|

市场调查报告书

商品编码

1689923

编码器:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Encoder - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

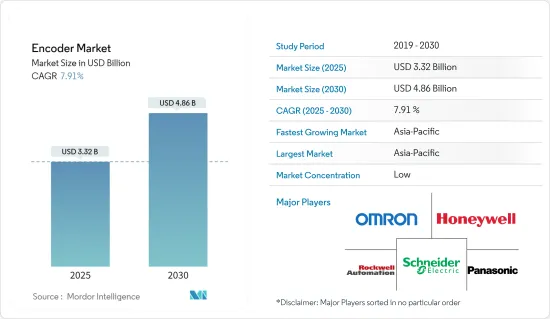

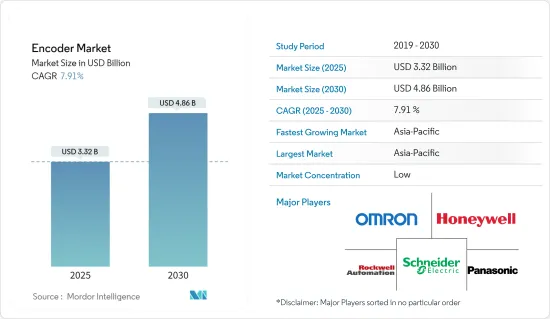

编码器市场规模预计在 2025 年为 33.2 亿美元,预计到 2030 年将达到 48.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.91%。

由于从资料中心到通讯等各种应用对编码器的需求不断增加,市场正在经历快速成长。

主要亮点

- 对高端自动化和工业 4.0 的需求是市场成长的主要驱动力。工业 4.0 是第四次工业革命,在这个新世界中,工厂自动化正在从由传统资讯技术系统控制的製造工厂转向云端基础的基础设施,从而实现巨量资料分析和生产流程虚拟。

- 世界许多国家都在积极回应工业4.0,制定策略性倡议以加强其应用。例如,SAMARTH Udyog Bharat 4.0 是印度政府重工业和公共企业部为提高印度资本财部门的竞争力而推出的工业 4.0倡议。根据联合国贸发会议统计,中国和美国在工业4.0技术的投资和能力方面处于领先地位。中国和美国是最大的数位平台所在地,占总市值的90%。

- 此外,编码器对于运动控制应用至关重要。编码器向控制器和驱动器提供位置、速度和方向回馈,提高驱动系统的准确性和可靠性。随着技术的进步,编码器也在不断进步,融合了通讯和网路领域的最新发展,为工程师提供了解决各种运动控制应用中所面临挑战的工具。

- 编码器的最大限制之一是它们相当复杂并且由精密的组件组成。这意味着它们对机械损伤的抵抗力较差,且耐温性有限。要找到能够承受1200°C以上温度的光学编码器似乎很困难。除此之外,由于获得功能安全认证的难度以及与运动控制编码器功能相关的错误的可能性,功能安全问题成为运动控制设计的关键,因此对功能安全问题的日益关注也是市场成长的一个显着限制因素。这些限制对市场成长构成了挑战。

- 此外,疫情凸显了自动化的重要性,製造业的远端应用可能会增加对自动化的投资,从而刺激对各种类型编码器的需求。电子商务和仓储物流等领域自动化的兴起预计将推动这些应用中对编码器的需求。

编码器市场趋势

预计工业部门将占据市场的主要份额

- 编码器的使用正在线性测量、抗蚀剂标记计时、捲筒纸张力、挡块测量、输送和填充等多种工业应用中迅速扩大。最典型的应用是为马达的运动控制提供回馈。在工业领域,大量电力由马达消耗,其中大部分电动机都装有编码器。

- 机器人的应用范围越来越广,特别是在焊接、物料输送、组装和研磨等任务中。通常,由于人工监控和监督有限,这些机器人需要可靠的编码器来引导其运动。在机器人技术中,编码器对于控制机械臂和移动机器人的位置和运动至关重要。

