|

市场调查报告书

商品编码

1690157

高压电缆及配件:市场占有率分析、产业趋势与统计、2025-2030 年成长预测High Voltage Cable Accessories - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

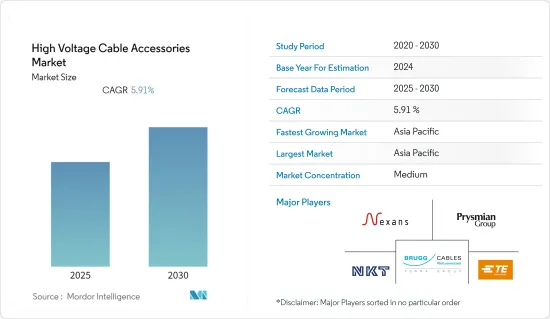

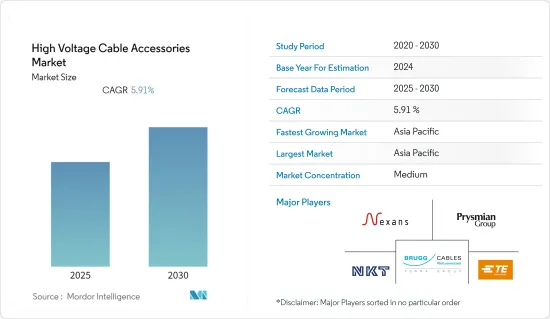

预测期内,高压电缆及配件市场预计复合年增长率为 5.91%

关键亮点

- 从中期来看,可再生能源发电与老化电网的日益融合预计将推动市场成长以及输配电基础设施的投资。

- 另一方面,原材料价格上涨和分散式可再生能源发电投资预计将在预测期内阻碍高压电缆和配件市场的成长。

- 随着非洲电气化计划的增加,电缆被用于将电力从发电站输送到输电和配电网络,即从变电站输送到客户。在预测期内,非洲和亚洲国家农村电气化的提高可能为高压电缆和配件市场创造丰厚的成长机会。

- 亚太地区占据市场主导地位,并可能在预测期内实现最高的复合年增长率。这一增长归因于都市化的上升和电力需求的增加,主要来自中国和印度。

高压电缆及配件的市场趋势

地下市场是成长最快的市场

- 部署地下电缆取代架空电缆是欧洲和北美等地区最近的趋势之一。在都市区,由于地面空间不足,地下电缆更受青睐。

- 过去 30 年来,全球发电量大幅成长,从 1990 年的不到 12,000兆瓦时增加到 2022 年的近 29,165.1兆瓦时。在此期间,全球发电量仅出现过两次年度下降:一次是 2009 年全球金融危机之后,另一次是 2020 年冠状病毒大流行期间。

- 亚太地区、北美和欧洲等多个地区的地下电缆安装正在增加。地下电力线比架空电缆具有多种优势,包括故障可能性更低、安全性更高(电缆位于地下)以及使用寿命更长(约 40-50 年),因此许多国家正在向地下电力线迈进。由于所有电线都隐藏起来,因此看起来也很棒。

- 2022年7月,由欧洲投资银行(EIB)主导的20家金融机构组成的财团同意为Noiconnect互联计划提供4.065亿美元。这条高压直流电缆连接德国和英国。此海底电缆长725公里,容量为1.4吉瓦,直流电压为525千伏特。它将通过位于格雷恩岛的换流站,将德国费德瓦尔登附近的 Tenet 运营的换流站与国家电网运营的英国电网连接起来。该计划预计将推动高压电缆配件市场地下部分的发展。

- 2022年8月,太韩推出其旗舰战略产品,包括500kV等各电压等级的超高压电缆、海底电缆、HVDC(高压直流电)。 500kV超高压电缆是目前商用最高电压的地下电缆。泰韩拥有北美第一张商业唱片,同时也拥有韩国第一张商业唱片。

- 因此,基于上述因素及其主导地位,预计地下部分将成为预测期内高压电缆配件市场中成长最快的部分。

亚太地区占市场主导地位

- 近年来,亚太地区已成为最大的电缆配件市场之一。由于都市化、经济现代化和整个地区生活水准的提高,能源需求不断增加,带动了永续电力系统的成长,从而增加了该地区对电缆配件的需求。

- 在许多亚太国家,输配电(T&D)网路不足意味着一些偏远和农村地区无法用电。为了向这些地区供应电力,该地区的国家正在大力投资建造电力输配网路。

- 由于创纪录的经济成长,加上快速的都市化和工业化等因素,中国对电力的需求一直很高。根据国家能源局的数据,2021年中国全社会用电量约8.31兆千瓦时。其中,一级产业产业用电量较上年成长16.4%,第二产业用电量较上年成长9.1%,第三产业与前一年同期比较17.8%。

