|

市场调查报告书

商品编码

1690118

工业 4.0 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Industry 4.0 - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

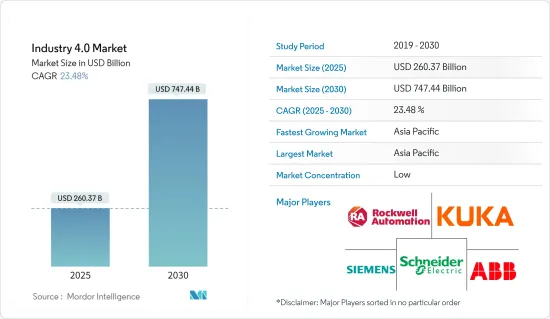

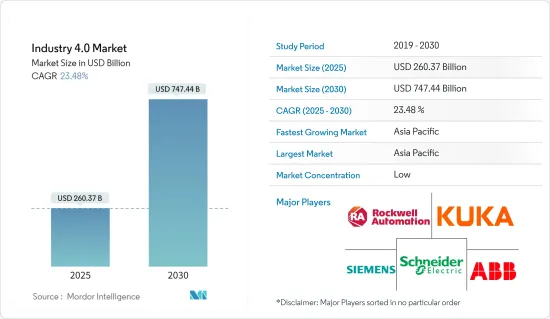

预计 2025 年工业 4.0 市场规模为 2,603.7 亿美元,到 2030 年将达到 7,474.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 23.48%。

快速成长的全球工业 4.0 市场正在改变全球众多产业。工业4.0,又称第四次工业革命,是将最新技术和数位解决方案融入生产流程,打造智慧工厂,提高生产效率的过程。

关键亮点

- 工业 4.0 市场正在经历快速成长,这得益于智慧製造的广泛应用、连网型设备的激增以及对即时资料分析以支持敏捷决策的日益增长的需求。在快速发展的工业格局中,企业正在转向工业 4.0 解决方案,以抓住机会简化业务、优化资产利用率并开闢新的收益来源。

- 製造商必须接受以工业 4.0 为导向的数位转型,以变得更加灵活、敏捷并应对力客户需求。这种转变的关键驱动因素包括利润预期、新的市场机会、劳动力问题、不断变化的客户需求、竞争压力以及对品质驱动的品牌形象的追求。

- 例如,工业 4.0 是由不断变化的最终客户需求所驱动的。 3D 列印等技术正在将数位设计转化为有形产品,这种转变在工业环境中正在获得发展动力。最终产品可以大规模生产,但又可以依照个人喜好进行客製化。使用数位系统设计和创造产品为公司和最终用户提供了灵活性。人类洞察力和即时资料分析的结合可能很快就会催生一个数位生态系统,在这个生态系统中,人类的判断能力会透过演算法得到增强。

- 然而,要使所研究的市场实现永续成长,需要解决几个障碍。例如,第四次工业革命面临着许多挑战,例如解决与人工智慧相关的伦理问题、保护资料隐私、提高劳动力在数位经济中的角色技能以及确保公平获得技术。

- 新冠肺炎疫情影响了基础建设、交通运输和製造业等多个领域。作为回应,一些国家的政府实施了封锁规定。因此,公众基本上遵守了居家令和社交距离准则。结果导致汽车等产品的需求急剧下降,迫使主要企业削减营运能力。但在动盪之中,该地区的一些工业公司已转向自动化,以应对疫情带来的挑战。鑑于这些技术带来的好处,疫情期间预计获得的见解将激励供应商进一步采用自动化和工业控制解决方案。这种转变将在预测期内所研究的市场中创造机会。

工业4.0市场趋势

工业物联网技术领域占主要市场占有率

- 作为工业 4.0 的基石,物联网 (IoT) 在製造业和服务业的生产系统监控中发挥着至关重要的作用。物联网使製造商能够为创新铺平道路并提高业务绩效。物联网的核心是透过连接到互联网的机器和设备收集和传播资料。每个设备都有一个独特的识别号码或代码,可以透过智慧型手机等日常设备进行控制。

