|

市场调查报告书

商品编码

1689957

软性电子产品隔热材料:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Flexible Insulation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

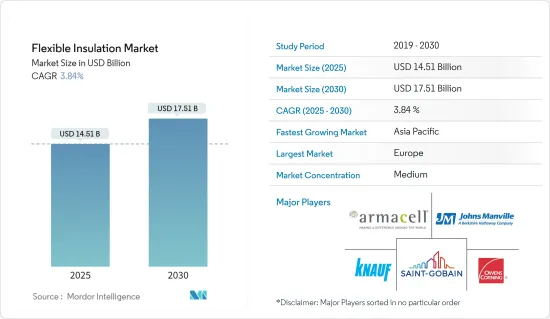

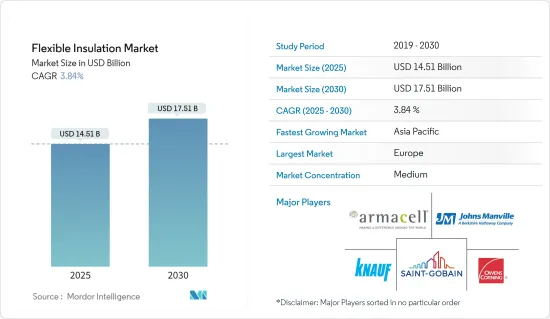

软性电子产品隔热市场规模预计在2025年为145.1亿美元,预计到2030年将达到175.1亿美元,预测期内(2025-2030年)的复合年增长率为3.84%。

主要亮点

- 建设产业对能源效率的需求不断增加以及柔性管道隔热材料应用的不断扩大预计将在未来几年推动软性电子产品隔热市场的发展。

- 然而,预计更好的替代品的出现将阻碍市场的成长。

- 预计在预测期内,电动汽车气凝胶隔热材料的新兴机会将为市场创造机会。

- 虽然欧洲预计将主导市场,但由于中国、印度和日本等国家的消费不断增加,预计亚太地区将以最高的复合年增长率成长。

软性电子产品隔热材料的市场趋势

玻璃纤维隔热材料需求不断增加

- 玻璃纤维由细玻璃纤维和高温黏合剂之间的极强结合组成。这些纤维(每根直径约 6-7 微米)的分布方式使得它们能够捕捉数百万个微小气穴,从而形成出色的隔热和隔音效果。玻璃纤维具有化学惰性,不含铁粒、硫和氯化物等杂质。

- 它无腐蚀性,不会发霉。它由可再生原材料製成,在生产的各个阶段都是环保的。它可用于多种隔热材料,如毯子(毡和捲)和鬆散填充物,也可用作硬质板和管道隔热材料。玻璃纤维隔热材料由沙子、石灰石、碱灰和回收玻璃玻璃屑的混合物製成。

- 两种玻璃纤维广泛用于住宅、商业和基础设施建设。一种类型是纤维状的,可製成柔性毯、刚性板、管道隔热材料和其他预製形状。它不易燃,并且具有出色的吸音性能。另一种类型是蜂窝状,以板材或块状形式存在,可加工成管道隔热材料和各种其他形状。结构强度高,但抗衝击性低。这种材质不易燃、不吸水,而且耐多种化学物质。主要用于工业烤箱、热交换器、干燥机、锅炉、管道等的绝缘。

- 美国等国家的建设活动正在增加,推动了对玻璃纤维软性电子产品隔热的需求。例如,根据美国人口普查局的数据,2023年美国年度建筑价值为19,787亿美元,与2022年相比增长约7.03%。

- 玻璃纤维隔热材料用于金属板管道、外壳和静压室的外部。它可形成半刚性至刚性板,也适用于绝缘冷冻和其他加热和冷却设备。它可以在 0°F (-18°C) 至 450°F (232°C) 的温度范围内使用。

- 最近,回收的窗玻璃、汽车玻璃和瓶子玻璃越来越多地被用作製造玻璃纤维。市场上可获得的再生材料的数量对再生内容做出了限制。使用回收材料有助于稳定减少製造隔热产品所需的能源。

