|

市场调查报告书

商品编码

1689951

浮法玻璃:市场占有率分析、行业趋势和成长预测(2025-2030 年)Float Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

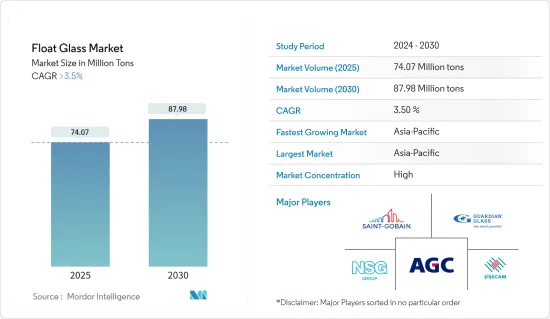

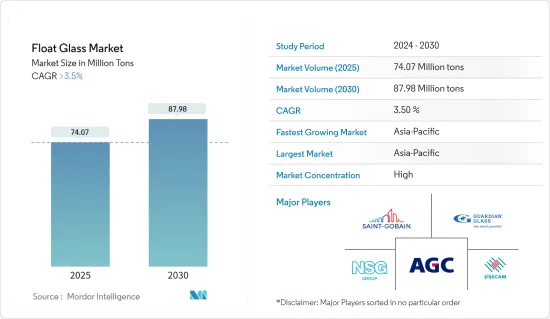

浮法玻璃市场规模预计在 2025 年为 7,407 万吨,预计在 2030 年达到 8,798 万吨,预测期内(2025-2030 年)的复合年增长率将超过 3.5%。

浮法玻璃的主要消费者是建筑业,该行业在 2020 年受到 COVID-19 疫情的严重负面影响,导致多个建筑和施工计划的建设活动暂停甚至推迟。受新冠疫情影响,部分建设活动已于 2021 年和 2022 年恢復,导致浮法玻璃需求增加。

关键亮点

- 短期内,建筑业需求成长、汽车业復苏是推动市场的关键因素。

- 限制该产品类型需求的因素包括原材料价格上涨、某些类型玻璃需求下降以及浮法玻璃生产对环境的影响。

- 太阳能电池领域的巨大成长潜力预计将为所研究的市场提供丰厚的成长机会。

- 亚太地区在全球市场占据主导地位,其中消费量最高的国家是中国和印度。

浮法玻璃市场趋势

建筑和施工领域的需求增加

- 浮法玻璃已成为建筑和设计计划的基本元素,从闪闪发光的高层建筑到现代住宅、豪华别墅和时尚的职场。对于业务应用而言,浮法玻璃越来越受欢迎。浮法玻璃可以建造出让人感觉身处户外的结构,同时又具有室内结构的优点,可以免受天气影响。

- 在建筑和施工应用中,浮法玻璃主要用于功能性和美观性的玻璃,使客户可以看到外面,同时也能提供防紫外线等自然因素的保护。

- 此外,城市人口的成长和全球人口可支配收入的增加是推动全球基础设施和建设活动成长的其他关键因素。建筑和基础设施建设的成长与浮法玻璃的需求直接相关,并可能推动市场成长。

- 最近的趋势显示建筑结构正在快速变化,透过在建筑幕墙和屋顶上使用浮法玻璃来优化自然采光。此外,市场驱动因素还包括 Low-E 和 Triple Silver 绝缘产品等技术。

- 根据日本土木工程师学会预测,未来十年,全球整体建筑产出预计将成长 85%,销售额达到 15.5 兆美元,其中印度、中国等新兴国家和美国等已开发国家将引领这一趋势。教育、零售、医疗保健和办公商业等各个领域的商业建筑不断增加,增加了对浮法玻璃的需求,从而推动了市场成长。

- 牛津经济研究院建筑经济学家团队发布的研究报告《全球建筑业未来》指出,未来15年,全球建筑工程价值将增加4.2兆美元以上,从2022年的9.7兆美元增加到2037年的13.9兆美元。预计这将支持各类建筑应用对浮法玻璃的需求。

- 例如,根据美国建筑师协会的数据,预计2022年美国住宅建筑支出与前一年同期比较成长10%。

- 由于这些发展,预计未来几年建筑业对浮法玻璃的需求将会增加。

亚太地区占市场主导地位

- 由于中国和印度等国家的建筑、太阳能板等行业的需求,预计亚太地区将在预测期内主导浮法玻璃市场。

- 根据国际贸易组织的统计,中国是全球最大的建筑市场,拥有全球最高的都市化。根据美国建筑师协会(AIA)上海分会的资料,自1990年代以来,到2025年,中国可能已经建成了一个相当于10个纽约规模的城市。

