|

市场调查报告书

商品编码

1689959

物联网闸道 -市场占有率分析、产业趋势与统计、成长预测(2025-2032)IoT Gateway - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2032) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

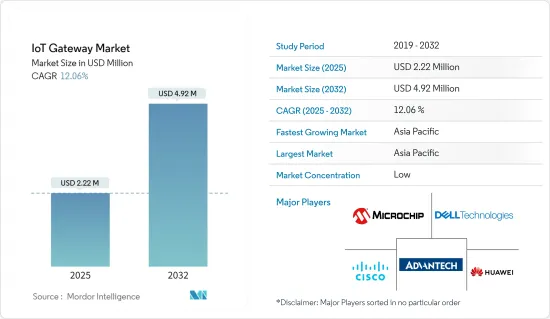

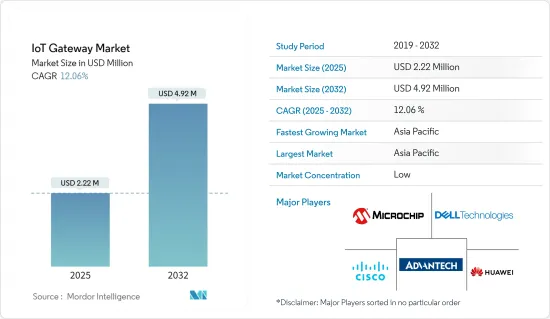

预计 2025 年物联网闸道市场规模为 222 万美元,到 2032 年将达到 492 万美元,预测期内(2025-2032 年)的复合年增长率为 12.06%。

物联网 (IoT) 彻底改变了装置和事物通讯和互动的方式。物联网闸道器是实现物联网设备与云端之间无摩擦通讯的关键中介。它是任何物联网架构的重要组成部分,因为它在整合来自感测器的资料、连接互联网和协调资料流方面发挥关键作用。随着各行各业的企业采用物联网解决方案来提高生产力、降低成本和改善决策流程,全球物联网闸道市场正在经历显着成长。

关键亮点

- 物联网设备和解决方案在许多行业的广泛使用导致对物联网闸道器的需求日益增长。随着越来越多的企业将物联网技术融入业务,对有效和安全的资料管理和传输的需求变得越来越迫切。随着边缘运算的发展,物联网闸道的功能不断增强。边缘运算将推动物连网网关的采用,它允许更靠近源头进行资料处理,从而减少延迟、频宽使用和对云端基础的资源的依赖。随着物联网设备的激增及其潜在漏洞的出现,确保强大的安全性和资料隐私已成为企业关注的首要问题。物联网闸道器充当安全层,提供加密、身份验证和安全资料传输。

- 物联网闸道市场的主要驱动因素包括专用 MCU 的成长、灵活的 SOC 类型设计以及新兴国家智慧城市的兴起。在系统晶片(SoC) 内开发电子电路具有显着的优势,包括提高效率和相容性,同时减少空间需求和开发速度。包含无线技术的 SoC 的物联网有助于避免网路整合、不相容和可靠性问题等实施挑战。

- 随着智慧城市的发展和基于物联网的解决方案融入城市基础设施,对物联网闸道器进行妥善管理各种设备和资料流的需求日益增加。基于 IIoT 的解决方案将融入城市基础设施。随着工业部门采用 IIoT 应用来提高业务效率并获得即时洞察,对工业级物联网闸道的需求正在显着增长。

- 阻碍物联网网关市场成长的挑战包括对用户资料安全和隐私的担忧,以及缺乏物联网技术的通用通讯协定和通讯标准。物联网技术的标准化通讯协定正处于开发阶段。然而,由于标准通讯协定预计将在未来几年内出台,因此这项挑战的影响将在未来几年逐渐减弱。

- 后疫情时代,许多产业的物联网应用都出现了成长。物联网闸道已在医疗保健、製造业、农业和运输等多个行业中找到了新的案例和潜在应用。该农场使用物联网网关和感测器来监测土壤水分、温度和湿度。这使得灌溉和资源管理更加精准,进而提高农业生产力。

物联网闸道市场趋势

蓝牙领域占据主要市场占有率

- 蓝牙网关将基于蓝牙的产品连接到其他装置和硬体。该网关旨在以无线方式从蓝牙设备收集资料并透过互联网网路传输到云端。路由器和网关即时从蓝牙 BLE 信标和感测器产品发送和接收资料。

- 功耗是近距离无线通讯技术中最重要的问题之一。高功耗的设备不应用于行动应用,并且应该由稳定电源而不是电池供电。当比较Zigbee和BLE的功耗时,BLE技术的功耗最低。

