|

市场调查报告书

商品编码

1910855

低程式码开发平台:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Low-code Development Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

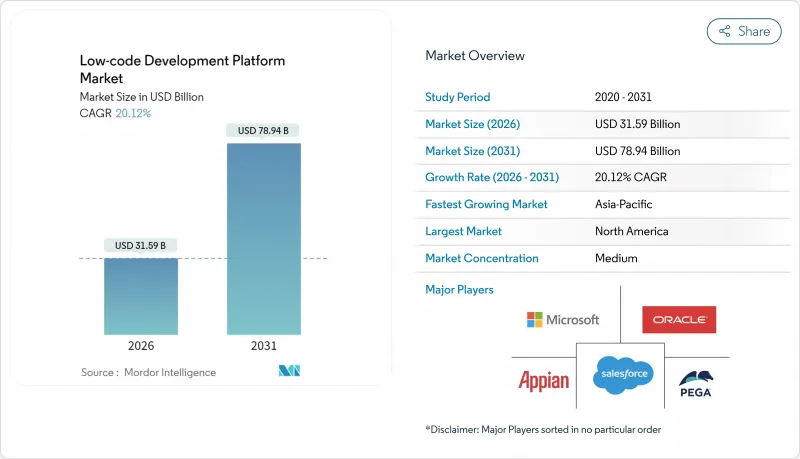

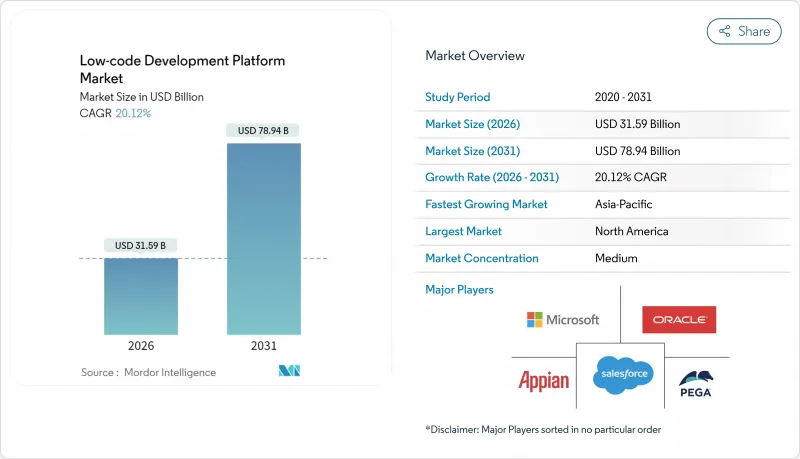

预计到 2026 年,低程式码开发平台市场规模将达到 315.9 亿美元,从 2025 年的 263 亿美元成长到 2031 年的 789.4 亿美元,2026 年至 2031 年的复合年增长率为 20.12%。

这一增长的驱动力源于对旧有系统现代化改造的迫切需求、开发人员的严重短缺以及重视快速应用交付的严格监管期限。联邦机构正在签署多年期低代码解决方案一揽子采购协议,欧盟银行也在争分夺秒地遵守将于2027年生效的《可组合银行和资料存取条例》。云端优先架构、人工智慧驱动的开发协同模式以及不断扩展的自主云端框架进一步推动了各行业和地区的采用。随着平台供应商不断迭加生成式人工智慧和资料架构功能以缩短建置週期、统一资料并巩固市场地位,竞争压力也日益加剧。

全球低程式码开发平台市场趋势与洞察

美国联邦机构透过低程式码采购强制实现遗留 COBOL 系统现代化

联邦机构正在逐步淘汰使用了数十年的COBOL平台,并透过多公司总括采购协议转向低程式码系统,从而降低23%的合约管理成本。国防合约管理署(DCMA)在其2025年现代化RFI中明确指出,低程式码是整合合约管理的首选方法。各州政府也正在效仿联邦政府的做法,扩大符合条件的支出范围,并将低程式码平台确立为公共部门快速现代化的标准方法。能够检验是否符合FedRAMP和DoD IL5标准的供应商将优先进入许可权这一日益增长的采购机会,进一步推动低程式码开发平台市场的发展。

