|

市场调查报告书

商品编码

1689921

交联剂:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Crosslinking Agents - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

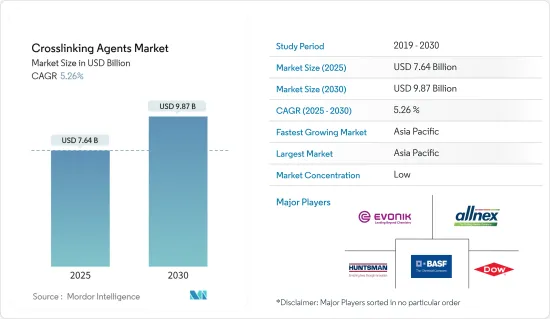

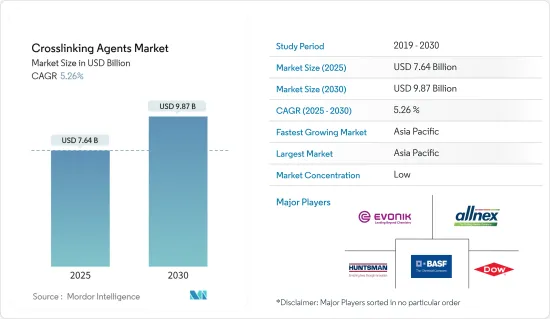

交联剂市场规模预计在 2025 年为 76.4 亿美元,预计到 2030 年将达到 98.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.26%。

儘管 COVID-19 疫情对市场产生了负面影响,但由于全球建筑业和汽车业的强劲增长,预计预测期内市场将实现强劲增长。

主要亮点

- 推动市场发展的主导因素是对各种被覆剂的需求不断增加以及对高性能交联剂的日益关注。

- 另一方面,自交联剂的存在可能会阻碍市场的成长。

- 在预测期内,对创新涂料的需求不断增加意味着全球交联剂市场存在巨大机会。

- 亚太地区占据市场主导地位,预计在预测期内将以最高的复合年增长率成长。

交联剂市场趋势

装饰涂料的需求不断增加

- 装饰被覆剂适用于住宅、商业、机构和工业建筑的内部和外部表面。全球建筑业的不断增长推动了对装饰被覆剂中各种交联剂的需求。

- 亚太地区的建筑业是世界上最大的建筑业。由于人口增长、中产阶级的壮大和都市化,中国经济正在健康成长。

- 中国是购物中心建设领先的国家之一。中国是购物中心建设领域的领先国家之一。中国目前约有 4,000 家购物中心,预计到 2025 年还将有 7,000 家购物中心开幕。

- 此外,据国家发展和改革委员会称,中国政府在2019年核准了26个基础设施计划,预计投资约1,420亿美元,预计将于2023年完工,目前正在进行中。不断增长的住宅需求可能会推动该国公共和私营部门的住宅。

- 美国是世界上最大的建筑业国家之一。根据美国人口普查局的数据,2021 年美国新建设年金额将达到 16,264.44 亿美元,而 2020 年为 1,4995.7 亿美元。

- 在加拿大,经济适用住房倡议(AHI)、新建筑加拿大计划(NBCP)和加拿大製造等各种政府计划正在支持该行业的扩张。

- 根据美国建筑师美国)建筑业共识预测小组的数据,住宅建筑支出预计将在 2022 年成长 5.4%,到 2023 年将增加至 6.1%。到 2023 年,预计所有主要商业、工业和机构类别都将实现至少相当健康的成长。

- 预计所有这些因素都将在预测期内推动装饰涂料的需求。

亚太地区占市场主导地位

- 由于中国汽车产业高度发展以及多年来对建筑业和各个工业领域的持续投资,亚太地区有望主导全球市场。

- 中国政府预测,2025年电动车普及率将达20%。 2022年上半年,中国当地将向客户交付超过240万辆电动车,占中国汽车总销量的26%。随着国内汽车产量的增加,汽车被覆剂的需求预计也会增加,这也预计对交联剂市场产生影响。