- 根据IFR的《2023年世界机器人报告》,全球工厂安装了约553,052台工业机器人。在全部安装的工业机器人中,新引进的机器人中有73%安装在亚洲,15%安装在欧洲,10%安装在美洲。中国、日本、美国、韩国和德国是电气电子、汽车、金属和机械等主要产业每年部署工业机器人数量最多的国家。预计这些产业自动化程度的提高将进一步推动市场对编码器的需求。

- 随着工业自动化的快速发展,各种工业应用对编码器的需求日益增加。因此,为了满足这一需求,市场上的供应商正在推出用于工业应用的新型编码器。例如,2023年6月,SICK推出了新的线性编码器产品线,用于高精度侦测油压缸中的活塞位置并监控机器的线性运动。这种新型线性编码器产品线为无数工业应用提供了灵活性。

亚太地区预计将创下最快成长

- 中国、印度和其他东南亚国家正在经历快速工业化和製造业基地的扩张,导致工业应用中使用的编码器的需求激增,以在组装和工厂机器上提供精确的定位和控制,用于提高各种工业设备(如机器人、数控机床、输送机和包装器材)的生产率。

- 亚太地区各国政府正积极推行自动化和工业 4.0倡议。其中包括中国的“中国製造2025”,旨在减少对外国技术进口的依赖并投资于创新;以及印度的“国家製造业战略”,主张透过生产模式的技术转型实现自力更生。预计这些努力将带来更大程度的自动化和工业活动的振兴,从而增加对各种应用的编码器的需求。

- 此外,预计汽车行业的快速扩张将在预测期内推动对编码器的需求。该地区是一些世界主要汽车製造商的所在地。编码器在汽车零件和组装的製造过程中的应用越来越多。该地区生产的电动车数量不断增加,预计将推动对编码器的需求,因为编码器对于先进的马达控制和电池管理系统至关重要。

- 2024年1月,铃木汽车公司宣布计划扩大在印度古吉拉突邦的业务,并将其汽车产能提高近一倍。该工厂计划于2028财年投入运营,年产能预计将扩大至400万辆。汽车製造厂的扩张需要提高自动化程度、精确控制生产线、加强品管系统和最佳化供应链管理,从而推动对编码器的需求。

编码器行业概况

有许多不同的公司参与编码器市场,包括欧姆龙公司、霍尼韦尔、海德汉有限公司、堡盟集团和 Posital Fraba 公司。每家公司都拥有庞大的基本客群,这使得他们能够大规模生产编码器,这是确保感测器市场获得更好的利润和规模经济的关键因素。由于强大的品牌意味着卓越的业绩,老字型大小企业有望占据优势。由于市场渗透和先进产品供应,竞争对手之间的敌意预计将持续下去。

2023 年 11 月,全球感测器和编码器解决方案製造商堡盟推出了 EAM580RS,这是一款绝对式编码器,专为在运动机械和户外环境等恶劣应用中的安全性和性能而设计。此外,这款经过安全认证的编码器还提供经济高效且易于实施的安全自动化。此磁性安全编码器采用不銹钢外壳,可抵御恶劣的户外环境,并可承受振动和衝击等工业因素。

2023 年 8 月,编码器製造商 Dynapar 宣布推出一款新型可程式中空轴编码器,即采用 PulseIQ 技术的 HS35iQ 编码器。它是一种具有彩色 LED 和数位输出的自我诊断回馈设备,为重型机械应用的OEM和最终用户提供了一种存取即时编码器健康状态和排除故障编码器故障的新方法。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 在先进汽车系统中采用率高

- 工业自动化需求不断成长

- 市场挑战

- 极端条件下的机械故障

第六章市场区隔

- 按类型

- 旋转编码器

- 线性编码器

- 依技术

- 光学的

- 磁的

- 光电

- 其他的

- 按最终用户产业

- 车

- 电子的

- 纤维

- 印刷机械

- 产业

- 医疗保健

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Omron Corporation

- Honeywell International

- Schneider Electric

- Rockwell Automation Inc.

