|

市场调查报告书

商品编码

1689914

清洗化合物:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Purging Compound - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

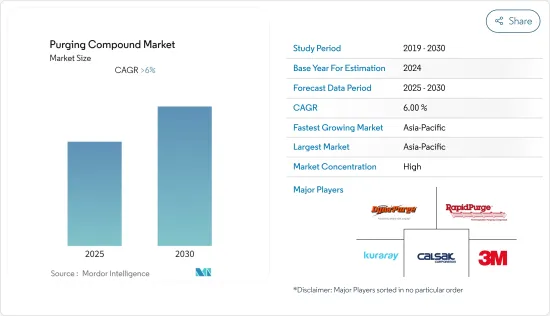

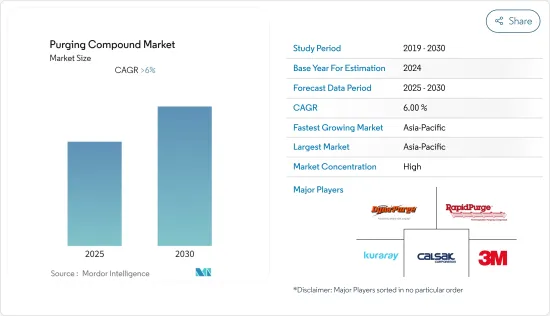

预计预测期内清洗化合物市场复合年增长率将超过 6%。

COVID-19 疫情严重影响了汽车和航太产业,减少了对清洁剂的需求。疫情扰乱了供应链,减缓了汽车和飞机的需求,关闭了许多生产设施,并减缓了化合物的清除速度。然而,随着 2021 年全球经济復苏和製造业回暖,企业寻求恢復生产能力,对化学品清除的需求也随之增加。

主要亮点

- 未来,作为工业机械清洗化学品,对清洁剂的需求可能会增加。

- 预计清洗剂价格的波动将阻碍市场的成长。

- 预测期内,热塑性塑胶加工中清洗化合物的使用预计会增加。

- 预计亚太地区将主导市场,其中中国和印度等国家占最大的消费量。

清洁剂市场趋势

全球市场对热塑性塑胶加工产业清洁剂的需求不断增加

- 市售的清洁剂是专门为清洗热塑性成型机和挤出机而製造的产品。它通常含有基础树脂和添加的其他物质,用于清洗挤出机的螺桿、机筒和晶粒。

- 在竞争日益激烈的环境中,清洁剂的使用在热塑性塑胶加工中已变得至关重要。高效生产和节省成本是塑胶加工商的关键标准。

- 在电动车 (EV)组装中,通常使用注塑射出成型等热塑性加工技术来製造各种零件,包括电池外壳、内饰和外部零件。

- 热塑性塑胶重量轻、强度高、使用寿命长,是组装电动车的理想材料。热塑性塑胶易于加工,可模製成复杂的设计,从而减少生产时间和成本。根据国际能源总署(IEA)的数据,2021年纯电动车销量将达450万辆,比2020年成长135%。

- 预计预测期内热塑性塑胶市场将显着成长。需求正在增加汽车产业下游加工和应用的产能。

- 由于上述因素,预计预测期内热塑性塑胶产业的清洗化合物的应用将占据主导地位。

亚太地区占市场主导地位

- 由于中国和印度等新兴市场的需求不断增加,预计亚太地区将主导全球市场。该地区是聚合物和热塑性塑胶的製造地。该地区是聚合物和热塑性塑胶的製造地,推动了对清洗化合物的需求不断增长。

- 最大的清洁剂生产地是亚太地区。清洗化合物生产的主要企业包括 Calsak Corporation、RapidPurge、3M、Kuraray 和 Dyna-Purge。

- 亚太地区的快速工业化正在促进食品饮料、建筑、汽车、石化和化学等行业的扩张。这些行业正在逐步采用复合材料来减少停机时间并提高製造效率。

- 中国、日本和印度是该领域最大的参与者,因为他们的塑胶加工行业使用并需要大量的清洁剂。

- 许多汽车塑胶零件都是在清洁剂的帮助下製造的。根据国际汽车工业联合会统计,2021年中国汽车产量与前一年同期比较增3%,超过2,600万辆,成为全球最大汽车生产国。

- 根据印度品牌股权基金会的数据,2021 年印度塑胶和油毡产品出口额达到 98 亿美元。这比去年的出口额成长了30%。

- 由于上述原因,预计在研究期间亚太地区的清洗化合物市场将会成长。

清洁剂产业概况

全球清洁剂市场已部分整合,只有少数几家大公司占据主导地位。主要企业包括 Calsak Corporation、RapidPurge、3M Company、Kuraray 和 Dyna-Purge。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 全球市场对热塑性塑胶产业清洁剂的需求不断增加

- 化学工业对有效去除腐蚀抑制解决方案的需求日益增加

- 其他驱动因素

- 限制因素

- 消除复合材料价格波动

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争程度

- 原料分析

第五章 市场区隔

- 类型

- 机械清洗

- 化学清洗

- 流体清洗

- 过程

- 射出成型

- 挤压

- 吹塑成型

- 其他流程

- 应用

- 车

- 建筑学

- 工业机械

- 聚合物

- 热塑性树脂加工

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Dow Chemical Company

- Kuraray Co. Ltd

- 3M Company

- BASF SE

- RapidPurge

- Daicel Corporation

- VELOX GmbH(IMCD Group)

- Calsak Corporation

- ChemTrend LP

- Dyna-Purge

- Formosa Plastics Corporation

- Ultra System SA

- Purge Right

- Clariant AG

第七章 市场机会与未来趋势

- 工业机械清洗剂需求不断增加

- 其他机会

The Purging Compound Market is expected to register a CAGR of greater than 6% during the forecast period.

