|

市场调查报告书

商品编码

1690106

法国资料中心市场:市场占有率分析、产业趋势与成长预测(2025-2030 年)France Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

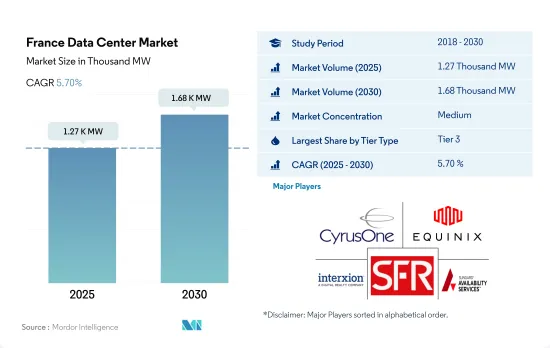

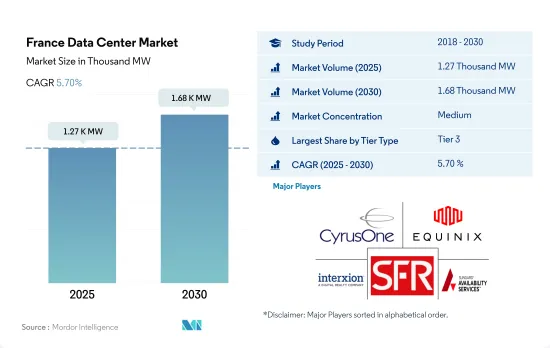

法国资料中心市场规模预计在 2025 年达到 1,270 千瓦,预计在 2030 年达到 1,680 千瓦,复合年增长率为 5.70%。

预计主机託管收益将在 2025 年达到 17.993 亿美元,到 2030 年将达到 31.578 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.91%。

以容量计算,预计 2023 年 3层级资料中心将占据大部分份额,并将在整个预测期内继续占据主导地位。

- 预计 2023 年层级 3资料中心容量将达到 782.67 MW,到 2029 年将超过 1,016.98 MW,复合年增长率为 4.46%。另一方面, 层级 4资料中心预计将成长,复合年增长率为 6.72%,到 2029 年容量将达到 283.98MW。

- 未来几年,层级和层级设施的需求将逐渐减少,成长率也将放缓。预计到 2029 年,层级和层级设施的市场占有率将保持在 2% 左右,且成长幅度很小。这是由于长时间且不稳定的停电造成的。由于对储存、处理和分析资料的需求增加,大多数用户最终将迁移到第 3层级和第 4 级设施,这两项设施将分别占市场占有率的 76.5% 和 21.4%。

- 经济体中的 BFSI 部门正在扩张。近年来,法国网路银行和手机银行的使用率增加。在欧洲市场中,法国的网路银行普及率名列前15名。截至 2021 年,72% 的法国消费者使用网路银行,高于 2017 年的 62%。由于电子银行和线上交易的需求不断增长,这需要建造符合层级 3 和 Tier 4 要求的批发和超大规模设施。

- 此外,预计未来几年层级资料中心将大幅扩张。这是因为越来越多的公司提供云端基础的服务,从而导致更多公司建立提供采用最佳技术的主机託管空间的设施。

法国资料中心市场的趋势

智慧型手机用户数量的增加和无现金交易正在推动市场成长

- 2022 年,该国智慧型手机用户总数为 5,420 万,预计到 2029 年将达到 5,915 万,预测期内复合年增长率为 1.25%。

- 法国的数位化应用正在迅速成长。网路和智慧型手机等技术在各行业的快速应用正在影响消费行为。例如,2018年至2021年间,法国的人均购买力从0.9%成长至2%。结果,更多的人能够购买智慧型手机,导致智慧型手机用户数量的增加。

- 该国的网路普及率从 2017 年的 80.05% 上升到 2020 年的 84.8%,智慧型手机用户数量从 2017 年的 3,970 万增加到 2020 年的 4,980 万。如此广泛的使用促进了数位付款服务的发展,而新冠疫情期间,数位支付的应用也随之增加。此外,该国已将支付门槛从 30 欧元提高到 50 欧元,以减少病毒传播的机会。人们越来越喜欢无现金交易,预计将对市场产生长期影响。因此,法国的智慧型手机用户数量正在增加。

