|

市场调查报告书

商品编码

1689970

线性运动系统-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Linear Motion System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

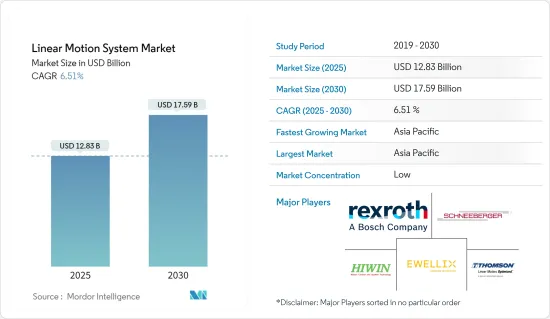

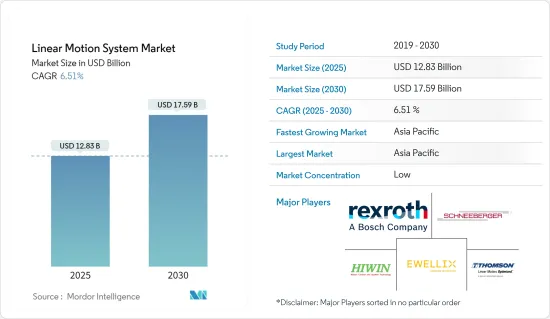

线性运动系统市场规模预计在 2025 年为 128.3 亿美元,预计到 2030 年将达到 175.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.51%。

主要亮点

- 直线运动系统具有多种优点,包括沿着单一平面平稳、可靠的运动、高定位精度,以及以优异的推力实现高加速度和长行程距离的能力。此外,线性运动技术可以快速且轻鬆地应用到现有系统和新系统中,从而实现更大的生产弹性。

- 此外,还有许多因素推动市场的发展,包括从液压和气压系统转变为电子机械系统的技术转变,这种系统可以提供更高的精度、灵活性、可靠性和效率,同时减少能源消耗。这些系统由于在恶劣的工业环境条件下表现出色而需求量很大。在包装和自动化等工业领域,目前的趋势是从液压缸和气压转向电动线性致动器。其主要目的是在安装电动线性致动器的机器和系统的自动化和详细客製化中提供更好的控制和更大的多功能性。

- 线性运动系统在製造业有广泛的应用。它们用于设备和产品的精确定位,适用于自动化製造流程。这些系统用于包装和堆迭、拾取和放置操作、物料输送、精密加工、产品组装和拆卸、检查和品管、模具製造等。

- 安装时间是市场的关键问题。零件数量众多,导致安装过程漫长而复杂。为了实现正确的运动,所有相应的部件必须仔细、精确地定位和固定。例如,如果导螺桿和线性滑轨在两个轴上不平行,则很可能会发生卡住,整个驱动机构将失速。

- 在后疫情时代,汽车、家电、医疗保健等产业的需求不断增加,预计将推动所研究市场的需求。

直线运动系统市场趋势

电子和半导体产业强劲成长

- 电子和半导体产业以各种方式利用线性运动系统来支援製造流程和设备。这些系统通常用于晶圆处理、检查和测试、组装和包装、雷射加工等。

- 製造电子设备需要几个步骤,其中涉及定位、对准、测试和放置其他测试设备等多个接触和放置活动。製造过程中的反覆搬运和移动是增加设备损坏风险的重要因素。运动系统等自动化系统有助于避免过程中的风险。

- 电子和半导体行业越来越多地采用线性运动系统预计将推动市场成长。生产成本下降、製造技术改进、自动化程度提高、先进设备需求增加以及持续投资等因素推动全球电子和半导体产业的成长,从而推动了对直线运动系统的需求。

- 电子和半导体产业利用线性运动系统进行多种应用,因为它们具有许多优势。为了满足半导体产业的需求,平滑度、低噪音和高速度的结合是必要的。圆形球路径可实现高价值晶圆加工设备中经常需要的快速、平稳和安静的运动。

- 精密测量和检测设备中直线运动部件的小型化正在推动市场的发展。蓬勃发展的电子、半导体和相关产业使用微型线性运动部件作为各种操作的关键部件,包括用于製造高价值电脑和办公室自动化产品的小型精密机器和机器人。直线运动导轨是精密自动化产业不可或缺的部件。

