|

市场调查报告书

商品编码

1690100

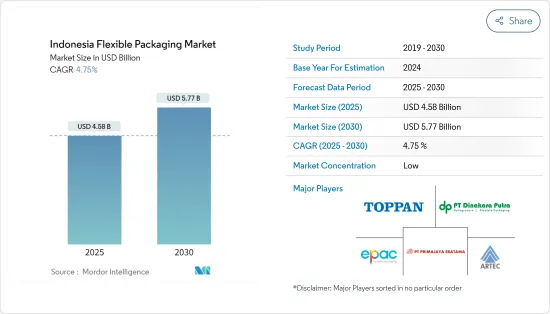

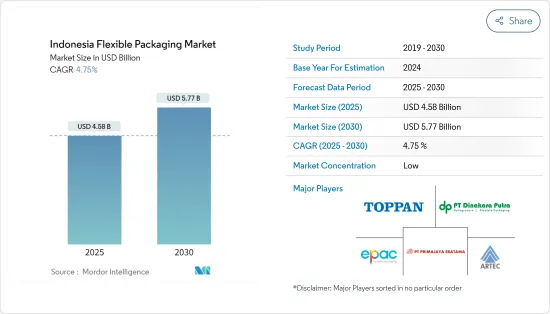

印尼软包装:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Indonesia Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

印尼软包装市场规模预计在 2025 年为 45.8 亿美元,预计在 2030 年将达到 57.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.75%。

主要亮点

- 软包装为产品包装提供了经济且可客製化的解决方案。食品饮料、个人护理和製药等行业受益于它的多功能性。它之所以受欢迎是因为其效率和成本效益。在印尼,轻量化包装需求不断增长、消费者永续性意识不断增强、以及延长保质期和产品保护的技术进步等因素正在推动软包装市场的发展。

- 软包装能够适应各种形状和尺寸,而且成本效益高、运输方便,推动市场的成长。随着业界越来越重视环保解决方案以及消费者追求便利,印尼的软包装市场将会扩大。印尼的软包装市场在该国从单层塑胶朝向多层、阻隔性、可回收材料的永续性发展过程中至关重要。这个市场是由快速成长的人口和对经济实惠包装日益增长的需求所推动的。它也受到当地食品、饮料和製药业的影响。

- 印尼的食品和饮料产业是经济成长的关键。根据 Permata Bank 经济研究的报告,製造业持续增强了印尼的製造业格局。 2023年食品和饮料製造业的运转率预计将从上一季的74.6%上升至75.0%,反映出工业活动的回升。随着食品和饮料产量的增加,对软包装的需求也预计将增加。

- 印尼对个人保健产品的需求日益增长,对能够增强产品美观度、维持品质并延长保质期的软包装的需求也日益增长。创新的软包装设计正在吸引消费者并提高小袋和小包装等产品的销售。

- 印尼的经济成长和对方便单份食品的日益增长的偏好正在刺激软包装的生产。作为回应,市场供应商正在扩大生产能力。快速发展的印尼製造商 Putra Naga Indotama 正在投资最先进的机械,以促进与现有和新客户的业务往来。

- 根据经济合作暨发展组织(OECD)和联合国粮食及农业组织(FAO)的资料,到2030年,印尼人均新鲜乳製品消费量将达到3.82公斤左右。虽然乳製品不是许多印尼人的日常必需品,但鲜牛奶、起司和优格等产品正越来越受欢迎,尤其是在中等收入家庭中。随着消费量的增加,对乳製品客製化软包装的需求也预计将增加。

- 塑胶包装解决方案广泛应用于製造业、零售业、医疗保健业等领域。医疗保健产业尤其采用塑胶包装,因为它具有阻隔性、延长的保质期和耐用性。然而,随着消费者越来越意识到一次性塑胶和不可持续的做法对环境的影响,他们要求产品能够考虑其生态足迹。消费者情绪的这些变化对市场成长构成了挑战。

- 在不断发展的印尼市场中,对永续性和便利性的日益重视正在改变软包装的动态。当地公司正在投资先进的永续解决方案,利用再生材料并采用製造流程来减少排放,为市场扩张铺平了道路。