- Panasonic Corporation

- Baumer Group

- Renishaw PLC

- Dynapar Corporation(Fortive Corporation)

- FAULHABER Drive Systems

- Pepperl+Fuchs International

- Hengstler GMBH(Fortive Corporation)

- Maxon Motor AG

- Dr. Johannes Heidenhain GmbH

- POSITAL FRABA Inc.(FRABA BV)

- Sensata Technologies

第八章投资分析

第九章:未来市场展望

The Encoder Market size is estimated at USD 3.32 billion in 2025, and is expected to reach USD 4.86 billion by 2030, at a CAGR of 7.91% during the forecast period (2025-2030).

The market is witnessing rapid growth due to the increasing demand for encoders in multiple applications, from data centers to telecommunication.

Key Highlights

- The need for high-end automation and Industry 4.0 are the major factors driving the growth of the market. Industry 4.0 describes the fourth industrial revolution, a new world where factory automation moves beyond manufacturing plants controlled by conventional information technology systems to a cloud-based infrastructure that permits big data analytics and the virtualization of production processes.

- Many countries worldwide have positively responded to Industry 4.0 by developing strategic initiatives to strengthen its implementation. For instance, SAMARTH Udyog Bharat 4.0 is an Industry 4.0 initiative of the Ministry of Heavy Industry & Public Enterprises, Government of India, under its scheme on Enhancement of Competitiveness in the Indian Capital Goods Sector. According to the UNCTAD, China and the United States are leaders in investment and capacity in Industry 4.0 technologies. They are home to the largest digital platforms, accounting for 90% of the market capitalization.

- Furthermore, encoders are central to motion control applications. They can offer feedback on position, speed, and direction to a controller or drive to increase the accuracy and reliability of a drive system. As technology advances, so do encoders, incorporating the latest developments in communications and networking and offering engineers tools to solve challenges they face across a diverse array of motion control applications.

- One of the most significant limitations of encoders is that they can be reasonably complex and comprise some delicate parts. This makes them less tolerant of mechanical abuse and restricts their allowable temperature. One would be hard-pressed to find an optical encoder that will survive beyond 1200C. In addition to this, rising concern about functional safety issues, which is of significant importance in any motion control design, is also a notable limitation for the growth of the market as the acquisition of functional safety certification can be arduous, and there can be some errors associated with the functionality of the motion control encoders. Such limitations pose a challenge to the market's growth.

- Furthermore, the pandemic highlighted the importance of automation, and remote applications in manufacturing resulted in increased investments in automation, potentially boosting demand for various types of encoders. The rise of e-commerce and automation in sectors like warehousing and logistics is anticipated to drive demand for encoders in these applications.

Encoder Market Trends

The Industrial Sector is Expected to Hold a Major Share in the Market

- The use of encoders is rapidly growing in multiple industrial applications, such as linear measurement, registration mark timing, web tensioning, backstop gauging, conveying, and filling. The most standard application is providing feedback on the motion control of electric motors. In the industrial sector, a significant amount of electricity goes to electric power motors, most of which incorporate encoders.

- Robots are experiencing a growing number of application areas, especially for operations like welding, material handling, assembly, and grinding. Since there is typically limited human oversite or monitoring, these robots must have reliable encoders to help guide their movement. In robotics, encoders are essential for controlling robotic arms' and mobile robots' position and movement.

- According to IFR's World Robotics 2023 report, about 553,052 industrial robots were installed in factories across the world. Among the total installed industrial robots, 73% of all newly deployed robots were installed in Asia, 15% in Europe, and 10% in the Americas. China, Japan, the United States, the Republic of Korea, and Germany are among the top countries with a greater number of annual installations of industrial robots in key industries, including electrical/electronics, automotive, and metal and machinery. Such a rise in the adoption of automation in industries is expected to further fuel the demand for encoders in the market.

- As industrial automation rapidly gains momentum, the demand for encoders in various industrial applications is growing. Thus, to cater to this demand, vendors operating in the market are introducing new encoders for industrial applications. For instance, in June 2023, SICK launched a new linear encoder product family for high-precision detection of piston positions in hydraulic cylinders and monitoring linear movements in machines. This new linear encoder product line offers flexibility for countless industrial applications.

