|

市场调查报告书

商品编码

1689911

脂肪酸酯:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Fatty Acid Ester - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

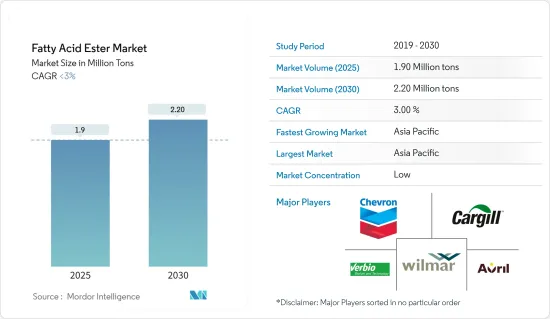

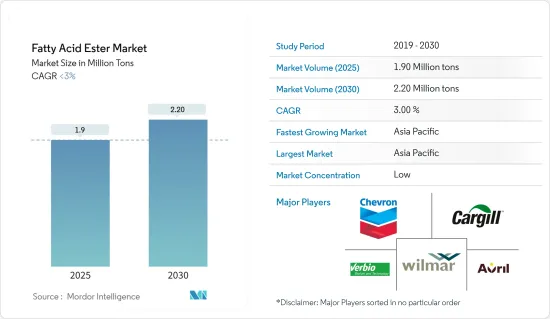

脂肪酸酯市场规模预计在 2025 年为 190 万吨,预计在 2030 年达到 220 万吨,预测期内(2025-2030 年)的复合年增长率低于 3%。

主要亮点

- 推动脂肪酸酯市场发展的主要因素是对生物柴油的偏好日益增长以及对个人保健产品的需求不断增加。

- 然而,与脂肪酸酯相关的性能限制可能会在预测期内阻碍市场成长。

- 脂肪酸酯的新应用和回收可能为未来几年的市场研究带来机会。

- 预计亚太地区将在预测期内实现最高的复合年增长率,成为成长最大的市场。

脂肪酸酯市场趋势

生质燃料应用对脂肪酸酯的需求不断增加

- 生质柴油比石油柴油产生更多的有害污染物和温室气体。生物柴油由多种可再生资源生产,包括脂肪酸酯。常用的可再生资源包括脂肪酸甲酯和乙酯。

- 这些脂肪酸酯可以纯净形式使用,也可以与石油柴油混合使用。燃料混合物包括 B2(2% 生质柴油、98% 石油柴油)、B5(5% 生质柴油、95% 石油柴油),以及更高浓度的 B20 和 B100。特别是,大型卡车运输公司经常使用最纯净的生物柴油 B100。

- 据美国能源资讯署称,到2023年美国生物柴油产量将达到约17亿加仑。

- 大约在同一时间,巴西成为南美洲领先的生质燃料生产国。根据能源研究所的《世界能源统计评论》,预计2023年石油产量将达到每天45.5万桶,成长18.5%。

- 为了满足日益增长的生物柴油需求,各企业正在提高生产能力。例如,巴西着名的生物柴油生产商 Binatural 于 2023 年 12 月宣布计划将年产量提高 20%,到 2026年终达到每年 6.5 亿公升。

- 这些发展表明生质燃料生产对各种脂肪酸酯的需求强劲。

预计亚太地区将主导市场

- 由于对生质燃料、合成润滑油和其他应用的需求庞大,亚太地区是脂肪酸酯 (FAE) 最大的市场。

- 根据2024年世界能源统计评论,亚太地区已成为生物柴油的主要生产国。到 2023 年,该地区的生物柴油产量将占全球的 33% 以上,日产量约 32 万桶,高于 2022 年的 29 万桶。

- 脂肪酸酯也用于生产合成润滑油,如润滑脂和液压油。

- 最近,各公司正在投资建立生产工厂,以满足印度对各种润滑油日益增长的需求。例如,埃克森美孚在2023年3月宣布将投资1.1亿美元在印度孟买建立润滑油生产工厂。该厂预计将于 2025年终运作,每年成品润滑油的生产能力为 159,000 千吨。

- 2024 年 5 月,另一家全球润滑油製造商克鲁勃润滑剂公司宣布将投资 1,560 万欧元(1,720 万美元)扩建其位于印度迈索尔的润滑油製造厂。

- 2024年3月,壳牌印尼宣布将在印度建立第一家润滑脂製造厂。该工厂的润滑脂年生产能力为 12 千吨,将生产用于轴承、齿轮和其他应用的壳牌佳度 (Gadus) 品牌润滑脂产品。

- 预计此类投资将对亚太地区的脂肪酸酯消费产生正面影响。

脂肪酸酯产业概况

脂肪酸酯市场本质上是分散的,只有少数几家大公司占据市场主导地位。一些主要企业(不分先后顺序)包括 Wilmar International Ltd、Avril、Chevron Corporation、Verbio Vereinigte Bioenergie AG 和 Cargill Corporation。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 生质柴油偏好

- 个人保健产品需求不断成长

- 市场限制

- 脂肪酸酯的性能限制

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 按类型

- 脂肪酸甲酯 (FAME)

- 多元醇酯

- 山梨糖醇酯

- 蔗糖酯

- 其他类型(乙酯、丙酯、蔗糖酯等)

- 按应用

- 合成润滑油

- 药品

- 个人保健产品

- 食物

- 生质燃料

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 合併、收购、合资、合作和协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Avril

- Cargill Incorporated

- Chevron Corporation

- Cremer Oleo Gmbh & Co. KG

- Croda International PLC

- DuPont

- Granol

- Inolex Incorporated

- IOI Corporation Berhad

- KLK Oleo

- P&G Chemicals

- Sasol

- Stepan Company

- Verbio Vereinigte Bioenergie AG

- Wilmar International Ltd

第七章 市场机会与未来趋势

- 脂肪酸酯的新用途及回收利用

简介目录

Product Code: 69276

The Fatty Acid Ester Market size is estimated at 1.90 million tons in 2025, and is expected to reach 2.20 million tons by 2030, at a CAGR of less than 3% during the forecast period (2025-2030).

