|

市场调查报告书

商品编码

1689958

不饱和聚酯树脂 (UPR):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Unsaturated Polyester Resin (UPR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

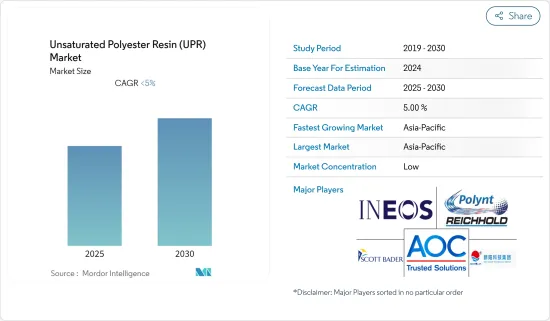

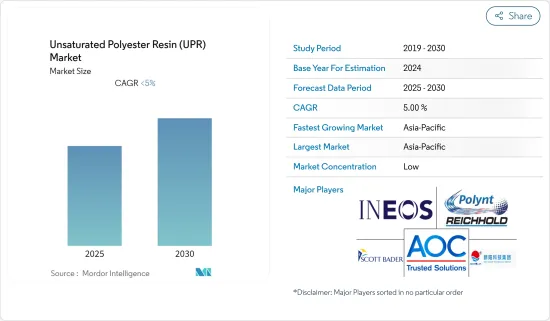

预测期内不饱和聚酯树脂 (UPR) 市场预计年复合成长率低于 5%

2020年,新冠疫情对市场产生了负面影响。不过,目前估计和预测市场已达到疫情前的水平,预计将稳定成长。

主要亮点

- 在预计预测期内,欧洲玻璃纤维增强塑胶 (GRP) 产量的增加和不饱和聚酯树脂 (UPR) 的优良性能将推动市场扩张。

- 然而,汽车行业的衰退预计将阻碍市场成长。

- UPR 疏水和疏冰诱导技术的进步是一个巨大的市场机会,预计将在未来几年推动市场的发展。

- 亚太地区占据最大的市场,由于中国、印度和日本等国家的消费量不断增加,预计将在预测期内成为成长最快的市场。

不饱和聚酯树脂 (UPR) 市场趋势

建设产业

- UPR 广泛应用于建筑工程,包括屋顶瓦片、建筑板、混凝土成型盘、增强材料、住宅结构复合材料、浴室配件等。

- 不饱和聚酯树脂 (UPR) 广泛用于生产玻璃增强塑胶 (GRP),可用于建设产业,如平板和波纹板、采光顶和天窗、排水沟、污水处理厂的完整盖板、洗手盆、淋浴设备间、天窗、门饰等。

- 建筑业在世界各地正在迅速扩张。例如,中国的成长主要得益于住宅和商业建筑业的快速扩张。中国正在推动并持续推动都市化进程,预计2030年都市化率将达70%。此外,中国建筑业产出在2021年达到峰值,约29.3兆元。因此,这些因素往往会增加全球对 UPR 的需求。

- 玻璃钢的优点如设计自由、产品尺寸精度高、与其他建筑材料相容性好等也是影响研究市场成长的因素。

- 玻璃纤维增强 UP 树脂因其能够承受水、酸、溶剂、氧化介质和变化的温度条件等恶劣条件的特性,在化工厂中得到了广泛的应用。

- 例如,投资3.75亿美元兴建的单硝基苯生产工厂。该计划预计于2024年第二季完工,韩国的产能为每年30万吨。

- 世界各地正在进行多座桥樑建设计划。例如在美国,拜登-哈里斯政府于2023年1月累计21亿美元建造和升级四座具有国家重要意义的桥樑。这些拨款将资助四座桥樑建设计划。这些计划可能会增加用于桥樑建造的不饱和聚酯树脂(UPR)的需求。

- 由于上述因素,预测期内建筑业很可能主导全球不饱和聚酯树脂 (UPR) 市场。

亚太地区占市场主导地位

- 预计亚太地区将由中国、印度和日本等主要消费国和生产国主导。

- 中国汽车产业的扩张预计将有利于不饱和聚酯树脂 (UPR) 的需求,因为其广泛应用于汽车产业。根据国际汽车工业组织(OICA)的数据,中国是最大的汽车生产国。光是中国在 2021 年就生产了 26,082,220 辆汽车。

