|

市场调查报告书

商品编码

1690060

MRAM:市场占有率分析、产业趋势与统计、成长预测(2025-2030)MRAM - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

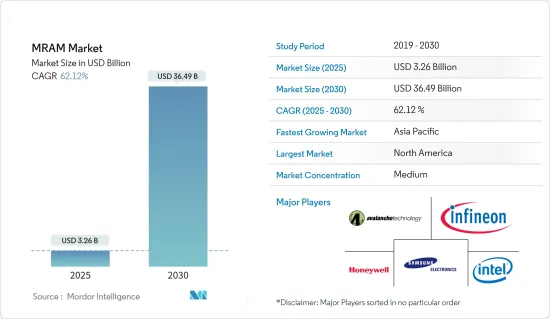

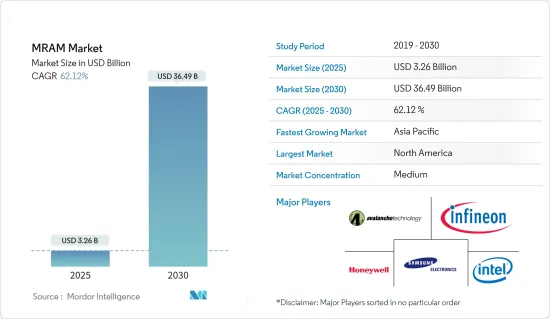

2025 年 MRAM 市场规模估计为 32.6 亿美元,预计到 2030 年将达到 364.9 亿美元,市场估计和预测期(2025-2030 年)的复合年增长率为 62.12%。

各行各业日益采用数位化技术、计算技术、物联网 (IoT) 的技术进步、智慧机器人领域的快速市场发展以及对智慧型手机、电视、智慧型穿戴装置、电脑和无人机等电子设备的投资不断增加,可能会在未来几年推动市场需求。

关键亮点

- 过去十年来,电脑的快速普及推动了工业、商业、汽车和国防系统对低成本、小型、节能的随机存取记忆体技术的需求。 MRAM 可以承受高辐射,在极端温度条件下运行,并且具有防篡改功能,适用于军事和工业应用。

- 增加对下一代读取存取记忆体研发的投资可能会创造新的产品应用机会并刺激市场成长。

- 全球智慧型手机的普及促使製造商开发先进的 RAM,以提供更快的启动时间、更大的记忆体空间和更高的效能。市场主要参与企业正专注于独立或嵌入式MRAM 的开发和量产,以在未来占据市场主导地位。

- 新冠疫情对智慧型手机产业造成了不利影响,但儘管居家令刺激了对伺服器和 PC 记忆体的需求,但预计该产业将在 2020-2021 年復苏。过去十年,在云端运算、人工智慧和物联网等主要大趋势的推动下,记忆体市场经历了巨大的成长。

- 据英特尔称,对虚拟桌面基础设施和虚拟储存解决方案日益增长的需求正在推动其资料中心对其储存和记忆体产品的需求。在新冠疫情期间,在家工作的趋势日益增长以及数位资源的使用增加,加速了对这两种应用类型更强大、更快的储存和记忆体功能的需求。

磁阻电阻式记忆体(MRAM)市场趋势

消费性电子产品具有巨大成长潜力

- 由于技术进步、物联网的渗透、4G 和 5G 技术的出现以及各种设备在提高记忆体容量和电源效率方面的创新,家用电子电器可能会见证显着增长。随着可支配收入的增加和智慧型装置的普及,智慧型手机、笔记型电脑、智慧型穿戴装置和数位相机预计将越来越受欢迎。

- 智慧型手机在全球的普及促使製造商开发先进的 RAM,以提供更快的启动时间、更高的记忆体容量和更高的效能。越来越多的市场主要参与企业正专注于独立或嵌入式MRAM的开发和量产,以在未来占据市场主导地位。