欧盟即时可组合银行计画加速低程式码技术的应用

《金融资料存取条例》要求欧洲银行在2027年前透过API开放客户资料。与之配套的《数位营运韧性法案》加强了资讯通信技术风险监管,并鼓励金融机构转向能够适应不断变化的监管环境的敏捷架构。低程式码平台透过自动化产生合规API和证据管理来满足这两项需求。欧洲央行监管机构已正式确立了对云端外包的期望,重视模组化服务部署。因此,传统银行正在转向低程式码工具,以跟上低程式码开发平台市场中金融科技挑战者的快速发布步伐。

锁定在专有运行时供应商会增加迁移成本

2024 年一项经过同行评审的研究引入了云端供应商锁定预测框架,用于量化迁移风险,并强调与专有运行时绑定的应用程式的高成本。许多低程式码系统将工作流程编译到封闭式的执行引擎中,限制了其可移植性。资讯长们要求提供原始程式码汇出和容器化配置选项,这延长了采购週期,并在一定程度上抑制了低程式码开发平台市场的发展。

细分市场分析

到2025年,平台业务将占总营收的71.35%,成为低程式码开发平台市场的基础。企业倾向于采用整合式环境,将视觉化建模、流程协作和整合资料库结合,从而减少工具的冗余。 Salesforce以80亿美元收购Informatica等整合策略将资料管理和人工智慧整合到单一执行时间环境中,加剧了企业对供应商的依赖。服务线的扩展紧随平台部署之后:政府机构采用单一供应商将持续推动对整合咨询、管治框架和人工智慧加速设计的需求。

服务领域虽然规模较小,但正以 23.45% 的复合年增长率快速成长,因为企业寻求合作伙伴来帮助他们迁移 COBOL 工作负载、整合 ESG 分析以及训练生成式 AI 助理。对咨询服务日益增长的需求将推高高级支援和託管服务的附加率,从而为行业增加经常性收入。将训练、资料架构调优和 AI 模型管治与授权打包在一起的供应商,其生命週期价值将在预测期内翻番,市场份额也将扩大。

到2025年,Web应用程式仍将占总支出的54.40%,但行动工作负载正以22.63%的复合年增长率快速成长,这主要得益于现场技术人员和远端员工对离线优先功能的需求不断增长。相机、生物识别和扩增实境(AR)的原生插件使行动体验更加丰富和情境化。面向行动应用场景的低程式码开发平台市场规模预计将快速成长,尤其是在保险检验和公共产业维护领域。

以 API 为中心的设计将扩展 Web 和行动应用程式的规模,符合可组合银行和开放资料的要求。微软计划从 Dynamics 365 的单体式介面转向任务导向的 AI 代理,这标誌着介面设计正向情境化的微互动转变。提供响应式设计、一键式 PWA 产生和安全离线同步功能的供应商将在追求多通路统一性的组织中赢得市场份额。

区域分析

到2025年,北美将占据30.60%的收入份额,这主要得益于联邦政府的现代化进程和成熟的创投生态系统。美国政府逐步淘汰COBOL语言的倡议以及FedRAMP合规计划,正为各州政府机构树立榜样,促进司法、交通和医疗保健等领域的可复製部署。加拿大正利用低程式码技术加快金融科技授权和数位身分计划的审批,推动全部区域的成长动能。创业投资持续支持融合人工智慧的低程式码Start-Ups,推动产品创新,进而促进低程式码开发平台市场的发展。

亚太地区以21.13%的复合年增长率领先。日本保险公司正在采用符合审核要求的建构器以遵守国际财务报告准则第17号(IFRS 17),新加坡金融管理局也积极推动金融科技沙盒的快速发展。中国正在为海湾地区的超大规模资料中心提供资金,以建立託管与西方相容运行时环境的主权云端。印度IT服务巨头正在将低代码加速器纳入全球转型合同,以提升出口收入,同时推动国内公共部门采用低程式码技术。这些共同努力为该地区未来显着推动低程式码开发平台市场的成长奠定了基础。

