|

市场调查报告书

商品编码

1689938

导电硅胶:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Conductive Silicone - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

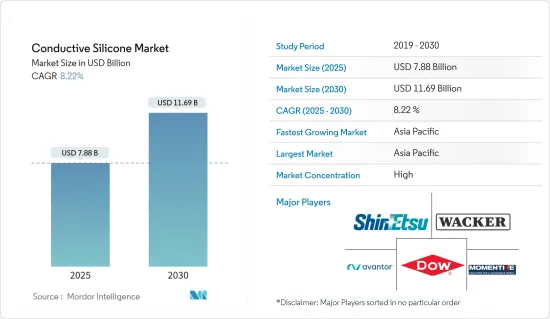

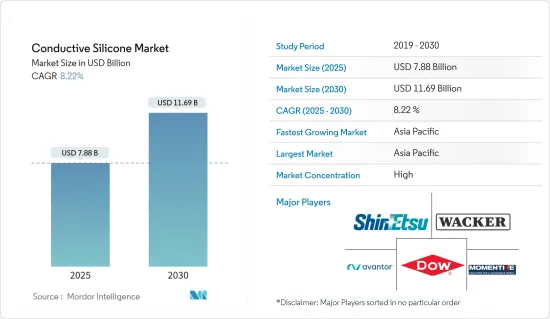

导电硅胶市场规模预计在 2025 年为 78.8 亿美元,预计到 2030 年将达到 116.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.22%。

COVID-19 疫情最初扰乱了导电硅胶的供应链。随后,快速数位化以及远距学习和远距工作的引入导致电子设备的需求激增。因此,导电硅胶市场轻鬆恢復到疫情前的水平。

主要亮点

- 电子设备对导电硅胶的需求不断增加以及太阳能电池产业对导电硅胶的使用量不断增加,预计将推动导电硅胶的市场需求。

- 然而,预计 EMI 屏蔽中导电硅胶的替代将在预测期内抑制市场成长。

- 微流体设备等医疗设备技术的进步为市场开闢了新的可能性。

- 由于汽车、电子和通讯行业的需求不断增加,亚太地区在导电硅胶市场占据主导地位。

导电硅胶市场趋势

电子产业成长导致需求增加

- 导电硅胶因具有导电性、导热性、柔韧性和耐腐蚀性等优异的性能,广泛应用于电气和电子应用领域。

- 导电硅胶具有优异的导电性,使其成为电气设备的理想材料。硅胶中的导电颗粒可以传输电流,使其适用于需要传输讯号、资料和电力的应用。

- 中国是世界上最大的电子设备製造基地。智慧型手机、电视和其他个人电子设备等电子产品是电子产业中成长最快的产品。

- 该国对电子产品的需求很高。为了满足这项普遍需求,中国已启动「中国製造2025」计画等战略措施。根据该计划,中国政府宣布了2030年实现产出3,050亿美元、满足80%国内需求的目标。此外,中国是智慧型手机的製造中心,大大增加了对导电硅胶的需求。

- 日本电子情报技术产业协会(JEITA)发布的资料显示,2022年日本电子产业总产值将达到约11.1243兆日圆(约843.4亿美元),较前一年成长近8%。

- 德国是欧洲最大的电子国家。德国是欧洲最大的电气电子产品市场,也是世界第五大电气电子产品市场。据德国电气电子协会称,预计2022年该市场规模将达到2,200亿欧元以上(2,348.4亿美元)。

- 德国电气与电子相关企业在国内外僱用了160多万名员工。此外,全国30%的研发人员从事电子和微技术领域的工作。

- 此外,电子产品占德国出口总额的13%。德国电子和数位产业名目出口将年增7.0%,到2023年4月将达到190亿欧元(约209.3亿美元)。今年前四个月,该产业的海外交付额达842亿欧元(约927.5亿美元),年增10.7%。

- 作为法国2030投资计画的一部分,法国政府计划在2030年投资约8亿欧元(8.8亿美元),支持各种电子技术发展的学术研究生态系统。

- 因此,预计上述因素将在不久的将来推动导电硅胶的需求。

亚太地区占市场主导地位

- 亚太地区是导电硅胶最大且成长最快的市场。电子、汽车和发电产业的应用日益增多,推动了亚太地区对导电硅胶的需求。

- 中国、印度、日本、印尼和越南等该地区的国家正在加大对发电工程的投资,从而推动导电硅胶市场的成长。

- 此外,防静电包装变得越来越重要,为了防止灰尘积聚并保持电气和电子设备的功能和长寿命,电子设备中导电硅胶的使用预计会增加。亚洲是最大的电气和电子设备生产地区,其中中国、日本、印度和东南亚国协占据领先地位。