- 例如,三星最近开始大量生产首款商用嵌入式磁性 RAM(eMRAM)。由于 eMRAM 在写入资料之前不需要擦除循环,因此在较低电压下其速度比 eFlash 快 1,000 倍,为未来智慧型手机的实施提供了良好的机会。

- 在现有和新兴的嵌入式记忆体技术中,STT MRAM 具有巨大的发展前景,因为它结合了持久性、低功耗、高速度和高耐久性,使其成为低功耗微控制器、穿戴式装置、游戏和物联网装置的理想选择。

北美可能占据很大市场占有率

- 预计在预测期内,北美磁阻电阻式记忆体市场将实现成长。无论大小,企业都在转向云端基础的服务,以降低与技术基础设施相关的成本并简化业务。这些变化的时代正在推动低功耗资料中心的成长,并鼓励 MRAM 的实施,MRAM 不需要刷新并允许低功耗状态。

- MRAM 技术即使在极端温度范围内也依然坚固可靠,从而增加了汽车领域对记忆体产品的需求。 Everspin 为BMW超级摩托车提供 4MB MRAM 晶片(MR2A16AMYS35)。它们也用于各种汽车应用,例如引擎控制单元、用于高级传输控制的汽车资料记录以及用于汽车娱乐的多媒体系统。

- MRAM 技术也正在医疗设备中应用,为下一代感测器提供更高的灵敏度、准确性和降噪性能。这些感测器用于对糖尿病和缺氧等疾病的血液、体液和组织进行非侵入性诊断测试。

- 物联网设备正在医疗设备中迅速应用,以整合资料通讯、资料储存和资料探勘技术,有助于减少人为错误。因此,无线射频识别 (RFID) 设备与 MRAM 集成,使其具有抗伽马射线的能力。北美慢性疾病患者数量的增加也推动了市场的成长。据报导,慢性病是美国最普遍、最昂贵的健康状况之一,近一半的美国人口(约45%,即1.33亿人)患有至少一种慢性病。

- 新冠疫情也影响了全球大多数产业。但它推动了用于对抗病毒的机器人、无人机和其他自动化机器的成长。疫情导致医院和检测机构越来越多地采用辅助机器人来消毒医院和居住区域、监测体温以及向新冠肺炎患者运送食物和药品。它也使医院工作人员从非必要任务中解放出来,有助于遏制病毒的传播。例如,波士顿动力公司的机器人 Spot 正在帮助波士顿动力公司的医护人员治疗感染的患者。波士顿动力公司也宣布计划将其机器人的使用范围扩大到其他医院。

磁阻电阻式记忆体(MRAM)产业概况

磁阻电阻式记忆体(MRAM) 市场竞争非常激烈。拥有压倒性市场占有率的大公司正致力于扩大海外基本客群。这些公司正在利用策略合作措施来增加市场占有率和盈利。然而,随着技术进步和产品创新,中小企业透过赢得新契约和开拓新市场来扩大其市场占有率。

- 2022 年 1 月-全球先进半导体技术领导者三星电子展示了世界上第一个采用 MRAM(磁阻随机存取记忆体)的记忆体内运算。该研究由三星先进技术实验室(SAIT)与三星电子代工业务和半导体研发中心合作进行。透过这项技术发展,三星旨在加强其市场地位,并将记忆体和系统半导体结合起来,打造下一代人工智慧 (AI) 晶片。

- 2022 年 5 月 - Everspin 推出了 EMxxLX xSPI MRAM,这是一种用于工业IoT和嵌入式系统的新型非挥发性记忆体解决方案。 EMxxLX xSPI MRAM 旨在为客户提供 8MB 至 64MB 的密度和高达 400MB/秒的高 R/W资料传输速度,作为 SPI NOR/ NAND快闪记忆体的替代品。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 价值链分析

- COVID-19 工业影响评估

第五章市场动态

- 市场驱动因素

- 对小型电子设备的需求不断增加

- MRAM 在 RFID 标籤中的应用日益增多

- 市场问题

- 电磁场问题导致设计成本高

第六章市场区隔

- 类型

- 切换 MRAM

- 自旋转移扭矩MRAM

- 祭品

- 独立

- 嵌入式

- 应用

- 消费性电子产品

- 机器人技术

- 企业储存

- 车

- 航太与国防

- 其他的

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Avalanche Technology Inc.

