|

市场调查报告书

商品编码

1690097

印度资料中心 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)India Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

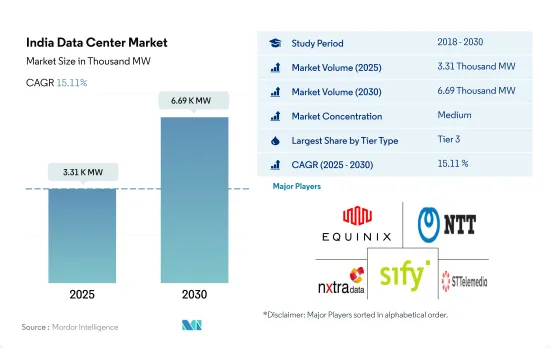

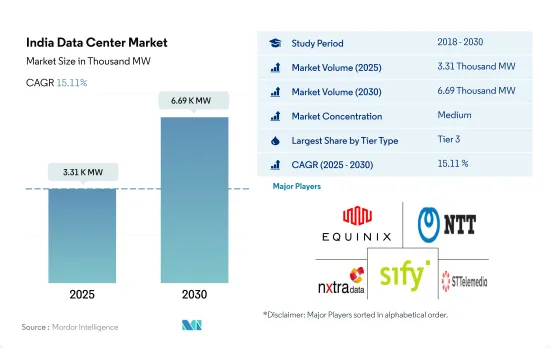

印度资料中心市场规模预计在 2025 年达到 3,310 千瓦,预计到 2030 年将达到 6,690 千瓦,复合年增长率为 15.11%。

预计 2025 年主机託管收益将达到 23.379 亿美元,到 2030 年将达到 49.318 亿美元,预测期内(2025-2030 年)的复合年增长率为 16.10%。

到 2023 年, 层级 3资料中心将占据容量的大部分份额,并且预计在整个预测期内仍将占据主导地位。

- 随着城市人口不断增长,越来越人开始采用智慧技术,加上各州政府提供诱人的奖励,资料中心营运商正在全国各地建立大型资料处理设施。

- 随着印度业务的发展,大型企业正在转向层级 3 和层级 4资料中心,因为它们具有停机时间短、灾难復原和现场援助能力强等特点。这导致该地区层级和层级资料中心的兴起。

- 预计层级 3资料中心将从 2022 年的 888.5MW 成长到 2029 年的 3,365.0MW,复合年增长率为 16.20%。同样,4层级资料中心于 2021 年运作使用,容量为 211.9MW。预计该容量将从 2022 年的 211.9MW 成长到 2029 年的 1,380.2MW,复合年增长率为 29.54%。

- 由于需求低迷,预计层级和二级资料中心在预测期内将停滞不前。

印度资料中心市场趋势

Jio 等通讯业者已开始提供廉价的智慧型手机和网路服务,从而推动了资料中心市场的发展。

- 预计印度智慧型手机用户将从 2022 年的 7.944 亿成长到 2029 年的 12 亿,复合年增长率为 5.52%。 「印度製造」运动等政府倡议为智慧型手机产业提供了奖励,使得印度能够生产价格合理、规格齐全且能够无缝运行应用程式的智慧型手机。

- Jio 等通讯业者的成长以其实惠的套餐彻底改变了网路产业。此外,随着政府鼓励线上数位付款和服务,资料需求持续增加。

- 随着印度 5G 网路的推出,资料消费量预计将快速成长,因为印度用户倾向于线上 OTT 内容、游戏、购物、智慧家庭自动化应用、线上保全摄影机等,预计将进一步推动对资料中心的需求。

家庭宽频存取的增加和互联网互动的扩大正在推动市场成长。

- 铜线网路连线提供的速度高达 300Mbps,而光纤网路速度则高达 10Gbps。此前,印度的宽频网路严重依赖铜缆连接。云端技术等新创新推动了光纤电缆的采用,光纤电缆可以以更快的速度移动储存在云端中的资料。用户正在转向使用光纤电缆连接云端伺服器和资料中心。因此,就连接性而言,对铜缆的需求正在下降。

- 宽频连线预计将从 2014 年 3 月的 6.1 兆增加 1,238% 至 2022 年 9 月的 816.2 兆。旗舰计划BharatNet 正在分阶段实施,旨在为该国所有 26,000 个 Gramme Panchayats(GP)提供宽频存取。第一阶段于 2017 年 12 月完成,涵盖超过 1,000 位全科医生。截至 2022 年 10 月,该计划已铺设 6,00,898 公里光纤电缆,1,90,364 个 GP 已与光纤电缆 (OFC) 连接,1,77,665 个 GP 已透过 OFC 投入服务。此外,还有 4,466 名全科医生透过卫星媒体进行了连接。 1,82,131 名全科医生已准备好提供服务。此统计数据显示宽频资料使用量增加。