主要亮点

- 例如,PT Charoen Pokphand Indonesia (CPI) Flexible Packaging 与 BOBST 合作,自 2019 年成立以来一直保持 10% 的年增长率。 BOBST 是领先的基材转换、印刷和转换设备供应商,服务于标籤、软包装和瓦楞纸行业等多个行业。此次伙伴关係至关重要,其中oneECG(扩展色域)技术脱颖而出,成为关键驱动力。该技术使 CPI 能够持续、快速地提供高品质的软包装,同时降低成本并提高永续性。

- PT Himalaya Wellness 优先考虑永续包装。该公司致力于最大限度地减少包装足迹,透过创新材料采用环保的形式和结构。该公司的产品开发过程专注于减少碳和环境影响。该公司已将 50% 的产品从 PVC 转换为可回收 PET,并以环保替代品取代所有产品,目标是彻底消除 PVC。

印尼软包装市场趋势

包装薄膜可望强劲成长

- 由于对高性能薄膜的需求不断增加,包装薄膜和包装纸市场正在不断增长。由于各个终端用户行业对阻隔性的要求更高,因此正在采用转化技术的先进包装薄膜,以确保适用应用和具有成本效益的生产。

- 人们对永续性的日益关注正在推动包装从传统的硬质包装转向创新和灵活的解决方案。这种发展,加上对消费者友善包装和增强产品保护的不断增长的需求,使得薄膜和包装成为印尼领先的具有成本效益的包装选择。

- 印尼消费者越来越喜欢方便食品和即食食品。为了应对这种情况,食品和饮料製造商开始转向热成型包装薄膜。这些薄膜具有优异的阻隔性,主要用于真空包装肉类和鱼贝类等生鲜食品,有效地保持其新鲜度。

- 事实证明,拉伸膜是包装饮料、个人护理用品、家居用品等的理想解决方案。印尼的零售和电子商务产业正在崛起,确保货物安全、完好无损地到达至关重要。拉伸膜由于其捆绑和保护功能而变得越来越受欢迎。此外,随着航运和物流业务的扩大,对高效、经济的捆绑解决方案的需求日益增长——这是拉伸膜擅长的利基。

- 据新加坡零售协会称,印尼零售业成长迅速,对该国GDP的贡献率约为13%。超过2.7亿的庞大人口、不断增长且购买力强劲的中产阶级以及具有突出消费习惯的千禧世代凸显了该国的零售潜力。因此,包装薄膜的优势加上快速成长的零售业正在推动印尼软包装市场的成长。

- 印尼的电子商务产业一直经历强劲而稳定的成长,这表明其潜力巨大。拉伸膜在电商包装中起着至关重要的作用,主要是确保货物的安全。它可充当坚固的屏障,防止物品在运输过程中移动。这对于精密或易碎且需要小心谨慎以避免破损的产品尤其重要。

- 根据国际贸易管理局的报告,包装薄膜市场价值预计将在2023年超过529.3亿美元,并在2028年达到868.1亿美元。因此,拉伸膜等包装薄膜的优势,加上零售业的扩张,正在推动印尼包装薄膜市场的成长。

食品业占有较大市场占有率

- 食品和饮料(F&B)产业是创新和产品开发的温床。该行业依赖敏捷且适应性强的包装行业。预计2023年印尼消费者信心指数将达到123.8,预示明年消费者信心强劲。矿泉水和泡麵成为消费者最爱的商品。

- 主食和食用油是印尼饮食的重要组成部分。过去五年来,包装香辛料和咖啡等非主食的支出显着增加。烹饪越来越便利和生产效率越来越高,推动了包装香辛料和咖啡消费的持续强劲成长。

- 印尼人的偏好正在转向软包装。这种包装不仅经济实惠,而且还可客製化以适应各种各样的产品。软包装在经常需要多功能包装解决方案的行业中特别有优势,例如食品和饮料以及个人护理。它之所以越来越受欢迎,是因为它是高效且具有成本效益。