- 该技术的主要组成部分是软体和硬件,它们透过网路互连来收集和修改资料。物联网不仅仅是一种工具;它是製造业颠覆性创新的催化剂。实现物联网的潜力对于现代生产系统至关重要。在工业 4.0 领域,物联网是个重大飞跃,能够对製造过程进行全面、智慧的监控。

- 工业物联网 (IIoT) 技术在推动工业 4.0倡议方面发挥关键作用,并以多种方式展现其影响。其中一个关键体现就是智慧工厂方法,其中感测器和互连的监控和分析设备交换资料以实现即时增强。 5G 网路的快速普及增强了这种无缝通讯,确保了快速的资料传输,并透过保护这些连接的强大网路安全措施得到了加强。

- 製造业、汽车业和医疗业越来越多地采用工业IoT技术,推动市场扩张。在传统製造业数位转型的浪潮中,工业物联网正站在变革的前沿,开启智慧互联的新工业革命。这种转变正在重塑公司管理先进系统和机械的方式,旨在提高生产力并最大限度地减少停机时间。

- 工业 4.0 和 IIoT 是智慧工厂自动化中物流链开发、生产和管理的核心。随着工业 4.0 和 IIoT 的实施颠覆製造业,企业被迫采用敏捷和创新的方法。这些方法不仅旨在透过使用机器人技术补充人类劳动来提高生产力,而且还旨在减少因製程故障造成的工伤。

- 製造业中连网型设备、感测器和 M2M通讯的激增导致资料点的激增。据爱立信称,预计2022年至2028年间,全球连网设备的数量将增加近一倍。这一增长主要归因于近距离物联网 (IoT) 设备的数量将达到 287.2 亿。

- 这些资料点包括基本指标(例如材料完成一个製程週期所需的时间)以及更高级的计算(例如评估汽车领域材料的应力能力)。 IIoT 有望成为满足此类使用案例需求的解决方案。

亚太地区经济强劲成长

- 几年前,印度开始提出将自己转变为製造业和出口强国的愿景。该计划旨在减少对进口的依赖,并增强该国作为全球製造业领导者的地位,能够为国内消费和国际市场生产商品。

- 印度推出了「印度製造」和「自力更生印度」等宣传活动来推动製造业的发展,目标是到2025年将其对GDP的贡献率从目前的16%提高到25%。凭藉先进的技术和庞大的国内消费群,印度完全有能力生产出在品质和价格上具有全球竞争力的产品。但要实现这一潜力,印度需要超越单纯的雄心壮志,拥抱工业 4.0。印度物联网的出现预示着这场技术革命的到来,尤其是在政府的「数位印度」计画下。

- 在全球范围内,各行各业都在见证工业 4.0 带来的好处。对印度来说,这是一个及时的机会来重新建构其叙事,特别是考虑到全球政治格局的变化以及已开发国家对摆脱传统製造地的兴趣重新燃起。

- 面对地缘政治变化、技术落后和竞争优势,中国产业正经历转型期。随着工业4.0的清晰轨迹,中国製造业必将迎来快速加速。作为全球最大的製造地,中国正处于数位革命的前沿,利用其庞大的工业基础和技术力始终处于创新前沿。

- 中国政府已推出「中国製造2025」等计划,推动工业4.0技术的应用,提升製造能力,培育高科技产业。受德国工业4.0的启发,「中国製造2025」专注于开发云端物联网和量身定制的工业自动化系统。

- 为了加强全球影响力,日本机器人自动化供应商不仅扩大了生产能力,还在海外建立製造地。例如,2024年7月,FANUC美国子公司在密西根州开设了一家价值1.1亿美元的工厂。该设施将专门用于储存、销售和维护日本製造的工业机器人,特别针对北美客户。

工业4.0行业概览

工业 4.0 市场较为分散,主要参与者包括 ABB、西门子股份公司、罗伯特博世有限公司和罗克韦尔自动化。该市场的参与企业正在采取伙伴关係、投资和收购等策略来加强其产品供应并获得可持续的竞争优势。

