|

市场调查报告书

商品编码

1690195

聚合物加工助剂-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Polymer Processing Aid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

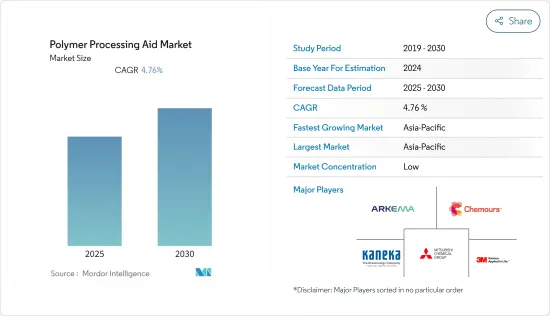

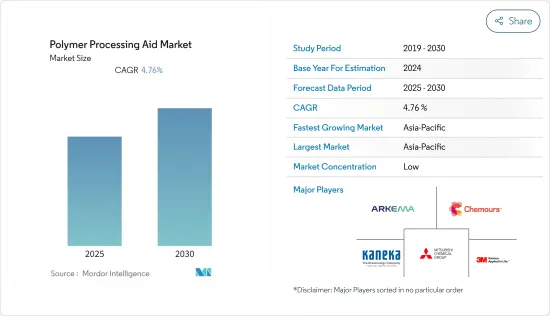

预计预测期内聚合物加工助剂市场复合年增长率将达到 4.76%。

新冠疫情为聚合物加工助剂市场带来了沉重打击。全球封锁和严格的政府规定导致我们大部分生产基地关闭,造成了毁灭性的打击。儘管如此,业务从 2021 年开始復苏,预计未来几年将大幅成长。

主要亮点

- 从中期来看,吹塑和铸膜对聚合物加工助剂的需求不断增加以及电线电缆领域的需求不断增长是推动市场发展的主要因素。

- 然而,根据挤压过程中使用的聚合物,聚合物加工助剂引起的品质问题和高产品成本预计将成为市场扩张的重大障碍。

- 然而,纺织和拉菲草公司对聚合物加工助剂的需求不断增长、即将开展的通讯计划以及电动汽车的日益普及预计将为市场增长提供各种有利可图的机会。

- 亚太地区在全球聚合物加工助剂市场占据主导地位,其中中国、印度和日本等国家消费量最高。

聚合物加工助剂市场趋势

吹塑薄膜和铸膜领域的需求不断增长

- 聚合物加工助剂用于挤出工艺,将熔融的聚合物製成管道、薄膜、管子和其他产品。聚合物加工助剂可提高最终产品的品质。

- 聚合物加工助剂有助于提高薄膜的透明度、改善光滑度、改善产品外观并增强机械性能。由于这些因素,吹塑和铸膜领域对聚合物加工助剂的需求正在增加。

- 根据包装协会和塑胶工业协会的预测,2023年全球塑胶铸膜技术市场规模将达到144.866亿美元。铸膜技术主要用于食品和工业包装。

- 此外,对包装薄膜、农用薄膜和胶带的需求不断增长,推动了对具有高机械强度和耐久性等改进性能的聚合物的需求,例如高高密度聚苯乙烯(HDPE)、线型低密度聚乙烯(LLDPE) 和低密度聚乙烯 (LDPE)。

- 根据国际矿业与资源委员会(IMARC)的数据,全球食品包装市场规模预计到2022年将达到3,630亿美元,到2028年将达到5,120亿美元。

- 此外,根据塑胶工业协会的预测,到2023年,全球塑胶薄膜市场的包装部分将达到30,280.8千吨。塑胶薄膜包装用于食品包装、药品包装和医疗包装等行业。

- 由于上述所有因素,预计预测期内聚合物加工助剂市场将快速成长。

亚太地区占市场主导地位

- 预计预测期内亚太地区将主导聚合物加工助剂市场。包装、汽车、建筑等各终端使用者产业对塑胶的需求不断增加,推动了中国、印度、日本和韩国等国家对聚合物加工助剂的需求。

- 根据包装协会和塑胶工业协会的数据,亚太地区塑胶铸膜技术市场规模预计在2023年达到62.636亿美元。铸膜技术主要用于食品和工业包装。

- 中国正经历建筑业的繁荣。该国是该地区最大的建筑市场,占全球整体建筑投资的20%。据估计,中国政府将在 2022 年为新的基础设施债券设定年度限额为 3.85 兆元(约 5.7249 亿美元),高于 2021 年的 3.65 兆元(约 5.4275 亿美元)。

- 聚合物加工有助于改善产品的表面质量,消除熔体破裂,并减少模具沉积物。预计这些因素将对聚合物加工助剂市场产生正面影响。

- 此外,预计中国、印度、日本和韩国等国家对聚合物加工助剂的需求将会增加,以满足食品包装和农业领域对清洁薄膜的需求。预计这将刺激该地区的聚合物加工助剂市场。

- 此外,最佳使用聚合物加工助剂可以减少生产过程中对聚乙烯的损害。

- 因此,航空、国防、汽车、通讯、科学实验室、商业设施等各个应用领域对聚合物产品的需求不断增长,刺激了对聚合物加工助剂的需求,从而推动了聚合物加工助剂市场的发展。