- 印尼千禧世代消费者对单份、便携食品的偏好主要推动了对软包装解决方案的需求。这些偏好使得软包装因其便携性、耐用性和重量轻而成为一种不错的选择。近年来,印尼的消费者在各种食品上的支出大幅增加。这包括烘焙食品和谷物棒、已调理食品、咖啡和热巧克力棒和袋装食品、脱水零嘴零食、零食、坚果、香辛料、巧克力、糖果零食、新品冰淇淋、饼干、蛋糕、薯片等。这种不断增长的需求推动了食品业软包装的普及,尤其是自立袋和枕形袋。

- 尤其是枕形袋,在食品、食品饮料以及乳製品行业中得到了迅速的普及。袋子的吸引力在于其实惠的价格、有效的密封性和经济的运输成本。

- 然而,对塑胶废弃物的环境担忧以及日益增多的提倡永续包装替代品的法规对市场构成了重大挑战。此外,全球原材料价格的波动,尤其是聚乙烯和聚丙烯的价格,可能会降低製造商的利润率并抑制市场成长。印尼在推动塑胶回收方面取得了进展,但回收基础设施和公众意识仍然滞后,这使得有效的塑胶废弃物管理和永续的市场扩张变得复杂。

- 环保意识的不断增强,为环保软包装,特别是可回收、生物分解性的软包装的发展提供了机会。随着消费者偏好的不断变化和中等收入阶层的不断壮大,印尼的食品和饮料行业迅速增长,为软包装市场提供了丰厚的机会,尤其是在乳製品、零嘴零食和饮料等行业。

- 在印尼,公司提供各种各样的高品质纸袋。这些袋子采用耐用材料製成,顶部具有强力黏合密封。这些适应性极强的纸袋专为食品包装行业量身定制,是餐厅、酒店、咖啡馆和其他类似场所的理想选择。有多种尺寸可供选择,以满足您的特定需求。这些袋子可以承受相当大的重量,这使得它们在食品和饮料服务行业中具有吸引力。它还很轻而且坚固。

- 塑胶包装技术的不断进步为产品创新和差异化铺平了道路。例如,嵌入在软包装中的智慧感测器可以将有关温度、湿度和其他环境因素的资料传递到集中系统,从而使软包装更具功能性和吸引力。

印尼软包装产业概况

- 印尼的软包装市场分散,有多家参与者。市场主要企业不断努力,取得进步。主要参与者包括 PrimaJaya Eratama、PT ePac Flexibles Indonesia、PT Indonesia Toppan Group、PT Dinakara Putra 和 PT Artec Package Indonesia。

- 在印尼,软包装正越来越多地被终端消费者所采用,其中包括 PT Dolphin Food &Beverages、PT Aimfood Manufacturing Indonesia、PT RBFOOD MANUFAKTUR INDONESIA 等公司,以及 PT Kalbe Farma Tbk 和 PT Kimia Farma Tbk 等主要国内製药公司。这一趋势对市场成长贡献巨大。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 印尼的行业法规与回收政策

第五章 市场动态

- 市场驱动因素

- 国内转向更轻、更小的包装

- 对永续包装解决方案的需求不断增加

- 市场限制

- 缺乏明确的回收计划和环境挑战

第六章 市场细分

第 7 章 按材料类型

- 塑胶

- 聚乙烯 (PE)

- 双轴延伸聚丙烯(BOPP)

- 流延聚丙烯(CPP)

- 乙烯 - 乙烯醇(EVOH)

- 聚氯乙烯(PVC)

- 其他塑料

- 纸

- 金属

第 8 章 按产品类型

- 袋子和小袋

- 薄膜和包装

- 其他产品类型

第九章 按最终用户行业

- 食物

- 饮料

- 製药和医疗

- 家庭和个人护理

- 其他最终用户产业

第十章 竞争格局

- 公司简介

- PrimaJaya Eratama

- PT ePac Flexibles Indonesia

- PT Indonesia Toppan Group

- PT Dinakara Putra

- PT Artec Package Indonesia

- Mondi Group

- PT Trias Sentosa Tbk

- PT Indopoly Swakarsa Industry Tbk

- PT Argha Prima Industry

- PT Lotte Packaging

- PT Karuniatama Polypack

- PT. Masplast Poly Film

- PT Polidayaguna Perkasa

第十一章 投资分析

第十二章:未来市场展望

简介目录

Product Code: 69928

The Indonesia Flexible Packaging Market size is estimated at USD 4.58 billion in 2025, and is expected to reach USD 5.77 billion by 2030, at a CAGR of 4.75% during the forecast period (2025-2030).