The COVID-19 pandemic reduced demand for purging compounds in the automobile and aerospace industries, which were severely impacted. The pandemic disrupted supply networks, lowered demand for automobiles and aircraft, and shut down many production facilities, slowing compound purging. However, in 2021, the global economy rebounded and manufacturing began, increasing the need for purging chemicals as businesses attempted to rebuild their production capacity.

Key Highlights

- In the future, the market may be able to take advantage of the growing demand for purging compounds as cleaning chemicals in industrial machines.

- Volatile prices of purging compounds are expected to hinder the growth of the market studied.

- During the forecast period, there is likely to be a rise in the use of purging compounds in thermoplastic processing.

- The Asia-Pacific region is expected to dominate the market, with the largest consumption coming from countries such as China and India.

Purging Compound Market Trends

Increasing Demand of Purging Compound from Thermoplastic Processing Industry in Global Market

- A commercial purging compound is a product specifically manufactured to clean thermoplastic molding machines and extruders. It usually has a base resin and other substances added to it that are meant to clean the screw, barrel, and extruder die.

- The utilization of purging compounds has become a necessary piece of thermoplastics processing in the growing competitive environment. Efficient production and a decrease in cost are significant standards for plastics processors.

- In the assembly of electric vehicles (EVs), thermoplastic processing techniques like injection molding are often used to make a wide range of parts and components, such as battery housing, interior trim, and exterior body pieces.

- Thermoplastics are ideal for use in the assembly of EVs because of their low weight, high strength, and long service life. They're easy to process and can be shaped into intricate designs, both of which cut down on production time and cost. Sales of battery electric vehicles reached 4.5 million units in 2021, up 135% from 2020, according to the International Energy Agency.

- The thermoplastics market is expected to register substantial growth during the forecast period. The demand is increasing capacity in downstream processing and applications in the automotive industry.

- The application of purging compounds from the thermoplastic industry is expected to dominate during the forecast period due to the aforementioned factors.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the global market, owing to the increasing demand from developing nations, including China and India. The region is a manufacturing hub for polymers and thermoplastics. This factor is a propelling factor for the increasing demand for purging compounds in the region.

- The largest producers of purging compounds are based in the Asia-Pacific region. Some of the leading companies in the production of purging compounds are Calsak Corporation, RapidPurge, 3M, Kuraray Co. Ltd., and Dyna-Purge, among others.

- The rapid industrialization in the Asia-Pacific region is contributing to the expansion of several industries, including the food and beverage, construction, automotive, petrochemical, and chemical industries. These industries are gradually implementing composites to reduce downtime and increase manufacturing efficiency.

- China, Japan, and India are the biggest players in this area because the plastics processing industry uses and needs a lot of purging compounds.

- Many automobile plastic components are manufactured with the help of purging chemicals. According to the International Organization of Motor Vehicle Manufacturers, China produced over 26 million automobiles in 2021, an increase of 3% from the previous year, making it the world's largest automotive producer.

- According to the India Brand Equity Foundation, India's exports of plastic and linoleum products reached USD 9.8 billion in 2021. This is a 30% increase over the previous year's exports.

- Due to the above reasons, the market for purging compounds is expected to grow in the Asia-Pacific region during the study period.

Purging Compound Industry Overview

The global purging compound market is partially consolidated, with only a few major players dominating the market. Some of the major companies are Calsak Corporation, RapidPurge, 3M Company, Kuraray Co. Ltd., and Dyna-Purge, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand of Purging Compound from Thermoplastic Industry in Global Market

- 4.1.2 Growing Demand as Effective Removal Solutions to Control Corrosion in Chemical Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Volatile Prices of Purging Compounds

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

- 4.5 Raw Material Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Mechanical Purge

- 5.1.2 Chemical Purge

- 5.1.3 Liquid Purge

- 5.2 Process

- 5.2.1 Injection Molding

- 5.2.2 Extrusion

- 5.2.3 Blow Molding

- 5.2.4 Other Processes

- 5.3 Application

- 5.3.1 Automotive

- 5.3.2 Construction

- 5.3.3 Industrial machinery

- 5.3.4 Polymers

- 5.3.5 Thermoplastic Processing

- 5.3.6 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Dow Chemical Company

- 6.4.2 Kuraray Co. Ltd

- 6.4.3 3M Company

- 6.4.4 BASF SE

- 6.4.5 RapidPurge

- 6.4.6 Daicel Corporation

- 6.4.7 VELOX GmbH (IMCD Group)

- 6.4.8 Calsak Corporation

- 6.4.9 ChemTrend LP

- 6.4.10 Dyna-Purge

- 6.4.11 Formosa Plastics Corporation

- 6.4.12 Ultra System SA

- 6.4.13 Purge Right

- 6.4.14 Clariant AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand of Cleaning Chemicals in Industrial Machines

- 7.2 Other Opportunities