- 随着城市人口的成长,智慧电视、智慧型手机和智慧照明系统等设备的使用也随之增加,产生了对只有光纤电缆才能提供的更快频宽的需求。

印度资料中心产业概况

印度资料中心市场正在缓慢整合,前五大参与者占55.86%的市场。该市场的主要企业有:Equinix Inc.、NTT Ltd、Nxtra Data Ltd、Sify Technologies Ltd 和 STT GDC Pte Ltd(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 市场展望

- 负载能力

- 占地面积

- 主机代管收入

- 安装机架数量

- 机架空间利用率

- 海底电缆

第五章 产业主要趋势

- 智慧型手机用户数量

- 每部智慧型手机的资料流量

- 行动资料速度

- 宽频资料速度

- 光纤连接网路

- 法律规范

- 印度

- 价值炼和通路分析

第六章市场区隔

- 热点

- 班加罗尔

- 清奈

- 海得拉巴

- 孟买

- NCR

- 普纳

- 其他地区

- 资料中心规模

- 大规模

- 超大规模

- 中等规模

- 百万

- 小规模

- 层级类型

- 1层级和2级

- 层级

- 层级

- 吸收量

- 未使用

- 使用

- 按主机託管类型

- 超大规模

- 零售

- 批发的

- 按最终用户

- BFSI

- 云

- 电子商务

- 政府

- 製造业

- 媒体与娱乐

- 电信

- 其他最终用户

第七章竞争格局

- 市场占有率分析

- 商业状况

- 公司简介.

- CtrlS Datacenters Ltd

- Equinix Inc.

- ESDS Software Solution Ltd

- Go4hosting

- NTT Ltd

- Nxtra Data Ltd

- Pi Datacenters Pvt Ltd

- Reliance

- Sify Technologies Ltd

- STT GDC Pte Ltd

- WebWerks

- Yotta Infrastructure Solutions

- LIST OF COMPANIES STUDIED

第八章:CEO面临的关键策略问题

第九章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 全球市场规模和DRO

- 资讯来源及延伸阅读

- 图表清单

- 关键见解

- 资料包

- 词彙表

The India Data Center Market size is estimated at 3.31 thousand MW in 2025, and is expected to reach 6.69 thousand MW by 2030, growing at a CAGR of 15.11%. Further, the market is expected to generate colocation revenue of USD 2,337.9 Million in 2025 and is projected to reach USD 4,931.8 Million by 2030, growing at a CAGR of 16.10% during the forecast period (2025-2030).

Tier 3 data center accounted for majority share in terms of volume in 2023, and is expected to dominate through out the forecasted period

- The growing urban population's adoption of smart technologies and attractive incentives offered by state governments has led data center operators setting up huge data processing facilities in the country.

- As businesses evolve in India, large businesses increasingly focus on tier 3 and tier 4 data centers due to their lower downtime, disaster recovery, and onsite assistance facility. This has led to the growth of tier 3 and tier 4 data centers in the region.

- Tier 3 data centers are expected to grow from 888.5 MW in 2022 to 3365.0 MW by 2029 at a CAGR of 16.20%. Similarly, tier 4 data centers operated at a capacity of 211.9 MW in 2021. This capacity is expected to increase from 211.9 MW in 2022 to 1380.2 MW by 2029 at a CAGR of 29.54%.

- As a result of low demand, tier 1 & 2 data center is expected to stagnate during the forecast period.

India Data Center Market Trends

Growth of telecom operators such as Jio, and others providing smartphones and internet services at resonable rates, it has boosted the data centers market

- Indian smartphone users are expected to grow from 794.4 million in 2022 to 1.2 billion in 2029 at a CAGR of 5.52%. Government initiatives such as the "Make in India" movement have offered incentives to the smartphone industry, which has resulted in India producing smartphones with specifications that run applications seamlessly and at an affordable cost.

- The growth of telecom operators, such as Jio, has revolutionized the internet industry with their packages at a reasonable cost. In addition to that, the data demand increased continuously, with the government encouraging digital payments and services online.

- With the launch of the 5G network in India, data consumption is expected to rapidly increase, as Indian users have a heavy inclination toward online OTT content, gaming, shopping, smart home automation applications, online security cams, etc., which is expected to further propel the demand for data centers.

Increasing household access to broadband and growing Internet exchanges are driving the market growth.

