|

市场调查报告书

商品编码

1689953

磷酸:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Phosphoric Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

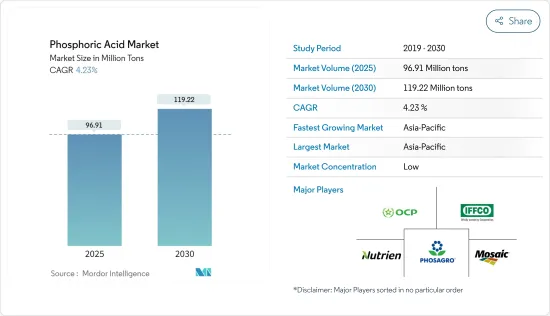

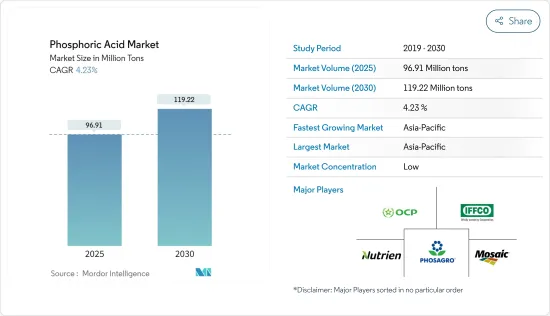

预计 2025 年磷酸市场规模为 9,691 万吨,到 2030 年将达到 1.1922 亿吨,预测期内(2025-2030 年)的复合年增长率为 4.23%。

由于主要供应和生产线中断,市场受到 COVID-19 疫情的负面影响,导致严重的供不应求。磷酸的主要用途是生产肥料。疫情也导致作物减产,并引发民众食物和其他必需品短缺。疫情过后,随着重点产业復工,市场加速发展,需求成长。

主要亮点

- 由于大部分磷酸被用作肥料的原料,预计肥料行业的需求增加以及食品和饮料行业用量的增加将推动市场需求。

- 磷酸盐造成的健康危害和化肥价格上涨预计会阻碍市场成长。

- 然而,从磷酸中回收稀土元素以及手性磷酸作为催化剂的商业化预计将为市场带来丰厚的机会。

- 亚太地区贡献了最大的市场占有率,并可能在预测期内占据市场主导地位。

磷酸市场趋势

肥料产业占据市场主导地位

- 磷酸盐本质上是生产肥料的中间体。磷酸一铵(MAP)、磷酸二铵(DAP)、磷酸三钠(TSP)等肥料都是由磷酸生产的。

- 磷酸盐是一种多功能剂,可用于植物营养、调节 pH 值以及清除灌溉系统中的石灰沉积物,是许多肥料的主要成分。磷酸盐是植物的丰富磷来源。

- 磷肥对植物非常重要,而且比有机肥料效果更好。磷促进植物成熟并有助于根部发育。这在干旱地区尤其重要。

- 根据基本化学工业统计,全世界每年生产超过 4,300 万吨磷酸盐,其中约 90% 用于製造肥料。

- 根据美国农业部对外农业服务局的数据,中国、俄罗斯、美国、印度和加拿大共生产了全球 60% 以上的肥料养分。俄罗斯和美国的化肥产量均占全球总量的不到 10%,而中国的化肥产量则约为 25%。

- 2022年9月,美国政府宣布了一项5亿美元的计划,以促进国内化肥产量,并敦促欧盟采取类似措施。加拿大已经是世界上最大的钾肥供应国,该国于2022年11月宣布,将每年增加20%的化肥出口量,以填补其他国家停止出口留下的缺口。

- 根据国际肥料协会(IFA)统计,中国是最大的化肥使用国,消耗了全球近四分之一的化肥供应。 2022年,中国总合生产NPK肥料5,570万吨。这高于 2021 年的 5,544 万吨和 2020 年的 5,496 万吨。

- 因此,考虑到世界各个地区化肥的成长趋势和产量,化肥产业可能会主导市场,导致预测期内磷酸盐的需求增加。

亚太地区占市场主导地位

- 2022 年,亚太地区在磷酸市场上占据主导地位,占有相当大的份额,预计在预测期内仍将保持主导地位。

- 这是因为中国是世界上最大的化肥生产国和消费国。中国、印度和东南亚等国家对磷酸的需求持续增加。

- 中国约占世界农业面积的7%,但却养活了全球22%的人口。该国是多种农作物的最大生产国,其产品包括大米、棉花、马铃薯等。因此,由于该国大规模的农业活动,对肥料中使用的磷酸盐的需求正在迅速增长。

