expected to reach USD 4.72 billion by 2030, at a CAGR of greater than 6.9% during the forecast period (2025-2030).

Key Highlights

- Factors driving the market include the increasing demand for low-friction coatings in the aerospace industry and increasing applications in the automotive industry across major economies.

- However, government regulations on the toxicity of PTFE (polytetrafluoroethylene) are expected to hinder the market's growth.

- The growing demand for flow-friction coating in the healthcare industry is expected to act as an opportunity for the market studied in the coming years.

- During the forecast period, the low friction coating market is estimated to register the fastest growth and be the most dominant in Asia-Pacific.

Low Friction Coating Market Trends

Increasing Demand for Low Friction Coating in the Automotive and Transportation Industry

- Low-friction coatings possess extremely low coefficients of friction (COF), excellent release properties for resistance to galling, fretting, and sticking, high corrosion resistance, and many other benefits.

- Therefore, there is an increasing demand for low-friction coatings in the Automotive and Transportation Industry driven by the need for improved fuel efficiency, reduced emissions, and enhanced performance, as well as the adoption of new technologies like electrification and autonomous vehicles.

- Moreover, the rising volume of vehicle production globally is propelling the demand even further. For instance, according to the Organisation Internationale des Constructeurs d'Automobiles (OICA), automotive production globally increased from 84.83 million units in 2022 to 93.54 million units in 2023, representing a growth of 17% year-on-year.

- Furthermore, according to the European Automobile Manufacturers Association, in the first three quarters of 2023 (January 2023 to September 2023), the total production of cars in Europe increased by almost 14% compared to the same period in 2022. This substantially boosted the demand in the low-friction coating market.

- The automotive industry is expected to grow significantly over the coming years. Evolving digital technology, changes in customer sentiment, and economic health have played a vital role in non-commercial business practices of manufacturing vehicles.

- For instance, various automotive manufacturing companies such as Hyundai Motor Group, BMW Group, Toyota, Honda, Ford Motor Company, and General Motors have announced investments in electric vehicle manufacturing in North Carolina, Michigan, Ohio, Missouri, Kansas, and other states. This is likely to boost automotive manufacturing, thereby increasing the demand for low-friction coating.

- Hence, the automotive and transportation industry is projected to exhibit the highest demand for low-friction coating during the forecast period, solidifying its dominance in the market.

Asia-Pacific to Witness the Fastest Growth

- Asia-Pacific is expected to dominate the market during the forecast period. The rising demand for low-friction coatings, combined with the growing automotive and healthcare industry in countries like China and India, is expected to drive the demand for low-friction coatings in this region.

- The largest producers of low-friction coating are based in Asia-Pacific. Some of the leading companies in the production of low-friction coating are VITRACOAT, Daikin Industries, The Chemours Company, Dow, and ASV Multichemie Private Limited.

- China is the world's largest automobile market in terms of production and sales. According to the China Association of Automobile Manufacturers (CAAM), vehicle production in China reached 30.16 million units in 2023, growing 11.6% compared to the previous year.

- Furthermore, according to the Society of Indian Automotive Manufacturing (SIAM) data, in the financial year 2023, India manufactured 4.58 million vehicles, marking a notable increase from the 3.65 million produced in 2022-a growth rate of about 25%.

- According to the Boeing Commercial Outlook 2021-2040, in China, around 8,700 new deliveries will be made by 2040, with a market service value of USD 1,800 billion.

- Furthermore, the construction sector of Malaysia grew in 2023, with a total of 9,144 projects successfully implemented until September 2023, according to Public Works Minister Datuk Seri Alexander Nanta Linggi. In addition, there has been an increase in the country's investments in various commercial construction projects. For instance, Google invested around USD 2 billion in developing the country's first data center and a Google Cloud hub in May 2024. The new hubs will be developed at a business park in central Malaysia's Selangor state to meet the growing demand for IT services and artificial intelligence literacy programs for Malaysian students and educators.

- Given the above-mentioned facts and factors, the demand for low-friction coatings is expected to increase at the fastest rate in the Asia-Pacific market during the forecast period.

Low Friction Coating Industry Overview

The global low-friction coating market is consolidated. Some of the major companies in the market include (not in any particular order) PPG Industries Inc., The Chemours Company, DuPont, Kluber Lubrication, and Daikin Industries Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Application in the Automotive Industry

- 4.1.2 Growing Demand for Low-friction Coating in Aerospace Industry

- 4.2 Restraints

- 4.2.1 Government Regulation on Toxicity of Overheated PTFE

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Type

- 5.1.1 Molybdenum Disulphide

- 5.1.2 Tungsten Disulphide

- 5.1.3 Polytetrafluoroethylene (PTFE)

- 5.1.4 Other Types

- 5.2 By End-user Industry

- 5.2.1 Automotive and Transportation

- 5.2.2 Aerospace and Defense

- 5.2.3 Healthcare

- 5.2.4 Construction

- 5.2.5 Oil and Gas

- 5.2.6 Others End-user Industries

- 5.3 By Application

- 5.3.1 Bearings

- 5.3.2 Automotive Parts

- 5.3.3 Power Transmission Items

- 5.3.4 Valve Components and Actuators

- 5.3.5 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AFT Fluorotec Ltd

- 6.4.2 ASV Multichemie Private Limited

- 6.4.3 Carl Bechem GmBH

- 6.4.4 DAIKIN INDUSTRIES Ltd

- 6.4.5 DuPont

- 6.4.6 Endura Coatings

- 6.4.7 Curtiss-Wright Corporation

- 6.4.8 FUCHS

- 6.4.9 GGB

- 6.4.10 IHI HAUZER TECHNO COATING BV

- 6.4.11 IKV Tribology Ltd

- 6.4.12 Impreglon UK Limited

- 6.4.13 Indestructible Paint Limited

- 6.4.14 Kluber Lubrication (Freudenberg SE)

- 6.4.15 Micro Surface Corp.

- 6.4.16 Poeton

- 6.4.17 PPG Industries Inc.

- 6.4.18 The Chemours Company

- 6.4.19 VITRACOAT

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Low Friction Coating in Healthcare Industry

02-2729-4219

+886-2-2729-4219