|

市场调查报告书

商品编码

1690143

电力工程、采购和建设(EPC) -市场占有率分析、行业趋势和统计、成长预测(2025-2030)Power Engineering, Procurement, And Construction (EPC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

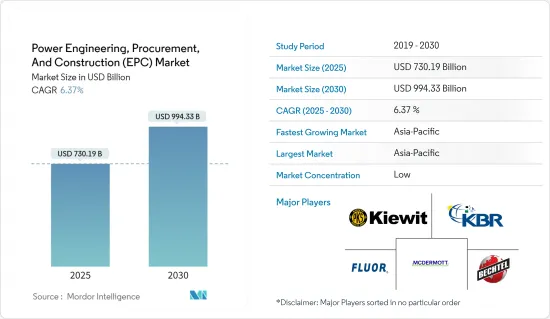

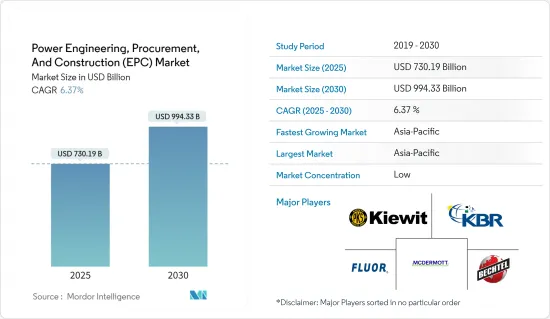

电力工程、采购和建设市场规模预计在 2025 年为 7,301.9 亿美元,预计到 2030 年将达到 9,943.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.37%。

关键亮点

- 从长远来看,发电量增加、能源消耗需求以及发电行业动态变化等因素预计将推动电力 EPC 市场的需求。此外,政府增加对可再生能源的支出等对电力产业的投资预计将进一步提振市场。

- 另一方面,占全球发电量绝大部分的燃煤发电厂的逐步淘汰,以及原油价格波动导致多个上游计划延期,预计将阻碍电力 EPC 市场的成长。

- 超临界和超超临界燃煤电厂等新型高效技术以及政府提高可再生能源份额的倡议预计将为未来的电力 EPC 市场创造许多机会。

- 预计亚太地区将成为预测期内最大的市场。这是由于都市化高和电力需求不断增加(主要来自中国和印度)。

电力EPC市场趋势

市场细分显示可再生能源可望快速成长

- 全世界越来越意识到石化燃料对环境的负面影响,包括温室气体排放和气候变迁。政府、组织和个人越来越关注减少碳排放和向更清洁的能源来源转型。太阳能、风能、水力发电和生质能等可再生能源为石化燃料提供了永续的低碳替代能源,并正在推动对可再生计划的需求。

- 此外,多年来可再生能源技术的成本大幅下降,使其与传统能源来源的竞争力日益增强。太阳能电池板效率、风力发电机技术和能源储存系统的不断进步使得可再生能源计划更加可靠、可扩展且具有成本效益。这增强了投资者信心,使可再生能源对 EPC 公司和计划开发商更具吸引力。

- 根据国际可再生能源机构(IRENA)的报告,2023年全球可再生能源装置容量将达到约3.9兆瓦,比上年增长近14%。过去几十年来,由于技术成本的下降以及人们对传统能源来源的环境问题的日益关注,可再生能源产业经历了快速增长。

- 此外,世界各国政府正在实施支持政策和奖励,以促进可再生能源的采用。这些措施包括上网电价、税额扣抵、补贴和可再生能源组合标准。这为可再生能源计划创造了良好的商业环境。稳定的长期政策提供了可预测的市场前景,并鼓励对可再生能源EPC计划的投资。

- 例如,印度政府在2023年4月宣布计划在本财年的前两个季度竞标15吉瓦的计划。此外,约有 10 GW 的计划计划在接下来的几个季度交付。竞标将由印度太阳能公司、NTPC 有限公司、NHPC 有限公司和 SJVN 有限公司等国有电力公司代表政府进行。

- 欧洲是风电市场的成熟参与企业,根据欧洲风能协会的报告,2023年欧洲将新增18.3吉瓦风电装置容量。其中,欧盟27国的发电量达到创纪录的16.2吉瓦。然而,这一数字仅为实现欧盟2030年气候能源目标所需产能的一半。虽然 79% 的新装置容量位于陆上,但海上装置容量达到了创纪录的 3.8 吉瓦。儘管离岸风电装置容量不断增长,但预测显示,到 2030 年,三分之二的装置容量仍将留在陆上。

- 展望未来,欧洲预计在2024年至2030年间增加260吉瓦的新风电装置容量。其中,欧盟27国预计将贡献200吉瓦,平均每年29吉瓦。但为了实现2030年的气候能源目标,欧盟必须加快这一步伐至每年33吉瓦。预计这一成长将在未来几年为风电 EPC 市场提供巨大推动力。

