|

市场调查报告书

商品编码

1690112

全球印刷金属包装:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Global Metal Print Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

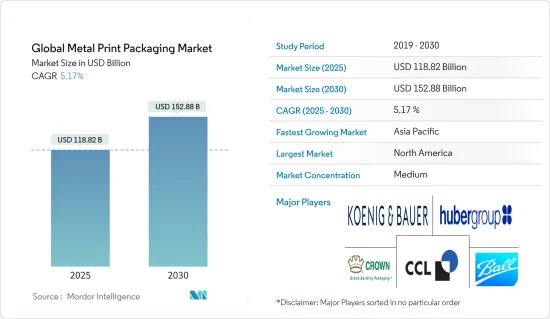

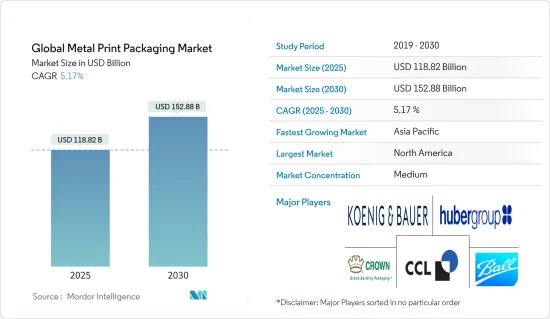

预计 2025 年全球金属印刷包装市场规模为 1,188.2 亿美元,到 2030 年将达到 1,528.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.17%。

主要亮点

- 由于客製化和优质化、金属包装的普及以及对可回收和可重复使用材料的日益关注等因素,全球印刷金属包装市场呈上升趋势。此外,印刷技术的进步为市场供应商创造了越来越多的机会。

- 预计在预测期内,对视觉吸引力和个人化罐装食品和饮料产品的需求不断增长将进一步推动金属印刷包装市场的成长。印刷油墨的技术创新,尤其是针对金属包装的油墨,正在推动市场需求。随着印刷设备数位化,对金属印刷包装的需求正在显着增长。

- 金属包装固有的装饰便利性使其能够实现多种效果和饰面,以满足特定的市场和机会。为了加快产品进入市场,供应商正在转向尖端金属列印技术。这种转变使供应商能够加强内部生产能力,更好地管理调度挑战,并及时将金属包装产品推向市场。

- 领先的饮料製造商倾向于客製化包装来提高货架可见度并吸引消费者,凸显了金属印刷包装的重要性。可口可乐引领这一趋势,推出了多项以数位喷墨印刷金属罐为特色的宣传活动。着名铝包装製造商 Ball Corp. 表示,由于品牌对塑胶包装的担忧日益加剧并寻求替代品,铝罐的需求预计将上升。

- 市场面临严峻的挑战。金属供应商价格上涨迫使油墨製造商调整定价策略。许多油墨製造商正在试图吸收这些上涨的成本,但许多製造商采取了涨价和额外费用。

金属印刷包装市场趋势

胶印微影术预计将显着成长

- 平张胶印已成为包装印刷的主导方法。平张胶印因其能够以最少的维护生产大量高品质的印刷品而广受欢迎。这种效率使得它在已开发地区,尤其是欧洲和北美特别受欢迎。在这些地区,微影术是金属罐印刷的主要方法,这在很大程度上是由于金属材料的硬度和不吸收性。

- 例如,市场领导者皇冠控股 (Crown Holdings) 在两片式和三片式金属包装上都采用胶印。该过程包括将油墨从印版转移到橡皮布上,然后将其涂在金属表面上。其中,两片罐是在成型后进行印刷,而三片罐则是预先在片材上进行印刷。 Crown Food Europe 为零嘴零食行业的众多客户提供服务,为 Bier Nuts 的脆皮花生生产 100% 可回收金属容器,并为 Satisfied Snacks 的 Salad Crisp 概念交付印刷金属罐装包装。

- 胶印以输出高品质作品而闻名,但却面临着来自凹印和照相凹版等尖端技术的激烈竞争。此外,阳极铝印板容易因氧化而生锈,需要小心维护。这些挑战可能会阻碍该领域的扩张。

- Metal Print 等公司专门从事高品质保护漆和马口铁和铝板上的鲜艳平版印刷,可满足广泛的金属包装需求。金属印刷产品范围从食品和饮料罐到化学容器和装饰罐。一个显着的趋势是,有机食品行业青睐轻质金属罐,因为其具有优异的阻隔性和环保性。

- 根据有机贸易协会的报告,美国有机包装食品市场经历了显着成长。 2019 年的消费额为 184.418 亿美元,预计到 2025 年将成长到 250.604 亿美元。有机包装食品需求的成长将增加食品包装产业对胶印的依赖。