- 由于上述因素,预计预测期内玻璃纤维隔热材料的需求将进一步增长。

欧洲主导市场

- 预计欧洲将成为柔性隔热材料的最大市场。欧盟提高建筑效率的指令导致了严格的建筑能源法规,预计将推动该地区对柔性隔热材料的需求。

- 德国等国家的建筑业对软性电子产品隔热材料的巨大需求是软性电子产品隔热材料市场成长的另一个原因。预测期内,德国的酒店建设预计也将激增。 2022 年,预计推出;2023 年,还将有 78 个计划开业,提供 13,073 间客房。预计 2024 年后酒店业发展仍将保持强劲势头,目前已有 153 个计划和 22,769 间客房在筹备中。

- 此外,英国的建筑计划数量正在激增,预计将推动未来对柔性隔热材料的需求。例如,根据《新伦敦建筑》的数据,伦敦有近 540 座高层建筑正在规划或建造中,而现有的高层建筑数量为 360 座。预计高层建筑建设的增加将推动所研究市场的发展。

- 在法国,建设产业的营业额指数近年来一直在缓慢成长。该国建设产业在经历八年的衰退之后,最近已恢復成长势头。生态与团结转型部表示,法国建筑许可总数已从 2023 年 12 月的 33,765 套增加到 2024 年 1 月的 26,585 套。

- 欧洲工业化进程迅速,拥有主要隔热材料製造商,是最早采用新兴材料并取得较高产品销售的地区之一。

- 因此,预计欧洲地区对软性电子产品隔热材料的需求不断增长将在预测期内推动市场研究。

软性电子产品隔热行业概况

软性电子产品隔热市场比较分散。市场的主要企业包括(不分先后顺序)Armacell、Knauf Group、Johns Manville、Owens Corning 和 Saint-Gobain。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 建设产业对能源效率的需求日益增加

- 扩大柔性管道隔热材料的使用

- 其他驱动因素

- 市场限制

- 替代产品的可用性

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 按材质

- 气凝胶

- 交联聚乙烯

- 合成橡胶

- 玻璃纤维

- 其他材料

- 按绝缘类型

- 隔音

- 电气绝缘

- 隔热材料

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 市场排名分析

- 主要企业策略

- 公司简介

- Altana AG

- Armacell

- Cabot Corporation

- Etex Group

- Fletcher Insulation

- Johns Manville

- Kingspan Group

- Knauf Insulation

- Owens Corning

- Saint-Gobain

- Superlon Holdings Berhad

- Thermaxx Jackets

第七章 市场机会与未来趋势

- 气凝胶隔热材料在电动车中的新机会

- 其他机会

简介目录

Product Code: 69527

The Flexible Insulation Market size is estimated at USD 14.51 billion in 2025, and is expected to reach USD 17.51 billion by 2030, at a CAGR of 3.84% during the forecast period (2025-2030).

Key Highlights

- The increasing demand for energy efficiency from the construction industry and the increasing application of flexible piping insulation are expected to drive the flexible insulation market in the coming years.

- However, the availability of better alternatives is expected to hinder the growth of the market.

- Emerging opportunities for aerogel insulation in electric vehicles are expected to create opportunities for the market during the forecast period.

- Europe is expected to dominate the market, while Asia-Pacific is expected to register the highest CAGR owing to the increasing consumption from countries such as China, India, and Japan.

Flexible Insulation Market Trends

Rising Demand for Fiberglass Insulation

- Fiberglass consists of extremely strong bonds between thin glass fibers and a high-temperature binder. These fibers (each of nearly 6-7 microns in diameter) are distributed to trap millions of tiny pockets of air in them, thereby creating excellent thermal and acoustic insulation. Fiberglass is chemically inert and has no impurities, such as iron shots, sulfur, or chloride.

- The product is non-corrosive and does not support mold growth. It is manufactured from renewable raw materials and is eco-friendly in every stage of manufacturing. It is used in different forms of insulation, such as blankets (batts and rolls) and loose-fill, and is also available as rigid boards and duct insulation. Fiberglass insulation is manufactured with a blend of sand, limestone, soda ash, and recycled glass cullet.