- 此外,该地区的其他几个国家也正致力于加强其汽车产业,并大力投资电动车,以实现净零排放。例如,在日本,2021年交付的20,000辆新电动车中,超过8,600辆将是进口电动车。与去年相比,新进口外国电动车註册数量增加了约三倍。

- 印度电子业是全球成长最快的产业之一。 100% 外商直接投资 (FDI)、无需工业许可证以及从手动到自动化生产过程的技术转换等优惠的政府政策帮助国内电子製造业稳步扩张。

- 随着该展会在日本举办,日本建设产业预计将会蓬勃发展。东京将于2021年举办奥运会,大阪将于2025年举办世博会。日本的建设主要受重建和自然灾害復原的推动。

- 此外,亚洲、北美和太平洋地区的强劲需求,使得韩国建筑商的海外建筑订单在 2022 年连续第三年超过 300 亿美元。

- 因此,基于上述因素,预计亚太地区将在预测期内主导全球不饱和聚酯树脂 (UPR) 市场。

不饱和聚酯树脂(UPR)产业概况

不饱和聚酯树脂(UPR)市场比较分散。市场的主要企业包括(不分先后顺序)AOC、Polynt-Reichhold Group、INEOS、Scott Bader Company Ltd. 和信阳科技集团。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 欧洲对玻璃纤维增强塑胶 (GRP) 製造的需求不断增长

- 不饱和聚酯树脂 (UPR) 的理想特性

- 限制因素

- 汽车产业的挑战

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 类型

- 正交树脂

- 异松香

- 双环戊二烯 (DCPD)

- 其他类型

- 最终用户产业

- 建筑和施工

- 化学

- 电气和电子

- 油漆和涂料

- 运输

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- AOC

- BASF SE

- Crystic Resins India Pvt. Ltd

- DIC Corporation

- INEOS

- Interplastic Corporation

- Reichhold LLC

- Scott Bader Company Ltd

- Showa Denko KK

- Tianhe Resin

- Xinyang Technology Group

- Zhangzhou Yabang Chemical Co. Ltd

第七章 市场机会与未来趋势

- 不饱和聚酯树脂液压和低温诱导方法研究进展

简介目录

Product Code: 69530

The Unsaturated Polyester Resin Market is expected to register a CAGR of less than 5% during the forecast period.

COVID-19 negatively impacted the market in 2020. However, the market has now been estimated to have reached pre-pandemic levels and is forecasted to grow steadily.

Key Highlights

- The growing production of glass fiber-reinforced plastics (GRP) in Europe and the desirable properties of unsaturated polyester resins are expected to fuel market expansion over the projection period.

- However, a decline in the automotive industry is expected to hinder the market growth.

- Advancements in hydro and ice-phobic property induction methodologies of UPR are the key market opportunity expected to drive the market in the coming years.

- The Asia-Pacific region represents the largest market and is expected to be the fastest-growing market over the forecast period due to increasing consumption from countries such as China, India, and Japan.

Unsaturated Polyester Resin (UPR) Market Trends

Building and Construction Industry to Dominate the Market

- UPR is extensively used in the building and construction sector for tiles of roofs, building panels, concrete forming pans, reinforcement, household structure composites, bathroom accessories, etc.

- Unsaturated polyester resins are used significantly to produce glass fiber-reinforced plastic (GRP), which has applications in the building and construction industry for flat and corrugated sheets, light domes and skylights, rain gutters, complete covers for sewage water treatment plants, washbasins, shower cabins, dormer windows, and door ornaments.

- The building construction sector is expanding rapidly across the globe. For example, China's growth is fueled mainly by rapid expansion in the residential and commercial building sectors. China is encouraging and enduring a continuous urbanization process, with a projected rate of 70% by 2030. Also, China's construction output peaked in 2021 at a value of about 29.3 trillion yuan. As a result, these factors tend to increase the demand for UPR across the globe.