- 2024年8月-施耐德电机在多个城市举办的2024年创新日推出了八款尖端产品和解决方案。这些活动为施耐德电机提供了一个动态平台,展示其最新的创新成果,并专注于效率、可靠性、永续性和安全性方面的改进。此外,产业专家还将举办会议,旨在推动整个生态系统的转型。

- 2024 年 6 月—ABB 机器人公司推出 OmniCore,这是一个优先考虑速度、精度和永续性的先进自动化平台。 OmniCore 平台在下一代机器人技术上投资超过 1.7 亿美元,标誌着其向模组化、先进控制架构迈出了关键一步。该架构无缝整合了人工智慧、感测器、云端和边缘运算,为尖端自主机器人应用奠定了基础。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 市场驱动因素

- 政府积极措施和相关人员之间的合作

- 工业机器人需求不断成长

- 中小企业如何因应数位转型

- 市场限制

- 对工业 4.0 采用的投资报酬率 (ROI) 认知相对缺乏

- 劳动力和标准化挑战

- 宏观经济趋势对市场的影响

- 技术简介

第五章市场区隔

- 依技术类型

- 工业机器人

- IIoT

- 人工智慧和机器学习

- 区块链

- 扩增实境

- 数位双胞胎

- 3D列印

- 其他的

- 按最终用户产业

- 製造业

- 车

- 石油和天然气

- 能源公共产业

- 电子铸件

- 饮食

- 航太与国防

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 亚洲

- 印度

- 中国

- 日本

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

- 北美洲

第六章 竞争格局

- 公司简介

- ABB Ltd

- Siemens AG

- Schneider Electric

- Swisslog Holding AG(Kuka AG)

- Rockwell Automation Inc.

- Cognex Corporation

- Honeywell International Inc.

- Robert Bosch GmbH

- Johnson Controls International PLC

- Emerson Electric Company

- General Electric Company

- Cisco Systems Inc.

- Intel Corporation

- Fanuc Corporation

- Denso Corporation

第七章投资分析

第八章:市场的未来

The Industry 4.0 Market size is estimated at USD 260.37 billion in 2025, and is expected to reach USD 747.44 billion by 2030, at a CAGR of 23.48% during the forecast period (2025-2030).

Numerous industries all around the world are being transformed by the global Industry 4.0 market, which is growing quickly. Industry 4.0, also referred to as the fourth industrial revolution, is the process of integrating modern technologies and digital solutions into production processes in order to build intelligent factories and increase production efficiency.

Key Highlights

- The Industry 4.0 market is experiencing rapid growth, fueled by the rising adoption of smart manufacturing, the surge of connected devices, and the escalating demand for real-time data analytics to enhance agile decision-making. In a fast-evolving landscape, organizations are turning to Industry 4.0 solutions, seizing opportunities to streamline operations, optimize asset use, and tap into new revenue streams.

- Manufacturers find it imperative to embrace digital transformation toward Industry 4.0, enhancing their flexibility, agility, and responsiveness to customer needs. Key drivers for this shift include anticipated benefits, emerging market opportunities, labor challenges, evolving customer demands, competitive pressures, and the pursuit of a strong quality-centric brand image.

- For example, Industry 4.0 is being driven by the changing demands of end customers. Technologies like 3-D printing are transforming digital designs into tangible products, and this shift is gaining momentum in industrial settings. As a result, products can be tailored to individual preferences, even while being produced in masse. Leveraging digital systems for product design and creation offers flexibility for both businesses and end users. By merging human insights with real-time data analysis, the world may soon see the emergence of a digital ecosystem where human decisions are enhanced by algorithms.

- However, there are several hurdles that need to be addressed for uninterrupted growth of the studied market. For example, the 4th industrial revolution faces challenges such as tackling ethical concerns tied to artificial intelligence, safeguarding data privacy, upskilling the workforce for roles in a digital economy, and guaranteeing fair access to technology.