- 线性运动系统广泛应用于半导体工业的各种应用。其主要应用之一是半导体晶片的製造过程。直线运动导轨在製造过程中运输晶圆和其他材料起着至关重要的作用。它确保输送顺畅、精确且可重复,这对于生产高品质、可靠的晶片至关重要。它们也用于半导体检查和测试设备中以实现精确定位。

- 例如,晶圆检测设备严重依赖线性运动系统来确保扫描和缺陷检测的准确性。设备必须在高速下保持精确、一致的运动,这只有透过高品质的线性运动系统才能实现。根据半导体产业协会(SIA)预测,2022年全球半导体销售额将达到5,801.3亿美元,到2023年中期将超过5,500亿美元。

亚太地区可望主导市场

- 由于工业活动的增加、技术的进步、政府对工业自动化系统的投资增加以及提供这些系统的老字型大小企业的存在,亚太地区的线性运动系统市场预计将显着增长。

- 该地区是汽车、食品饮料和机械製造等行业的中心。除此之外,该地区还拥有庞大的半导体产业。各个应用领域日益趋向小型化,推动了各种直线运动系统产量的增加。

- 此外,线性致动器和其他系统的广泛采用也有望推动市场的发展。由于中国庞大的电子和汽车製造业越来越多地采用运动系统,中国在该地区占据主导地位。印度等其他新兴经济体市场也正在快速发展,市场发展潜力大。

- 技术从气压和液压系统转向电子机械系统,以满足对灵活性、可靠性、高精度以及透过减少能源使用来提高效率日益增长的需求,这些是预计推动线性运动系统需求的一些原因。预计这将促进市场成长。机械化推动效率的成长趋势预计将持续并维持工业发展,尤其是在亚太地区。

- 此外,汽车行业向自动驾驶汽车和电气化的转变为汽车行业的线性运动系统创造了巨大的机会。汽车製造过程中自动化程度的不断提高,加上数位化和人工智慧的参与,正在扩大汽车领域对各种线性运动系统的需求。

直线运动系统行业概况

线性运动系统市场是一个竞争激烈的市场领域,多家全球公司都在争取关注。考虑到安全问题,与公司相关的品牌识别对市场有重大影响。线性运动系统在亚太地区等许多成长地区的应用日益广泛。

此外,在新的领域中也发现了潜在的应用,这意味着基本客群将会扩大。预计这将为市场公司开闢更多机会并减少竞争对手之间的敌意。总体而言,我们预期竞争对手之间的敌意将适度增加。市场的主要参与者包括博世力士乐股份公司(罗伯特博世有限公司)、施耐博格集团、伊维莱克斯集团(舍弗勒集团)、上银公司、汤姆森工业公司(Regal Rexnord 公司)等。

2023 年 3 月,国际领先的先进线性运动技术创新者和製造商 Ewellix 推出了全新的 e-MOVEKIT,帮助行动机器设计师和製造商简化电动线性驱动系统的规格、组装和测试。

2023 年 1 月,汤姆森工业公司推出了一系列紧凑型线性系统,帮助运动设计师在狭小空间内实现复杂的应用。需要在单一紧凑单元中提供推力和轴承支撑的设计人员现在可以使用多功能、久经考验的 Thomson 组件来建造此类应用。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 产业价值链分析

- 评估主要宏观经济趋势的影响

- 技术简介

- 功率元件(马达、驱动器、控制设备)

- 推力机构(致动器)

- 引导基础设施(直线导轨)

第五章市场动态

- 市场驱动因素

- 初级包装自动化需求不断成长

- 工业数位化以及对品质检验和安全日益增长的兴趣

- 市场限制

- 直线运动系统的设计和安装前置作业时间高成本

- 由于材料浪费严重且需要客製化,不适合大规模生产

第六章市场区隔

- 按类型

- 单轴线性运动系统

- 多轴线性运动系统

- 按最终用户产业

- 车

- 电子和半导体

- 製造业

- 航太

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Bosch Rexroth AG(Robert Bosch GmbH)

- Schneeberger Group

- Ewellix AB(Schaeffler Group)

- Hiwin Corporation

- Thomson Industries Inc.(Regal Rexnord Corporation)

- Nippon Bearing Co. Ltd

- NSK Ltd

- HepcoMotion Inc.(Hepco Group)

- THK Co. Ltd

- The Timken Company

- Rockwell Automation Inc.