- The benefits of GRP, including the freedom of design, high dimensional accuracy of the product, and excellent compatibility with other construction materials, are also factors influencing the growth of the market studied.

- Glass fiber-reinforced UP resins are extensively used in chemical plants, owing to their properties to withstand harsh conditions, such as exposure to water, acids, and solvents, oxidizing media, and changing temperature conditions.

- Several chemical and pharmaceutical construction projects are going on across the globe that is expected to fuel the market growth-for example, the construction of a Mononitrobenzene manufacturing plant worth USD 375 million. The project is expected to finish in Q2 2024, with a production capacity of 300,000 tons per annum in South Korea.

- Several bridge construction projects are undergoing across the globe. For example, in the United States, in January 2023, Biden-Harris Administration accounted USD 2.1 Billion to construct and improve four nationally significant bridges. These grants will fund the construction of four bridge projects. These projects are likely to increase the demand for unsaturated polyester resins used in the construction of bridges.

- Owing to all of the factors above, the building and construction sector is likely to dominate the global unsaturated polyester resins market over the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate the market due to major consumer and producer countries, such as China, India, and Japan.

- The expansion of the automotive segment in China is anticipated to benefit the demand for unsaturated polyester resins as they are widely used in the automotive industry. According to the International Organization of Motor Vehicle Manufacturers (OICA), China is the largest producer of automobiles. The country alone produced 2,60,82,220 units of vehicles in 2021.

- Furthermore, several other countries in the region are putting efforts to enhance the Automotive sector by investing heavily in electric cars to achieve net zero emissions. For example, in Japan, over 8,600 of the 20,000 new EVs delivered in 2021 were imported electric vehicles. Compared to the previous year, the number of foreign automobile registrations of newly imported EVs increased nearly thrice.

- The Indian electronics industry is one of the fastest-growing industries globally. The domestic electronics manufacturing sector has been expanding at a steady rate, owing to favorable government policies, such as 100% foreign direct investment (FDI), no requirement for industrial licenses, and the technological transformation from manual to automatic production processes.

- The Japanese construction industry is expected to be blooming, owing to the events to be hosted in the country. Tokyo hosted the Olympics in 2021, and Osaka will host the World Expo in 2025. Construction in Japan is mainly driven by redevelopment and recovery from natural disasters.

- Furthermore, South Korean builders' overseas building orders have surpassed USD 30 billion for the third consecutive year in 2022, owing to strong demand from Asia, North American and Pacific Ocean regions.

- Hence, based on the aforementioned factors, the Asia-Pacific region is expected to dominate the global unsaturated polyester resins market over the forecast period.

Unsaturated Polyester Resin (UPR) Industry Overview

The unsaturated polyester resin market is fragmented in nature. Some of the major players in the market include AOC, Polynt-Reichhold Group, INEOS, Scott Bader Company Ltd., and Xinyang Technology Group, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Manufacturing Glass Fiber-reinforced Plastics (GRP) in Europe

- 4.1.2 Desirable Properties of Unsaturated Polyester Resins

- 4.2 Restraints

- 4.2.1 Challenges in Automotive Industry

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Ortho-resins

- 5.1.2 Isoresins

- 5.1.3 Dicyclopentadiene (DCPD)

- 5.1.4 Other Types

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Chemical

- 5.2.3 Electrical and Electronics

- 5.2.4 Paints and Coatings

- 5.2.5 Transportation

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AOC

- 6.4.2 BASF SE

- 6.4.3 Crystic Resins India Pvt. Ltd

- 6.4.4 DIC Corporation

- 6.4.5 INEOS

- 6.4.6 Interplastic Corporation

- 6.4.7 Reichhold LLC

- 6.4.8 Scott Bader Company Ltd

- 6.4.9 Showa Denko KK

- 6.4.10 Tianhe Resin

- 6.4.11 Xinyang Technology Group

- 6.4.12 Zhangzhou Yabang Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Hydro and Icephobic Property Induction Methodologies of UPR

02-2729-4219

+886-2-2729-4219