|

市场调查报告书

商品编码

1689940

高尔夫球车:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Golf Cart - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

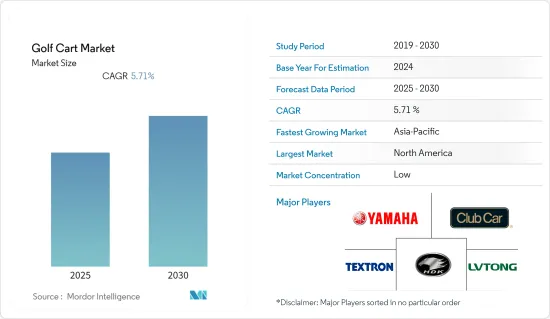

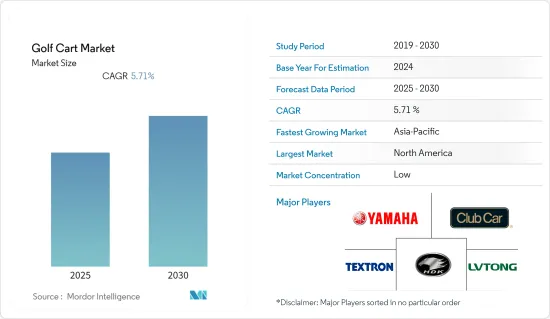

预计预测期内高尔夫球车市场复合年增长率为 5.71%。

全球各行各业都感受到了冠状病毒疫情的影响。疫情扰乱了大多数主要产业的整个价值链。这是因为大多数人都待在室内并遵守社交距离规范。

疫情期间,高尔夫球车销量下降,对一些市场产生了负面影响。儘管新冠疫情造成了干扰,但随着大众开始认识到高尔夫运动的休閒益处,高尔夫球车的销量增加。自 2020 年下半年以来,销售量一直急剧成长,预计在预测期内将继续引领市场。

预计在预测期内,快速的都市化、人均收入的提高以及国际和国内旅游业的成长将推动高尔夫球车的需求。预计城市发展和精明的私人活动将促进高尔夫球车的销售,因为它们低功率、易于驾驶且功能多样。随着上述产业的健康成长,高尔夫球车市场预计在预测期内也将实现正成长率。

高尔夫球车市场趋势

打高尔夫球的人数增加

生活方式的改变和对永续能源解决方案的日益增长的偏好导致高尔夫球车的受欢迎程度增加,这是推动成长的主要因素之一。虽然高尔夫活动的增加仍然是主要的成长要素,但高尔夫球车市场也在扩展到其他领域,如酒店、婚礼活动、游乐园、旅游目的地、机场、体育场、安全/巡逻和货物运输。

2012 年至 2019 年,高尔夫产业连续八年迎来超过 200 万名新进者,预计 2020 年至 2022 年每年将超过 300 万。在 2020 年和 2021 年疫情激增之前,2000 年的最高纪录是 240 万。 2021 年,有 310 万名青少年在球场上打高尔夫球,而 2020 年的成长率为 24%,是 1997 年以来的最大增幅。与一般的高尔夫人群相比,这一人群的多样性依然更强。

为了满足公众的兴趣,高尔夫球场和乡村俱乐部的数量也在以显着的速度增加,预计这将推动全球对高尔夫球车的需求。例如,全球有 540 个新高尔夫球场计划正在规划中(344)或正在建设中(196)。这些开发案遍布 96 个国家,其中近三分之二的新高尔夫球场开发案与度假村有关。

在亚太地区,45%的高尔夫球场是私人俱乐部,而全球整体只有 20% 的高尔夫球场是会员制。这凸显了高尔夫、旅游业和经济发展之间的功能亲和性。随着高尔夫球场数量的增加以及对高尔夫运动感兴趣的人的增多,预测期内高尔夫球车的需求也可能会增加。例如

- 2022 年 9 月,Kinetic & Firodia 集团旗下的电动车部门 Kinetic Green 计划在未来四到五年内投资 40 亿卢比用于其电动两轮车、三轮车和高尔夫球车系列。

2020年,美国高尔夫基金会发现,该国的高尔夫球手数量达到了2,480万,比2019年增加了近2%。这直接增加了对高尔夫球车的需求。此外,人口成长和都市化,即在高科技和智慧住宅和商业住宅计划、酒店、接待、旅游、游乐园等领域中高尔夫球车的使用增加,可能会在预测期内支持所研究市场的成长。