- Two types of fiberglass are extensively used in residential, commercial, and infrastructural construction. One is the fibrous one, which is available in flexible blankets, rigid boards, pipe insulation, and other pre-molded shapes. It is non-combustible and has good sound absorption qualities. The second one is the cellular type, which is available in board and block forms and capable of being fabricated into pipe insulation and various shapes. It has good structural strength but poor impact resistance. The material is non-combustible, non-absorptive, and resistant to many chemicals. It is mainly used to insulate industrial ovens, heat exchangers, driers, boilers, and pipe work.

- Construction activities are increasing in countries like the United States, which is increasing the demand for fiberglass flexible insulation. For instance, according to the US Census Bureau, the annual value for construction in the United States accounted for USD 1,978.7 billion in 2023, which is an increase of about 7.03% compared to that of 2022.

- Fibrous glass insulation is applied to the exterior of sheet metal ducts, housings, and plenums. It forms semi-rigid to rigid boards that are also suitable for insulating chillers and other cold or hot equipment. It can be used in applications within the temperature range of 0°F (-18°C) to 450°F (232°C).

- In recent times, recycled windows and automotive or bottle glass have been increasingly used in the manufacture of glass fiber. The amount of usable recycled material available in the market limits the recycled content. The use of recycled material has helped to reduce the energy required to produce insulation products steadily.

- Owing to the above-mentioned factors, the demand for fiberglass insulation is expected to grow further over the forecast period.

Europe to Dominate the Market

- Europe is projected to be the largest market for flexible insulation. Stringent building energy codes accompanied by EU Directives to enhance efficiency in buildings are expected to drive the demand for flexible insulation in the region.

- Robust demand for flexible insulation from the construction sector in countries like Germany is another reason for the growth of the flexible insulation market. The construction of hotels in Germany is also expected to witness a sharp rise during the forecast period. The year 2022 witnessed the launch of 89 new hotels and 15,780 rooms, and 78 more projects with 13,073 keys were mooted for 2023. The pipeline of hotels is anticipated to stay strong for 2024 and beyond, with 153 projects and 22,769 rooms already in the works.

- Moreover, various construction projects are active in the United Kingdom, which is expected to enhance the future demand for flexible insulation. For instance, according to New London Architecture, there are nearly 540 planned and under construction high-rise buildings in London, with an existing number of 360 tall buildings. The growing construction of high-rise buildings is estimated to drive the market studied.

- In France, the construction index has been witnessing slow growth, with a gradual increase in the industry turnover index over the past few years. The construction industry in the country recently gained momentum after eight long years of decline. The Ministere de la Transition ecologique et solidaire revealed an increase in total building permits in France to 26,585 Units in January 2024 from 33,765 Units in December 2023.

- Europe was an early adopter of emerging materials on account of rapid industrialization and the presence of major insulation product manufacturers, thus leading to high product sales.

- Thus, the growing demand for flexible insulation in the Europe region is expected to drive the market studied during the forecast period.

Flexible Insulation Industry Overview

The flexible insulation market is fragmented in nature. Some of the major players in the market include (not in any particular order) Armacell, Knauf Group, Johns Manville, Owens Corning, and Saint-Gobain, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand for Energy Efficiency from the Construction Industry

- 4.1.2 Increasing Application of Flexible Piping Insulation

- 4.1.3 Other Drivers

- 4.2 Market Restraints

- 4.2.1 Availability of Alternatives

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Material

- 5.1.1 Aerogel

- 5.1.2 Cross-Linked Polyethylene

- 5.1.3 Elastomer

- 5.1.4 Fiberglass

- 5.1.5 Other Materials

- 5.2 By Insulation Type

- 5.2.1 Acoustic Insulation

- 5.2.2 Electrical Insulation

- 5.2.3 Thermal Insulation

- 5.3 By Geography

- 5.3.1 Asia - Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia - Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Ranking Analysis

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Altana AG

- 6.3.2 Armacell

- 6.3.3 Cabot Corporation

- 6.3.4 Etex Group

- 6.3.5 Fletcher Insulation

- 6.3.6 Johns Manville

- 6.3.7 Kingspan Group

- 6.3.8 Knauf Insulation

- 6.3.9 Owens Corning

- 6.3.10 Saint-Gobain

- 6.3.11 Superlon Holdings Berhad

- 6.3.12 Thermaxx Jackets

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Opportunity for Aerogel Insulation in Electric Vehicles

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219