- The COVID-19 outbreak challenged various sectors, including infrastructure, transportation, and manufacturing. In response, the government across several countries imposed lockdown restrictions. As a result, the public largely followed stay-at-home orders and social distancing guidelines. This adherence led to a significant drop in the demand for products like automobiles, forcing companies to operate at reduced capacities. Yet, amidst this turmoil, several regional industrial enterprises turned to automation as a means to navigate the pandemic's challenges. Given the advantages these technologies present, the insights gained during the pandemic are expected to motivate vendors to further embrace automation and industrial control solutions. This shift is poised to create opportunities in the market studied during the forecast period.

Industry 4.0 Market Trends

IIoT Technology Segment Holds Significant Market Share

- As a cornerstone of Industry 4.0, the Internet of Things (IoT) plays a pivotal role in monitoring production systems across both manufacturing and service sectors. By harnessing IoT, manufacturers can unlock innovative avenues, driving enhanced performance. At its core, IoT excels in gathering and disseminating data via internet-connected machines and devices. Each device is tagged with a unique identification number or code, allowing control through everyday gadgets like smartphones.

- Key components of this technology encompass software and hardware, all interconnected through a network for data collection and alteration. IoT is not just a tool; it is a catalyst for disruptive innovation in manufacturing. Recognizing the potential of IoT is essential for modern production systems. Within the realm of Industry 4.0, IoT stands out as a significant leap forward, enabling comprehensive smart monitoring of manufacturing processes.

- IIoT technologies play a pivotal role in driving Industry 4.0 initiatives, showcasing their impact in various forms. A dominant manifestation is the smart factory approach, where sensors and interconnected monitoring/analysis devices exchange data, enabling real-time enhancements. This seamless communication is bolstered by the swift adoption of 5G networks, ensuring rapid data transfer and fortified by robust cybersecurity measures to safeguard these connections.

- The growing adoption of industrial IoT technology across manufacturing, automotive, and healthcare sectors is driving positive market expansion. As the traditional manufacturing sector undergoes a digital transformation, the IIoT is spearheading this evolution, heralding a new industrial revolution of intelligent connectivity. This transformation is reshaping how businesses manage their sophisticated systems and machinery, aiming to boost productivity and minimize downtime.

- At the heart of the logistics chain's development, production, and management, termed smart factory automation, lie Industry 4.0 and IIoT. As manufacturing undergoes seismic shifts due to Industry 4.0 and the embrace of IIoT, businesses are compelled to adopt agile, innovative methods. These methods not only enhance production through technologies that complement human labor with robotics but also aim to curtail industrial accidents stemming from process failures.

- The surge in connected devices, sensors, and M2M communication in the manufacturing sector has led to an explosion of generated data points. According to Ericsson, Between 2022 and 2028, the global count of connected devices is projected to nearly double. This surge is largely attributed to the rise of short-range IoT (Internet of Things) devices, with forecasts estimating 28.72 billion of these devices by 2028.

- These data points vary widely, from basic metrics like the time taken for materials to complete a process cycle to advanced calculations, such as assessing material stress capabilities in the automotive sector. IIoT is expected to be the solution to address the requirements of such use cases.

Asia Pacific to Register Significant Growth

- Years ago, India embarked on a vision to transform into a manufacturing and export powerhouse. This initiative aimed to reduce the nation's reliance on imports and elevate India's status as a global manufacturing leader, capable of producing goods for both domestic consumption and international markets.

- Campaigns such as 'Make In India' and 'Atmanirbhar Bharat' were introduced to bolster the manufacturing sector, targeting a GDP contribution of 25% by 2025, up from the current 16%. With advanced technology and a vast internal consumer base, India stands poised to produce globally competitive products in quality and price. Yet, to realize this potential, India requires more than just ambition; and it needs to embrace Industry 4.0. The advent of IoT in India, especially under the government's "Digital India" initiative, heralds this technological revolution.

- Globally, industries are witnessing the benefits of Industry 4.0, which promises to minimize defects and wastage in production. For India, this presents a timely opportunity to reshape its narrative, especially given the shifting global political landscape and the renewed interest from developed nations in diversifying away from their traditional manufacturing hubs.