- 此外,RDF(无线电测向)和RSSI(接收讯号强度指示器)技术使蓝牙追踪讯号方向和强度以定位设备的能力提高了四倍,从而有利于在更多物联网设备中接受先进的蓝牙应用。

- 蓝牙连接已成为物联网的首选技术,因为它可以释放创造性的应用,加速未来智慧生活的发展——从智慧照明、智慧医疗、智慧建筑到智慧城市。此外,根据制定蓝牙标准的蓝牙技术联盟(Bluetooth SIG)的《蓝牙市场更新报告》,预测期内蓝牙装置网路装置的年出货量预计将成长 2.63 倍,达到 16.3 亿台。

- 支援蓝牙连接的物联网网关具有低功耗运行的优势,这支持了基于蓝牙的物联网网关市场的成长。此外,智慧建筑和零售领域对物联网闸道器的温度监控需求正在产生包括蓝牙闸道在内的市场需求,这推动了预测期内全球物联网闸道市场的成长。

亚太地区占市场主导地位

- 印度工业部门正在迅速采用物联网技术来提高业务效率、减少停机时间并优化资源利用率。工业物联网 (IIoT) 解决方案的日益普及正在推动印度对工业应用物联网闸道的需求。

- 在「数位印度」和「智慧城市」等政府措施的推动下,印度的物联网生态系统正在迅速扩张。该国庞大的人口、不断增长的智慧型手机普及率以及发达的连接基础设施正在加速各行各业采用物联网解决方案。物联网网关透过实现物联网设备和云端之间的一致网路和资讯交流,成为此生态系统的重要组成部分。

- 大中华区既是工业IoT的庞大市场,也是构成物联网基础的感测器、微晶片和其他组件的组件技术的主要供应商。此外,最初使用物联网来提高效率的中国製造商现在看到了其增加收益和管理风险的潜力。因此,随着中国向更有效率的发电方式转型,以及企业寻求替代方案在该地区更贴近新客户生产产品,泰国、印尼和越南等国家预计将变得更加重要。

- 在政府的大力支持、工业IoT的采用以及连接基础设施的进步的推动下,中国的物联网网关市场正在经历显着的成长和转型。随着中国持续注重技术创新和数位转型,物联网闸道市场预计将进一步扩大,并为国内外参与企业带来机会。

- 日本拥有强大的技术生态系统,主要企业和研究机构积极参与开发和部署物联网解决方案。日本的工程专业知识和研究能力正在促进物联网闸道器和相关技术的创新和进步。

- 该研究涵盖的其他亚太地区国家包括韩国、澳洲和台湾等,但它们各自的贡献并不显着。相反,整体捐款占了更大的份额。

物联网网关产业概览

该市场由思科系统公司和戴尔公司等老字型大小企业组成,这些公司在改进其产品技术方面投入了大量资金。这些参与企业的存在和不断的创新活动使得市场竞争激烈。市场参与企业正在进行研究,以加强其分销管道和影响力,并为其产品提供最新规格,从而获得竞争优势。公司正试图透过采取联盟和收购等强有力的竞争策略来扩大其在市场上的产品供应。由于该市场资本密集的特性,退出门槛相当高。这意味着市场参与企业面临激烈的竞争。市场上其他主要企业包括研华、微晶片科技公司和华为技术有限公司。

- 2023年7月-研华推出全新数位商务平台“IoTMart International”,协助跨国线上商务服务。该平台是对研华现有销售模式的补充。该平台是对研华现有分销模式的补充,旨在满足不同客户群的多样化需求,特别关注中小型客户的需求。

- 2023 年 5 月 - 专业IT基础设施和服务公司 NTT Ltd 与思科联手创建并实施了一项协作解决方案,有效支援领先组织的永续发展目标。利用 NTT 的边缘即服务 (EaaS) 产品组合和思科的物联网功能,两家公司的共同努力将实现即时资料分析、增强安全措施、改进决策流程,并透过预测性维护、资产追踪和供应链管理功能降低营运成本。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 专用 MCU 和灵活的 SOC 类型设计的成长

- 智慧城市的新兴发展

- 市场限制

- 用户资料安全和隐私问题

- 物联网技术缺乏通用通讯协定和通讯标准

第六章市场区隔

- 按组件

- 处理器

- 感应器

- 记忆体和储存设备

- 其他的

- 连结性别

- Bluetooth

- Wi-Fi

- ZigBee

- 乙太网路

- 蜂巢

- 其他连线类型

- 按最终用户

- 汽车和运输

- 医疗保健

- 工业的

- 消费性电子产品

- BFSI

- 石油和天然气

- 零售

- 航太与国防

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章竞争格局

- 公司简介

- Cisco Systems Inc.

