|

市场调查报告书

商品编码

1690168

沥青路面:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Asphalt Pavers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

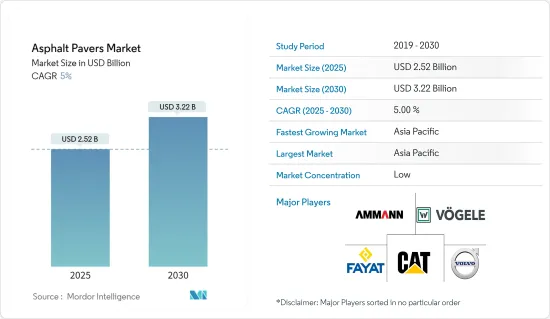

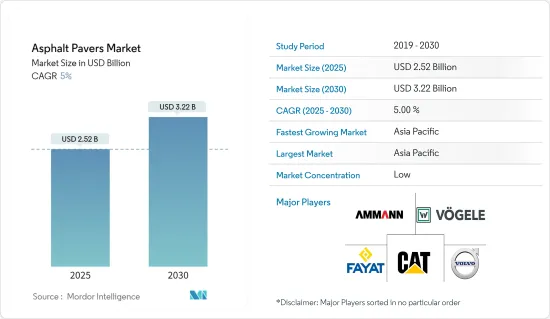

2025 年沥青路面市场价值预计为 25.2 亿美元,预计到 2030 年将达到 32.2 亿美元,市场估计和预测期(2025-2030 年)的复合年增长率为 5%。

世界各国政府都投入更多资金建造优质道路和高速公路,以便货物和乘客从偏远地区快速运送到各大城市。智慧城市计画正在创造对沥青路面的需求,以提高道路和高速公路的品质和可扩展性。政府和私人道路计划进展加快,增加了对沥青摊舖机的需求。

从长远来看,由于政府活动和改革的增多,沥青路面摊舖机设备市场预计将呈现指数级增长。增加用于道路和高速公路建设的预算拨款也显得至关重要。

由于该地区公共和私人对高速公路和道路建设的投资不断增加,中国、印度、美国和德国等国家被视为沥青摊舖机和破碎机成长的基地。政府将采取各种倡议,长期推动对沥青摊舖机和破碎机的需求。

主要亮点

- 例如,根据印度住宅和都市化部的数据,到 2023 年,在布巴内斯瓦尔、普纳、斋浦尔、苏拉特、科钦、新德里等地的 100 个智慧城市中已经启动 7,978 个计划,用于计划开发的投资额为 88 亿美元。

- 2024年1月,日本政府承诺在印度各领域9个计划投资15亿美元。这些计划包括东北公路网连通计画和Start-Ups创新促进计划。

OEM在汽车设计、製造、交付和建筑行业的转型中发挥着至关重要的作用。考虑到印度和中国等国家的建设活动呈指数级增长,公司正专注于推出各种技术先进的产品,促进市场的成长。

沥青路面市场趋势

卡车摊舖机市场占有最高市场份额

与轮式摊舖机相比,履带式摊舖机获得了更广泛的认可,因为它们为需要更宽的牵引器或更大的混合牵引车的工作提供了更好的牵引力。此外,卡车摊舖机机动性强,可以轻鬆运送到进行道路建设计划的所需位置。该领域的参与者提供可靠且技术先进的轨道摊舖机以实现较高的销售标准。例如

- 2023 年 10 月,Power Pavers 推出了新型全宽四轨混凝土滑模摊舖机 SF-3404。据说该摊舖机采用了多种技术改进,可以为承包商提供更顺畅的操作。

- 2023 年 7 月,Vogele 在欧洲推出了最小的摊舖机:MINI 500 履带式摊舖机和 MINI 502 轮式摊舖机。

为了实现工业的快速顺畅运输,人们增加了对道路、高速公路和快速道路的支出,从而推动了市场的发展。考虑到这些因素和发展,预计预测期内卡车摊舖机的需求将呈现高成长率。

亚太地区占最大

2023 年,亚太地区成为最大的沥青摊舖机市场。由于道路和高速公路建设率高等因素,预计该地区在预测期内将进一步成长。

- 印度、中国和东协是道路建设增加的中心,增加了对沥青摊舖机的需求。从长远来看,预计公共和私人对道路和高速公路建设的投资增加仍将成为该地区沥青摊舖机需求的主要成长要素。