- 中国是全球最大的电子产品製造基地。智慧型手机、电视和其他个人设备等电子产品的成长最为显着。

- 官方资料显示,2023年华虹集团无锡规划兴建12吋特殊製程产线,製程等级涵盖65/55-40nm,月产能达8.3万片。

- 此外,晶圆代工巨头晶圆半导体公司将于2023年投资约29亿美元用于12吋晶圆製造计划。

- 近年来,由于能源需求不断增长,中国一直在投资各种可再生能源计划。 2023年11月,中国政府计画安装230GW风电和太阳能发电容量。该国已在 2023 年向各种风能和太阳能发电工程共投资 1,400 亿美元,目标是到 2060 年实现碳中和目标。

- 2021-2025年的电网投资预算为4,550亿美元,比前十年增加60%。此外,併网储能容量将比2020年增加一倍,到2023年达到67GW。

- 因此,预计上述因素将在预测期内推动该地区对导电硅胶的需求。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章 调查范围

- 研究范围

- 研究假设和市场定义

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 电子产业需求不断成长

- 扩大太阳能电池产业的应用

- 限制因素

- EMI 屏蔽中导电硅胶的替代品

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 依产品类型

- 合成橡胶

- 树脂

- 凝胶

- 其他产品类型(糊剂、填缝剂、黏合剂、油脂)

- 按应用

- 黏合剂和密封剂

- 热界面材料

- 封装和灌封化合物

- 三防胶

- 其他用途(生物医学、光催化)

- 按最终用户产业

- 车

- 建造

- 发电

- 电气和电子

- 其他终端用户产业(工业机械、消费品、航太)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- 3M

- Avantor Inc.

- CHT Germany GmbH

- Dongguan City Betterly New Materials Co. Ltd

- Dow

- Elkem ASA

- Euro Technologies

- Henkel AG & Co. Kgaa

- Momentive

- Parker Hannifin Corporation

- Polymax Ltd

- Shin-Etsu Chemical Co. Ltd

- Silicone Solutions

- Soliani Emc Srl

- Specialty Silicone Products Inc.

- Wacker Chemie AG

第七章 市场机会与未来趋势

- 医疗设备新技术发展

The Conductive Silicone Market size is estimated at USD 7.88 billion in 2025, and is expected to reach USD 11.69 billion by 2030, at a CAGR of 8.22% during the forecast period (2025-2030).

The COVID-19 outbreak initially disrupted the conductive silicone supply chain. Later on, demand for electronics surged due to rapid digitization and the adoption of distance learning and remote work. Thus, the conductive silicone market readily recovered to its pre-pandemic stage.

Key Highlights

- The increasing demand for conductive silicone in electronic devices and its increasing usage in the solar industry are expected to raise the market demand for conductive silicone.

- On the other hand, the alternative to conductive silicone in EMI shielding is anticipated to restrain market growth during the forecast period.

- Advancements in medical device technology, such as microfluidic devices, are opening up new possibilities within the market.

- The Asia-Pacific region dominates the conductive silicone market, owing to rising demand from the automotive, electronics, and telecommunications industries.

Conductive Silicone Market Trends

Growth in the Electronics Segment to Augment the Demand

- Conductive silicone is extensively used in electrical and electronics applications because of its superior properties such as electrical conductivity, thermal conductivity, flexibility, and corrosion resistance.

- The superior electrical conductivity associated with the use of conductive silicone makes it the ideal material for electric devices. Silicone's conductive particles enable the transfer of electrical current, making it useful for applications that require the transmission of signals, data, and power.

- China is the largest base for electronics production in the world. Electronic products such as smartphones, TVs, and other personal electronic devices recorded the highest growth in the electronics segment.

- The country has a large demand for electronic products. To benefit from this extensive demand, China has embarked on strategic initiatives like the "Made in China 2025" plan. Under this plan, the Chinese government has announced its goal to reach an output of USD 305 billion by 2030 and, therefore, meet 80% of its domestic demand. Moreover, China is an industrial hub for smartphone production, significantly boosting the demand for conductive silicone.

- According to the data released by the Japan Electronics and Information Technology Industries Association (JEITA), in 2022, the total production value of the electronics industry in Japan amounted to around JPY 11,124.3 billion (USD 84.34 billion), showcasing a rise of nearly 8% from the previous year.

- Germany has the largest electronic industry in Europe. The German market is Europe's largest and the world's fifth-largest electrical and electronics market. It had registered more than EUR 220 billion (USD 234.84 billion) in 2022, according to the Germany Electrical and Electronics Association.