欧洲正在发挥监管影响力,并塑造全球产品蓝图。欧洲央行(ECB)的云端标准、开放银行API的最后期限以及ESG资讯揭露要求,正迫使企业迅速实现合规工作的自动化。北欧各国政府正利用低程式码入口网站为公民提供服务;德国汽车製造商不顾效能方面的担忧,仍在开发现场应用程式原型;法国公共产业也在整合ESG报告流程。随着政策动能不断增强,欧洲将继续成为蓬勃发展的低程式码开发平台市场的基石。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 美国联邦机构透过低程式码采购强制实施遗留 COBOL 系统现代化

- 欧盟即时可组合银行计画加速低程式码技术的应用

- 亚太地区保险公司低代码审核追踪获得监管部门核准

- 平台内建的 GenAI Copilot 可将建置週期时间缩短 40%。

- 欧盟ESG报告截止日期推动应用程式部署需求快速成长

- 市场限制

- 与专有运行时供应商的锁定会增加迁移成本

- 运算密集型工业IoT应用的效能限制

- 资料居住障碍阻碍中东地区云端优先部署

- 监管或技术环境

- 新兴科技趋势

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 供应商市场定位分析

- 投资分析

第五章 市场规模与成长预测

- 按组件

- 平台

- 服务

- 透过使用

- 基于网路的

- 基于行动装置的

- 基于桌面/伺服器

- 以 API 为中心和微服务

- 透过部署模式

- 云

- 本地部署

- 按组织规模

- 小型企业

- 大公司

- 按行业

- 银行业

- 金融服务和保险 (BFSI)

- 零售与电子商务

- 政府/国防

- 资讯科技与通讯

- 医疗保健和生命科学

- 製造业

- 能源与公共产业

- 教育

- 媒体与娱乐

- 其他(交通运输、房地产)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Microsoft Corporation

- Salesforce Inc.

- Appian Corporation

- Oracle Corporation

- Mendix(Business of Siemens)

- OutSystems Inc.

- ServiceNow Inc.

- Magic Software Enterprises Ltd.

- Quickbase Inc.

- Zoho Corporation

- Clear Software LLC

- Temenos(formerly Kony Inc.)

- AgilePoint Inc.

- Betty Blocks BV

- Creatio Global

- Kissflow Inc.

- Nintex Global Ltd.

- GeneXus International SA

- LANSA Inc.

- Newgen Software Technologies

- WaveMaker Inc.

第七章 市场机会与未来展望

Low-code Development Platform Market size in 2026 is estimated at USD 31.59 billion, growing from 2025 value of USD 26.30 billion with 2031 projections showing USD 78.94 billion, growing at 20.12% CAGR over 2026-2031.

This growth rests on urgent legacy-system modernization, acute developer shortages, and strict regulatory deadlines that reward rapid application delivery. Federal agencies are issuing multi-year blanket purchase agreements for low-code solutions, while EU banks race to meet 2027 composable-banking and data-access rules. Cloud-first architectures, AI-driven development copilots, and expanding sovereign-cloud frameworks are further lifting adoption across industries and regions. Competitive pressure is intensifying as platform vendors layer generative AI and data-fabric capabilities to shorten build cycles, consolidate data, and defend market position.

Global Low-code Development Platform Market Trends and Insights

Mandated modernization of legacy COBOL systems in U.S. federal agencies via low-code procurement

Federal departments are retiring decades-old COBOL platforms and replacing them with low-code systems through multi-award blanket purchase agreements that lower contract overhead by 23% . The Defense Contract Management Agency highlighted low-code in its 2025 modernization RFI as the preferred path for integrated contract management. States now replicate these federal templates, expanding addressable spend and cementing low-code platforms as the public-sector default for rapid modernization. Vendors able to verify FedRAMP and DoD IL5 compliance gain privileged access to this growing procurement wave, supporting further growth for the low-code development platform market.