- 中国的汽车生产对全球汽车生产做出了重大贡献。根据OICA统计,中国是全球最大的汽车生产基地,预计2021年汽车总产量将达2,608万辆,较去年的2,523万辆成长3%。此外,根据中国工业协会(CAAM)的数据,2022年1-7月汽车产量为1,457万辆,与前一年同期比较去年同期成长31.5%。

- 在「印度製造」改革政策下,印度政府为跨国公司在该国设立基地推出了优惠规定。此外,製造业外商直接投资比例的提高可能会吸引更多的外国公司的投资。预计这将支持未来几年的工业生产。

- 日本经济产业省报告显示,2021年日本工业生产成长3%以上。日本拥有大型电子设备和其他零件製造基地,其中大部分出口到北美、欧洲和亚太经济体。电子情报技术产业协会(JEITA)发布的资料显示,预计到2022年终,日本电子和IT企业的全球产量将年增2%与前一年同期比较正成长。

- 预计未来几年油漆和涂料行业在各个应用领域的持续成长将推动交联剂市场的发展。

交联剂产业概况

交联剂市场在收益方面较为分散,有许多参与者在市场上竞争。市场的主要企业包括(不分先后顺序)赢创工业集团、BASF公司、陶氏化学、亨斯迈国际有限责任公司和Allnex GMBH。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 对多种涂料的需求不断增加

- 人们对高性能交联剂的兴趣日益浓厚

- 限制因素

- 存在自交联剂

- 价值链分析

- 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 类型

- 酰胺

- 胺

- 胺基

- 碳二亚胺

- 异氰酸酯

- 其他类型

- 应用

- 汽车涂料

- 装饰涂料

- 工业涂料

- 包装涂料

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- BASF SE

- Aditya Birla Chemicals

- Allnex GMBH

- Covestro AG

- Evonik Industries AG

- Hexion

- Huntsman International LLC

- Dow

- Wanhua Chemical Group Co. Ltd

- Nisshinbo Chemical Inc.

- NIPPON SHOKUBAI CO. LTD

- Mitsubishi Chemical Corporation

- KUMHO P&B CHEMICALS INC.

第七章 市场机会与未来趋势

- 对创新被覆剂的需求

The Crosslinking Agents Market size is estimated at USD 7.64 billion in 2025, and is expected to reach USD 9.87 billion by 2030, at a CAGR of 5.26% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market but is projected to grow steadily in the forecast period owing to strong global growth in the construction and automotive sectors.

Key Highlights

- The major factors driving the market are rising demand for various coatings and an increased emphasis on high-performance crosslinking agents.

- On the other hand, the presence of self-crosslinking agents might hamper the market growth.

- During the forecast period, the increasing demand for innovative coatings is a major opportunity in the global crosslinking agent market.

- Asia-Pacific has dominated the market and is expected to grow with the highest CAGR during the forecast period.

Crosslinking Agents Market Trends

Increasing Demand for Decorative Coatings

- Decorative coatings are applied to the interior and exterior surfaces of residential, commercial, institutional, and industrial buildings. The increase in the construction sector worldwide is, in turn, boosting the demand for various crosslinking agents in decorative coatings.

- The construction sector in the Asia-Pacific region is the largest in the world. It is increasing at a healthy rate, owing to the rising population, increase in middle-class income, and urbanization.

- China is one of the leading countries concerning the construction of shopping centers. China is one of the leading countries in shopping-center construction. China has almost 4,000 shopping centers, while 7,000 more are estimated to be open by 2025.

- Moreover, according to National Development and Reform Commission, the Chinese government approved 26 infrastructure projects at an estimated investment of about USD 142 billion in 2019, which are estimated to be completed by 2023 and are ongoing. The growing demand for housing is likely to drive residential construction in the country, both in the public and private sectors.