- 法国市场智慧型手机的普及导致资料不断增加,需要增加储存空间来容纳需要即时处理和分析的无法控制的资料流。资料中心必须管理大量资料。因此,随着智慧型手机用户数量的增加,法国资料中心可能需要增加更多的机架。

电子商务、5G 基础设施和新型银行等数位银行的日益普及将推动市场需求

- 2022年,法国的平均资料速度为59.66Mbps。法国于 2000 年代中期推出了 4G。法国于2020年推出5G服务。自两项服务推出以来,4G在2022年达到86.72Mbps,5G在2022年达到201.3Mbps。法国四大行动服务供应商——Orange、SFR、Bouygues Telecom和Free Mobile——于2013年在巴黎、马赛、里昂、里尔和南特测试了4G服务。 4G覆盖率从2018年初的45%扩大到2020年中期的76%。

- 在5G网路服务方面,Nokia、Orange Business Services、Free Mobile、爱立信和法国国家铁路公司(SNCF)将于2020年在法国部署5G网络,用于商业和工业服务。根据法国政府的规划,到2030年,5G将覆盖法国全境。四大通讯业者都计划在2022年在3000个地点安装5G,到2024年在8000个地点安装5G,到2025年在10500个地点安装5G,这意味着在不久的将来,原始资料将以更指数级的速度增长。 2G服务将于2026年逐步淘汰,3G服务将于2029年逐步淘汰。

- 更高的通讯为最终用户扩展其客户的线上服务(例如电子商务和数位银行)铺平了道路。新银行(纯数位银行)正在改变法国银行业未来的运作方式。自 2018 年以来,在新银行开设的活期帐户数量增加了 2.5%,法国的活跃帐户超过 350 万个。也就是说,31% 的新银行用户希望未来能更频繁地使用银行服务。因此,更高的行动资料速度预计将在终端用户产业中带来更多面向服务的应用,预计这将在未来几年带来资料处理设施的成长。

法国资料中心产业概况

法国资料中心市场正在缓慢整合,前五大参与者占60.47%的市场。市场的主要企业有:CyrusOne Inc.、Equinix Inc.、Interxion(Digital Reality Trust Inc.)、SOCIETE FRANCAISE DU RADIOTELEPHONE-SFR 和 Sungard Availability Services LP(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 市场展望

- 负载能力

- 占地面积

- 主机代管收入

- 安装的机架数量

- 机架空间利用率

- 海底电缆

第五章 产业主要趋势

- 智慧型手机用户数量

- 每部智慧型手机的资料流量

- 行动资料速度

- 宽频资料速度

- 光纤连接网路

- 法律规范

- 法国

- 价值炼和通路分析

第六章市场区隔

- 热点

- 巴黎(法国法兰西岛)

- 法国其他地区

- 资料中心规模

- 大规模

- 超大规模

- 中等规模

- 百万

- 小规模

- 层级类型

- 1层级和2级

- 层级

- 层级

- 吸收量

- 未使用

- 使用

- 按主机託管类型

- 超大规模

- 零售

- 批发的

- 按最终用户

- BFSI

- 云

- 电子商务

- 政府

- 製造业

- 媒体与娱乐

- 电信

- 其他最终用户

第七章竞争格局

- 市场占有率分析

- 商业状况

- 公司简介.

- Cogent Communications

- CyrusOne Inc.

- Equinix Inc.

- Euclyde Data Centers

- Global Switch Holdings Limited

- Interxion(Digital Reality Trust Inc.)

- Scaleway SAS(Illiad Group)

- SOCIETE FRANCAISE DU RADIOTELEPHONE-SFR

- Sungard Availability Services LP

- Telehouse(KDDI Corporation)

- Thesee DataCenter

- Zenlayer Inc.