- 磷酸也广泛用于磷酸锂铁锂电池的生产,而中国是该领域的主导国家。到2022年,中国销售的所有电动车中44%将使用LFP电池,其次是欧洲的6%和美国和加拿大的3%。

- 另一个肥料生产大国印度是第二大肥料用户。印度的大部分化肥使用资金都来自印度政府的巨额补贴。 22财年,印度生产了超过4,200万吨化肥。印度的化肥产量在20财年达到峰值,超过4,600万吨。近年来,政府推出了一系列优惠政策,鼓励公共、合作和私营部门进行投资。

- 磷酸也用于食品和饮料工业,使各种可乐和果酱等食品和饮料变酸并产生浓郁或酸味。根据美国农业部(USDA)的数据,印度食品产业排名世界第三。过去几年,该行业一直稳步成长,印度有望成为世界上最大的食品生产国。预计到 2025 年,该国食品和杂货 (F&G) 零售市场销售额将超过 8,500 亿美元。

- 因此,上述原因可能会推动预测期内亚太磷酸市场的成长。

磷酸盐产业概况

磷酸市场部分一体化,有多家公司在全球和区域层面开展业务。市场的主要企业(不分先后顺序)包括 OCP Group、Mosaic、PhosAgro Group of Companies、Nutrien Ltd 和 IFFCO。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 肥料业需求旺盛

- 在食品和饮料行业的使用日益广泛

- 市场限制

- 磷酸的健康危害

- 价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 磷酸价格走势分析(2018-2023年)

- 技术简介

第五章 市场区隔

- 按最终用户产业

- 肥料

- 饮食

- 化学品

- 药品

- 冶金

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 墨西哥

- 加拿大

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Aditya Birla Chemicals

- Agropolychim

- EuroChem Group

- ICL

- IFFCO

- Innophos

- JR Simplot Company

- Mosaic

- Nutrien Ltd

- Phosagro

- Sterlite Copper(A Unit of Vedanta Limited)

第七章 市场机会与未来趋势

- 从磷酸回收稀土元素

- 手性磷酸催化剂的商业化

The Phosphoric Acid Market size is estimated at 96.91 million tons in 2025, and is expected to reach 119.22 million tons by 2030, at a CAGR of 4.23% during the forecast period (2025-2030).

The market was negatively impacted by the COVID-19 pandemic as it disrupted the main supply and manufacturing lines, leading to acute shortages. The main use of phosphoric acid is for producing fertilizers. The pandemic also led to a decrease in crop production, accompanied by a shortage of food and other essentials among people. After the pandemic, the market picked up speed, and the demand grew as major industries got back to work.

Key Highlights

- Since most phosphoric acid is used to make fertilizer, the rising demand from the fertilizer industry and increasing usage in the food and beverage industry are expected to drive market demand.

- Health hazards caused by phosphoric acid and the high price of fertilizers are expected to hinder the market's growth.

- Nevertheless, the recovery of rare earth elements from phosphoric acid and the commercialization of chiral phosphoric acid as a catalyst are expected to offer lucrative opportunities to the market.

- Asia-Pacific accounted for the highest market share, and the region is likely to dominate the market during the forecast period.

Phosphoric Acid Market Trends

Fertilizer Industry to Dominate the Market

- Phosphoric acid is basically an intermediate used to produce fertilizers. Fertilizers like monoammonium phosphate (MAP), diammonium phosphate (DAP), and trisodium phosphate (TSP) are produced from phosphoric acid.

- Phosphoric acid forms a key component for many fertilizers as it is a multi-function agent used for plant nutrition, pH adjustment, and cleansing irrigation equipment from lime precipitation. It is a rich source of phosphorus for plants.

- Phosphorus fertilizers are extremely important for the plant and provide better activities than organic fertilizers. Phosphorus accelerates the maturation of the plant and also provides the development of the roots. This is particularly important for dry areas.

- According to the Essential Chemical Industry, annually, more than 43 million metric tons of phosphoric acid are produced worldwide, of which about 90% are used to make fertilizers.

- According to the USDA Foreign Agricultural Service, China, Russia, the United States, India, and Canada produce more than 60% of the world's fertilizer nutrients combined. Russia and the United States each produce less than 10% of global fertilizers, while China produces approximately 25%.

