|

市场调查报告书

商品编码

1690151

中东可再生能源:市场占有率分析、产业趋势和成长预测(2025-2030 年)Middle East Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

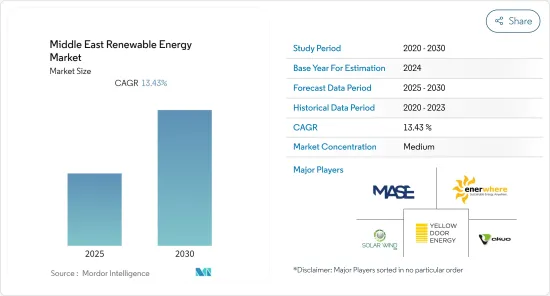

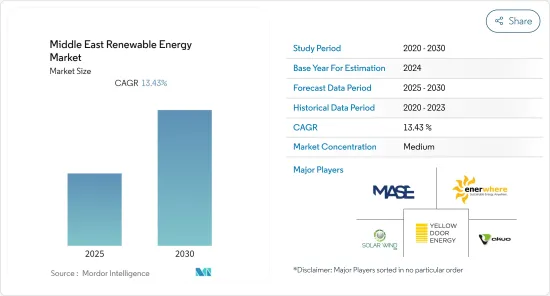

预测期内,中东可再生能源市场预计将以 13.43% 的复合年增长率成长

关键亮点

- 从中期来看,预计市场将受到政府各种措施的推动,以实现能源结构多样化并增加对可再生能源的投资。

- 然而,预计在预测期内,天然气发电使用量的增加和价格的下降将抑制市场成长。

- 可再生能源是一种间歇性能源来源。因此,储能对于维持再生能源的分布稳定至关重要。因此,可再生能源与能源储存系统的日益整合有望在未来创造市场机会。

- 由于即将实施的计划和政府目标,预计阿拉伯联合大公国将在预测期内见证中东可再生能源市场的显着成长。

中东可再生能源市场趋势

太阳能领域将经历显着成长

- 在中东地区,太阳能在实现各国可再生能源目标方面发挥关键作用,预计在预测期内将显着增长。 2015年中东地区太阳能发电装置容量约为1GW,预计2021年将成长至8.4GW。

- 根据全球能源监测报告,阿拉伯国家计划建造的太阳能和风力发电场将使中东的可再生能源生产能力提高五倍。该计划包括近45个风电场和114个太阳能发电厂。

- 此外,根据国际可再生能源机构的《泛阿拉伯清洁能源倡议》,到2030年,中东国家可再生能源发电计划将实现92%的目标。预计到2030年,这些国家的太阳能和风力发电将使该地区的可再生能源发电量增加一倍。

- 此外,天然气价格上涨和太阳能成本下降正在提高阿联酋可再生能源的效用。预计阿联酋三年内20%的电力将来自非石化燃料,2050年50%的能源将来自非石化燃料。

- 此外,中东地区正在对可再生能源和太阳能进行投资,其中的计划将把太阳能发电厂改造成能源树,这将彻底改变世界。 「E 树」形状似一棵巨大的遮荫树,由一个巨大的漏斗形结构组成,该结构倾斜 360 度,形成一个巨大的悬臂,悬停在下面的花园上方。周围还有19棵较小的“电力树”,可额外提供28%的电力。这些树全天追踪太阳并旋转 180 度以优化能量收集。这些树木也为下面的花园提供遮荫和阳光。

- 因此,由于上述因素,预计预测期内太阳能将在中东可再生能源市场中呈现显着成长。

阿拉伯联合大公国:预计将经历显着成长

- 近年来,阿联酋在采用可再生能源,特别是太阳能方面迈出了重要一步。预计到 2050 年可再生能源发电计划将产生超过 70 吉瓦的电力,投资额将达到 7,000 亿美元。