- Parker Hannifin Corporation

- Lintech Corporation

第八章投资分析

第九章:市场的未来

The Linear Motion System Market size is estimated at USD 12.83 billion in 2025, and is expected to reach USD 17.59 billion by 2030, at a CAGR of 6.51% during the forecast period (2025-2030).

Key Highlights

- Linear motion systems provide a range of benefits, including smooth and reliable motion along a single plane, high positioning accuracies, and the ability to achieve high acceleration rates and long travel lengths with good thrust forces. Additionally, linear motion technology can increase production flexibility by allowing for quick and easy implementation in both existing and new systems.

- Further, the market is driven by many factors, including the shift in technology from hydraulic and pneumatic systems toward electromechanical systems to achieve higher precision, flexibility, reliability, and efficiency with less energy usage. These systems are in high demand due to their superior performance in extreme environmental conditions in industries. With reference to some industrial fields, such as packaging and automatic machines, the current trend is the transition from using hydraulic or pneumatic cylinders to electric linear actuators. The primary purpose is to have better control and greater versatility in automation and detailed customization of the machine or system in which the electric linear actuator is mounted.

- Linear motion systems have a diverse range of applications in manufacturing. They are used to provide precise and accurate positioning of equipment and products, making them suitable for use in automated manufacturing processes. These systems are used in packaging & palletizing, pick & place operations, material handling, precision machining, assembly & disassembly of products, inspection& quality control, die making, etc.

- Installation time is a significant challenge for the market. The high component count contributes to a longer and more complex installation process. All corresponding components need to be carefully and correctly positioned and secured for a proper motion to occur. For example, if the lead screw and linear guides are not parallel with one another in both axes, there is a high likelihood of binding occurring, causing the entire drive mechanism to stall out.

- The demand from industries like automotive, consumer electronics, and healthcare has increased in the post-pandemic situation, and this is anticipated to boost the demand for the market studied.

Linear Motion System Market Trends

Electronics and Semiconductor to Witness Major Growth

- The electronics and semiconductor industries utilize linear motion systems in various ways to support their manufacturing processes and equipment. These systems are commonly used in wafer handling, inspection and testing, assembly and packaging, and laser processing, among others.

- There are several processes required to create an electronic device, and these processes entail several touches and placement activities that position, align, examine, and other test equipment. Repeated handling and movement during the manufacturing process are critical components that raise equipment damage risk. An automation system, such as a motion system, is helpful in avoiding risk during the process.

- Increased adoption of linear motion systems in the electronics and semiconductor industry is expected to drive the market's growth. Factors like falling production costs, improving fabrication techniques, increasing adoption of automation, growing demand for advanced equipment, and ongoing investments will propel growth in the global electronics and semiconductor industry, thus driving the demand for linear motion systems.

- The electronic and semiconductor industries utilize linear motion systems for multiple applications due to the benefits they provide. Smoothness combined with low noise and high-speed capabilities is necessary to meet the demands of the semiconductor industry. The circular ball path enables fast, smooth, and quiet movement, often required by high-value wafer processing equipment.

- The miniaturization of the linear motion component in precision measurement and inspection instruments drives the market. The fast growth of electronics, semiconductors, and their peripheral industries uses miniature linear motion components as a major component in their various operations, such as compact precision machinery and robots for the fabrication of high-value computer and office automation products. A linear motion guide is a vital component of the precision automation industry.

- Linear motion systems are widely used in the semiconductor industry for various applications. One of their primary uses is in the manufacturing process of semiconductor chips. They play a crucial role in transferring wafers and other materials during production. They ensure that the transfer is smooth, precise, and repeatable, which is critical for producing high-quality, reliable chips. They are also used in semiconductor inspection and testing equipment, where they are used for precision positioning.

- For instance, wafer inspection equipment relies heavily on linear motion systems to ensure accuracy during scanning and defect detection. The equipment must maintain precise and consistent motion at high speeds, which can only be achieved through the use of high-quality linear motion systems. According to Semiconductor Industry Association (SIA), in 2022, semiconductor sales reached USD 580.13 billion worldwide; it is estimated that semiconductor sales will cross USD 550 billion by mid-2023.