- Amidst geopolitical shifts, technological lags, and competitive advantages, China's industries are in a state of transformation. With a clear trajectory toward Industry 4.0, China's manufacturing sector is set for rapid acceleration. As the world's largest manufacturing hub, China is at the helm of the digital revolution, harnessing its expansive industrial base and technological capabilities to spearhead innovation.

- The Chinese government, with initiatives like "Made in China 2025", is championing the adoption of Industry 4.0 technologies, aiming to elevate manufacturing capabilities and nurture high-tech industries. Drawing inspiration from Germany's Industry 4.0, "Made in China 2025" focuses on developing cloud-driven IoT and tailored industrial automation systems.

- In a bid to enhance their global footprint, Japanese robot and automation suppliers have not only increased their production capacities but have also established manufacturing sites overseas. For example, in July 2024, Fanuc's US subsidiary inaugurated a USD 110 million facility in Michigan. This facility is dedicated to storing, selling, and maintaining industrial robots, all manufactured in Japan, specifically catering to North American clientele.

Industry 4.0 Industry Overview

The Industry 4.0 Market is fragmented, with the presence of major players like ABB Ltd, Siemens AG, Robert Bosch GmbH, and Rockwell Automation Inc., among others. Players in the market are adopting strategies such as partnerships, investments, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- August 2024 - During its Multi-city INNOVATION DAYS 2024, Schneider Electric introduced eight state-of-the-art products and solutions. These events serve as a dynamic platform for Schneider Electric to present its newest innovations, highlighting improvements in efficiency, reliability, sustainability, and safety. Furthermore, the event features sessions conducted by industry experts with the goal of fostering transformative changes across the ecosystem.

- June 2024 - ABB Robotics launched OmniCore, an advanced automation platform that prioritizes speed, precision, and sustainability, with the goal of empowering businesses for the future. With over USD 170 million invested in next-gen robotics, the OmniCore platform marked a pivotal move toward a modular and forward-thinking control architecture. This architecture seamlessly integrates AI, sensors, cloud, and edge computing, setting the stage for cutting-edge autonomous robotic applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Favorable Governmental Initiatives and Collaborations Between Stakeholders

- 4.3.2 Growth in Demand for Industrial Robotics

- 4.3.3 Digital Transformation Initiatives Undertaken by SMEs

- 4.4 Market Restraints

- 4.4.1 Relative Lack of Awareness on the ROI Related to Adoption of Industry 4.0

- 4.4.2 Workforce and Standardization Related Challenges

- 4.5 Impact of Macroeconomic Trends on the Market

- 4.6 Technology Snapshot

5 MARKET SEGMENTATION

- 5.1 By Technology Type

- 5.1.1 Industrial Robotics

- 5.1.2 IIoT

- 5.1.3 AI and ML

- 5.1.4 Blockchain

- 5.1.5 Extended Reality

- 5.1.6 Digital Twin

- 5.1.7 3D Printing

- 5.1.8 Other Technology Types

- 5.2 By End-user Industry

- 5.2.1 Manufacturing

- 5.2.2 Automotive

- 5.2.3 Oil and Gas

- 5.2.4 Energy and Utilities

- 5.2.5 Electronics and Foundry

- 5.2.6 Food and Beverage

- 5.2.7 Aerospace and Defense

- 5.2.8 Other End-user Industries

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.3 Asia

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.4 Australia and New Zealand

- 5.3.5 Latin America

- 5.3.6 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd

- 6.1.2 Siemens AG

- 6.1.3 Schneider Electric

- 6.1.4 Swisslog Holding AG (Kuka AG)

- 6.1.5 Rockwell Automation Inc.

- 6.1.6 Cognex Corporation

- 6.1.7 Honeywell International Inc.

- 6.1.8 Robert Bosch GmbH

- 6.1.9 Johnson Controls International PLC

- 6.1.10 Emerson Electric Company

- 6.1.11 General Electric Company

- 6.1.12 Cisco Systems Inc.

- 6.1.13 Intel Corporation

- 6.1.14 Fanuc Corporation

- 6.1.15 Denso Corporation