- NVE Corporation

- Qualcomm Incorporated

- Crocus Nano Electronics LLC

- Everspin Technologies Inc.

- HFC Semiconductor Corporation

- Tower Semiconductor

- Honeywell International Inc.

- Infineon Technologies AG

- Intel Corporation

- Samsung Electronics Co. Ltd

- Spin Transfer Technologies

- Numem

第八章投资分析

第九章:市场的未来

The MRAM Market size is estimated at USD 3.26 billion in 2025, and is expected to reach USD 36.49 billion by 2030, at a CAGR of 62.12% during the forecast period (2025-2030).

Increasing adoption of digitalization across the industry, technological advancement of computing technologies, Internet of Things (IoT) and rapid development of smart robots across the world, and rising investment in electronic devices such as smartphones, televisions, smart wearables, computers, and drones, may boost the market demand in the future.

Key Highlights

- The need for low-cost, small-size, power-efficient random-access memory technology grew in the past decade in industrial, commercial, automotive, and defense systems due to the rapid implementation of computers. MRAMs can withstand high radiation, operate in extreme temperature conditions, and are tamper-resistant, making them fit for military and industrial applications.

- Growing investments in the research and development of next-generation read access memory may open provide opportunities to new product applications and fuel the market's growth.

- The global adoption of smartphones has encouraged manufacturers to develop advanced RAM that could reduce the boot-up time and enhance memory space to offer high performance. The number of key players in the market has grown, focusing on developing and mass-producing MRAM either in stand-alone or embedded design to gain a leading position in the market in the future.

- Despite the COVID-19 outbreak, which negatively impacted the smartphone industries but spurred demand for server and PC memory for stay-at-home activities, the year 2020-2021 was expected to see recovery. Driven by important megatrends such as cloud computing, AI, and the IoT, the memory market experienced extraordinary growth in the past decade.

- According to Intel, the increased need for virtualized desktop infrastructure and virtualized storage solutions is driving the demand for its storage and memory products in data centers. The need to enhance and accelerate storage and memory capabilities for the two application types grew due to the rising trend of work-from-home and the increased usage of digital resources during the COVID-19 pandemic.

Magneto Resistive RAM (MRAM) Market Trends

Consumer Electronics May Experience Significant Growth

- Consumer electronics may experience significant growth due to technological advancements, penetration of IoT, the emergence of 4G and 5G technologies, and innovation in various devices to increase memory capacity and power efficiency. Smartphones, laptops, smart wearables, and digital cameras are expected to gain popularity due to increased disposable income and the rising adoption of smart devices.

- Global adoption of smartphones has encouraged manufacturers to develop advanced RAM that could reduce the boot-up time and enhance the memory space to offer high performance. The number of key players in the market has grown, focusing on developing and mass-producing MRAM either in stand-alone or embedded design to gain a leading position in the market in the future.

- For instance, recently, Samsung has started mass producing its first commercial embedded magnetic RAM (eMRAM). As eMRAM does not require an erase cycle before writing data, it is 1,000 times faster than eFlash with lower voltage, providing a promising opportunity for its implementation in an upcoming smartphone.

- Among the established and emerging embedded memory technologies, STT MRAM is very promising, as it offers a combination of persistence, low power consumption, high speed, and high endurance, ideal for low-power microcontrollers wearables and gaming and IoT devices.

North America May Hold a Significant Market Share

- North America is projected to experience growth in the magneto-resistive RAM market during the forecast period. Large, small, and medium enterprises are moving toward cloud-based services to reduce the costs related to technology infrastructure and streamline operations. This contemporary shift is boosting the growth of data centers with lower power consumption and encouraging MRAM implementation as it does not require refreshing and allows low-power states.