Asia Pacific Expected to Dominate the Market

- Asia-Pacific is anticipated to witness significant growth in the linear motion system market owing to an increase in industrial activities, technological advancements, the rise in government investments in industrial automation systems, and the presence of well-established players providing these systems.

- The region has several industries, including automotive, pharmaceutical, food and beverages, and machine manufacturing. Apart from these, the region is also home to a large semiconductor industry. The increasing degree of miniaturization in various fields of applications leads to a rise in the production of different linear motion systems.

- The significant adoption of linear actuators and other systems is also expected to drive the market. China dominates the region due to the increased adoption of motion systems from the vast deployment of the massive electronic and automotive manufacturing sectors. As the market also develops at high speed in other regional economies, such as India, there is enormous potential for growth in the market studied.

- The shift in technology from pneumatic and hydraulic systems toward electromechanical systems to meet the increasing demand for flexibility, reliability, higher precision, and greater efficiency with reduced energy usage are some of the reasons that are expected to drive the demand for linear motion systems. This, in turn, is expected to boost the growth of the market. The growing trend of machinery to facilitate greater efficiency is expected to continue and sustain industrial development, especially in Asia-Pacific.

- Further, the automobile industry's shift toward autonomous and electrified vehicles has created a massive opportunity for linear motion systems in the automotive industry. The need for various linear motion systems is expanding in the automotive sector due to the increased adoption of automation in the automotive manufacturing process and the involvement of digitalization and AI.

Linear Motion System Industry Overview

The Linear Motion System Market comprises several global players vying for attention in a fairly contested market space. Considering the security concerns, the brand identity associated with the companies significantly influences the market. Linear motion systems are in the process of adoption in many growing regions, such as Asia-Pacific.

Additionally, it is finding potential for utilization in new sectors as well, indicating the expansion of the customer base. This is expected to reduce the competitive rivalry as more opportunities for the market players will open. Overall, the intensity of competitive rivalry is expected to be moderately high. Some of the major players in the market are Bosch Rexroth AG (Robert Bosch GmbH), Schneeberger Group, Ewellix AB (Schaeffler Group), Hiwin Corporation, Thomson Industries Inc. (Regal Rexnord Corporation), etc.

In March 2023, Ewellix, the significant international innovator and manufacturer of advanced linear motion technologies, announced a new e-MOVEKIT to help designers and manufacturers of mobile machinery simplify the specification, assembly, and testing of electric linear actuation systems.

In January 2023, Thomson Industries Inc. introduced a family of compact linear systems to help motion designers implement complex applications in small spaces. Designers who require thrust and bearing support in a single, compact unit can now build such applications using versatile, time-tested Thomson components.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 An Assessment of the Impact of Key Macroeconomic Trends

- 4.5 Technology Snapshot

- 4.5.1 Power Components (Motors, Drives, and Controls)

- 4.5.2 Thrust Mechanism (Actuator)

- 4.5.3 Guidance Infrastructure (Linear Rail)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Automation in Primary Packaging

- 5.1.2 Digital Transformation in Industries and Growing Focus on Quality Inspection and Safety

- 5.2 Market Restraints

- 5.2.1 Increased Lead Time High Cost of Designing and Installation of Linear Motion System

- 5.2.2 Not Suitable for Mass Production Owing to High Material Wastage and Customized Needs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Single-axis Linear Motion System

- 6.1.2 Multi-axis Linear Motion System

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Electronics and Semiconductor

- 6.2.3 Manufacturing

- 6.2.4 Aerospace

- 6.2.5 Healthcare

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Bosch Rexroth AG (Robert Bosch GmbH)

- 7.1.2 Schneeberger Group

- 7.1.3 Ewellix AB (Schaeffler Group)

- 7.1.4 Hiwin Corporation

- 7.1.5 Thomson Industries Inc. (Regal Rexnord Corporation)

- 7.1.6 Nippon Bearing Co. Ltd

- 7.1.7 NSK Ltd

- 7.1.8 HepcoMotion Inc. (Hepco Group)

- 7.1.9 THK Co. Ltd

- 7.1.10 The Timken Company

- 7.1.11 Rockwell Automation Inc.

- 7.1.12 Parker Hannifin Corporation

- 7.1.13 Lintech Corporation