- 根据国际汽车製造商组织 (OCIA) 的数据,作为最大的汽车生产地区亚太地区在 2022 年也实现了 7% 的成长。汽车产量将从2021年的4,676万辆增加至2022年的5,002万辆。

- 此外,2021年中国汽车产量为2,612万辆,而2022年产量约2,702万辆,成长率约3%。

- 据印度民航总局(DGCA)称,印度航空业发展迅速。该行业已成为比耗时的公路和铁路运输更经济、更可靠的替代方案。印度市场发展模式清晰,预计2034年将成为全球主要航空市场之一。截至22财年,靛蓝航空是该领域的市场领导者,占约55%的市场。

- 预计上述因素和政府支持将在预测期内增加对聚合物加工助剂的需求。

聚合物加工助剂产业概况

聚合物加工助剂市场较为分散,主要企业的市场占有率较小。该市场的主要企业包括 3M、阿科玛、科慕公司、三菱化学和KANEKA。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 包装产业对聚丙烯的需求不断增加

- PVC 和 HDPE 在建筑和基础设施产业的应用

- 其他驱动因素

- 限制因素

- 聚合物加工助剂会导致品质问题并增加产品成本。

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 聚合物类型

- 聚乙烯

- LLDPE

- LDPE

- 高密度聚苯乙烯

- 聚丙烯

- PVC、ABS、聚碳酸酯

- 其他聚合物

- 聚乙烯

- 应用

- 吹塑薄膜和铸膜

- 电线电缆

- 挤出吹塑成型

- 纤维和拉菲草

- 管道

- 其他用途

- 最终用户产业

- 包装

- 建筑与施工

- 运输

- 纤维

- 资讯科技/通讯

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率分析(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Ampacet Corporation

- Arkema

- Avient Corporation

- BASF SE

- Clariant

- DAIKIN INDUSTRIES, Ltd.

- Dow

- Evonik Industries AG

- Fine Organic Industries Limited

- Guangzhou Shine Polymer Technology Co. Ltd

- Gujarat Fluorochemicals Limited(GFL)

- HANNANOTECH CO., LTD.

- Kaneka Corporation

- LG Chem

- MicroMB(INDEVCO Group)

- Mitsubishi Chemical Corporation

- Mitsui Chemicals Inc.

- Nouryon

- Plastiblends

- PMC Group, Inc.

- Shanghai Lanpoly Polymer Technology Co. Ltd

- Solvay

- The Chemours Company

- Tosaf Compounds Ltd

- WSD CHEMICAL COMPANY

第七章 市场机会与未来趋势

- 电动车日益普及

- 通讯领域的未来计划

The Polymer Processing Aid Market is expected to register a CAGR of 4.76% during the forecast period.

The COVID-19 pandemic harmed the polymer processing aid market. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business is recovering from 2021 and is expected to rise significantly in the coming years.

Key Highlights

- Over the medium term, major factors driving the studied market include increasing demand for polymer processing aids in blown film and cast film and rising demand from the wire and cable segment.

- However, quality difficulties and high product costs due to polymer processing aid depending on the polymer utilized during the extrusion process are important barriers projected to stymie market expansion.

- Nevertheless, the increasing need for polymer processing aid in the fiber and raffia company, forthcoming telecommunications projects, and increasing electric vehicle penetration are expected to offer various lucrative opportunities for the market's growth.

- The Asia-Pacific region dominated the polymer processing aid market globally, with the highest consumption from countries such as China, India, and Japan.

Polymer Processing Aid Market Trends

Increasing Demand from Blown Film and Cast Film Segment

- A polymer processing aid is used during polymer formulation when molten polymers are subjected to extrusion processes to be formulated into pipes, film, tubes, and other products. Polymer processing aid improves the quality of finished products.

- Polymer processing aids help in increasing film transparency, improving smoothness, improving product appearance, and improving mechanical properties. Owing to these factors, the demand for polymer processing aid is increasing in the blown film and cast film segment.

- According to the Packaging Association and Plastics Industry Association, the global plastic cast film technology market is estimated to be worth USD 14,486.6 million in 2023. The cast film technique is mostly utilized in food and industrial packaging.

- Additionally, the rise in demand for packaging films, agriculture films, and tapes is increasing the demand for polymers such as high-density polyethylene (HDPE), linear low-density polyethylene (LLDPE), and low-density polyethylene (LDPE) with improved properties such as high mechanical strength and durability.

- According to the International Mining and Resources Conference (IMARC), the global market value of food packaging was USD 363 billion in 2022 and is expected to reach USD 512 billion in 2028.

- Moreover, according to the Plastics Industry Association, the packaging segment of the global plastic film market is predicted to reach 30,280.8 kilotons by 2023. Plastic film packaging is utilized in industries such as food packaging, pharmaceutical packaging, and medical packaging.