- 此外,根据住宅及城乡建设部预测,到2025年,建筑业将占全国GDP的6%,中国建筑业在提振经济、稳定就业方面发挥越来越重要的作用。

- 在挡风玻璃、侧窗和后窗的生产中使用汽车玻璃显着提高了所有参数的安全性。国际贸易组织预测,中国仍是全球最大的汽车市场,以年销售量和产量计算,到2025年国内产量预计将达3,500万辆。根据日经新闻报道,预计2023年中国汽车销量将比2022年成长12%,达到3,009万辆。

- 在印度,2022 年 9 月,由 Kotak Investment Advisors Limited (KIAL) 管理的 Kotak Special Situations Fund (KSSF) 宣布向浮法玻璃製造商 Gold Plus Glass Industry Limited 投资约 4,500 亿印度卢比。这项投资将加速公司的扩张计划,为该产业带来显着利益,并有助于提高印度的玻璃自给自足能力,目前印度的玻璃需求有30%以上依赖进口。

- 据印度工业和国内贸易促进部称,预计2022年印度玻璃行业出口额将达到400.7亿印度卢比(4.82亿美元),与前一年同期比较增长31.8%。

- 在亚太地区营运的主要企业包括 AGC Inc.、Nippon Sheet Glass 和 Guardian Glass LLC。

- 预计所有这些因素都将对预测期内该地区的市场成长产生重大影响。

浮法玻璃产业概况

全球浮法玻璃市场正在整合。去年,五大公司占据了很大的市场。市场的主要企业包括 AGC Inc.、Saint-Gobain、Guardian Glass, LLC、Nippon Sheet Glass、Sisecam 等(排名不分先后)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 建筑业需求增加

- 汽车工业的成长

- 限制因素

- 原物料价格上涨

- 某些类型玻璃的需求减少

- 浮法玻璃生产对环境的影响。

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 原料分析

- 沙

- 石灰石

- 碱灰

- 白云石

第五章市场区隔

- 类型

- 清除

- 染色

- 图案

- 钢丝增强型

- 超透明/低铁浮法玻璃

- 应用

- 建筑与施工

- 车

- 太阳能玻璃

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 越南

- 泰国

- 印尼

- 马来西亚

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 北欧的

- 土耳其

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 哥伦比亚

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 奈及利亚

- 卡达

- 阿拉伯聯合大公国

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- AGC Inc.

- BG

- Cardinal Glass Industries, Inc.

- China Glass Holdings Limited

- China Luoyang Float Glass Group Co., Ltd.

- Etex Group

- Guardian Glass, LLC

- Kibing Group

- Nippon Sheet Glass Co., Ltd

- PRESS GLASS Holding SA

- PT Mulia Industrindo Tbk

- Saint-Gobain

- SCHOTT

- Taiwan Glass Ind. Corp.

- Xinyi Glass Holdings Limited

第七章 市场机会与未来趋势

- 太阳能产业的巨大成长潜力

The Float Glass Market size is estimated at 74.07 million tons in 2025, and is expected to reach 87.98 million tons by 2030, at a CAGR of greater than 3.5% during the forecast period (2025-2030).

The major consumer of float glass is the construction industry, and with the widespread COVID-19 pandemic in 2020, the industry was significantly impacted in a negative way as it halted and even delayed the construction activities of several building and construction projects. With the restart of a few construction activities after COVID-19 in 2021 and 2022, the demand for float glass started to increase.

Key Highlights

- Over the short term, major factors driving the market studied are the increasing demand from the construction industry and the recovering automotive industry.

- Some of the factors restraining the demand for the market studied include the increasing price of raw materials, declining demand for certain types of glasses, and environmental impact related to float glass production, among other scenarios.

- Nevertheless, the huge growth potential of the solar sector is likely to create lucrative growth opportunities in the market studied.

- Asia-Pacific dominated the market across the world, with the most substantial consumption from countries like China and India.

Float Glass Market Trends

Increasing Demand from Building and Construction Segments

- Float glass has become a fundamental element in architectural and design projects, ranging from gleaming skyscrapers to modern co-ops and opulent villas to stylish workplaces. In commercial applications, float glass is becoming increasingly popular. It enables the construction of structures while giving the sense of being outdoors and providing the benefits of being inside and sheltered from the weather.

- In building and construction applications, float glass is majorly used in windows for both functional and aesthetic purposes, which allows clear sight for customers looking out of the window and, at the same time, protects them from elements such as UV radiation.

- In addition, the growing urban population and the rise in disposable income of the world population are a few other major factors that have significantly boosted the growth of infrastructure and construction activities across the world. The growth of construction and infrastructure development directly links to the demand for float glass, which tends to drive the growth of the market.

- The recent trend suggests a rapid change in building architecture, with the use of float glass in facades and roofs optimizing natural daylight. Furthermore, the market drivers include technologies such as low-E and triple silver insulated goods.