- 随着城市人口的成长,都市化预计将加速推进,从而增加对住宅和经济适用住宅的需求。根据印度国家转型委员会 (NITI Aayog) 预测,到 2047 年,印度人口将达到 16.4 亿,其中约 51% 的印度人口居住在城市中心。

- 根据国家计划计划,印度已拨款 1.4 兆美元用于 2025 年前的基础设施建设,这将增加对铺路承包商的需求。智慧城市计划旨在透过提供电力和充足的供水、高效的旅行和公共交通、卫生设施、经济适用住宅、数位化和有效的治理等核心基础设施和服务来改善基础设施和生活品质。

该地区的主要企业正大力投资研发,以提高道路建设的速度。考虑到这些发展和因素,预计未来几年亚太地区对沥青路面的需求将呈现高成长率。

沥青路面产业概况

沥青路面市场由全球和地区知名企业整合和主导。公司正在采取新产品发布、合作和合併等策略来保持其在市场中的地位。

- 2024年2月,约翰迪尔宣布与Hexagon旗下的Leica Geosystems建立策略伙伴关係关係,协助加速重型建设产业的数位转型。此次伙伴关係将利用两家公司的优势,为世界各地的建筑专业人士提供新技术和服务。

市场的主要企业包括沃尔沃建筑设备公司、卡特彼勒公司、法亚集团、安曼集团和维特根美国公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 亚太地区建设活动不断增加

- 市场限制

- 建筑租赁业务可能会阻碍市场成长

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第 5 章市场细分(市场规模:十亿美元)

- 类型

- 履带式摊舖

- 轮式摊舖

- 砂浆

- 铺路范围

- 小于1.5米

- 1.5 m~2.3 m

- 2.4 m~2.55 m

- 超过2.55米

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 墨西哥

- 巴西

- 阿拉伯聯合大公国

- 其他国家

- 北美洲

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Volvo Construction Equipment

- Caterpillar Inc.

- Fayat Group

- Ammann Group

- Astec Industry Inc.

- XCMG Construction Machinery Co. Ltd

- Wirtgen America Inc.

- Leeboy Inc.

- Sumitomo IHI Construction Machinery Co. Ltd

第七章 市场机会与未来趋势

The Asphalt Pavers Market size is estimated at USD 2.52 billion in 2025, and is expected to reach USD 3.22 billion by 2030, at a CAGR of 5% during the forecast period (2025-2030).

Governments worldwide are spending more on high-quality roads and highways for the swift movement of goods and passengers, even from remote locations to all major cities. Smart city initiatives are creating demand for asphalt pavers to enhance the quality and stretch of roads and highways. The government and private road projects achieved pace and increased demand for asphalt pavers.

Over the longer term, asphalt road paver equipment is anticipated to witness exponential growth due to increased activities and reforms by governments. Increased budget allocation for the development of roads and highways is also likely to be pivotal.

Countries like China, India, the United States, and Germany have been observed as the bedrock for the growth of asphalt paver and milling equipment owing to increased public and private investments in highways and road development in the region. Various government initiatives are set to propel the demand for asphalt paver and milling equipment in the long term.

Key Highlights

- For instance, according to the Ministry of Housing and Urbanization in India, till 2023, 7,978 projects were initiated across 100 smart cities, such as Bhubaneswar, Pune, Jaipur, Surat, Kochi, New Delhi, and various others, with USD 8.8 billion allocated for the development of the project.

- In January 2024, the Japanese government committed to invest USD 1.5 billion for nine projects related to various sectors in India, which include North East Road Network Connectivity and the Project for Promoting Start-up and Innovation.

