|

市场调查报告书

商品编码

1689902

矿棉:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Mineral Wool - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

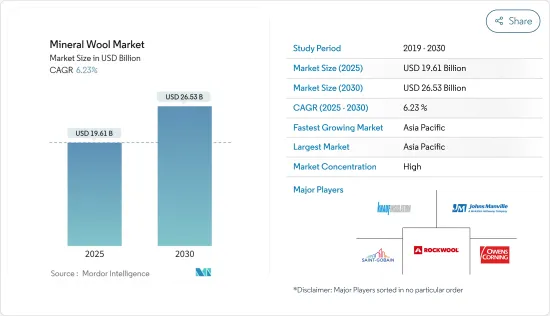

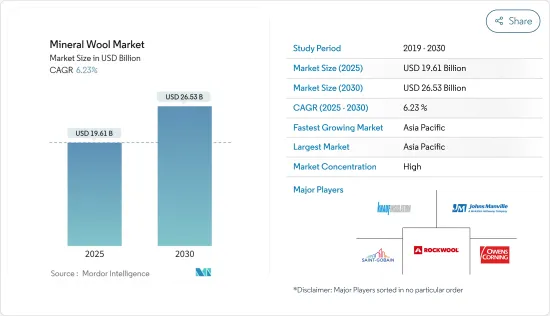

预计 2025 年矿棉市场规模为 196.1 亿美元,到 2030 年将达到 265.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.23%。

由于封锁、社交距离和贸易制裁导致全球供应链网路严重中断,COVID-19 疫情阻碍了市场发展。由于经济活动停止,建设产业出现衰退。不过,预计情况将在 2021 年復苏,这将有利于预测期内的市场。

主要亮点

- 推动市场发展的关键因素是建设产业的成长以及对提高能源效率的监管支持。

- 与矿棉相关的健康危害和廉价隔热材料的可用性是阻碍市场发展的因素。

- 亚太地区发电厂数量的增加和玻璃矿棉的可回收性是未来几年推动市场发展的主要机会。

- 由于政府对建设活动的投资导致中国、日本和印度等国家对矿棉的需求庞大,预计亚太地区将主导全球市场。

矿棉市场趋势

建设产业的成长

- 矿棉是近几十年来越来越受欢迎的材料。矿棉是石头、熔融气体和工业废弃物的混合物。它是一种独特的产品,具有柔韧性,常用作隔热材料。

- 矿棉隔热材料不易燃、不导热,可承受超过 1,000°C 的温度,是理想的阻燃产品。这意味着它不仅可用作天花板覆盖物,还可用作防火门和隔间墙。

- 近年来,由于人口增长、新城市的发展、都市区移民增加以及成熟城市老化基础设施的更换等因素,建筑和建设产业不断增长,预计到 2030 年将达到 4.4 兆美元的销售额。截至 2023 年,美国共有 14,200 家道路和高速公路建设公司,比 2022 年成长 0.7%。

- 根据日本土木工程学会预测,到2025年,中国、印度和美国预计将占全球建筑业成长的近60%,推动该产业矿棉市场的成长。

- 美国是全球最大的建筑市场之一,根据美国人口普查局的数据,2021 年美国建筑业价值为 1.58 兆美国,约占全国 GDP 总量的 4.3%。

- 岩绒国际公司报告称,2021年其隔热材料业务销售额与前一年同期比较增20%至24.4亿美元,高于去年的20.3亿美元。销售成长主要得益于住宅领域的建设和装修活动的活性化。

- 根据美国人口普查局的数据,2021年12月共发放了187.3万份建筑许可证,较11月修订后的171.7万份增加9.1%。 2021 年共发放了约 1,724,700 张建筑许可证,比前一年发放的 1,471,100 份增加 17.2%。

- 因此,预计未来几年建设产业的成长将推动全球对矿棉的需求。

亚太地区占市场主导地位

- 亚太地区占据全球矿棉市场的最大份额。该地区的矿棉市场主要受到建筑业持续变化的推动。

- 中国拥有全世界最大的建筑业。此外,随着多个大型建设计划的进行,中国很可能在可预见的未来保持其世界最大建筑业的地位。

- 根据美国国际贸易署预测,2030年,中国建筑市场年均成长率将达8.6%。根据国家发展和改革委员会预测,未来5年(至2025年)中国将在重大建设计划上投资1.43兆美元,其中上海计划在未来3年投资387亿美元,广州则已签约16个新计划,总投资80.9亿美元。