- Electrical and electronic companies in Germany employ a workforce of more than 1.6 million at home and abroad. Also, 30% of all R&D employees in the country are working in the field of electronics and microtechnology.

- Additionally, electronics constitute up to 13% of the country's overall exports. The nominal exports of the German electro and digital industry witnessed an annual growth of 7.0% to reach EUR 19.0 billion (USD 20.93 billion) in April 2023. In the first four months of this year, the sector's aggregated deliveries abroad experienced a Y-o-Y growth of 10.7%, reaching a value of EUR 84.2 billion (USD 92.75 billion).

- As part of the France 2030 investment plan, the French government plans to invest nearly EUR 800 million (USD 880 million) to support the academic research ecosystem for the development of various electronic technologies by 2030.

- Therefore, the aforementioned factors are projected to boost the demand for conductive silicone in the near future.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region stands to be the largest and fastest-growing market for conductive silicone. Factors such as the increasing utilization in the electronics, automotive, and power generation industries have been driving the demand for conductive silicone in Asia-Pacific.

- Countries in the region, such as China, India, Japan, Indonesia, and Vietnam, are witnessing increasing investments in power generation projects, boosting the growth of the conductive silicone market.

- The heightened significance of anti-static packaging for dust control during electric charge and sustaining functionality and longevity of electrical and electronic devices is anticipated to increase the utilization of conductive silicone in electronics. Asia is the largest producer of electrical and electronic devices, with countries like China, Japan, India, and ASEAN countries leading production.

- China is the most extensive base for electronics production in the world. Electronic products such as smartphones, TVs, and other personal devices recorded the highest growth.

- According to official data, in 2023, Huahong Group's Wuxi planned to build a 12-inch specialty process production line with a process grade covering 65/55-40 nm and a monthly production capacity of 83,000 pieces.

- Furthermore, Nexchip Semiconductor Corporation invested around USD 2.9 billion in 2023 in the 12-inch wafer manufacturing project.

- Recently, China has been investing in various renewable energy projects due to the growing demand for energy in the country. In November 2023, the Government of China planned to install 230 GW of wind and solar capacity. The country invested a total of USD 140 billion in 2023 in various wind and solar projects with the aim of achieving its 2060 carbon-neutral target.

- The country has budgeted USD 455 billion in grid investments from 2021-2025, an increase of 60% from the previous decade. It also doubled its grid-connected energy storage capacity from 2020 to reach 67 GW in 2023.

- Hence, the factors mentioned above are expected to drive the demand for conductive silicone in the region during the forecast period.

Conductive Silicone Industry Overview

The conductive silicone market is consolidated in nature. The major players operating in the market (not in any particular order) include Wacker Chemie AG, DOW, Shin-Etsu Chemical Co. Ltd, Momentive, and Avantor Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 SCOPE OF THE REPORT

- 1.1 Scope of the Study

- 1.2 Study Assumptions and Market Definition

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Electronics Industry

- 4.1.2 Increasing Usage in the Solar Industry

- 4.2 Restraints

- 4.2.1 Alternative to Conductive Silicone in EMI Shielding

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size In Value)

- 5.1 By Product Type

- 5.1.1 Elastomers

- 5.1.2 Resins

- 5.1.3 Gels

- 5.1.4 Other Product Types (Pastes, Gap Fillers, Adhesives, and Greases)

- 5.2 By Application

- 5.2.1 Adhesives and Sealants

- 5.2.2 Thermal Interface Materials

- 5.2.3 Encapsulant and Potting Compounds

- 5.2.4 Conformal Coatings

- 5.2.5 Other Applications (Biomedical and Photocatalysis)

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Construction

- 5.3.3 Power Generation

- 5.3.4 Electrical and Electronics

- 5.3.5 Other End-user Industries (Industrial Machinery, Consumer Goods, and Aerospace)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordic Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Avantor Inc.

- 6.4.3 CHT Germany GmbH

- 6.4.4 Dongguan City Betterly New Materials Co. Ltd

- 6.4.5 Dow

- 6.4.6 Elkem ASA

- 6.4.7 Euro Technologies

- 6.4.8 Henkel AG & Co. Kgaa

- 6.4.9 Momentive

- 6.4.10 Parker Hannifin Corporation

- 6.4.11 Polymax Ltd

- 6.4.12 Shin-Etsu Chemical Co. Ltd

- 6.4.13 Silicone Solutions

- 6.4.14 Soliani Emc Srl

- 6.4.15 Specialty Silicone Products Inc.

- 6.4.16 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 New Technological Developments in Medical Devices