- 此外,为了满足日益增长的需求,该国已开始面临加强能源安全、实现能源来源多样化和增加太阳能在电力结构中的比重的挑战。

- 该国已证明其拥有世界上最好的太阳能资源,同时支持经济和监管倡议以及清洁能源计划。其中一个因素是能否获得负担得起的融资。

- 除了传统的计划融资外,太阳能领域还出现了金融创新,以促进和提供长期所需的投资,其中包括1000亿迪拉姆的迪拜绿色基金,用于支持旨在刺激屋顶太阳能板安装的「沙姆斯迪拜倡议」。

- 此外,多种因素共同作用,使太阳能成为满足国家能源需求的一个有吸引力的选择。杜拜地理位置优越,太阳辐射量约 2,285 kWh/m2。这里是世界上太阳辐射量最高的地区之一,具有巨大的可再生能源开发潜力。

- 此外,太阳能电池组件和电池技术成本的下降也有助于提高太阳能在阿联酋的普及率。随着太阳能成本的快速下降,阿联酋正在评估其电力产业的策略。

- 阿联酋2050能源策略的目标是到2050年将清洁能源在该国整体能源结构中的比例提高到50%,从而节省约1,900亿美元的整体能源成本。这可减少70%的二氧化碳排放,并提高40%的消费效率。

- 该国致力于应对气候变化,并承诺加入国际太阳能联盟,该联盟的目标是到2030年向开发中国家提供1,000吉瓦的太阳能。

- 因此,预计阿联酋将在预测期内见证中东可再生能源市场的显着成长。

中东可再生能源产业概况

中东可再生能源市场中等程度细分。市场的主要企业包括(不分先后顺序)MASE、Enerwhere Sustainable Energy DMCC、Solarwind ME、Akuo Energy SAS 和 Yellow Door Energy。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 可再生能源结构(2020年)

- 2027年装置容量和吉瓦预测

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场区隔

- 按类型

- 水力发电

- 太阳热

- 风

- 其他的

- 按地区

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 阿曼

- 伊朗

- 以色列

- 约旦

- 其他中东地区

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- MASE

- Enerwhere Sustainable Energy DMCC

- Solarwind ME

- Akuo Energy SAS

- Yellow Door Energy Limited

- Masdar(Abu Dhabi Future Energy Co.)

- Canadian Solar Inc.

- Siraj Power Contracting LLC

- ACWA POWER BARKA SAOG

- EDF Renewables

第七章 市场机会与未来趋势

简介目录

Product Code: 70304

The Middle East Renewable Energy Market is expected to register a CAGR of 13.43% during the forecast period.

Key Highlights

- Over the medium term, factors such as various governments' plans to diversify the energy mix and increase investments in renewable energy are expected to drive the market.

- On the other hand, the increasing penetration of natural gas for power generation and its lower price are expected to restrain the growth of the market during the forecast period.

- Nevertheless, renewable power is an intermittent energy source. Therefore, the storage of electricity is essential to maintain the constant power distribution of generated renewable power. Thus, the increasing integration of renewable energy and energy storage systems is expected to create future market opportunities.

- The United Arab Emirates (UAE) is expected to witness significant growth in the Middle Eastern renewable energy market during the forecast period, owing to upcoming projects and government targets.

Middle East Renewable Energy Market Trends

Solar Energy Segment to Witness Significant Growth

- In the Middle Eastern region, solar energy plays a vital role in achieving the country's renewable energy target, and it is expected to show significant growth during the forecast period. In 2015, solar power installed capacity in the Middle East was around 1 GW, which increased to 8.4 GW in 2021.

- According to the Global Energy Monitor report, solar and wind power plants that are to be built by Arab Countries will increase the Middle Eastern renewable energy production capacity by five times. Nearly 45 wind power plants and 114 solar power plants are included in this project.

- Furthermore, according to the Pan Arab Clean Energy initiative by the International Renewable Energy Agency, 92% of the target to be attained through renewable energy generation projects in Middle Eastern countries will be reached by 2030. Solar and wind energy generated by these countries will double the region's renewable power generation capacity by 2030.

- Additionally, increasing natural gas prices and decreasing solar PV costs in UAE have made renewable energy more useful. The country is anticipated to achieve 20% of its electricity from non-fossil fuel sources within three years and derives 50% of its energy from these sources by 2050.