- LIST OF COMPANIES STUDIED

第八章:CEO面临的关键策略问题

第九章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 全球市场规模和DRO

- 资讯来源及延伸阅读

- 图表清单

- 关键见解

- 资料包

- 词彙表

The France Data Center Market size is estimated at 1.27 thousand MW in 2025, and is expected to reach 1.68 thousand MW by 2030, growing at a CAGR of 5.70%. Further, the market is expected to generate colocation revenue of USD 1,799.3 Million in 2025 and is projected to reach USD 3,157.8 Million by 2030, growing at a CAGR of 11.91% during the forecast period (2025-2030).

Tier 3 data center accounted for majority share in terms of volume in 2023, and is expected to dominate through out the forecasted period

- The tier 3 data center capacity is expected to reach 782.67 MW in 2023 and is further projected to register a CAGR of 4.46%, surpassing 1016.98 MW by 2029. On the other hand, the tier 4 data center is predicted to grow and register a CAGR of 6.72% to reach a capacity of 283.98 MW by 2029.

- Facilities in tier 1 and tier 2 gradually lose their demand and display a decrease in growth in the upcoming years. Tier 1 and 2 facilities are expected to hold a market share of nearly 2% by 2029 with minimal growth. This is a result of the prolonged and inconsistent outages. Most users will eventually switch to tier 3 and 4 facilities, holding 76.5% and 21.4% of the market share, respectively, owing to the increased demand for storing, processing, and analyzing data.

- The BFSI sector of the economy is expanding. In recent years, France has seen a rise in the use of online and mobile banking. In the European market, France has one of the top 15 best rates of online banking penetration. As of 2021, 72% of French consumers were using online banking, which increased from 62% in 2017. This necessitates the construction of wholesale and hyperscale facilities, which have tier 3 and 4 requirements and is driven by the rising demand for e-banking and online transactions.

- Additionally, tier 4 data centers are expected to expand significantly in the years to come. This is because more businesses are providing cloud-based services, which has caused more businesses to construct facilities to provide colocation space with the best technology.

France Data Center Market Trends

Rising smartphone users and cashless transactions boost the market growth

- The total number of smartphone users in the country was 54.20 million in 2022, which is expected to register a CAGR of 1.25% during the forecast period to reach a value of 59.15 million by 2029.

- Digital usage is expanding rapidly in France. The quick internet and smartphone technology adoption in various businesses has impacted consumer behavior. For instance, from 2018 to 2021, the per capita purchasing power per person in France increased from 0.9% to 2%. As a result, more people can purchase smartphones, leading to a growing number of smartphone users.

- The internet penetration of the country increased from 80.05% in 2017 to 84.8% in 2020, while the number of smartphone users increased from 39.7 million in 2017 to 49.8 million in 2020. Owing to such extensive use, digital payment services were promoted, and their application increased due to the COVID-19 pandemic. Additionally, the nation raised the payment threshold from EUR 30 to EUR 50 to lessen the chance of the virus spreading. People are now more inclined to prefer cashless transactions, which is predicted to have a long-term impact on the market. Consequently, there are more smartphone users in France.

- The rising use of smartphones in the French market results in a constant increase in data, necessitating a growing amount of storage space to accommodate this uncontrollable flow of data with the need for real-time processing and analysis. The data centers must manage the sheer amount of data. Thus, the requirement for extra racks in French data centers may increase as the number of smartphone users rises.

Rising adoption of e-commerce, 5G infrastructure and digital banking such as Neobank increases the adoption of market demand

- In 2022, the nation's average data speed was 59.66 Mbps. The mid-2000s saw the introduction of 4G in France. France launched its 5G services in 2020. Since the launch of both services, 4G reached 86.72 Mbps in 2022 and 5G reached 201.3 Mbps by 2022. Four French mobile service providers, Orange, SFR, Bouygues Telecom, and Free Mobile, tested their 4G offerings in 2013 in Paris, Marseille, Lyon, Lille, and Nantes, which are significant 4G hotspots. The 4G coverage has grown from 45% at the beginning of 2018 to 76% by the middle of 2020.

- In terms of 5G network services, France saw the deployments of these networks in 2020 for commercial and industrial services from Nokia, Orange Business Services, Free Mobile, Ericsson, and SNCF. According to French government plans, 5G should be available across the country by 2030. All four major operators had planned to install 5G in 3,000 locations by 2022, 8,000 by 2024, and 10,500 by 2025, which will further suggest the exponential generation of raw data in the near future. The 2G and 3G services will be decommissioned by 2026 and 2029, respectively.