- According to the Institution of Civil Engineers, the volume of construction output is projected to grow by 85%, with a revenue of USD 15.5 trillion across the world in the upcoming decade, led by emerging countries such as India and China and developed countries like the United States. The growing commercial construction in a wide range of sectors, including education, retail, healthcare, office commercials, and so on, increases the demand for float glass, which drives the growth of the market.

- According to the Global Construction Futures, a study published by the team of construction economists at Oxford Economics, stated that the global construction work done will grow over USD 4.2 trillion over the next 15 years from USD 9.7 trillion in 2022 to US$13.9 trillion by 2037. This is likely to support the demand for float glass from various construction applications.

- For instance, according to the American Institute of Architects, overall non-residential building construction spending in the United States grew by 10% in 2022 over the last year.

- All such aforementioned developments are expected to drive the demand for float glass in the construction industry through the years to come.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for float glass during the forecast period, owing to the demand from industries such as building and construction, solar panels, etc., in countries like China and India.

- According to the International Trade Organization, China is the world's largest construction market and has the highest rate of urbanization across the world. According to data from the American Institute of Architects (AIA) Shanghai, by 2025, China is likely to have built a city equivalent to 10 in New York since the 1990s.

- Furthermore, according to the Ministry of Housing and Urban-Rural Development of China, the construction industry is expected to account for 6% of the country's GDP by 2025. The Chinese construction sector plays an increasingly important role in stimulating the economy and stabilizing employment.

- The use of automotive glass in the production of windshields, side windows, and rear windows has significantly improved safety in all parameters. According to the International Trade Organization, China remains the world's largest automotive market in terms of both annual sales and production, with domestic production expected to reach 35 million units by 2025. According to Nikkei Inc., China's vehicle sales increased by 12% in 2023 over 2022, and recorded a sales of 30.09 million units.

- In India, in September 2022, Kotak Special Situations Fund (KSSF), managed by Kotak Investment Advisors Limited (KIAL), announced an investment of about INR 450 crore in Gold Plus Glass Industry Limited, a float-glass manufacturer. This investment would accelerate the company's expansion plans, bring significant benefits to the industry, and help make India self-sufficient in glass, where over 30% of glass demand is currently imported.

- According to the Department for Promotion of Industry and Internal Trade of India, the export value of the indian glass industry in 2022 was 40.07 INR billion (USD 482 million), representing a 31.8% increase over the previous year.

- Some of the major companies operating in the Asia-Pacific region are AGC Inc., Nippon Sheet Glass Co. Ltd, and Guardian Glass LLC.

- All the factors, in turn, are projected to have a significant impact on the market growth in the region during the forecast period.

Float Glass Industry Overview

The global float glass market is consolidated. The top five players dominated global production with a significant share in the previous year. Some of the key companies in the market include (not in any particular order) AGC Inc., Saint-Gobain, Guardian Glass, LLC, Nippon Sheet Glass Co., Ltd, and Sisecam, among other companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Construction Industry

- 4.1.2 Growing Automotive Industry

- 4.2 Restraints

- 4.2.1 Increasing Price of Raw Materials

- 4.2.2 Declining Demand for Certain Types of Glasses

- 4.2.3 Environmental Impact Related to Float Glass Production

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Raw Material Analysis

- 4.5.1 Sand

- 4.5.2 Limstone

- 4.5.3 Soda Ash

- 4.5.4 Dolomite

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Clear

- 5.1.2 Tinted

- 5.1.3 Patterned

- 5.1.4 Wired

- 5.1.5 Extra Clear/Low Ferrous Floated Glass

- 5.2 Application

- 5.2.1 Building and Construction

- 5.2.2 Automotive

- 5.2.3 Solar Glass

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Vietnam

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Malaysia

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 NORDIC

- 5.3.3.7 Turkey

- 5.3.3.8 Spain

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Colombia

- 5.3.4.3 Argentina

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Nigeria

- 5.3.5.3 Qatar

- 5.3.5.4 United Arab Emirates

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGC Inc.

- 6.4.2 BG

- 6.4.3 Cardinal Glass Industries, Inc.

- 6.4.4 China Glass Holdings Limited

- 6.4.5 China Luoyang Float Glass Group Co., Ltd.

- 6.4.6 Etex Group

- 6.4.7 Guardian Glass, LLC

- 6.4.8 Kibing Group

- 6.4.9 Nippon Sheet Glass Co., Ltd

- 6.4.10 PRESS GLASS Holding SA

- 6.4.11 PT Mulia Industrindo Tbk

- 6.4.12 Saint-Gobain

- 6.4.13 SCHOTT

- 6.4.14 Taiwan Glass Ind. Corp.

- 6.4.15 Xinyi Glass Holdings Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Huge Growth Potential From Solar Sector