Key Highlights

- Flexible packaging offers economical and customizable solutions for product packaging. Industries such as food and beverage, personal care, and pharmaceuticals benefit from its versatility. Its popularity stems from its efficiency and cost-effectiveness. In Indonesia, the flexible packaging market is driven by factors like the growing demand for lightweight packaging, heightened consumer awareness of sustainability, and technological advancements that enhance shelf life and product protection.

- The adaptability of flexible packaging to various shapes and sizes, combined with its cost-effectiveness and transport ease, fuels market growth. As Indonesian industries increasingly prioritize eco-friendly solutions and consumers demand convenience, the flexible packaging market is set for expansion. Indonesia's flexible packaging market is pivotal in the nation's sustainability journey, transitioning from single-layer plastics to multilayer, high-barrier, recyclable materials. The market is driven by the burgeoning population and the increasing demand for affordable packaging. It is also influenced by the local food, beverage, and pharmaceutical industries.

- Indonesia's food and beverage industry is a cornerstone of its economic growth. As reported by Permata Bank Economic Research, this industry has consistently bolstered Indonesia's manufacturing landscape. In 2023, food and beverage manufacturing capacity utilization increased to 75.0% from 74.6% the previous quarter, mirroring a rise in industrial activities. As food and beverage manufacturing ramps up, the demand for flexible packaging is also expected to increase.

- The rising demand for personal care products in Indonesia is boosting the need for flexible packaging, which enhances product aesthetics, preserves quality, and extends shelf life. Innovative flexible packaging designs attract consumers, driving up volume sales of products such as sachets and pouches.

- Indonesia's economic growth and the increased appetite for convenient, single-serve foods have spurred flexible packaging production. In response, market vendors are expanding their capacities. The rapidly growing Indonesian manufacturer, Putra Naga Indotama, is investing in cutting-edge machinery to bolster business with both existing and new clientele.

- According to the data from the Organisation for Economic Co-operation and Development (OECD) and the Food and Agriculture Organization (FAO), by 2030, per capita consumption of fresh dairy products in Indonesia will reach approximately 3.82 kilograms. While dairy is not a daily staple for many Indonesians, products like fresh milk, cheese, and yogurt are gaining popularity, especially among middle-income families. As consumption rises, the demand for flexible packaging tailored for dairy products is also expected to increase.

- Plastic packaging solutions find applications across various sectors, including manufacturing, retail, and healthcare. The healthcare sector, in particular, has embraced plastic packaging for its barrier qualities, extended shelf life, and durability. However, growing awareness of the environmental impacts of single-use plastics and unsustainable practices has led consumers to demand products with a positive ecological footprint. This shift in consumer sentiment poses a challenge to the market's growth.

- In Indonesia's evolving market, the rising emphasis on sustainability and convenience is reshaping trends in flexible packaging. Companies across the nation are channeling investments into advanced sustainable solutions, harnessing recycled materials, and adopting emission-reducing manufacturing processes, thereby unlocking avenues for market expansion.

- For instance, PT Charoen Pokphand Indonesia (CPI) Flexible Packaging, in collaboration with BOBST, has charted a growth trajectory of 10% annually since its 2019 inception. BOBST, a premier supplier in substrate processing, printing, and converting equipment, caters to diverse industries, including labels, flexible packaging, and corrugated industries. This partnership has been pivotal, with oneECG (Extended Color Gamut) technology standing out as a major driver. This technology empowers CPI to deliver high-quality, flexible packaging consistently and swiftly, all while curtailing costs and enhancing sustainability.

- PT Himalaya Wellness Company is prioritizing sustainable packaging. Committed to minimizing its packaging footprint, the company is embracing eco-friendly formats and structures through innovative materials. The company's product development process is centered on reducing carbon and environmental impact. The company has transitioned 50% of its product range from PVC to recyclable PET and aims for a complete PVC phase-out, replacing it with eco-friendly alternatives across its portfolio.