- The increased average speed is paving the way for end users, such as e-commerce, and digital banking, to expand their online services for customers. Neobanks, or digital-only banks, are changing how France's banking industry functions in the future. The number of current accounts opened in neobanks has increased by 2.5% from 2018, and France has over 3.5 million active accounts. Nevertheless, 31% of Neobank users want to use banks' services more frequently in the future. Thus, the rise in mobile data speed is expected to lead to more service-oriented applications among end-user industries and is expected to lead to the growth of data processing facilities in the coming years.

France Data Center Industry Overview

The France Data Center Market is moderately consolidated, with the top five companies occupying 60.47%. The major players in this market are CyrusOne Inc., Equinix Inc., Interxion (Digital Reality Trust Inc.), SOCIETE FRANCAISE DU RADIOTELEPHONE - SFR and Sungard Availability Services LP (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 MARKET OUTLOOK

- 4.1 It Load Capacity

- 4.2 Raised Floor Space

- 4.3 Colocation Revenue

- 4.4 Installed Racks

- 4.5 Rack Space Utilization

- 4.6 Submarine Cable

5 Key Industry Trends

- 5.1 Smartphone Users

- 5.2 Data Traffic Per Smartphone

- 5.3 Mobile Data Speed

- 5.4 Broadband Data Speed

- 5.5 Fiber Connectivity Network

- 5.6 Regulatory Framework

- 5.6.1 France

- 5.7 Value Chain & Distribution Channel Analysis

6 MARKET SEGMENTATION (INCLUDES MARKET SIZE IN VOLUME, FORECASTS UP TO 2030 AND ANALYSIS OF GROWTH PROSPECTS)

- 6.1 Hotspot

- 6.1.1 Paris (Ile-De-France)

- 6.1.2 Rest of France

- 6.2 Data Center Size

- 6.2.1 Large

- 6.2.2 Massive

- 6.2.3 Medium

- 6.2.4 Mega

- 6.2.5 Small

- 6.3 Tier Type

- 6.3.1 Tier 1 and 2

- 6.3.2 Tier 3

- 6.3.3 Tier 4

- 6.4 Absorption

- 6.4.1 Non-Utilized

- 6.4.2 Utilized

- 6.4.2.1 By Colocation Type

- 6.4.2.1.1 Hyperscale

- 6.4.2.1.2 Retail

- 6.4.2.1.3 Wholesale

- 6.4.2.2 By End User

- 6.4.2.2.1 BFSI

- 6.4.2.2.2 Cloud

- 6.4.2.2.3 E-Commerce

- 6.4.2.2.4 Government

- 6.4.2.2.5 Manufacturing

- 6.4.2.2.6 Media & Entertainment

- 6.4.2.2.7 Telecom

- 6.4.2.2.8 Other End User

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Landscape

- 7.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.3.1 Cogent Communications

- 7.3.2 CyrusOne Inc.

- 7.3.3 Equinix Inc.

- 7.3.4 Euclyde Data Centers

- 7.3.5 Global Switch Holdings Limited

- 7.3.6 Interxion (Digital Reality Trust Inc.)

- 7.3.7 Scaleway SAS (Illiad Group)

- 7.3.8 SOCIETE FRANCAISE DU RADIOTELEPHONE - SFR

- 7.3.9 Sungard Availability Services LP

- 7.3.10 Telehouse (KDDI Corporation)

- 7.3.11 Thesee DataCenter

- 7.3.12 Zenlayer Inc.

- 7.4 LIST OF COMPANIES STUDIED

8 KEY STRATEGIC QUESTIONS FOR DATA CENTER CEOS

9 APPENDIX

- 9.1 Global Overview

- 9.1.1 Overview

- 9.1.2 Porter's Five Forces Framework

- 9.1.3 Global Value Chain Analysis

- 9.1.4 Global Market Size and DROs

- 9.2 Sources & References

- 9.3 List of Tables & Figures

- 9.4 Primary Insights

- 9.5 Data Pack

- 9.6 Glossary of Terms