- A copper-based internet connection provides speeds of up to 300 Mbps whereas a fiber optic internet speeds are upto 10 Gbps. Earlier, the broadband network in India was more inclined toward copper cable connections. New innovations such as cloud technology have led to the adoption of fiber optic cables that offer higher speeds to move data stored in the cloud. Users are switching to fiber optic cables, which connect cloud servers with data centers. Hence, in terms of connectivity, the demand for copper cables is on the decline.

- Broadband connections rose from 6.1 crore in March 2014 to 81.62 crores in September 2022 growing by 1238%. The flagship BharatNet project is being implemented in phases to give broadband access to all 2.6 lakh Gramme Panchayats (GPs) in the country. Phase-I was finished in December 2017 and covered over 1 lakh GPs. As of October 2022, 6,00,898 km of Optical Fibre Cable had been laid under the project, 1,90,364 GPs had been connected by Optical Fibre Cable (OFC), and 1,77,665 GPs were Service Ready on OFC. Furthermore, 4466 GPs have been linked by satellite media. 1,82,131 GPs are ready to serve. This statistic shows an increase in broadband data usage.

- The growing urban population increasingly uses devices such as smart TVs, smartphones, and smart lighting systems, which has led to increased demand for higher bandwidth speeds that can only be achieved through the use of these fiber optic cables.

India Data Center Industry Overview

The India Data Center Market is moderately consolidated, with the top five companies occupying 55.86%. The major players in this market are Equinix Inc., NTT Ltd, Nxtra Data Ltd, Sify Technologies Ltd and STT GDC Pte Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 MARKET OUTLOOK

- 4.1 It Load Capacity

- 4.2 Raised Floor Space

- 4.3 Colocation Revenue

- 4.4 Installed Racks

- 4.5 Rack Space Utilization

- 4.6 Submarine Cable

5 Key Industry Trends

- 5.1 Smartphone Users

- 5.2 Data Traffic Per Smartphone

- 5.3 Mobile Data Speed

- 5.4 Broadband Data Speed

- 5.5 Fiber Connectivity Network

- 5.6 Regulatory Framework

- 5.6.1 India

- 5.7 Value Chain & Distribution Channel Analysis

6 MARKET SEGMENTATION (INCLUDES MARKET SIZE IN VOLUME, FORECASTS UP TO 2030 AND ANALYSIS OF GROWTH PROSPECTS)

- 6.1 Hotspot

- 6.1.1 Bangalore

- 6.1.2 Chennai

- 6.1.3 Hyderabad

- 6.1.4 Mumbai

- 6.1.5 NCR

- 6.1.6 Pune

- 6.1.7 Rest of India

- 6.2 Data Center Size

- 6.2.1 Large

- 6.2.2 Massive

- 6.2.3 Medium

- 6.2.4 Mega

- 6.2.5 Small

- 6.3 Tier Type

- 6.3.1 Tier 1 and 2

- 6.3.2 Tier 3

- 6.3.3 Tier 4

- 6.4 Absorption

- 6.4.1 Non-Utilized

- 6.4.2 Utilized

- 6.4.2.1 By Colocation Type

- 6.4.2.1.1 Hyperscale

- 6.4.2.1.2 Retail

- 6.4.2.1.3 Wholesale

- 6.4.2.2 By End User

- 6.4.2.2.1 BFSI

- 6.4.2.2.2 Cloud

- 6.4.2.2.3 E-Commerce

- 6.4.2.2.4 Government

- 6.4.2.2.5 Manufacturing

- 6.4.2.2.6 Media & Entertainment

- 6.4.2.2.7 Telecom

- 6.4.2.2.8 Other End User

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Landscape

- 7.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.3.1 CtrlS Datacenters Ltd

- 7.3.2 Equinix Inc.

- 7.3.3 ESDS Software Solution Ltd

- 7.3.4 Go4hosting

- 7.3.5 NTT Ltd

- 7.3.6 Nxtra Data Ltd

- 7.3.7 Pi Datacenters Pvt Ltd

- 7.3.8 Reliance

- 7.3.9 Sify Technologies Ltd

- 7.3.10 STT GDC Pte Ltd

- 7.3.11 WebWerks

- 7.3.12 Yotta Infrastructure Solutions

- 7.4 LIST OF COMPANIES STUDIED

8 KEY STRATEGIC QUESTIONS FOR DATA CENTER CEOS

9 APPENDIX

- 9.1 Global Overview

- 9.1.1 Overview

- 9.1.2 Porter's Five Forces Framework

- 9.1.3 Global Value Chain Analysis

- 9.1.4 Global Market Size and DROs

- 9.2 Sources & References

- 9.3 List of Tables & Figures

- 9.4 Primary Insights

- 9.5 Data Pack

- 9.6 Glossary of Terms