Key Highlights

- The major factors driving the fatty acid ester market are a growing preference for biodiesels and a rising demand for personal care products.

- On the other hand, performance limitations associated with fatty acid esters are likely to hamper the market's growth during the forecast period.

- Emerging applications and recycling of fatty acid esters are likely to act as opportunities for the market studied in the coming years.

- Asia-Pacific is expected to be the largest and fastest-growing market, registering the highest CAGR during the forecast period.

Fatty Acid Ester Market Trends

Increasing Demand for Fatty Acid Ester from Biofuel Applications

- Biodiesel produces a higher level of toxic pollutants and greenhouse gases than petroleum diesel. It is made from a wide range of renewable sources, such as fatty acid esters. Some of the commonly used renewable sources are fatty acid methyl and ethyl esters.

- These fatty acid esters can be utilized in their pure form or blended with petroleum diesel. Blends include B2 (2% biodiesel, 98% petroleum diesel), B5 (5% biodiesel, 95% petroleum diesel), and larger concentrations like B20 and B100. Notably, large trucking companies often use biodiesel in its purest form, B100.

- According to the United States Energy Information Administration, biodiesel production in the United States reached approximately 1.7 billion gallons in 2023.

- At the same time, Brazil emerged as South America's leading biofuel producer. In 2023, daily oil production hit 455 thousand barrels, marking an 18.5% rise, according to the Energy Institute's Statistical Review of World Energy.

- In response to rising biodiesel demand, companies are ramping up production capacities. For example, Binatural, a prominent Brazilian biodiesel producer, announced plans in December 2023 to boost its annual output by 20%, targeting 650 million liters per annum by the end of 2026.

- These developments indicate a robust demand for various kinds of fatty acid esters in biofuel production.

Asia-Pacific Projected to Dominate the Market

- Asia-Pacific is the biggest market for fatty acid esters (FAEs) owing to the huge demand for biofuels, synthetic lubricants, and other applications.

- As per the 2024 Statistical Review of World Energy, Asia-Pacific emerged as the dominant biodiesel producer. In 2023, the region accounted for over 33% of global biodiesel output, churning out approximately 320,000 barrels daily, up from 290,000 barrels in 2022.

- Fatty acid esters are also used in the production of synthetic lubricants such as greases, hydraulic fluids, and others.

- In recent times, various companies have invested in setting up production plants to meet the growing demand for various lubricants in India. For instance, in March 2023, Exxon Mobil announced the investment of USD 110 million in setting up a lubricant production plant in Mumbai, India. The plant is expected to be operational by the end of 2025 and will have a production capacity of 159,000 kilotons of finished lubricants every year.

- In May 2024, Kluber Lubrication, another global manufacturer of lubricants, announced an investment of EUR 15.6 million (USD 17.20 million) in expanding its lubricant manufacturing plant in Mysore, India.

- In March 2024, Shell Indonesia announced that it would set up its first grease manufacturing plant in India. The plant is expected to have a production capacity of 12 kilotons of grease every year and will produce grease products under the trademark of Shell Gadus, which are used in applications such as bearings and gears.

- Such investments are expected to have a positive impact on the consumption of fatty acid esters in Asia-Pacific.

Fatty Acid Ester Industry Overview

The fatty acid ester market is fragmented in nature, with only a few major players dominating it. Some of the major companies (not in a particular order) are Wilmar International Ltd, Avril, Chevron Corporation, Verbio Vereinigte Bioenergie AG, and Cargill Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Preference toward Biodiesel

- 4.1.2 Rising Demand for Personal Care Products

- 4.2 Market Restraints

- 4.2.1 Performance Limitations Associated with Fatty Acid Ester

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Type

- 5.1.1 Fatty Acid Methyl Esters (FAME)

- 5.1.2 Polyol Esters

- 5.1.3 Sorbitan Esters

- 5.1.4 Sucrose Esters

- 5.1.5 Other Types (Ethyl Esters, Propyl Esters, Sucrose Esters, etc.)

- 5.2 By Application

- 5.2.1 Synthetic Lubricants

- 5.2.2 Pharmaceuticals

- 5.2.3 Personal Care Products

- 5.2.4 Food

- 5.2.5 Biofuel Applications

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Avril

- 6.4.2 Cargill Incorporated

- 6.4.3 Chevron Corporation

- 6.4.4 Cremer Oleo Gmbh & Co. KG

- 6.4.5 Croda International PLC

- 6.4.6 DuPont

- 6.4.7 Granol

- 6.4.8 Inolex Incorporated

- 6.4.9 IOI Corporation Berhad

- 6.4.10 KLK Oleo

- 6.4.11 P&G Chemicals

- 6.4.12 Sasol

- 6.4.13 Stepan Company

- 6.4.14 Verbio Vereinigte Bioenergie AG

- 6.4.15 Wilmar International Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications and Recycling of Fatty Acid Ester

02-2729-4219

+886-2-2729-4219