- Advantech Co. Ltd

- Dell Inc.

- Microchip Technology Inc.

- Huawei Technologies Co. Ltd

- Hewlett Packard Enterprise Development LP

- Samsara Networks Inc.

- Eurotech Inc.

- ADLINK Technology Inc.

- Kontron S& T AG

第八章投资分析

第九章:市场的未来

The IoT Gateway Market size is estimated at USD 2.22 million in 2025, and is expected to reach USD 4.92 million by 2032, at a CAGR of 12.06% during the forecast period (2025-2032).

. The communication and interaction between devices and objects have been completely transformed by the Internet of Things (IoT). IoT gateways are key intermediaries in enabling frictionless communication between IoT devices and the cloud. They are critical parts of any IoT architecture since they play a crucial role in combining data from sensors, connecting to the internet, and regulating data flow. The global IoT gateway market has grown significantly as businesses from various industries implement IoT solutions to increase productivity, cut costs, and improve decision-making processes.

Key Highlights

- The need for IoT gateways has increased as a result of the widespread use of IoT devices and solutions in numerous industries. The necessity for effective and secure data management and transmission is becoming increasingly important as more businesses incorporate IoT technology into their operations. The capabilities of IoT gateways have improved with the development of edge computing. IoT gateway adoption is facilitated by edge computing, which enables processing data closer to the source, lowering latency, bandwidth usage, and dependency on cloud-based resources. Making sure there is strong security and data privacy has become a top concern for enterprises due to the increasing number of IoT devices and potential vulnerabilities. IoT gateways provide encryption, authentication, and safe data transport, acting as a security layer.

- The key drivers for the IoT gateway market include the growth of application-specific MCUs, flexible SOC-type designs, and the emerging development of smart cities. Building electronic circuits within a system-on-chip (SoC) has significant benefits, such as improving efficiency and compatibility while reducing space requirements and development speed. IoT with SoC, including wireless technology, helps prevent the implementation challenges, such as network integration, incompatibility, and reliability issues.

- IoT gateways are increasingly needed to properly manage a variety of devices and data streams as smart cities are developed and IoT-based solutions are integrated into urban infrastructure. The adoption of IIoT-based solutions is integrated into urban infrastructure. The adoption of IIoT applications by the industrial sector to increase operational effectiveness and obtain real-time insights has greatly increased demand for industrial-grade IoT gateways.

- The factors challenging the growth of the IoT gateway market include concerns regarding the security and privacy of user data and the lack of common protocols and communication standards of IoT technology. The standardization communication protocols of IoT technology are at a developing stage. However, the standard protocols are expected to happen in the next few years, making the impact of the challenge gradually low in the next few years.

- The post-COVID-19 era recorded the growth of IoT applications across numerous industries. IoT gateways discovered new cases and potential for adoption in industries ranging from healthcare and manufacturing to agriculture and transportation. Farms were monitored for soil moisture, temperature, and humidity using IoT gateways and sensors. This allowed for precise irrigation and resource management, which enhanced agricultural productivity.

IoT Gateway Market Trends

Bluetooth Segment Holds Major Market Share

- Bluetooth gateway connects Bluetooth-based products to other devices or hardware. Gateways are designed to collect data wirelessly from Bluetooth devices and then transfer it to the cloud via internet networks. Routers or gateways transmit and receive real-time data from Bluetooth BLE beacons and sensor products.

- Power consumption is among the most essential issues in short-range wireless communication technologies. Devices with high power consumption should not be used for mobile applications and should instead be used with a steady power source rather than a battery. While comparing Zigbee and BLE power consumption, BLE technology offers the lowest energy consumption.

- Further, Radio Direction Finding( RDF) and Received Signal Strength Indicator (RSSI) technologies have quadrupled Bluetooth's ability to locate devices by tracing the direction and strength of signals, which increases the acceptance of advanced Bluetooth applications into many IoT devices.

- Bluetooth connectivity has become a preferred technology of the IoT because it unlocks creative applications accelerating the future of intelligent living through smart lighting, smart healthcare, and intelligent buildings to smart cities. Additionally, according to the Bluetooth Market Update report by Bluetooth SIG, a company developing Bluetooth standards, the annual shipments of Bluetooth device network devices would achieve 2.63 times growth from during the forecast period, reaching 1.63 billion.

- The advantage of Bluetooth connectivity supported IOT gateways for IOT applications can be operated with low power consumption, which supports the market growth of Bluetooth-based IOT gateways in the market. In addition, the demand for IOT gateways in smart buildings and retail sector temperature monitoring is creating a demand for the market, including Bluetooth-enabled gateways, which is driving the market growth of IOT gateways worldwide during the forecast period.