- 2024年10月,三菱重工业株式会社(MHI)旗下的三菱发电公司开始其风力发电EPC(工程、采购和建设)业务。 2024 年 10 月,三菱重工业株式会社旗下的三菱发电厂在宫崎县日向该市建造了一座 50 兆瓦 (MW) 木质生物质发电厂。日向生物质热电厂是一个完整的交钥匙解决方案,由三菱重工株式会社牵头的财团承担所有工程、采购和施工 (EPC) 工作。该设施由特殊目的公司(SPC)日向生物质发电公司营运。

- 综上所述,可再生能源预计将在预测期内的市场研究中发挥关键作用。

亚太地区可望主导市场

- 亚太地区包括中国、印度、日本、韩国和东南亚,正经历强劲的经济成长。这种成长推动了工业化、都市化和基础设施发展,进而推动了对新电力计划的需求,为 EPC 服务创造了庞大的市场。

- 根据《2023年亚太人口与发展报告》,亚太地区居住着全球60%以上的人口和60%的最大城市。展望未来,由于再生能源来源的广泛采用、电力消耗的增加以及电网基础设施的扩大和加强,预计非洲大陆的电力需求将会增加。预计中国、印度、日本和澳洲等国家将成为该地区的主要贡献者。

- 例如,根据英国石油公司《2023年世界能源统计年鑑》,该地区初级能源消费量将从2013年的219.8艾焦耳增加到2023年的291.77艾焦耳,比2022年的水平增长4.7%。

- 此外,亚太地区许多国家都制定了雄心勃勃的可再生能源目标,以应对气候变迁问题、减少对石化燃料的依赖并增强能源安全。世界各国政府正在製定有利的政策、奖励和法律规范来促进可再生能源的发展。结果是太阳能、风能和水力发电等可再生能源计划激增,为 EPC 公司创造了蓬勃发展的经济。

- 此外,印度政府正在大力投资可再生能源以抑制碳排放。其中包括推出各种大型永续电力计划和推广绿色能源计划。截至 2024 年 10 月,印度的可再生能源装置容量为 203.22 吉瓦,其中太阳能光电(92.12 吉瓦)和风能(47.72 吉瓦)对装置容量贡献巨大。该国製定了雄心勃勃的目标,即到 2031-32 年安装 500 吉瓦的可再生能源容量,这将推动电力 EPC 市场的成长。

- 2024年9月,印度将开启离岸风力发电计划竞标,这标誌着其可再生能源进程的关键时刻。此次竞标由印度新和可再生能源部下属的印度太阳能公司(SECI)发起,旨在竞标位于古吉拉突邦海岸的一座 500 兆瓦离岸风力发电发电厂。得标者将与 SECI 签订为期 25 年的购电协议 (PPA),并负责建造、拥有和营运风电场。

- 由于大型可再生能源发电计划激增,煤炭在总发电量中的比例从2020年的62%下降到2023年的49.5%。 2024年10月,负责核准可再生能源目标下新发电厂容量的清洁能源监管机构将2024年大型风电和太阳能容量的核准预测从3GW上调至4GW。预计2024年可再生能源发电新增装置容量将超过7GW,其中包括新增3.1GW小规模装置容量。随着这些公告的发布,2024 年可再生能源发电计划总容量(160 万千瓦)现已超过 2023 年的总合容量(130 万千瓦)。

- 因此,在快速经济成长、都市化、政府措施、可再生能源采用、基础设施发展、工业需求和技术进步的推动下,亚太地区将主导市场。

电力EPC产业概况

电力EPC市场较为分散。市场的主要参与企业(不分先后顺序)包括 Fluor Corp.、KBR Inc.、Kiewit Corporation、McDermott International Ltd.、Bechtel Corporation 和 Saipem SpA。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概述

- 介绍

- 至2029年的市场规模及需求预测(单位:美元)

- 装置容量及2029年预测

- 初级能源消费量(单位:百万吨油当量,2023年)

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 能源需求不断成长

- 再生能源来源的采用日益增多

- 限制因素

- 逐步淘汰传统电力源

- 初期投资成本高,自然资源有限

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 投资分析

第五章市场区隔

- 发电

- 火力

- 核能

- 可再生能源

- 输电和配电 (T&D) - (仅定性分析)

- 市场分析:按地区{到 2028 年的市场规模和需求预测(按地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 义大利

- 西班牙

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 奈及利亚

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- EPC Developers

- Fluor Ltd

- John Wood PLC

- Kiewit Corporation

- McDermott International Inc.