Key Highlights

Indonesia Flexible Packaging Market Trends

Packaging Films Are Expected to Witness Significant Growth

- The market for packaging films and wraps is growing, driven by the escalating demand for high-performance films. As various end-user industries increasingly require enhanced barriers, advancements in processing technologies are poised to bolster the adoption of packaging films, ensuring both suitability for applications and cost-effective production.

- Amid a rising focus on sustainability, there is a shift from traditional rigid packaging to innovative, flexible solutions. This evolution, coupled with a heightened demand for consumer-friendly packaging and enhanced product protection, positions film and wrap packaging as a leading, cost-effective alternative in the nation.

- Indonesian consumers are increasingly favoring convenience foods and ready-to-eat meals. In response, food and beverage manufacturers are adopting thermoforming packaging films. Renowned for their exceptional barrier properties, these films are predominantly used for vacuum packaging perishables, such as meat and seafood, effectively preserving their freshness.

- Stretch films are gaining traction as the go-to solution for bundled packaging, especially for beverages, personal care items, and household products. With Indonesia's retail and e-commerce sectors on the rise, there is a heightened focus on ensuring products arrive at stores undamaged and secure. With its bundling and protective capabilities, stretch films are becoming increasingly favored. Furthermore, as shipping and logistics operations expand, the demand for efficient and cost-effective bundling solutions rises, a niche where stretch films excel.

- According to the Singapore Retailers Association, Indonesia's retail sector is rapidly growing, contributing approximately 13% to the nation's GDP. The country's vast population of over 270 million, an expanding middle-income group with enhanced purchasing power, and millennials with pronounced spending habits underscore its retail potential. Consequently, the advantages of packing films, combined with the burgeoning retail sector, are propelling the flexible packaging market's growth in Indonesia.

- Indonesia's e-commerce sector is witnessing robust and consistent growth, which signals immense potential. Stretch film plays a pivotal role in e-commerce packaging, primarily ensuring the security of shipments. It acts as a formidable barrier and prevents items from shifting during transit. This becomes especially vital for delicate or fragile products that demand heightened care to avert damage.

- As reported by The International Trade Administration, the market value of packaging films exceeded USD 52.93 billion in 2023, with forecasts suggesting a climb to over USD 86.81 billion by 2028. Thus, the benefits of packaging films such as stretch films, coupled with the expanding retail landscape, are driving the growth of the market for packaging films in Indonesia.

The Food Industry Holds a Major Market Share

- The food and beverage (F&B) industry is a hotbed of innovation and product development. The industry relies on a nimble and adaptive packaging industry. Indonesia's consumer confidence index stood at 123.8 in 2023, indicating robust spending optimism for the upcoming year. Mineral water and instant noodles emerged as top consumer favorites.

- Staple goods, alongside cooking oils, are cornerstones of the Indonesian diet. Non-staple items like packaged spices and coffee have witnessed a notable uptick in spending over the last five years. This trend toward convenient cooking and heightened productivity underscores the sustained strength of the consumption of packaged spices and coffee.

- Indonesia's preference is shifting toward flexible packaging. This type of packaging is not only economical but also customizable, catering to a diverse range of products. Industries like food and beverage and personal care, which often require versatile packaging solutions, find flexible packaging particularly advantageous. Its rising popularity can be attributed to its efficiency and cost-effectiveness.

- Millennial consumers in Indonesia favor single-serving and on-the-go food options, which primarily drive the demand for flexible packaging solutions. Such preferences make flexible packaging the go-to choice, given its portability, durability, and lightweight nature. In recent years, there has been a marked increase in consumer spending across a diverse range of food items in Indonesia. This includes bakery and cereal bars, ready meals, coffee or hot chocolate sticks and pouches, dehydrated foods, snack foods, nuts, spices, chocolates, sweets, ice-cream novelties, cookies, cakes, and chips. Such heightened demand has bolstered the popularity of flexible packaging items, particularly stand-up gussets and pillow pouches, in the food industry.

- Pillow pouches, in particular, have seen a surge in adoption, especially within the food, beverage, and dairy industries. The appeal of pouches lies in their affordability, effective sealing capabilities, and cost-efficient transportation.