- 此外,根据中国最大的国有电力公司中国国家电网公司(SGCC)预测,到 2030 年,中国的能源需求预计将超过 10 拍瓦时(PWh),这将为中国带来重大的输电挑战。为了发展基础设施和支援高功率发电,输电网路的成长与发电量的成长同步。

- 印度是继中国和美国之后的世界第三大电力生产国。印度的电力产业正在快速发展。截至 2023 年 6 月,装置容量约为 423.36 吉瓦,发电结构包括石化燃料(56.3%)、水力发电(11.1%)、核能(1.8%)和可再生能源(30.9%)。

- 印度政府制定了一个极其雄心勃勃的目标,即在未来十年内将装置容量翻一番,主要透过加速部署可再生能源来实现。到2030年,我们的目标是可再生能源发电量达到500吉瓦。要实现2030年的目标,需要投资约2,250亿至2,500亿美元。

- 中国的电网也正在进行重大升级和改造,以便能够输送更多电力并满足未来的需求。

- 亚太地区的智慧电网、发电、工业化以及输配电基础设施计划正在增加。例如,作为发展最快的新兴经济体之一的韩国计划在2030年实现全面一体化智慧电网。

- 2022年7月,日立能源印度有限公司宣布已订单,将建造连接印度西海岸库杜斯和孟买的高压直流(HVDC)输电项目。新的高压直流输电线路将输送高达 1,000MW 的电力,使来自城外的电力增加约 50%。该线路将透过加强现有输电线路帮助阿达尼确保该地区可靠的电力供应。

- 因此,由于上述因素,预计预测期内亚太地区将对高压电缆配件市场产生正面影响。

高压电缆及配件产业概况

高压电缆及配件市场区隔程度适中。该市场的主要企业(不分先后顺序)包括 Nexans SA、Prysmian SpA、NKT A/S、TE Connectivity Ltd 和 Brugg Kabel AG。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概述

- 介绍

- 至2028年的市场规模及需求预测(单位:美元)

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 提高可再生能源发电的整合度

- 电网老化以及输配电基础设施投资

- 限制因素

- 原料价格上涨及分散式可再生能源发电影响成长

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场区隔

- 部署位置

- 开卖

- 地下

- 海底

- 电压等级

- 高压

- 特高压

- 超高压

- 地区

- 北美洲

- 亚太地区

- 欧洲

- 南美洲

- 中东和非洲

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Nexans SA

- Prysmian SpA

- NKT A/S

- TE Connectivity Ltd

- Brugg Kabel AG

- Sumitomo Electric Industries, Ltd.

- LS Cable & System Limited

第七章 市场机会与未来趋势

- 超级电网在市场上的发展带来机会

简介目录

Product Code: 70437

The High Voltage Cable Accessories Market is expected to register a CAGR of 5.91% during the forecast period.

Key Highlights

- Over the medium term, increasing integration of renewable energy generation and aging power grids and investments in transmission and distribution infrastructure are expected to drive the market's growth.

- On the other hand, the increasing raw material prices and investment in distributed renewable energy generation are expected to hamper the growth of the high-voltage cables and accessories market during the forecast period.

- Nevertheless, with the rising electrification projects in Africa, cables are being used for transmission and distribution networks from power generation, i.e., delivered from substations to the customer. The increasing rural electrification in African and Asian countries is likely to create lucrative growth opportunities for the high-voltage cables and accessories market in the forecast period.

- The Asia-Pacific region dominates the market and is likely to witness the highest CAGR during the forecast period. This growth is attributed to the increased urbanization growth rate and growing electricity demand, mainly from China and India.

High Voltage Cables and Accessories Market Trends

Underground Segment to be the Fastest Growing Market

- Deployment of underground cables instead of overhead ones has been one of the trends in regions, like Europe and North America, in recent times. In urban areas, underground cables are more favored, as above-ground space is unavailable.

- Global electricity generation has increased significantly over the past three decades, from less than 12,000 terawatt-hours in 1990 to nearly 29165.1 terawatt-hours in 2022. During this period, electricity generation worldwide only registered an annual decline twice: in 2009, following the global financial crisis, and in 2020, amid the coronavirus pandemic.

- The installation of underground cables is increasing across several regions such as Asia-Pacific, North America, and Europe. Several countries are shifting to underground transmission line as it has several advantages over overhead cables, such as less chance of fault, safety (cables placed underground), and useful life (approximately 40-50 years). The general appearance of this system is good as all lines are invisible, etc.