- In September 2022, the US government announced programs worth USD 500 million to boost domestic fertilizer production, and the European Union is being urged to take similar action. Canada, already the world's largest supplier of potash fertilizers, announced in November 2022 that it will boost its fertilizer exports by 20% annually, filling a gap left by blocked shipments from other countries.

- According to the International Fertilizer Association (IFA), China is the largest user of fertilizer, consuming nearly one-quarter of global fertilizer supplies. In 2022, a total of 55.7 million tons of NPK fertilizer was produced in China. This was 55.44 million tons in 2021 and 54.96 million tons in 2020.

- Therefore, considering the growth trends and production of fertilizers in different regions worldwide, the fertilizer industry is likely to dominate the market, which, in turn, is expected to enhance the demand for phosphoric acid during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the phosphoric acid market in 2022 with a considerable volume share, and it is expected to maintain its dominance during the forecast period.

- This is due to China being the world's largest producer and consumer of fertilizer. In countries like China, India, and Southeast Asian nations, the demand for phosphoric acid has been increasing continuously.

- China accounts for approximately 7% of the overall agricultural acreage globally, thus feeding 22% of the world's population. The country is the largest producer of various crops, including rice, cotton, potatoes, and others. Hence, the demand for phosphoric acid, which is used in fertilizers, is rapidly increasing owing to the large-scale agricultural activities in the country.

- Phosphoric acid is also used extensively in the production of lithium-iron-phosphate batteries, and China is the dominant country in this field. In 2022, 44% of the total electric vehicles sold in China used LFP batteries, followed by 6% in Europe and 3% in the United States and Canada.

- India, another large fertilizer producer, is the second largest user. Much of India's usage is fueled by the Indian government's heavy subsidization of fertilizers. In the financial year 2022, over 42 million metric tons of fertilizers were produced in India. Fertilizer production in India peaked in the financial year 2020 at over 46 million metric tons. During the last few years, there has been a favorable policy facilitating investments in the public, cooperative, and private sectors.

- Phosphoric acid is also used in the food and beverage industries to acidify foods and beverages, such as various colas and jams, providing a tangy or sour taste. According to the US Department of Agriculture (USDA), the Indian food industry ranks as the third-largest food industry globally. The industry has been experiencing steady growth over the past several years, with India anticipated to become the largest food producer in the world. The country's food and grocery (F&G) retail market is projected to surpass USD 850 billion in sales by 2025.

- Hence, the reasons mentioned above are likely to fuel the growth of the phosphoric acid market in Asia-Pacific over the forecast period.

Phosphoric Acid Industry Overview

The phosphoric acid market is partially consolidated, with several companies operating on both global and regional levels. Some of the major players in the market (not in any particular order) include OCP Group, Mosaic, PhosAgro Group of Companies, Nutrien Ltd, and IFFCO, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Drivers

- 4.1.1 High Demand for Fertilizer Industry

- 4.1.2 Increasing Usage in the Food and Beverage Industry

- 4.2 Market Restraints

- 4.2.1 Health Hazards Caused by Phosphoric Acid

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Supplier

- 4.4.2 Bargaining Power of Buyer

- 4.4.3 Threat of New Entrant

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Price Trend Analysis of Phosphoric Acid (2018-2023)

- 4.6 Technological Snapshot

5 Market Segmentation (Market Size in Volume)

- 5.1 By End-user Industry

- 5.1.1 Fertilizer

- 5.1.2 Food and Beverages

- 5.1.3 Chemicals

- 5.1.4 Medicine

- 5.1.5 Metallurgy

- 5.1.6 Other End-user Industries

- 5.2 By Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Mexico

- 5.2.2.3 Canada

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Merger and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aditya Birla Chemicals

- 6.4.2 Agropolychim

- 6.4.3 EuroChem Group

- 6.4.4 ICL

- 6.4.5 IFFCO

- 6.4.6 Innophos

- 6.4.7 J.R. Simplot Company

- 6.4.8 Mosaic

- 6.4.9 Nutrien Ltd

- 6.4.10 Phosagro

- 6.4.11 Sterlite Copper (A Unit of Vedanta Limited)

7 Market Opportunities and Future Trends

- 7.1 Recovery of Rare Earth Elements from Phosphoric Acid

- 7.2 Commercialization of Chiral Phosporic Acid as a Catalyst