Asia-Pacific is Expected to Register the Fastest Growth

- Countries like China, India, and other Southeast Asian countries are experiencing rapid industrialization and expansion of their manufacturing bases, translating to a surge in demand for encoders used in industrial automation for precise positioning and control in robots, CNC machines, and assembly lines and factory machinery that used to improve productivity in various industrial equipment like conveyors and packaging machines.

- Governments across Asia-Pacific are actively promoting automation and Industry 4.0 initiatives, including China's "Made in China 2025" to reduce dependence on foreign technology imports and invest in innovations and India's "National Strategy for Manufacturing" to advocate self-reliance through the technological transformation of the production paradigm. Such initiatives are expected to fuel industrial activities with increased use of automation, creating the need for encoders in various applications.

- Moreover, the rapid expansion of the automotive industry is likely to propel the demand for encoders during the forecast period. The region has the presence of major global automotive manufacturers. Encoders are increasingly used in the manufacturing processes of automotive components and assembly lines. The rise in the production of electric vehicles in the region is expected to drive demand for encoders, as they are essential in advanced motor control and battery management systems.

- In January 2024, Suzuki Motor Corp. announced its plan to expand its operations in Gujarat, India, to nearly double its automotive manufacturing capacity, seeking to roll 4 million units off the assembly lines annually. The plant is planned to start operations in fiscal 2028 and is expected to increase its production capacity to 1 million units annually. Such growth in the automotive manufacturing plant expansion drives demand for encoders by necessitating increased automation, precision control in production lines, enhanced quality control systems, and optimized supply chain management.

Encoder Industry Overview

The encoder market comprises various players, such as Omron Corporation, Honeywell, Heidenhain GmbH, Baumer Group, and Posital Fraba Inc. Companies have the advantage of a large client base, enabling them to produce large volumes of encoders, a key factor in ensuring better profits and economies of scale in the sensor market. As strong brands are synonymous with good performance, long-standing players are expected to have the upper hand. Owing to their market penetration and the ability to offer advanced products, the competitive rivalry is expected to continue to be high.

In November 2023, Baumer, a global sensor and encoder solutions manufacturer, launched the absolute encoder EAM580RS, designed to deliver safety and performance in harsh applications, including mobile machinery and outdoor environments. Additionally, this safety-certified encoder would provide safe automation, which is cost-effective and easy to implement. The magnetic safety encoder has a stainless-steel casing for its protection from harsh outdoor environments, and it is able to withstand industrial factors, like vibrations and shock.

In August 2023, Dynapar, a manufacturer of encoders, launched HS35iQ Encoder with PulseIQ Technology, which is a new programmable hollow shaft encoder. This is a self-diagnosing feedback device with color-coded LEDs and digital output and offers a new way for OEM and end-users in heavy-duty machine applications to troubleshoot faulty encoders with access to encoder health status in real time.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Adoption in Advanced Automotive Systems

- 5.1.2 Rising Demand For Industrial Automation

- 5.2 Market Challenges

- 5.2.1 Mechanical Failures in Harsh Conditions

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Rotary Encoder

- 6.1.2 Linear Encoder

- 6.2 By Technology

- 6.2.1 Optical

- 6.2.2 Magnetic

- 6.2.3 Photoelectric

- 6.2.4 Other Technologies

- 6.3 By End-user Industry

- 6.3.1 Automotive

- 6.3.2 Electronics

- 6.3.3 Textile

- 6.3.4 Printing Machinery

- 6.3.5 Industrial

- 6.3.6 Medical

- 6.3.7 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Omron Corporation

- 7.1.2 Honeywell International

- 7.1.3 Schneider Electric

- 7.1.4 Rockwell Automation Inc.

- 7.1.5 Panasonic Corporation

- 7.1.6 Baumer Group

- 7.1.7 Renishaw PLC

- 7.1.8 Dynapar Corporation (Fortive Corporation)

- 7.1.9 FAULHABER Drive Systems

- 7.1.10 Pepperl+Fuchs International

- 7.1.11 Hengstler GMBH (Fortive Corporation)

- 7.1.12 Maxon Motor AG

- 7.1.13 Dr. Johannes Heidenhain GmbH

- 7.1.14 POSITAL FRABA Inc. (FRABA BV)

- 7.1.15 Sensata Technologies