- Bechtel Corporation

- Saipem SpA

- Larsen & Toubro Limited

- KBR Inc

- Original Equipment Manufacturers(OEMs)

- General Electric Company

- Siemens Energy AG

- ABB Ltd

- Schneider Electric SE

- Eaton Corporation PLC.

- EPC Developers

第七章 市场机会与未来趋势

- 电网现代化与智慧技术

The Power Engineering, Procurement, And Construction Market size is estimated at USD 730.19 billion in 2025, and is expected to reach USD 994.33 billion by 2030, at a CAGR of 6.37% during the forecast period (2025-2030).

Key Highlights

- Over the long term, factors such as increased electricity generation, energy consumption demand, and changing power generation industry dynamics are expected to drive demand for the power EPC market. Moreover, investments in the power sector, including increased government spending on renewable energy, are further expected to boost the market.

- On the other hand, the phasing out of coal-based power plants, which account for a major share in power generation around the globe, and volatile crude oil prices leading to delays in several upstream projects are expected to hinder the growth of the power EPC market.

- Nevertheless, new and efficient technologies like supercritical and ultra-supercritical coal power plants and government initiatives to increase renewable energy's share are expected to create several opportunities for the power EPC market in the future.

- Asia-Pacific is expected to be the largest market during the forecast period. It is due to the high urbanization growth rate and growing electricity demand, mainly from China and India.

Power Engineering, Procurement, And Construction (EPC) Market Trends

Renewable Expected to be the Fastest-growing Market Segment

- There is a growing global awareness of the adverse impacts of fossil fuels on the environment, including greenhouse gas emissions and climate change. Governments, organizations, and individuals increasingly commit to reducing carbon emissions and transitioning to cleaner energy sources. Renewable energy, such as solar, wind, hydroelectric, and biomass, offers a sustainable and low-carbon alternative to fossil fuels, driving the demand for renewable projects.

- Moreover, over the years, the costs of renewable energy technologies significantly declined, making them increasingly competitive with conventional energy sources. The continuous advancements in solar panel efficiency, wind turbine technology, and energy storage systems improved renewable energy projects' reliability, scalability, and cost-effectiveness. It boosted investors' confidence and made renewable energy more attractive for EPC companies and project developers.

- In 2023, global installed renewable energy capacity hit approximately 3.9 terawatts, marking a nearly 14 percent surge from the prior year, as reported by the International Renewable Energy Agency (IRENA). Over the past few decades, the renewable energy sector has witnessed a meteoric rise, driven by plummeting technology costs and growing environmental concerns over conventional energy sources.

- Additionally, governments worldwide are implementing supportive policies and incentives to promote renewable energy deployment. These policies include feed-in tariffs, tax credits, grants, and renewable portfolio standards. It creates a favorable business environment for renewable energy projects. Stable and long-term policies provide a predictable market outlook and encourage investments in renewable EPC projects.

- For instance, in April 2023, the Indian government announced plans to conduct auctions for 15 GW of projects in the first two quarters of the current fiscal year, 2023. Additionally, approximately 10 GW of projects will be offered in subsequent quarters. The auctions will be conducted by state-run power companies, including Solar Energy Corp. of India Ltd., NTPC Ltd., NHPC Ltd., and SJVN Ltd., on behalf of the government.

- In 2023, Europe, a mature player in the wind power market, added 18.3 GW of new wind power capacity, as reported by WindEurope. Of this, the EU-27 accounted for a record 16.2 GW. However, this figure is only half of the capacity needed to meet the EU's 2030 climate and energy targets. While 79% of the new installations were onshore, offshore installations reached a record 3.8 GW. Despite the growth in offshore capacity, projections indicate that two-thirds of installations through 2030 will remain onshore.

- Looking ahead, Europe is set to add 260 GW of new wind power capacity from 2024 to 2030. The EU-27 is expected to contribute 200 GW of this total, averaging 29 GW annually. However, to align with its 2030 climate and energy targets, the EU must accelerate its pace to 33 GW per year. This anticipated surge is poised to significantly energize the wind power EPC market in the coming years.

- In October 2024, Mitsubishi Power, a division of Mitsubishi Heavy Industries, Ltd. (MHI), completed a 50-megawatt (MW) woody biomass-fired power plant in Hyuga, Miyazaki Prefecture. The Hyuga Biomass Power Plant, a product of a consortium led by MHI, is a full turnkey solution for engineering, procurement, and construction (EPC). The facility will be operated by Hyuga Biomass Power Co., Ltd., a special purpose company (SPC).

- Therefore, according to the above points, renewable energy is expected to play a significant role in market studies during the forecasted period.

Asia-Pacific Expected to Dominate the Market

- The Asia-Pacific region, comprising countries such as China, India, Japan, South Korea, and Southeast Asia, is experiencing robust economic growth. This growth increased industrialization, urbanization, and infrastructural development, driving the demand for new power projects and creating a significant market for EPC services.