- The United States has one of the world's largest construction industries. According to the United States Census Bureau, the annual value for new construction put in place in the United States accounted for USD 1,626,444 million in 2021, compared to USD 1,499,570 million in 2020.

- In Canada, various government projects, including the Affordable Housing Initiative (AHI), New Building Canada Plan (NBCP), and Made in Canada, have been supporting the expansion of the sector.

- According to the AIA (American Institute of Architects) Construction Consensus Forecast Panel, nonresidential building construction spending is expected to expand by 5.4% in 2022 and strengthen to a 6.1% expansion in 2023. By 2023, all the major commercial, industrial, and institutional categories are projected to witness at least reasonably healthy gains.

- All such factors are anticipated to drive the demand for decorative coating during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate the global market, owing to the highly developed automotive sector in China, coupled with the continuous investments done in the region to advance the architectural and various industrial sectors through the years.

- The government of China estimates a 20% penetration rate of electric vehicles by 2025. China has the largest and fastest-growing EV market in the world, In H1 2022, over 2.4 million EVs were delivered to customers in mainland China equating to 26% of all car sales in China. With the increasing production of vehicles in the country, the demand for automotive coating is likely to ascend, which is anticipated to influence the market for crosslinking agents.

- Automobile manufacturing in China is a significant contributor to global automobile production. According to OICA, China has the largest automotive production base in the world, with a total vehicle production of 26.08 million units in 2021, registering an increase of 3% compared to 25.23 million units produced last year. Further, according to the China Association of Automobile Manufacturers (CAAM), in the first 7 months of 2022, the country has produced 14.57 million units of cars, registering a growth rate of 31.5% Year on Year.

- In India, under the Make in India reform, the government of the country has offered favorable regulations for multinationals to set up their bases in India. Moreover, an increase in FDI share in the manufacturing industry is further likely to attract investments by foreign players. Thereby, it is expected to support industrial production in the upcoming years.

- As per the reports by the Ministry of Economy Trade and Industry (METI), industrial production in Japan increased by over 3% in 2021. The country has a large production base for electronics and other components, the majority of which is exported to the economies in North America, Europe, and Asia-Pacific. According to the data published by the Japan Electronics and Information Technology (JEITA), Global production by Japanese electronics and IT companies is expected to record positive growth of 2% year on year by the end of 2022.

- Continuous growth in the paint and coatings industry for various applications is expected to drive the market for crosslinking agents through the years to come.

Crosslinking Agents Industry Overview

The crosslinking agents market is partially fragmented in nature in terms of revenue with many players competing in the market. Some of the major players in the market include (not in any particular order) Evonik Industries AG, BASF SE, Dow, Huntsman International LLC, and Allnex GMBH, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demad for Numerous Coatings

- 4.1.2 Increasing Focus on High-Performance Crosslinking Agents

- 4.2 Restraints

- 4.2.1 Presence of Self-Crosslinking Agents

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Amide

- 5.1.2 Amine

- 5.1.3 Amino

- 5.1.4 Carbodiimide

- 5.1.5 Isocyanate

- 5.1.6 Other Types

- 5.2 Application

- 5.2.1 Automotive Coatings

- 5.2.2 Decorative Coatings

- 5.2.3 Industrial Coatings

- 5.2.4 Packaging Coatings

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Aditya Birla Chemicals

- 6.4.3 Allnex GMBH

- 6.4.4 Covestro AG

- 6.4.5 Evonik Industries AG

- 6.4.6 Hexion

- 6.4.7 Huntsman International LLC

- 6.4.8 Dow

- 6.4.9 Wanhua Chemical Group Co. Ltd

- 6.4.10 Nisshinbo Chemical Inc.

- 6.4.11 NIPPON SHOKUBAI CO. LTD

- 6.4.12 Mitsubishi Chemical Corporation

- 6.4.13 KUMHO P&B CHEMICALS INC.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Demand for Innovative Coatings