Asia Pacific to Dominate the Market

- The industrial sector in India is rapidly adopting IoT technologies to enhance operational efficiency, reduce downtime, and optimize resource utilization. The increasing adoption of IIoT solutions is driving the demand for IoT gateways tailored to industrial applications in India.

- India's IoT ecosystem is rapidly expanding, fueled by government initiatives such as Digital India and Smart Cities Mission. The country's vast population, rising smartphone penetration, and increasing connectivity infrastructure drive IoT solutions adoption across industries. IoT gateways form a critical part of this ecosystem by enabling consistent network and information exchange between IoT gadgets and the cloud.

- Greater China is both a huge market for industrial IoT and a major supplier of component technologies, which consist of sensors, microchips, and other components that are the fabric of IoT. Also, after initially using IoT to drive efficiency improvement, Chinese manufacturers are focused on the potential for revenue growth and risk management. As a result, nations such as Thailand, Indonesia, and Vietnam are anticipated to become more vital as China shifts to more efficient generation as companies look for alternative ways to manufacture items closer to new clients within the region.

- The IoT gateway market in China is witnessing significant growth and transformation, driven by strong government support, industrial IoT adoption, and advancements in connectivity infrastructure. As China continues its focus on technological innovation and digital transformation, the IoT gateway market is expected to witness further expansion and opportunities for both domestic and international players.

- Japan has a robust technological ecosystem, with leading companies and research institutions actively involved in developing and deploying IoT solutions. The country's engineering expertise and research capabilities have contributed to the innovation and advancement of IoT gateways and related technologies.

- The rest of the Asia-Pacific region in the study considers the countries like South Korea, Australia, and Taiwan, which individually have a minor contribution. Rather, the collective contribution account for a significant share.

IoT Gateway Industry Overview

The market consists of long-standing established players, such as Cisco Systems Inc. and Dell Inc., which have made significant investments to improve product technology. The presence of these players and their constant innovative activities are intensifying the competition in the market studied. The players in the market are engaging in research in order to achieve a competitive edge by strengthening their distribution channels and presence, as well as by offering the latest specifications in their products. The companies are striving to expand their offerings in the market by employing powerful competitive strategies, such as partnerships and acquisitions. Owing to the capital-intensive nature of the market, the barriers to exit are considerably high. Hence, the players in the market are subjected to intense competition. Some other major players in the market include Advantech Co. Ltd, Microchip Technology Inc., Huawei Technologies Co. Ltd, etc.

- July 2023 - Advantech introduced a new digital commerce platform, IoTMart International, to facilitate cross-border online business services. This platform complements Advantech's existing distribution model. It is specifically designed to cater to the diverse requirements of different customer segments, particularly focusing on the needs of small and medium-sized customers.

- May 2023 - NTT Ltd, a company specializing in IT infrastructure and services, and Cisco joined forces to create and implement collaborative solutions that effectively aid the sustainability objectives of major organizations. By utilizing NTT's Edge as a Service portfolio and Cisco's IoT capabilities, the combined efforts of the two companies will deliver real-time data analysis, heightened security measures, better decision-making processes, and reduced operational expenses through predictive maintenance, asset tracking, and supply chain management capabilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Application-specific MCUs and Flexible SOC-type Designs

- 5.1.2 Emerging Development of Smart Cities

- 5.2 Market Restraints

- 5.2.1 Concerns Regarding the Security and Privacy of the User Data

- 5.2.2 Lack of Common Protocols and Communication Standards of IoT Technology

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Processor

- 6.1.2 Sensor

- 6.1.3 Memory and Storage Device

- 6.1.4 Other Components

- 6.2 By Connectivity

- 6.2.1 Bluetooth

- 6.2.2 Wi-Fi

- 6.2.3 ZigBee

- 6.2.4 Ethernet

- 6.2.5 Cellular

- 6.2.6 Other Connectivity Types

- 6.3 By End User

- 6.3.1 Automotive and Transportation

- 6.3.2 Healthcare

- 6.3.3 Industrial

- 6.3.4 Consumer Electronics

- 6.3.5 BFSI

- 6.3.6 Oil and Gas

- 6.3.7 Retail

- 6.3.8 Aerospace and Defense

- 6.3.9 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 India

- 6.4.3.2 China

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Advantech Co. Ltd

- 7.1.3 Dell Inc.

- 7.1.4 Microchip Technology Inc.

- 7.1.5 Huawei Technologies Co. Ltd

- 7.1.6 Hewlett Packard Enterprise Development LP

- 7.1.7 Samsara Networks Inc.

- 7.1.8 Eurotech Inc.

- 7.1.9 ADLINK Technology Inc.

- 7.1.10 Kontron S&T AG