- According to the Asia-Pacific Population and Development Report 2023, the Asia-Pacific region is home to more than 60% of the global population and 60% of the large cities. In the future, the continent will witness increasing demand for power due to the increasing penetration of renewable energy sources, rising power consumption, and growing access to electricity, expanding and enhancing the power grid infrastructure. Countries like China, India, Japan, and Australia are expected to be the key contributing nations in the region.

- For instance, according to the BP Statistical Review of World Energy 2023, primary energy consumption in the region increased from 219.8 exajoules in 2013 to 291.77 exajoules in 2023, representing a 4.7% increase from 2022 levels.

- Furthermore, many countries in the Asia-Pacific region set ambitious renewable energy targets to address climate change concerns, reduce dependence on fossil fuels, and enhance energy security. Governments implement favorable policies, incentives, and regulatory frameworks to promote renewable energy development. As a result, there is a surge in renewable energy projects such as solar, wind, and hydroelectric power, creating a thriving market for EPC firms.

- Moreover, the Government of India is investing significantly in renewable energy to curb carbon emissions. This includes launching various large-scale sustainable power projects and championing green energy initiatives. As of October 2024, India's renewable energy capacity reached 203.22 GW, with solar power (92.12 GW) and wind (47.72 GW) majorly contributing to installed capacity. The nation aims for an ambitious target of 500 GW of installed renewable energy capacity by 2031-32, bolstering the growth of the power EPC market.

- In September 2024, India marked a pivotal moment in its renewable energy journey by unveiling its inaugural offshore wind project tender. The tender, issued by the Solar Energy Corporation of India Ltd (SECI) - an entity under the Ministry of New and Renewable Energy - seeks bids for a 500-MW offshore wind farm situated off the coast of Gujarat. The successful bidder will secure a 25-year power purchase agreement (PPA) with SECI and take on the responsibilities of constructing, owning, and operating the wind farm.

- Due to surging large-scale renewable energy projects, coal's share in the total electricity generation dwindled from 62% in 2020 to 49.5% in 2023. In October 2024, The Clean Energy Regulator, responsible for approving new power station capacities under the Renewable Energy Target, upped its forecast for large-scale wind and solar capacity approvals from 3GW to 4GW for 2024. The total new renewable capacity is projected to surpass 7GW in 2024, complemented by an anticipated 3.1GW of small-scale capacity. Following these announcements, the capacity of financially committed renewable electricity generation projects for 2024 (1.6 GW) has eclipsed the total for 2023 (1.3 GW).

- Therefore, driven by rapid economic growth, urbanization, government initiatives, renewable energy deployment, infrastructure development, industrial demand, and technological advancements, Asia-Pacific is set to dominate the market.

Power Engineering, Procurement, And Construction (EPC) Industry Overview

The power engineering, procurement, and construction (EPC) market is fragmented. Some of the major players in the market (in no particular order) include Fluor Corp., KBR Inc., Kiewit Corporation, McDermott International Ltd, Bechtel Corporation, and Saipem SpA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, Till 2029

- 4.3 Installed Capacity and Forecast, Till 2029

- 4.4 Primary Energy Consumption, in MTOE, 2023

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Growing Energy Demand

- 4.7.1.2 Increasing Adoption Of Renewable Energy Sources

- 4.7.2 Restraints

- 4.7.2.1 Phasing Out of Conventional Sources of Electricity

- 4.7.2.2 High Initial Investment Cost And Limited Natural Resources

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitute Products and Services

- 4.9.5 Intensity of Competitive Rivalry

- 4.10 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Power Generation

- 5.1.1 Thermal

- 5.1.2 Nuclear

- 5.1.3 Renewables

- 5.2 Power Transmission and Distribution (T&D) - (Qualitative Analysis Only)

- 5.3 Geography Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)}

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Italy

- 5.3.2.4 Spain

- 5.3.2.5 France

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Chile

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 EPC Developers

- 6.3.1.1 Fluor Ltd

- 6.3.1.2 John Wood PLC

- 6.3.1.3 Kiewit Corporation

- 6.3.1.4 McDermott International Inc.

- 6.3.1.5 Bechtel Corporation

- 6.3.1.6 Saipem SpA

- 6.3.1.7 Larsen & Toubro Limited

- 6.3.1.8 KBR Inc

- 6.3.2 Original Equipment Manufacturers (OEMs)

- 6.3.2.1 General Electric Company

- 6.3.2.2 Siemens Energy AG

- 6.3.2.3 ABB Ltd

- 6.3.2.4 Schneider Electric SE

- 6.3.2.5 Eaton Corporation PLC.

- 6.3.1 EPC Developers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Grid Modernization and Smart Technologies