- The polymer processing aid market is expected to grow rapidly over the forecast period due to all the abovementioned factors.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market for polymer processing aid during the forecast period. Due to the increasing demand for plastics from various end-user industries like packaging, automotive, and building and construction, the demand for polymer processing aid is increasing in countries like China, India, Japan, and South Korea.

- According to the Packaging Association and Plastics Industry Association, the Asia-Pacific plastic cast film technology market is estimated to be worth USD 6,263.6 million in 2023. The cast film technique is mostly utilized in food and industrial packaging.

- China is amid a construction mega-boom. The country includes the largest building market in the region, making up 20% of all construction investments globally. The Chinese government is estimated to include an annual limit for new infrastructure bonds worth CNY 3.85 (~USD 572.49) trillion in 2022, up from CNY 3.65 trillion (~USD 542.75 million) in 2021.

- Polymer processing helps improve product surface quality, eliminate melt fractures, and reduce die deposits. These factors are expected to positively impact the polymer processing aid market.

- Additionally, the demand for polymer processing aid is expected to increase to meet the demand for clean films in food packaging and agriculture sectors in countries like China, India, Japan, and South Korea. It will stimulate the polymer processing aid market in the region.

- Furthermore, the optimum utilization of polymer processing aids can reduce the damage to polyethylene during manufacturing.

- Thus, the rise in demand for polymer products from various applications such as aviation, defense, automobile, telecommunication, scientific research labs, commercial facilities, and others is fueling the demand for polymer processing aid and, thus, propelling its market.

- According to Organisation Internationale des Constructeurs d'Automobiles (OCIA), Asia-Pacific, the largest automotive production region, also witnessed a growth rate of 7% in 2022. The production of motor vehicles increased from 46.76 million in 2021 to 50.02 million in 2022, respectively.

- Moreover, around 27.02 million motor vehicles were produced in China in 2022, compared to 26.12 million motor vehicles produced in 2021, witnessing a growth rate of about 3%.

- According to the Directorate General of Civil Aviation (DGCA), India's aviation sector rapidly expanded. The industry had established itself as a cost-effective and trustworthy alternative to time-consuming and lengthy excursions by road or rail. With a discernible development pattern, India was predicted to become one of the world's major aviation markets by 2034. As of fiscal year 2022, IndiGo was the market leader in the sector, accounting for around 55% of the market.

- The above factors and government support are expected to increase the demand for polymer processing aid during the forecast period.

Polymer Processing Aid Industry Overview

The polymer processing aid market is fragmented, with the top players accounting for a marginal market share. Some of the key companies in the market include 3M, Arkema, The Chemours Company, Mitsubishi Chemical Corporation, and Kaneka Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Polypropylene from the Packaging Industry

- 4.1.2 Usage of PVC and HDPE in the Building and Infrastructure Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Quality Difficulties and High Product Costs due to Polymer Processing Aid

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value

- 5.1 Polymer Type

- 5.1.1 Polyethylene

- 5.1.1.1 LLDPE

- 5.1.1.2 LDPE

- 5.1.1.3 HDPE

- 5.1.2 Polypropylene

- 5.1.3 PVC, ABS, and Polycarbonate

- 5.1.4 Other Polymer Types

- 5.1.1 Polyethylene

- 5.2 Application

- 5.2.1 Blown Film and Cast Film

- 5.2.2 Wire and Cable

- 5.2.3 Extrusion Blow Molding

- 5.2.4 Fibers and Raffia

- 5.2.5 Pipe and Tube

- 5.2.6 Other Applications

- 5.3 End-user Industry

- 5.3.1 Packaging

- 5.3.2 Building and Construction

- 5.3.3 Transportation

- 5.3.4 Textiles

- 5.3.5 IT and Telecommunication

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 UK

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Abalysis (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Ampacet Corporation

- 6.4.3 Arkema

- 6.4.4 Avient Corporation

- 6.4.5 BASF SE

- 6.4.6 Clariant

- 6.4.7 DAIKIN INDUSTRIES, Ltd.

- 6.4.8 Dow

- 6.4.9 Evonik Industries AG

- 6.4.10 Fine Organic Industries Limited

- 6.4.11 Guangzhou Shine Polymer Technology Co. Ltd

- 6.4.12 Gujarat Fluorochemicals Limited (GFL)

- 6.4.13 HANNANOTECH CO., LTD.

- 6.4.14 Kaneka Corporation

- 6.4.15 LG Chem

- 6.4.16 MicroMB (INDEVCO Group)

- 6.4.17 Mitsubishi Chemical Corporation

- 6.4.18 Mitsui Chemicals Inc.

- 6.4.19 Nouryon

- 6.4.20 Plastiblends

- 6.4.21 PMC Group, Inc.

- 6.4.22 Shanghai Lanpoly Polymer Technology Co. Ltd

- 6.4.23 Solvay

- 6.4.24 The Chemours Company

- 6.4.25 Tosaf Compounds Ltd

- 6.4.26 WSD CHEMICAL COMPANY

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Electric Vehicles Penetration

- 7.2 Upcoming Projects in the Telecommunication Sector