Real-time composable banking initiatives in the EU accelerating low-code adoption

The Financial Data Access regulation obliges European banks to expose customer data via APIs by 2027. Complementary Digital Operational Resilience Act rules tighten ICT risk oversight and push institutions toward agile architectures that can adapt to weekly rule updates. Low-code platforms answer both needs by generating compliant APIs and automating control evidence. Supervisors at the European Central Bank have formalized cloud-outsourcing expectations that reward modular service deployment. Traditional banks therefore rely on low-code tooling to match the release velocity of fintech challengers across the low-code development platform market.

Proprietary runtime vendor lock-in elevating migration costs

A 2024 peer-reviewed study introduced a cloud vendor lock-in prediction framework that quantifies switching risk and reveals high cost exposures for applications bound to proprietary runtimes. Many low-code systems compile workflows into closed execution engines that limit portability. CIOs now require source-code export and containerized deployment options, slowing purchase cycles and suppressing a portion of the low-code development platform market.

Other drivers and restraints analyzed in the detailed report include:

- APAC insurers' regulatory approval of low-code audit trails

- GenAI copilots within platforms reducing build-cycle time by 40%

- Performance limitations for compute-intensive industrial IoT apps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The platform segment represented 71.35% revenue in 2025 and anchors the low-code development platform market. Enterprises favor unified environments that combine visual modelling, process orchestration, and integrated databases, thereby reducing tool sprawl. Consolidation plays such as Salesforce's USD 8 billion acquisition of Informatica fold data management and AI into a single runtime to deepen enterprise lock-in. Service-line expansion follows platform rollout: federal agencies that standardize on one vendor generate continuous demand for integration consulting, governance frameworks, and AI-prompt design.

Services, while smaller, are growing at 23.45% CAGR as organizations look for partners to migrate COBOL workloads, embed ESG analytics, and train GenAI copilots. This advisory wave lifts attach rates for premium support and managed services, adding recurring revenue layers to the industry. Over the forecast, vendors that package training, data-fabric tuning, and AI-model governance alongside licences can double lifetime value and widen the market.

Web apps still controlled 54.40% spending in 2025, yet mobile workloads are rising at 22.63% CAGR as field technicians and remote employees demand offline-first capabilities. Native plug-ins for camera, biometrics, and augmented reality make mobile experiences richer and more contextual. The low-code development platform market size for mobile use cases is projected to grow rapidly, especially in insurance inspections and utility maintenance.

API-centric designs extend both web and mobile apps, aligning with composable-banking and open-data directives. Microsoft's planned shift from monolithic Dynamics 365 screens to task-oriented AI agents underlines how interfaces will dissolve into contextual micro-interactions. Vendors that ship responsive design, one-click PWA generation, and secure offline sync will capture incremental market share among organizations pursuing multi-channel parity.

Low Code Development Platform Market Report is Segmented by Component (Platform and More), Application Type (Web-Based, Mobile-Based, and More), Deployment Type (On-Premises, Cloud), Organization Size (Small and Medium Enterprises, Large Enterprises), Industry Vertical (BFSI, Retail and E-Commerce, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 30.60% revenue in 2025, driven by federal modernization and a mature venture ecosystem. The U.S. government's push to sunset COBOL and enforce FedRAMP compliance sets a template for state agencies, seeding repeatable rollouts across justice, transport, and health. Canada leverages low-code to expedite fintech licensing and digital-identity projects, broadening regional momentum. Venture capital continues to back AI-infused low-code startups, fuelling product innovation that sustains the low-code development platform market.

Asia-Pacific posts the fastest 21.13% CAGR. Japan's insurers adopted audit-ready builders for IFRS 17, while Singapore's Monetary Authority encourages rapid fintech sandboxing. China finances hyperscale data centers in Gulf states, offering sovereign clouds that host Western-compatible runtimes. India's IT-services leaders embed low-code accelerators within global transformation deals, amplifying export revenue while catalyzing local public-sector uptake. These initiatives collectively underpin the region's outsized contribution to future low-code development platform market growth.