- 2021 年 3 月,印度建筑开发部门的投资额为 260.8 亿美元,建设活动额为 247.2 亿美元。 2022 年,在政府基础设施和经济适用住宅措施(包括全民住宅和智慧城市计画)的推动下,印度将向建设产业投入约 6,400 亿美元。该国建设活动的活性化可能会推动该国隔热材料的需求,从而在预测期内推动矿棉市场的发展。

- 预计此次展会在日本举办后,日本的建设产业将会蓬勃发展。 2021年奥运会在东京举办,2025年世博会将在大阪举行。

- 根据日本财务省统计,2021财年日本建设产业销售额约1.22兆美元,较去年同期成长2.1%。

- 亚洲是世界上最大的汽车生产基地。尤其是在中国,出于各种环境问题的考虑,许多政府计画都在推动摆脱石化燃料,预计电动车的发展将继续获得动力。

- 中国政府计划在 2025 年引进至少 5,000 辆燃料电池电动车,到 2030 年引进 100 万辆。预计政府对电动、混合动力汽车和燃料电池电动车的推广将在预测期内推动市场研究。

- 根据中国工业协会(CAAM)的数据,12月中国汽车销量与前一年同期比较减8.4%至256万辆,但2022年全年销量回升至2,686万辆。

- 因此,预计在预测期内,来自各个终端用户领域的所有这些因素都会影响该地区对矿棉的需求。

矿棉产业概况

从收益方面来看,矿棉市场已部分合併。市场的主要企业包括 Rockwool International AS、Saint Gobain、Knauf Insulation、Owens Corning 和 Johns Manville(不分先后顺序)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 不断发展的建筑和建设产业

- 能源效率的监管支持

- 限制因素

- 矿棉造成的健康危害

- 廉价隔热材料的可用性

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 类型

- 玻璃棉

- 岩棉

- 渣绒

- 产品类型

- 木板

- 毯子

- 散羊毛

- 其他产品类型

- 最终用户产业

- 汽车与运输

- 建筑和施工

- 工业/家电

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)分析**/市占分析

- 主要企业策略

- 公司简介

- Ecowool

- Great Lakes Textiles

- Johns Manville

- Kingspan Group

- Knauf Insulation

- National Industrial Co.

- NTN OOD

- Owens Corning

- Rockwool International AS

- Rosewool Insulation Refractory Co. Ltd.

- Saint Gobain

第七章 市场机会与未来趋势

- 亚太地区发电厂数量不断增加

- 玻璃矿棉的可回收性

The Mineral Wool Market size is estimated at USD 19.61 billion in 2025, and is expected to reach USD 26.53 billion by 2030, at a CAGR of 6.23% during the forecast period (2025-2030).

The COVID-19 pandemic hindered the market because lockdowns, social distances, and trade sanctions caused significant disruptions to global supply chain networks. The construction industry has witnessed a decline due to the halt in activities. However, the condition recovered in 2021, which was expected to benefit the market during the forecast period.

Key Highlights

- The major factors driving the market are the growing building and construction industry and regulatory support to increase energy efficiency.

- Health hazards related to mineral wool and the availability of cheap insulating materials are the factors that may slow down the market.

- The increasing number of power plants in Asia-Pacific and the recyclability of glass mineral wool are the major opportunities to drive the market in the future.

- Asia-Pacific is expected to dominate the global market due to government investments in construction activities, leading to a huge demand for mineral wool from countries such as China, Japan, and India.

Mineral Wool Market Trends

Growth from the Building and Construction Industry

- Mineral wool is a material that has grown in popularity over the last few decades. Mineral wool is a mixture of stone, molten gas, or industrial waste. It is a flexible and one-of-a-kind product that is often used as insulation.

- Mineral wool insulation is non-combustible, does not conduct heat, and can resist temperatures above 1,000°C, making it an ideal fire-retardant product. Therefore, the material can be used as a covering for ceilings as well as in fire-resistant doors and partition walls.

- The building and construction industry has been growing for the past few years, owing to factors such as increasing population, development of new cities, growing migration in urban areas, renewal of old infrastructure in established cities, and others, and it is expected to reach a revenue of USD 4.4 trillion by 2030. There are 14,200 road and highway construction businesses in the United States as of 2023, an increase of 0.7% from 2022.

- According to the Institution of Civil Engineers, China, India, and the United States are expected to account for almost 60% of all global growth in the construction sector by 2025, thus increasing the market growth of mineral wool in the industry.

- The United States was among the top construction markets globally, and per the United States Census Bureau, in 2021, construction in the United States was valued at USD 1.58 trillion, accounting for around 4.3% of the total GDP of the country.