- In July 2022, A consortium of 20 lenders led by the European Investment Bank (EIB) agreed to provide USD 406.5 million for the NeuConnect interconnector project. This high-voltage direct current link will connect Germany with the United Kingdom. The predominantly submarine cable will have a length of 725 km, a capacity of 1.4 GW, and a DC voltage of 525 kV. It will connect a converter station operated by Tennet near Fedderwarden, in Germany, to the United Kingdom network operated by National Grid via a converter station on the Isle of Grain. The project is expected to drive the underground segment for the high-voltage cable accessories market.

- In August 2022, Taihan introduced its flagship products and strategic products such as ultra-high voltage cables, submarine cables, and HVDC (super high voltage direct transmission) with various voltages, including 500kV. The 500kV ultra-high voltage cable is the highest voltage underground cable currently commercialized. Taihan has the first commercial record in North America and the first commercial record in Korea.

- Therefore, based on the above-mentioned factors and its advantages, the underground segment is expected to be the fastest-growing segment in the high-voltage cable accessories market during the forecast period.

Asia Pacific to Dominate the Market

- Asia-Pacific has emerged as one of the largest cable accessories markets in the recent years, with the rise in energy demand associated with urbanization, economic modernization, and better living standards across the region has resulted in the growth of sustainable power systems, which in turn increased the demand for cable accessories in this region.

- Many countries in Asia-Pacific have inadequate transmission and distribution (T&D) networks; hence, electricity is unavailable in some remote and rural areas. To bring electricity to these areas, the countries in the region are investing heavily in building transmission and distribution line networks.

- China has witnessed high electricity demand due to the record growth of the economy, coupled with factors such as rapid urbanization and industrialization. According to the National Energy Administration (NEA), the total power use in China was approximately 8.31 trillion kilowatt-hours (kWh) in 2021. Specifically, the power consumed by the primary, secondary, and tertiary industries climbed 16.4%, 9.1%, and 17.8% year-on-year, respectively.

- Furthermore, according to the State Grid Corporation of China (SGCC), the largest state-owned utility corporation, China's energy demand is expected to exceed 10 petawatt hours (PWh) in 2030, representing a considerable challenge to power transmission that the country needs to address. The transmission network growth is parallel to the power generation growth to develop the infrastructure and support the high-power generation.

- India is the third-largest power generator in the world, after China and the United States. The electricity sector in India is growing at a rapid pace. As of June 2023, the installed capacity was registered to be almost 423.36 GW, with the generation mix being fossil fuels (56.3%), hydro (11.1%), nuclear (1.8%), and renewables (30.9%).

- The Indian government has set exceptionally ambitious targets to double installed capacity over the coming decade, primarily through accelerated deployment of renewable energy. By 2030, India aims to have 500 GW of power generation capacity by renewables. In order to meet the 2030 target, the country needs an investment of around USD 225-250 billion.

- Also, the power transmission and distribution grid of China has been experiencing major up gradations and modifications for making it capable to transmit higher electricity and cope up the future demand.

- Asia-Pacific region has had an increment in the number of projects in terms of smart grids, power generation, industrialization, and power transmission and distribution infrastructure. For an instance, South Korea, one of the fastest emerging nation, has plans for a completely integrated smart grid by 2030.

- In July 2022, Hitachi Energy India Ltd announced that it received a significant order from Adani to provide a direct high-voltage (HVDC) transmission system that will connect Kudus to Mumbai on India's west coast. The new HVDC link will supply up to 1,000 MW of electricity, increasing power from outside the city by nearly 50 percent. The link will help Adani ensure a reliable power supply in the region by strengthening the existing transmission infrastructure.

- Therefore, based on the above-mentioned factors, Asia-Pacific region is expected to have a positive impact on high voltage cable accessories market during the forecast period.

High Voltage Cables and Accessories Industry Overview

The high-voltage cable and accessories market is moderately fragmented. Some of the major players in the market (not in particular order) include Nexans SA, Prysmian SpA, NKT A/S, TE Connectivity Ltd, and Brugg Kabel AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Integration Of Renewable Energy Generation

- 4.5.1.2 Aging Power Grids And Investments In Transmission And Distribution Infrastructure

- 4.5.2 Restraints

- 4.5.2.1 Increasing Raw Material Prices And Investment In Distributed Renewable Energy Generation Affect The Growth

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Overhead

- 5.1.2 Underground

- 5.1.3 Submarine

- 5.2 Voltage Level

- 5.2.1 High Voltage

- 5.2.2 Extra High Voltage

- 5.2.3 Ultra High Voltage

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Asia-Pacific

- 5.3.3 Europe

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nexans SA

- 6.3.2 Prysmian SpA

- 6.3.3 NKT A/S

- 6.3.4 TE Connectivity Ltd

- 6.3.5 Brugg Kabel AG

- 6.3.6 Sumitomo Electric Industries, Ltd.

- 6.3.7 LS Cable & System Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of a Super Grid In Emerging Markets To Provide Opportunities

02-2729-4219

+886-2-2729-4219