亚太地区成长强劲

- 亚太地区在全球金属印刷包装市场占有很大份额,这主要是因为製造商专注于具有成本效益的包装解决方案。虽然数位印刷包装市场在成熟的已开发市场中正经历停滞,但中国和印度预计将在未来七到八年内经历强劲扩张。在电子零售激增和对方便食品包装需求不断增长的推动下,该地区预计将在预测期内见证最显着的增长。

- 推动亚太金属印刷包装市场发展的关键因素包括包装食品(包括冷冻和冷藏产品)销售的成长、可支配收入的增加、生活方式的改变、经济的稳定增长以及酒精和非酒精饮料消费量的增加。

- 金属罐因其出色的保存风味的能力而成为啤酒包装的主要形式。加拿大农业和农业食品部预测,印度的啤酒消费量将从 2020 年的 16.3 亿升呈指数级增长,到 2025 年将达到 34 亿公升。预计这将增加对印刷金属罐的需求。

- 数位印刷技术使整个印刷过程自动化,而 3D 列印正在成为下一个前沿技术。由于数位印刷技术的进步,日本、印度、中国和越南等国家正在呈现快速成长。值得注意的是,三菱电机最近宣布推出两款 AZ600 数位线雷射金属 3D 列印机的新型号。

- 亚太国家近年来不断加大对高效金属加工技术的投入,旨在减少金属加工产业的二氧化碳排放。这是为了抑制能源消耗和保护日益减少的自然资源。因此,预计对能够根据 3D 形状资料创建物体的金属 3D 列印机的需求将会增加。这些印表机不仅大大加快了传统的製造过程,而且还最大限度地减少了废弃物,提高了设计灵活性,实现了多个部件的整合,并减轻了整体重量。

金属印刷包装产业概况

全球金属印刷包装市场是一个分散的市场,既有小型市场,也有大型市场。拥有较大市场占有率的大公司正在积极努力扩大其全球消费者群体。主要参与者包括东洋精製、Ball Corporation、Hubergroup Deutschland GmbH、Envases Group、CCL Container(CL Industries Inc. 的一个部门)和 Koenig & Bauer AG。这些公司正在透过策略伙伴关係、创新解决方案投资和新产品发布来扩大其市场份额,所有这些都是为了在预测期内获得竞争优势。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场动态

- 市场驱动因素

- 数位印刷技术的快速发展

- 市场挑战

- 印刷油墨价格波动

- 有替代包装解决方案

第六章市场区隔

- 按印刷工艺

- 胶印

- 凹版印刷

- 柔版印刷

- 数位的

- 其他印刷技术

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Hubergroup Deutschland GmbH

- Crown Holdings Inc.

- CCL Container(CCL Industries Inc.)

- Ball Corporation

- Koenig & Bauer AG

- Toyo Seikan Group Holdings, Ltd

- Envases Group

- Real Pad Printer

- Ardagh Metal Packaging(AMP)

第八章投资分析

第九章:市场的未来

The Global Metal Print Packaging Market size is estimated at USD 118.82 billion in 2025, and is expected to reach USD 152.88 billion by 2030, at a CAGR of 5.17% during the forecast period (2025-2030).

Key Highlights

- The global metal print packaging market is on an upward trajectory driven by factors such as customization and premiumization, the growing adoption of metal packaging, and a heightened focus on recycling and reusable materials. Moreover, advancements in printing technologies are providing market vendors with expanded opportunities.

- The rising demand for visually appealing and personalized canned foods and beverages is poised to further propel the growth of the metal print packaging market during the forecast period. Innovations in printing inks, particularly those tailored for metal packaging, are fueling market demand. The increasing digitization of printing facilities has significantly heightened the appetite for metal print packaging.

- Metal packaging's inherent convenience in decoration enables a diverse range of effects and finishes, catering to specific markets or occasions. To expedite product entry, vendors are increasingly adopting state-of-the-art metal printing technologies. This shift is enhancing vendors' in-house production capabilities, enabling them to adeptly manage scheduling challenges and ensure timely market readiness of their metal-packaged products.

- Leading beverage manufacturers are gravitating toward customized packaging to boost shelf visibility and captivate consumers, underscoring the critical importance of metal print packaging. Pioneering this trend, Coca-Cola rolled out several campaigns centered on digitally inkjet-printed metal cans. According to Ball Corp., a prominent aluminum packaging manufacturer, the demand for aluminum cans is expected to rise owing to brands' growing apprehensions about plastic packaging and their pursuit of alternatives.

- The market faces formidable challenges. Rising prices from metal suppliers are compelling ink producers to adjust their pricing strategies. While many ink manufacturers are attempting to absorb these escalating costs, many have resorted to price hikes and surcharges.

Metal Print Packaging Market Trends

Offset Lithography is Expected to Record Significant Growth

- Offset lithography has solidified its position as the dominant method in packaging printing. It is popular for delivering high-quality prints in bulk with minimal upkeep. This efficiency has made it especially favored in developed regions, notably Europe and North America. In these areas, offset lithography is predominantly employed for printing on metal cans, a choice largely influenced by the material's hard and non-absorbent nature.