- In 2021, according to the reports by Rockwool International, the sales of the insulation business increased by 20% year over year to USD 2.44 billion, up from USD 2.03 billion the previous year. The residential sector's increased construction and renovation activity was what drove the sales.

- According to the US Census Bureau, the total privately owned housing units authorized by building permits in December 2021 were 1,873,000, 9.1% more than the revised rate of 1,717,000 in November. Building permits authorized an estimated 1,724,700 housing units in 2021, which was 17.2% more than the 1,471,100 in the previous year.

- Therefore, the growing building and construction industry is expected to fuel the demand for mineral wool globally through the years to come.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region held the largest market share in the overall mineral wool market worldwide. The ongoing changes in the construction sector are primarily what drive the market for mineral wool in the area.

- China has the world's largest construction industry. Moreover, with several major construction projects in progress, China is likely to maintain its stature as the world's largest construction industry over the foreseeable future.

- As per the U.S. International Trade Administration, China's construction market is forecasted to grow at an average annual rate of 8.6% until 2030. According to the National Development and Reform Commission (NDRC), China is investing USD 1.43 trillion in major construction projects over the next five years, until 2025. The Shanghai plan includes an investment of USD 38.7 billion in the next three years, whereas Guangzhou signed 16 new infrastructure projects with an investment of USD 8.09 billion.

- In India, the construction development sector and construction activities stood at USD 26.08 billion and USD 24.72 billion, respectively, in March 2021. In 2022, India contributed about USD 640 billion to the construction industry due to government initiatives in infrastructure development and affordable housing, such as housing for all, smart city plans, and others. The growing construction activities in the country are driving the demand for insulation materials in the country, which, in turn, may drive the mineral wool market over the forecast period.

- The Japanese construction industry is expected to be blooming, owing to the events to be hosted in the country. In 2021, Tokyo hosted the Olympics, and the World Expo is to be held in Osaka in 2025, due to which it is expected that there will be an immense growth in the infrastructure development in the country.

- According to the Ministry of Finance of Japan, the construction industry in Japan generated sales of approximately USD 1.22 trillion in the fiscal year 2021, registering an increase of 2.1% as compared to the same period last year.

- Asia is the largest automotive manufacturing hub in the world. The development of electric vehicles is expected to continue to gain momentum in the future, especially in China, where many government programs are promoting the move away from fossil fuels owing to various environmental concerns.

- The Chinese government is planning to have a minimum of 5,000 fuel cell electric vehicles by 2025 and 1 million by 2030. The government's promotion of the use of electric, hybrid, and fuel cell electric vehicles is expected to drive the market studied during the forecast period.

- According to the China Association of Automobile Manufacturers (CAAM), automotive sales in China fell by 8.4% year over year to 2.56 million units in December 2022, whereas they grew to 26.86 million units for the full year 2022.

- Hence, all such factors from various end-user sectors are expected to impact the demand for mineral wool in the region over the forecast period.

Mineral Wool Industry Overview

The mineral wool market is partially consolidated in nature in terms of revenue. Some of the major players in the market include (not in any particular order) Rockwool International AS, Saint Gobain, Knauf Insulation, Owens Corning, and Johns Manville, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Building and Construction Industry

- 4.1.2 Regulatory Support to Increase Energy Efficiency

- 4.2 Restraints

- 4.2.1 Health Hazards Related to Mineral Wool

- 4.2.2 Availability of Cheap Insulating Materials

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Glass Wool

- 5.1.2 Stone Wool

- 5.1.3 Slag Wool

- 5.2 Product Type

- 5.2.1 Board

- 5.2.2 Blanket

- 5.2.3 Loose Wool

- 5.2.4 Other Product Types

- 5.3 End-user Industry

- 5.3.1 Automotive and Transportation

- 5.3.2 Building and Construction

- 5.3.3 Industrial and Consumer Appliances

- 5.3.4 Other End-user industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 France

- 5.4.3.3 United Kingdom

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis **/ Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Ecowool

- 6.4.2 Great Lakes Textiles

- 6.4.3 Johns Manville

- 6.4.4 Kingspan Group

- 6.4.5 Knauf Insulation

- 6.4.6 National Industrial Co.

- 6.4.7 NTN OOD

- 6.4.8 Owens Corning

- 6.4.9 Rockwool International AS

- 6.4.10 Rosewool Insulation Refractory Co. Ltd.

- 6.4.11 Saint Gobain

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Number of Power Plants in Asia-Pacific

- 7.2 Recyclability of Glass Mineral Wools