- However, stricter regulations advocating for sustainable packaging alternatives, driven by environmental concerns over plastic waste, pose significant challenges to the market. Additionally, global raw material price fluctuations, especially for polyethylene and polypropylene, can reduce manufacturers' profit margins and restrain market growth. While Indonesia is making strides in promoting plastic recycling, its recycling infrastructure and public awareness still lag, complicating efficient plastic waste management and sustainable market expansion.

- Rising environmental consciousness presents an opportunity for the development of eco-friendly flexible packaging, especially those that are recyclable and biodegradable. With a burgeoning food and beverage industry, which is spurred by evolving consumer preferences and an expanding middle-income group, Indonesia presents lucrative opportunities for the flexible packaging market, especially in industries like dairy, snacks, and beverages.

- In Indonesia, businesses are rolling out a diverse array of high-quality paper bags. Crafted from durable materials, these bags feature a strong adhesive seal at the top. Tailored for the food packaging industry, these adaptable paper bags serve as an ideal choice for restaurants, hotels, cafes, and other similar venues. They are available in multiple sizes and can be tailored to meet specific needs. These bags can handle significant weight, enhancing their appeal in the food and beverage service sector. They are also lightweight and sturdy.

- Continuous advancements in plastic packaging technologies pave the way for product innovation and differentiation. For instance, smart sensors embedded in flexible packaging can relay data on temperature, humidity, and other environmental factors to a centralized system, amplifying the functionality and allure of flexible packaging.

Indonesia Flexible Packaging Industry Overview

- The flexible packaging market in Indonesia is fragmented as it has several players. The key players in the market are constantly making efforts to bring advancements. Some of the major players include PrimaJaya Eratama, PT ePac Flexibles Indonesia, PT Indonesia Toppan Group, PT Dinakara Putra, and PT Artec Package Indonesia.

- End-use consumers in Indonesia, including companies like PT Dolphin Food & Beverages, PT Aimfood Manufacturing Indonesia, and PT RBFOOD MANUFAKTUR INDONESIA, and domestic pharmaceutical giants such as PT Kalbe Farma Tbk and PT Kimia Farma Tbk, are increasingly adopting flexible packaging. This trend is significantly contributing to the growth of the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Regulations and Recycling Policies in Indonesia

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Shift Toward Light Weight and Smaller Pack Types in the Country

- 5.1.2 Rising Demand for Sustainable Packaging Solutions

- 5.2 Market Restraints

- 5.2.1 Lack of a Defined Recycling Plans Coupled with Environmental Challenges

6 MARKET SEGMENTATION

7 By Material Type

- 7.1 Plastics

- 7.1.1 Polyethene (PE)

- 7.1.2 Bi-Orientated Polypropylene (BOPP)

- 7.1.3 Cast Polypropylene (CPP)

- 7.1.4 Ethylene Vinyl Alcohol (EVOH)

- 7.1.5 Polyvinyl Chloride (PVC)

- 7.1.6 Others Plastics Types

- 7.2 Paper

- 7.3 Metal

8 By Product Type

- 8.1 Bags and Pouches

- 8.2 Films and Wraps

- 8.3 Other Product Types

9 By End-user Industry

- 9.1 Food

- 9.2 Beverage

- 9.3 Pharmaceutical and Medical

- 9.4 Household and Personal Care

- 9.5 Other End-User Industries

10 COMPETITIVE LANDSCAPE

- 10.1 Company Profiles

- 10.1.1 PrimaJaya Eratama

- 10.1.2 PT ePac Flexibles Indonesia

- 10.1.3 PT Indonesia Toppan Group

- 10.1.4 PT Dinakara Putra

- 10.1.5 PT Artec Package Indonesia

- 10.1.6 Mondi Group

- 10.1.7 PT Trias Sentosa Tbk

- 10.1.8 PT Indopoly Swakarsa Industry Tbk

- 10.1.9 PT Argha Prima Industry

- 10.1.10 PT Lotte Packaging

- 10.1.11 PT Karuniatama Polypack

- 10.1.12 PT. Masplast Poly Film

- 10.1.13 PT Polidayaguna Perkasa

11 INVESTMENT ANALYSIS

12 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219