Europe wields regulatory influence that shapes global product roadmaps. ECB cloud standards, open-banking API deadlines, and ESG disclosure mandates force enterprises to automate compliance fast. Nordic governments deliver citizen services via low-code Portals, Germany's auto OEMs prototype shop-floor apps despite performance caveats, and French utilities integrate ESG reporting pipelines. With policy momentum compounding, Europe remains a cornerstone of the expanding low-code development platform market.

- Microsoft Corporation

- Salesforce Inc.

- Appian Corporation

- Oracle Corporation

- Mendix (Business of Siemens)

- OutSystems Inc.

- ServiceNow Inc.

- Magic Software Enterprises Ltd.

- Quickbase Inc.

- Zoho Corporation

- Clear Software LLC

- Temenos (formerly Kony Inc.)

- AgilePoint Inc.

- Betty Blocks B.V.

- Creatio Global

- Kissflow Inc.

- Nintex Global Ltd.

- GeneXus International SA

- LANSA Inc.

- Newgen Software Technologies

- WaveMaker Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandated Modernization of Legacy COBOL Systems in U.S. Federal Agencies via Low-Code Procurement

- 4.2.2 Real-Time Composable Banking Initiatives in EU Accelerating Low-Code Adoption

- 4.2.3 APAC Insurers Regulatory Approval of Low-Code Audit Trails

- 4.2.4 GenAI Copilots Within Platforms Reducing Build-Cycle Time by 40%

- 4.2.5 EU ESG Reporting Deadlines Driving Rapid App Deployment Demand

- 4.3 Market Restraints

- 4.3.1 Proprietary Runtime Vendor Lock-In Elevating Migration Costs

- 4.3.2 Performance Limitations for Compute-Intensive Industrial IoT Apps

- 4.3.3 Data-Residency Barriers Hampering Cloud-First Deployments in Middle East

- 4.4 Regulatory or Technological Outlook

- 4.4.1 Emerging Technology Trends

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Vendor Market Positioning Analysis

- 4.7 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Platform

- 5.1.2 Services

- 5.2 By Application Type

- 5.2.1 Web-Based

- 5.2.2 Mobile-Based

- 5.2.3 Desktop / Server-Based

- 5.2.4 API-Centric & Micro-Services

- 5.3 By Deployment Mode

- 5.3.1 Cloud

- 5.3.2 On-Premise

- 5.4 By Organization Size

- 5.4.1 Small and Medium Enterprises

- 5.4.2 Large Enterprises

- 5.5 By Industry Vertical

- 5.5.1 Banking

- 5.5.2 Financial Services and Insurance (BFSI)

- 5.5.3 Retail and E-commerce

- 5.5.4 Government and Defense

- 5.5.5 Information Technology and Telecom

- 5.5.6 Healthcare and Life Sciences

- 5.5.7 Manufacturing

- 5.5.8 Energy and Utilities

- 5.5.9 Education

- 5.5.10 Media and Entertainment

- 5.5.11 Others (Transportation, Real Estate)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Nordics

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Nigeria

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Microsoft Corporation

- 6.4.2 Salesforce Inc.

- 6.4.3 Appian Corporation

- 6.4.4 Oracle Corporation

- 6.4.5 Mendix (Business of Siemens)

- 6.4.6 OutSystems Inc.

- 6.4.7 ServiceNow Inc.

- 6.4.8 Magic Software Enterprises Ltd.

- 6.4.9 Quickbase Inc.

- 6.4.10 Zoho Corporation

- 6.4.11 Clear Software LLC

- 6.4.12 Temenos (formerly Kony Inc.)

- 6.4.13 AgilePoint Inc.

- 6.4.14 Betty Blocks B.V.

- 6.4.15 Creatio Global

- 6.4.16 Kissflow Inc.

- 6.4.17 Nintex Global Ltd.

- 6.4.18 GeneXus International SA

- 6.4.19 LANSA Inc.

- 6.4.20 Newgen Software Technologies

- 6.4.21 WaveMaker Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment