|

市场调查报告书

商品编码

1689908

煞车液:市场占有率分析、产业趋势和统计数据、成长预测(2025-2030 年)Brake Fluids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

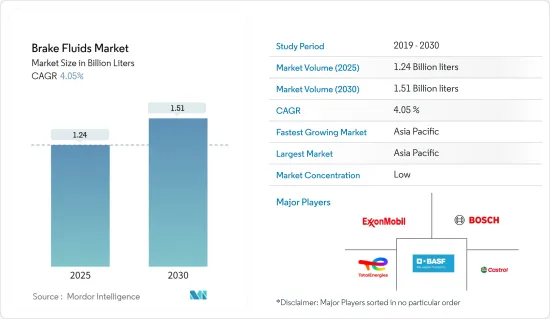

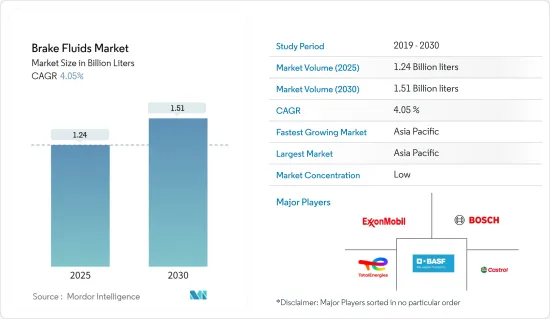

预计 2025 年煞车油市场规模将达到 12.4 亿公升,预计到 2030 年将达到 15.1 亿公升,预测期内(2025-2030 年)的复合年增长率为 4.05%。

由于新冠疫情,煞车液市场面临重大挑战。全球封锁和严格的政府监管导致大面积製造工厂关闭。不过,预计市场将在 2021 年復苏,并在未来几年内将显着成长。

主要亮点

- 短期内,电动和混合动力汽车的普及率不断提高以及汽车保有量的激增是推动市场需求的关键因素。

- 然而,与煞车油使用相关的严格安全标准预计会阻碍市场成长。

- 然而,汽车系统的技术进步有望为市场带来新的机会。

- 预计亚太地区将主导市场,其中中国和印度将占据大部分需求。

煞车液市场趋势

轻型商用车占据市场主导地位

- 在货车、卡车和巴士等轻型商用车 (LCV) 中,煞车油可确保安全可靠的煞车力道。这些车辆通常要承载重物并面临各种各样的驾驶条件,因此它们依赖强大的煞车系统。煞车油在这个系统中的重要性极高。

- 煞车液需求的不断增长是由于新兴市场对更轻、性能更高的汽车的偏好日益增长、新车中心的建立以及可支配收入的增加。

- 国际汽车製造商组织(OICA)预测,2023年全球新车销量将稳定成长,较2022年成长11.9%,超过9,270万辆。其中,预计2023年全球新商用车註册量将达2,750万辆,较2022年的2,420万辆成长13.3%。

- 此外,根据OICA数据,2023年轻型商用车产量预计将达2,144万辆,与前一年同期比较增长9%,进一步推动市场成长。

- 亚洲-大洋洲地区的国家在全球市场上具有战略地位,是新兴的汽车中心。亚洲-大洋洲地区的註册车辆数量是其他任何地区中最多的。该地区的註册主要集中在中国、日本、韩国和印度。 2023年,该地区新商用车销量将比2022年增长10.9%,2023年註册量将达到796万辆,而2022年为717万辆。

- 然而,在印度,商用车 (CV) 销量在 2024 财年实现 2-5% 的小幅成长后,预计在 2024-25 财年 (FY25) 出现下降。 ICRA(印度投资资讯和信用评级机构)的数据预测25财年经济将下降4-7%。

- OICA 预计,2023 年北美汽车产量将达到 1,914 万辆,较 2022 年的 1,775 万辆成长 7.8%。轻型商用车将占据市场的大部分份额,从2022年的1224万辆增加到2023年的1330万辆。

- 根据联邦汽车运输局的数据,到2023年,德国汽车数量将达到5,350万辆,高于2022年的5,305万辆。此外,德国汽车运输局也强调,到2023年,德国註册汽车数量将略有增加,从上年度的4,854万辆增加至4,876万辆。

- 根据OICA预测,2023年德国商用车註册量将超过35.9万辆,高于去年的31.2万辆。

- 根据OICA数据,预计2023年巴西轻型商用车产量将达42.2万辆,与前一年同期比较成长20%。预计2023年南非的产量也将达到26.3万辆,与前一年同期比较成长22%,进一步推动市场成长。

- 鑑于这些趋势,预计未来几年对煞车油的需求将会成长。

亚太地区占市场主导地位

- 由于中国、印度、日本和韩国等主要汽车生产国的存在,亚太地区预计将占据最大的煞车油市场。这些国家正在努力加强其汽车製造基础并建立高效的供应链以提高盈利。

- 中国汽车业是润滑油的主要消费产业,反映出汽车持有强劲成长和技术进步。根据中国工业协会的数据,2023年中国汽车产销量将分别突破3,000万辆,与前一年同期比较实现两位数成长。

- 根据OICA的数据,2023年中国将以约230万辆的轻型商用车产量领先全球,其次是泰国,产量为126万辆。

- 根据印度汽车製造商工业(SIAM)的数据,2024年1月至3月,印度的乘用车、商用车、三轮车、两轮车和四轮车产量为739万辆。其中,乘用车销售114万辆,商用车销售26.8万辆。

- 韩国拥有成熟的汽车工业,拥有现代、雷诺、三星、起亚等知名品牌。根据汽车工业协会和韩国汽车研究所的预测,到 2024 年,国内汽车产量预计将增加 1.0%,达到 436 万辆。预计这种成长将推动市场需求。

- OICA数据显示,预计2023年国内汽车销量将达174万辆,较2022年成长3%以上。其中,乘用车销量140万辆,较去年成长4.8%;商用车销量26万辆,与前一年同期比较去年同期微降1.1%。

- 此外,OICA表示,2023年日本汽车销量将达470万辆,较2022年成长13%。其中,乘用车成长15%以上,达390万辆,商用车成长4%,达到78万辆。

- 鑑于这些趋势,亚太地区对煞车油的需求预计会增加。

煞车液产业概况

全球煞车油市场部分分散。主要参与者(不分先后顺序)包括 TotalEnergies SE、Robert Bosch LLC、CASTROL LIMITED、埃克森美孚公司和BASF SE。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 电动和混合动力汽车日益普及

- 汽车保有量快速成长带动煞车油需求

- 其他的

- 限制因素

- 煞车液使用的严格安全标准

- 其他的

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按流体类型

- 石油基

- 非油性

- 依产品类型

- DOT 3

- DOT 4

- DOT 5

- DOT 5.1

- 按应用

- 轻型商用车

- 搭乘用车

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率分析(%)**/排名分析

- 主要企业策略

- 公司简介

- BASF SE

- CASTROL LIMITED

- Chevron Corporation

- China Petrochemical Corporation(SINOPEC)

- Dow

- Exxon Mobil Corporation

- FUCHS

- Hi-Tec Oils Pty Ltd

- Morris Lubricants

- Motul

- Repsol

- Robert Bosch LLC

- TotalEnergies SE

- Valvoline

第七章 市场机会与未来趋势

- 汽车系统的技术进步

- 其他机会

The Brake Fluids Market size is estimated at 1.24 billion liters in 2025, and is expected to reach 1.51 billion liters by 2030, at a CAGR of 4.05% during the forecast period (2025-2030).

The brake fluids market faced significant challenges due to the COVID-19 pandemic. Global lockdowns and stringent government regulations led to widespread shutdowns of production hubs. However, the market rebounded in 2021 and is projected to grow substantially in the years ahead.

Key Highlights

- Over the short term, increasing adoption of electric and hybrid vehicles and surging vehicle population are the major factors driving the demand for the market studied.

- However, stringent safety standards associated with using brake fluids are expected to hinder the market's growth.

- Nevertheless, technological advancements in the automobile systems are expected to create new opportunities for the market studied.

- Asia-Pacific is expected to dominate the market, with most of demand coming from China and India.

Brake Fluids Market Trends

Light Commercial Vehicles to Dominate the Market

- In Light Commercial Vehicles (LCVs) like vans, trucks, and buses, brake fluid ensures safe and reliable stopping power. These vehicles, often handling heavy payloads and facing diverse driving conditions, depend on a robust braking system. The significance of brake fluid in this system is paramount.

- Rising demand for brake fluids includes a growing appetite for lightweight, high-performance cars in emerging markets, the establishment of new automotive hubs, and an uptick in disposable income.

- In 2023, global new vehicle sales saw a robust growth of 11.9% over 2022, totaling over 92.7 million units, as reported by the Organisation Internationale des Constructeurs d'Automobiles (OICA). Specifically, new commercial vehicle registrations worldwide rose to 27.5 million units in 2023, marking a notable 13.3% increase from the 24.2 million units recorded in 2022.

- Additionally, light commercial vehicle production climbed to 21.44 million units in 2023, marking a 9% rise from the previous year, according to OICA data, further fueling the market's growth.

- The countries in the Asia-Oceania region are strategically positioning themselves as the emerging automotive hub in the global market. The Asia-Oceania region registered the largest number of vehicles compared to other regions. Registration in this region is dominated mainly by China, Japan, South Korea, and India. In 2023, the region witnessed a 10.9% increase in new commercial vehicle sales compared to 2022, with 7.96 million units registered in 2023, compared to 7.17 million units in 2022.

- However, in India, commercial vehicle (CV) sales are projected to dip in the financial year 2024-25 (FY25) after a modest 2-5% growth in FY24. The data from ICRA (Investment Information and Credit Rating Agency of India Limited) forecasts a 4-7% decline in FY25.

- North America's motor vehicle production in 2023 hit 19.14 million units, a 7.8% increase from 2022's 17.75 million units, according to OICA. Light commercial vehicles constituted a significant portion, rising from 12.24 million units in 2022 to 13.30 million units in 2023.

- Data from the Federal Motor Transport Authority indicates that Germany's motor vehicle count reached 53.50 million in 2023, up from 53.05 million in 2022. Furthermore, the Kraftfahrt-Bundesamt highlighted that car registrations in Germany saw a slight uptick, with 48.76 million in 2023 compared to 48.54 million the previous year.

- According to OICA, Germany registered over 359 thousand commercial vehicles in 2023, up from 312 thousand units the previous year.

- OICA data reveals that Brazil's light commercial vehicle production hit 422 thousand units in 2023, marking a 20% increase from the prior year. South Africa also saw a boost, with production reaching 263 thousand units in 2023, a 22% rise from the previous year, bolstering the market's growth.

- Given these dynamics, the demand for brake fluids is poised for growth in the coming years.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region is expected to account for the largest brake fluid market due to the presence of leading automobile producers such as China, India, Japan, and South Korea. These countries are working hard to strengthen the manufacturing base for vehicles and develop efficient supply chains for greater profitability.

- China's automotive industry stands out as the leading consumer of lubricants, reflecting its robust vehicle fleet growth and technological advancements. In 2023, both automobile sales and production in China reached a milestone, hitting 30 million units each, marking a double-digit increase from the previous year, as per the data from the China Association of Automobile Manufacturers (CAAM).

- As per the data from OICA, China led in the production of light commercial vehicles in 2023, churning out approximately 2.30 million vehicles, with Thailand trailing at 1.26 million.

- In India, data from the Society of Indian Automobile Manufacturers (SIAM) indicates that from January to March 2024, the production of passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycle reached 7.39 million units. Specifically, sales for passenger and commercial vehicles were 1.14 million units and 268 thousand units, respectively.

- South Korea boasts a mature automotive industry with notable brands like Hyundai, Renault, Samsung, and Kia. Projections from the Automobile Manufacturers Association and The Korea Automobile Research Institute anticipate a 1.0% rise in domestic automobile production for 2024, reaching 4.36 million units. This growth is expected to drive demand in the studied market.

- OICA data shows that in 2023, vehicle sales in the country reached 1.74 million units, up over 3% from 2022. Passenger vehicle sales climbed 4.8% to 1.4 million units, but commercial vehicles saw a slight dip, selling 0.26 million units, down 1.1% from the previous year.

- Further, OICA reports that Japan's vehicle sales in 2023 touched 4.7 million units, marking a 13% uptick from 2022. Breaking it down, passenger vehicle sales rose over 15% to 3.9 million units, while commercial vehicles saw a modest 4% increase, totaling 0.78 million units.

- Given these dynamics, the demand for brake fluids in the Asia-Pacific is set to rise.

Brake Fluids Industry Overview

The global brake fluids market is partially fragmented in nature. The major players (not in any particular order) include TotalEnergies SE, Robert Bosch LLC, CASTROL LIMITED, Exxon Mobil Corporation, and BASF SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Adoption of Electric and Hybrid Vehicles

- 4.1.2 Surging Vehicle Population to Drive the Demand for Brake Fluids

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Safety Standard Associated With the Use of Braking Fluids

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Fluid Type

- 5.1.1 Petroleum

- 5.1.2 Non-petroleum

- 5.2 By Product Type

- 5.2.1 DOT 3

- 5.2.2 DOT 4

- 5.2.3 DOT 5

- 5.2.4 DOT 5.1

- 5.3 By Application

- 5.3.1 Light Commercial Vehicles

- 5.3.2 Passenger Cars

- 5.3.3 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 CASTROL LIMITED

- 6.4.3 Chevron Corporation

- 6.4.4 China Petrochemical Corporation (SINOPEC)

- 6.4.5 Dow

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 FUCHS

- 6.4.8 Hi-Tec Oils Pty Ltd

- 6.4.9 Morris Lubricants

- 6.4.10 Motul

- 6.4.11 Repsol

- 6.4.12 Robert Bosch LLC

- 6.4.13 TotalEnergies SE

- 6.4.14 Valvoline

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in the Automotive Systems

- 7.2 Other Opportunities