- Furthermore, an upcoming project in the Middle East, investing in renewable energy and solar energy to convert from solar farms to E-trees, will mark a revolution in the world. 'E-tree' is reminiscent of a giant shade tree consisting of a funnel-shaped structure that forms an enormous, slanted 360-degree cantilever that hovers above the garden below. It is also surrounded by 19 small 'E-trees,' which help supply an additional 28% of electricity. These trees will track the sun around the day and optimize harvesting the energy by rotation of 180 degrees. These trees also provide shade and stippled sunlight to the gardens below.

- Therefore, owing to the abovementioned factors, solar energy is expected to witness significant growth in the Middle Eastern renewable energy market during the forecast period.

The UAE is Expected to Witness Significant Growth

- The UAE has undertaken significant steps over the past few years, driving the region toward adopting renewable energy, particularly in the solar sector. Renewable energy projects will generate more than 70 GW of power by 2050, witnessing an investment of USD 700 billion.

- Furthermore, to meet the rising demand, the country embarked on a challenging mission to increase its energy security, diversify its energy sources, and increase the share of solar energy in its power mix.

- The country has proven that it has some of the world's best solar resources while supporting economic and regulatory policies and helping its clean energy program. One of the contributing factors is access to affordable finance.

- In addition to conventional project financing, the solar sector is witnessing financial innovation to help facilitate and provide investments required in the long term, including the AED 100 billion Dubai Green Fund to support the Shams Dubai initiative, a program aimed at promoting the installation of rooftop solar panels.

- Further, several factors converged to make solar energy an attractive option, to meet the country's energy needs. The country is geographically well-positioned, with solar irradiance of approximately 2,285 kWh/m2. It has one of the highest solar exposure rates globally, thereby holding tremendous potential for renewable energy development.

- In addition, the declining cost of solar modules and battery technology is increasing solar PV adoption in the United Arab Emirates. As the cost of solar power is declining rapidly, the United Arab Emirates is evaluating its strategies related to the power sector, which currently relies on large subsidies for electricity generated from natural gas or liquefied natural gas (LNG).

- The 'UAE Energy Strategy 2050' aims to increase the contribution of clean energy to the country's overall national energy mix, to 50%, by 2050, thereby saving approximately USD 190 billion of the overall energy costs. It will help reduce carbon emissions by 70% and increase consumption efficiency by 40%.

- The country is committed to tackling climate change and announced joining the International Solar Alliance, which aims to help developing countries harness 1,000 GW of solar power by 2030.

- Therefore, owing to the abovementioned factors, the United Arab Emirates is expected to witness significant growth in the Middle Eastern renewable energy market during the forecast period.

Middle East Renewable Energy Industry Overview

The Middle Eastern renewable energy market is moderately fragmented. Some of the major players in the market include (in no particular order) MASE, Enerwhere Sustainable Energy DMCC, Solarwind ME, Akuo Energy SAS, and Yellow Door Energy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Mix, 2020

- 4.3 Installed Capacity and Forecast in GW, till 2027

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Hydro

- 5.1.2 Solar

- 5.1.3 Wind

- 5.1.4 Other Types

- 5.2 By Geography

- 5.2.1 United Arab Emirates (UAE)

- 5.2.2 Saudi Arabia

- 5.2.3 Oman

- 5.2.4 Iran

- 5.2.5 Israel

- 5.2.6 Jordan

- 5.2.7 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 MASE

- 6.3.2 Enerwhere Sustainable Energy DMCC

- 6.3.3 Solarwind ME

- 6.3.4 Akuo Energy SAS

- 6.3.5 Yellow Door Energy Limited

- 6.3.6 Masdar (Abu Dhabi Future Energy Co.)

- 6.3.7 Canadian Solar Inc.

- 6.3.8 Siraj Power Contracting LLC

- 6.3.9 ACWA POWER BARKA SAOG

- 6.3.10 EDF Renewables

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219