北美可能主导高尔夫球车市场

预计预测期内北美将主导高尔夫球车市场。该地区的一些主要市场参与者包括 Yamaha Golf-Car Company、Club Car LLC、Cruise Car Inc.、Columbia ParCar Corp.、Garia Inc. 和 Textron Inc.(EZ-GO)。

美国在高尔夫运动中占有特殊地位,因为它拥有超过 17,000 个球场、四项男子大满贯赛事中的三项、以及众多优秀球员。这些高尔夫球场占全球高尔夫球场总数的42%以上。在美国,高尔夫练习场的业务在 2021 年持续成长。例如,截至 2020 年,美国共有 57,465 个註册的高尔夫练习场。到 2021 年,这一数字预计将达到历史最高水平,为高尔夫球车创造巨大的市场潜力和需求。此外,参与者也在市场上推出新的产品线。例如,

- 2022 年 1 月,电动车和高尔夫球车市场的新兴领导者 DSG World 宣布在 1 月 24 日至 28 日在佛罗里达州奥兰多举行的高尔夫行业年度盛事 PGA 展会上推出其颠覆性的 Shelby 高尔夫球车系列。

对于其他用途的高尔夫球车製造商来说,墨西哥也正成为一个利润丰厚的市场。该国有几家度假公司提供各种服务,包括电动高尔夫球车旅游。例如,Sayulita Life.com 是一家旅游服务提供商,根据客户的要求出租经过定期维护、安全的客运电动高尔夫球车,供客户在城镇周围进行短期或长期的观光旅行。

高尔夫球车产业概况

高尔夫球车市场被多家区域性企业所分散。例如,主要企业包括雅马哈高尔夫球车公司、Club Car LLC、德事隆公司、HDK电动车、广东绿通新能源电动车科技等。随着短程旅游和电动车等全新应用的出现,这些公司正在提供新模式,利用先进技术来满足这些用途。

- 2021 年 10 月,哥伦比亚宣布与先进电池系统设计和製造的全球领导者 Inventus Power 建立合作关係。该合作旨在从 2022 年开始将锂电池组选项纳入 Columbia Utilitruck 产品。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按类型

- 电动高尔夫球车

- 汽油高尔夫球车

- 太阳能高尔夫球车

- 按应用

- 高尔夫球

- 个人/住宅

- 商业

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 巴西

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他国家

- 北美洲

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Yamaha Golf-Car Company

- Cruise Car Inc.

- Columbia ParCar Corp.

- Garia Inc.

- Club Car LLC

- Textron Specialized Vehicles Inc.

- HDK Electric Vehicles

- Suzhou Eagle Electric Vehicle Manufacturing Co. Ltd

- JH Global Services Inc.

- Dongguan Excellence Golf & Sightseeing Car Co. Ltd

第七章 市场机会与未来趋势

The Golf Cart Market is expected to register a CAGR of 5.71% during the forecast period.

All industries around the world feel the impact of the coronavirus pandemic. The outbreak disrupted the entire value chain of most major industries. Due to the lockdowns imposed, the golf cart market has also been affected due to the pandemic as most people stayed indoors and followed social distancing norms.

The sales of golf carts declined during the pandemic, negatively affecting several markets. Despite the disruption due to the COVID-19 pandemic, public realization of the recreational benefits of golfing has driven the sales of golf carts. The sales have been soaring from the second half of 2020, which is expected to drive the market forward in the forecast period.

During the forecast period, rapid urbanization, rising per capita income, and growth in the international and national tourism industries are expected to boost demand for golf carts. As the golf carts are low-powered, easy-to-drive vehicles and have a wide range of functions, urban development in savvy private activities is expected to boost golf cart sales. As the industries mentioned above are witnessing healthy growth, the golf cart market is also anticipated to register a positive growth rate during the forecast period.

Golf Cart Market Trends

Increasing number of individuals involved in golf activities

Golf carts are becoming increasingly popular due to changing lifestyles and a growing preference for sustainable energy solutions, which is one of the primary factors driving growth. While increasing patronage of golfing activities remains a primary growth driver, the golf cart market has expanded into other sectors such as hotels, wedding events, amusement parks, tourism destinations, airports, stadiums, security & patrolling, and cargo transport.