- Market leaders, such as Crown Holdings Inc., harness offset printing for both 2-piece and 3-piece metal packaging. The process involves transferring ink from a printing plate to a blanket and subsequently applying it to the metal surface. Notably, while 2-piece cans are printed post-formation, 3-piece cans are printed on sheets beforehand. Crown Food Europe caters to a variety of clients in the snacks industry, producing 100% recyclable metal containers for Bier Nuts' crunchy, coated peanuts and delivering print packaging for Satisfied Snacks' Salad Crisp concept in metal tins.

- Despite its reputation for high-quality output, offset printing faces stiff competition from cutting-edge methods like rotogravure and photogravure. Additionally, the anodized aluminum printing plates, susceptible to rust from oxidation, demand careful maintenance. Such challenges could hinder the expansion of the segment.

- Companies like Metal-Print, specializing in high-quality protective lacquering and vibrant lithography on tinplate or aluminum sheets, address a wide array of metal packaging demands. Metal-Print's offerings span from food and beverage cans to chemical containers and decorative tins. A prominent trend is the organic food industry's preference for lightweight metal cans, lauded for their excellent barrier properties and eco-friendliness.

- According to a report by the Organic Trade Association, the US organic packaged food market witnessed significant growth. The consumption value was USD 18,441.8 million in 2019, which is expected to increase to USD 25,060.4 million by 2025. This increase in demand for organic packaged food is poised to boost the reliance on offset printing in the food packaging industry.

Asia-Pacific to Witness Significant Growth

- Asia-Pacific commands a significant share of the global metal printing packaging market, primarily due to manufacturers' emphasis on cost-effective packaging solutions. While mature markets in established nations see the digital printing packaging market plateauing, China and India are gearing up for vigorous expansion in the coming seven to eight years. Bolstered by a surge in e-retail sales and a growing appetite for convenient food packaging, the region is on track to experience the most pronounced growth during the forecast period.

- Key factors driving the metal print packaging market in Asia-Pacific include rising sales of packaged foods (encompassing frozen and chilled items), growing disposable incomes, shifting lifestyles, consistent economic growth, and an uptick in beverage consumption, both alcoholic and non-alcoholic.

- Beer packaging predominantly favors metal cans, attributed to their superior ability to preserve taste. Projections from Agriculture and Agri-Food Canada indicate a leap in India's beer consumption from 1.63 billion liters in 2020 to a staggering 3.4 billion liters by 2025. This is expected to increase the demand for printed metal cans.

- With digital printing technology automating the entire printing process, 3D printing is emerging as the next frontier. Countries like Japan, India, China, and Vietnam are witnessing a surge driven by advancements in digital printing technologies. Notably, Mitsubishi Electric recently launched two new AZ600 digital wire-laser metal 3D printer models.

- Asia-Pacific countries have ramped up their efforts on efficient metalworking techniques in recent years, aiming to slash CO2 emissions in the metal fabrication industry. This pivot seeks to curtail energy consumption and safeguard dwindling natural resources. Consequently, there is an anticipated uptick in demand for metal 3D printers, which can craft objects from 3D shape data. These printers not only significantly expedite traditional manufacturing processes but also minimize waste and boost design flexibility, allowing the integration of multiple parts and a reduction in overall weight.

Metal Print Packaging Industry Overview

The global metal print packaging market is fragmented in nature, with the presence of both small and large players. Major players holding significant market shares are actively working to broaden their global consumer base. Key players include Toyo Seihan Co. Ltd, Ball Corporation, Hubergroup Deutschland GmbH, Envases Group, CCL Container (a division of CCL Industries Inc.), and Koenig & Bauer AG. These companies are bolstering their market presence through strategic partnerships, investments in innovative solutions, and new product launches, all aimed at gaining a competitive edge during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Evolution of Digital Print Technology

- 5.2 Market Challenges

- 5.2.1 Fluctuations in the Prices of Printing Inks

- 5.2.2 Presence of Alternate Packaging Solutions

6 MARKET SEGMENTATION

- 6.1 By Printing Process

- 6.1.1 Offset Lithography

- 6.1.2 Gravure

- 6.1.3 Flexography

- 6.1.4 Digital

- 6.1.5 Other Printing Technologies

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Hubergroup Deutschland GmbH

- 7.1.2 Crown Holdings Inc.

- 7.1.3 CCL Container (CCL Industries Inc.)

- 7.1.4 Ball Corporation

- 7.1.5 Koenig & Bauer AG

- 7.1.6 Toyo Seikan Group Holdings, Ltd

- 7.1.7 Envases Group

- 7.1.8 Real Pad Printer

- 7.1.9 Ardagh Metal Packaging (AMP)