- As MRAM technology is robust and reliable over extreme temperature ranges, its demand for memory products in the automotive sector is increasing. Everspin provided a 4MB MRAM chip (MR2A16AMYS35) to BMV for its superbike. It is also used in various automotive applications, such as engine control units, advanced transmission control in-car data logs, and multimedia systems for in-car entertainment.

- MRAM technology is also implemented in medical devices to provide next-generation sensors with higher sensitivity, accuracy, and noise reduction. These sensors are used for non-invasive diagnostic testing of blood, body fluids, and tissue for medical conditions, including diabetes and hypoxia.

- The rapid adoption of IoT devices in medical devices to integrate technology for data communication, data storage, and data mining is helping reduce human errors. Therefore, radio-frequency identification (RFID) devices are integrated with MRAM to withstand gamma radiation. An increased number of chronic disease cases in North America are also fueling the growth of the market. According to a report, chronic diseases are among the most prevalent and costly health conditions in the United States, and nearly half (approximately 45%, or 133 million) of the American population suffer from at least one chronic disease.

- The COVID-19 pandemic also affected most industries worldwide. However, it boosted the growth of robots, drones, and other automated machines used to fight the virus. The outbreak led to an increasing adoption of assistive robots in hospitals and testing facilities to disinfect hospitals and residential areas, monitor temperature, and deliver food and medicines to COVID -19 patients. It also relieved hospital staff from non-essential tasks and helped limit the spread of the virus. For instance, Spot, a robot by Boston Dynamics, helps Boston's healthcare workers by providing assistance in treating infected patients. Boston Dynamics also announced its plans to expand the use of its robots to other hospitals.

Magneto Resistive RAM (MRAM) Industry Overview

The magneto resistive RAM (MRAM) market is competitive. The major players with a prominent market share are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and profitability. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

- January 2022 - Samsung Electronics, a world leader in advanced semiconductor technology, demonstrated the world's first in-memory computing based on MRAM (Magneto-resistive Random Access Memory). The research was carried out by the Samsung Advanced Institute of Technology (SAIT) in collaboration with the Samsung Electronics Foundry Business and Semiconductor R&D Center. In line with this technological development, Samsung aims to merge memory and system semiconductors for next-generation artificial intelligence (AI) chips, along with strengthening its market position.

- May 2022 - Everspin launched its new product, the EMxxLX xSPI MRAM, a non-volatile memory solution, for applications in industrial IoT and embedded systems. It aims to provide its customers with an alternative to SPI NOR/NAND flash, along with densities ranging between 8MB and 64MB and much faster R/W data rates of up to 400MB/s.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Miniaturization of Electronic Devices

- 5.1.2 Increased Use of MRAM in RFID Tags

- 5.2 Market Challenges

- 5.2.1 High Design Cost with Electromagnetic Interface Problems

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Toggle MRAM

- 6.1.2 Spin-transfer Torque MRAM

- 6.2 Offering

- 6.2.1 Stand-alone

- 6.2.2 Embedded

- 6.3 Application

- 6.3.1 Consumer Electronics

- 6.3.2 Robotics

- 6.3.3 Enterprise Storage

- 6.3.4 Automotive

- 6.3.5 Aerospace and Defense

- 6.3.6 Other Applications

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Avalanche Technology Inc.

- 7.1.2 NVE Corporation

- 7.1.3 Qualcomm Incorporated

- 7.1.4 Crocus Nano Electronics LLC

- 7.1.5 Everspin Technologies Inc.

- 7.1.6 HFC Semiconductor Corporation

- 7.1.7 Tower Semiconductor

- 7.1.8 Honeywell International Inc.

- 7.1.9 Infineon Technologies AG

- 7.1.10 Intel Corporation

- 7.1.11 Samsung Electronics Co. Ltd

- 7.1.12 Spin Transfer Technologies

- 7.1.13 Numem