OEMs play a pivotal role in designing, manufacturing, and delivering vehicles and in the transition of the construction sector. Considering the exponential rise in construction activities in countries like India and China, companies are focusing on the launch of various technologically advanced products, contributing to the market's growth.

Asphalt Pavers Market Trends

Track Pavers Segment Holds the Highest Share in the Market

Track pavers have been widely accepted compared to wheeled pavers owing to their superior traction for jobs that require wide pulls or large mix-delivery vehicles. In addition, track pavers are more mobile and easily shipped to the desired locations where road construction projects are undergoing. Players in the segment are offering reliable and technologically advanced track pavers to achieve elevated sales bars. For instance,

- In October 2023, Power Pavers launched a new full-width, four-track concrete slipform paver, the SF-3404. The machine is said to offer an array of improvements in technology, providing smooth operation for contractors.

- In July 2023, Vogele launched its smallest pavers, the MINI 500 tracked paver and the MINI 502 wheeled paver, in Europe.

The increasing spending on roads, highways, and expressways for swift and smooth movement of industrial products is driving the market. Considering these factors and developments, the demand for track pavers is expected to witness a high growth rate during the forecast period.

Asia-Pacific Region Holds the Highest Share

Asia-Pacific was the largest market for asphalt pavers in 2023. The region is expected to witness further growth over the forecast period due to factors like the high rate of road and highway construction.

- India, China, and ASEAN are the epicenters of increased road construction, elevating the demand for asphalt pavers. In the long term, increased public and private investment in road and highway construction is expected to remain a key growth enabler for asphalt paver demand in the region.

- With the rise in urban population, urbanization is expected to happen at a faster pace and create more demand for mid-end and affordable housing units. According to NITI Aayog, India's population is projected to reach 1.64 billion by 2047, and an estimated 51% of India's population is likely to be living in urban centers.

- Under the National Project Scheme, India allocated a budget of USD 1.4 trillion in infrastructure by 2025, boosting the demand for pavers. Smart city projects seek to enhance infrastructure and quality of life through core infrastructure provision and services, including electric and adequate water supply, efficient mobility and public transport, sanitation, affordable housing, digitalization, and effective governance.

The major players in the region are spending heavily on R&D to increase the rate of road construction. Considering these developments and factors, the demand for asphalt pavers in Asia-Pacific is expected to witness a high growth rate in the coming years.

Asphalt Pavers Industry Overview

The asphalt pavers market is consolidated and led by globally and regionally established players. The companies adopt strategies such as new product launches, collaborations, and mergers to sustain their market positions.

- In February 2024, John Deere announced a strategic partnership with Leica Geosystems, part of Hexagon, to help accelerate the digital transformation of the heavy construction industry. The partnership will leverage the strengths of both companies to bring new technologies and services to construction professionals worldwide.

Some of the major players in the market include Volvo Construction Equipment Corporation, Caterpillar Inc., Fayat Group, Ammann Group, and Wirtgen America Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increase in Construction Activities in Asia-Pacific

- 4.2 Market Restraints

- 4.2.1 Construction Rental Business May Hamper The Target Market Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION ( Market Size in Value USD Billion)

- 5.1 Type

- 5.1.1 Tracked Pavers

- 5.1.2 Wheeled Pavers

- 5.1.3 Screeds

- 5.2 Paving Range

- 5.2.1 Less than 1.5 m

- 5.2.2 1.5 m to 2.3 m

- 5.2.3 2.4 m to 2.55 m

- 5.2.4 Above 2.55 m

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of World

- 5.3.4.1 Mexico

- 5.3.4.2 Brazil

- 5.3.4.3 United Arab Emirates

- 5.3.4.4 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Volvo Construction Equipment

- 6.2.2 Caterpillar Inc.

- 6.2.3 Fayat Group

- 6.2.4 Ammann Group

- 6.2.5 Astec Industry Inc.

- 6.2.6 XCMG Construction Machinery Co. Ltd

- 6.2.7 Wirtgen America Inc.

- 6.2.8 Leeboy Inc.

- 6.2.9 Sumitomo IHI Construction Machinery Co. Ltd