The industry has seen more than 2 million newcomers for eight consecutive years between 2012 and 2019, with the number exceeding 3 million per year between 2020 and 2022. Prior to the pandemic-boosted totals of 2020 and 2021, the previous high was 2.4 million in 2000. In 2021, 3.1 million juniors played golf on a course, following a 24% increase in 2020 that was the largest since 1997. This segment continues to be more diverse than the general golf population.

To accommodate public interest, the number of golf courses and country clubs is also rising at a notable rate, which, in turn, is anticipated to propel the demand for golf carts globally. For example, there are 540 new golf course projects in various stages of planning (344) or active construction (196) worldwide. These developments span 96 countries, and almost two-thirds of these emerging golf courses are associated with resort developments.

Across the Asia-Pacific region, 45% of golf courses are private clubs, compared to 20% defined as membership-only worldwide. This highlights a functional affinity between golf, tourism, and economic development. An increase in the number of golf courses is also supported by a rise in the number of people interested in golf, which is also likely to push demand for golf carts during the forecast period. For instance,

- In September 2022, Kinetic Green, the Kinetic & Firodia group's electric mobility arm, planned to invest 400 crores in its electric two-wheeler, three-wheeler, and golf cart range over the next four to five years.

In 2020, US National Golf Foundation witnessed 24.8 million golfers in the country, representing a rise of nearly 2% compared to 2019. This directly increased demand for golf carts. Moreover, rising population and urbanization, i.e., hi-tech and smart residential and commercial housing projects, and the rise in utilization of golf carts in hotels, hospitality, tourism, amusement parks, etc., are likely to support the growth of the market studied during the forecast period.

North America May Dominate the Golf Cart Market

North America is anticipated to dominate the golf cart market over the forecast period. The region has the presence of major market players, such as Yamaha Golf-Car Company, Club Car LLC, Cruise Car Inc., Columbia ParCar Corp., Garia Inc., and Textron Inc. (E-Z-GO).

The United States has a special place for this sport, as it possesses more than 17,000 courses, hosts three of the four men's major championships, and has many of its finest players. These golf courses constituted over 42 % of the golf courses worldwide. The United States witnessed a consistent number of businesses in the golf driving ranges in 2021. For instance, as of 2020, 57,465 golf driving ranges were registered in the United States. This number reached an all-time high by 2021, creating tremendous market potential and demand for golf carts. Moreover, players are also launching new product lines in the market. For instance,

- In January 2022, DSG Global, Inc., an emerging leader in the Electric Vehicle and Golf Cart markets, announced the launch of its disruptive Shelby Golf Cart line at the PGA Show, the year's pinnacle event for the business of golf, which takes place from January 24 to 28 in Orlando, Florida.

Mexico is becoming a profitable market for golf cart manufacturers for other applications. Several vacation companies in the country offer various services, including tours on electric golf carts. For instance, Sayulita Life.com is a tour service provider that rents out electric golf carts that are regularly maintained and are safe for passenger travel for touring across the town for short or long durations, defined as per customer specifications.

Golf Cart Industry Overview

The golf cart market is fragmented, owing to the presence of several regional players. For instance, major players include Yamaha Golf-Car Company, Club Car LLC, Textron Inc., HDK Electric Vehicles, and Guangdong Lvtong New Energy Electric Vehicle Technology Co. Ltd. With extremely new applications, such as short-distance tourism and electric mobility, coming into the picture, these companies have been offering new models that cater to such applications with advanced technologies.

- In October 2021, Columbia announced its partnership with Inventus Power, a global leader in designing and manufacturing advanced battery systems. The partnership aimed at incorporating a lithium battery pack option in Columbia Utilitruck products from 2022.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Electric Golf Cart

- 5.1.2 Gasoline Golf Cart

- 5.1.3 Solar Golf Cart

- 5.2 By Application Type

- 5.2.1 Golf

- 5.2.2 Personal/Residential

- 5.2.3 Commercial

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 Saudi Arabia

- 5.3.4.3 United Arab Emirates

- 5.3.4.4 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Yamaha Golf-Car Company

- 6.2.2 Cruise Car Inc.

- 6.2.3 Columbia ParCar Corp.

- 6.2.4 Garia Inc.

- 6.2.5 Club Car LLC

- 6.2.6 Textron Specialized Vehicles Inc.

- 6.2.7 HDK Electric Vehicles

- 6.2.8 Suzhou Eagle Electric Vehicle Manufacturing Co. Ltd

- 6.2.9 JH Global Services Inc.

- 6.2.10 Dongguan Excellence Golf & Sightseeing Car Co. Ltd