|

市场调查报告书

商品编码

1690198

物联网中的人工智慧 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)AI In IoT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

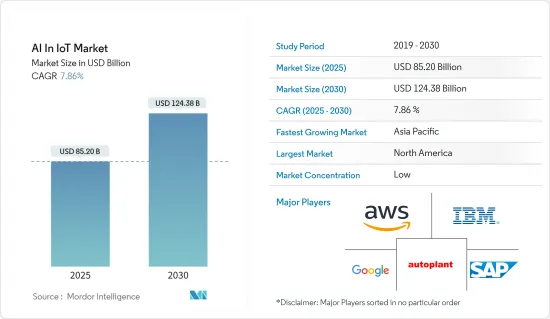

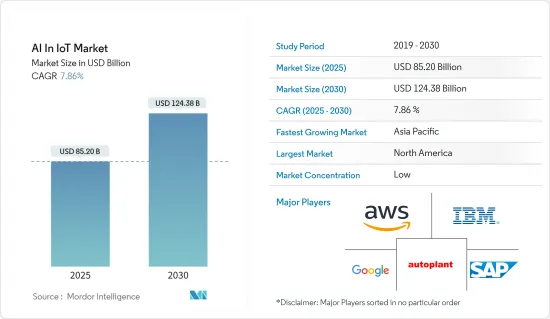

预计2025年物联网人工智慧市场规模为852亿美元,预计到2030年将达到1,243.8亿美元,预测期内(2025-2030年)的复合年增长率为7.86%。

高效处理物联网设备产生的大量即时资料的需求、对性能管理设备不断增长的需求以及减少停机时间和维护成本的需求是推动市场成长的主要因素。

主要亮点

- 物联网技术是各个组织数位转型不可或缺的一部分,从而使他们能够透过建构和追踪新的经营模式来升级现有流程。随着越来越多的公司将物联网视为业务成功的关键推动因素,物联网的采用率正在上升。人工智慧和物联网这两种技术的结合将创造出能够模拟理性行为并在很少或完全不需要人工干预的情况下支援决策的智慧机器。越来越重视对物联网设备产生的资料进行有效管理,以获得有价值的见解和即时监控以改善客户体验,这是市场的主要成长要素。

- 零售业正在利用基于物联网的云端 AI 来增强客户体验计划并创造更多以客户为中心的产品。例如,在智慧零售环境中,具有电脑视觉功能的摄影系统可以使用脸部辨识来识别进门的顾客。例如,假设系统侦测到许多千禧世代正在造访您的商店。在这种情况下,您可以推送针对这一人群的产品广告和店内特价商品,以帮助推动销售。

- 此外,许多公司正在从内部部署人工智慧转向云端,因为低延迟和即时追踪可以缩短交付时间,这可能会在预测期内推动市场成长。例如,Amazon Echo亚马逊推出了託管云端平台Web Services IoT,使装置能够安全地连接到云端应用程式和其他装置。 2021 年 2 月,IBM 和 Red Hat 宣布开展新的合作,利用混合云旨在为製造商和工厂营运商提供开放、灵活且更安全的解决方案,从工业IoT的营运资料中获取混合云端价值。

- 然而,技术纯熟劳工的短缺和对资料安全的日益担忧是限制调查市场成长的主要因素。人工智慧和物联网从使用者和客户收集敏感和重要的资料,因此确保资料的安全并交到可靠的人手中至关重要。然而,安全性一直是个技术问题,因为使用者永远不知道何时有人会试图存取我们的个人敏感资料,这限制了市场的成长。

- 在冠状病毒大流行期间,组织获得可扩展、可靠和安全的运算能力是当前市场成长的一些关键驱动力,无论是用于关键的医疗保健业务,还是用于学生继续学习,还是用于前所未有的数量的员工在家在线保持高效工作。医院网路、製药公司和研究机构正在使用支援人工智慧的物联网设备来照顾患者、寻找治疗方法、减轻 COVID-19 的影响等等。所有上述因素都在短期内加速市场成长率,并有望在长期内进一步提高市场成长率。

物联网人工智慧的市场趋势

医疗保健产业可望推动市场强劲成长

- 医疗保健组织可以收集和分析高频物联网 (IoT) 感测器资料和电脑视觉 (AI),以提高人类在做出诊断和治疗决策以及协助临床医生治疗疾病等任务中的表现。常规的身体活动能力和平衡能力评估是一项常规医疗保健活动,透过结合物联网和人工智慧技术,该活动具有巨大的转变潜力。利用物联网,医疗保健提供者可以进行定量、一致和可重复的测试,同时以更少的步骤简化评估。

- 测试和储存疫苗(包括 COVID-19 疫苗)的医院、诊所、製药公司和学术机构目前无法了解其冰箱的即时状态和性能。这增加了基于物联网的疫苗物流和安全预测性维护的需求。物联网还可以提高诊断准确性、实现远端患者监控、减少后续观察需求、缩短等待时间、识别重症患者以及追踪医疗设备。

- 此外,人工智慧和物联网的创新可以帮助医院充分利用电脑断层扫描和病患生命征像等资料。这些系统使医生能够远端监控患者的健康状况,并识别需要紧急治疗的患者,即使他们不在医院内。物联网还可以提高某些疾病(如乳癌和肺癌)的诊断准确性。

- 智慧医院正在利用物联网技术和机器人技术开创医疗支援和治疗的新时代。各种专为医疗保健领域设计的物联网设备和应用程式正在涌现,包括用于远端医疗远端医疗咨询和监控的感测器和应用程式。在这方面,物联网正在透过即时病患监测(健身追踪器、智慧型穿戴装置、紧急按钮等)、透过智慧影像分析进行进阶诊断以及机器人手术来帮助改善医疗保健。这些应用程式有助于收集人类预防措施、早期检测和药物治疗的资料。

- 随着物联网技术的日益普及,智慧医疗趋势预计将显着成长。例如,2022年12月,电脑硬体製造商华硕在台湾医疗健康博览会上发表了其智慧医疗解决方案。华硕智慧医疗的主题成为华硕展会上展出的各种产品数位转型的催化剂。涵盖的主题包括推动台湾医疗机构数位化的社区健康管理、精准医疗和远端医疗趋势。此外,AI演算法和物联网设备也协助医院管理本地医疗,使其能够透过数位转型从本地医院转型为现代化医院。

预计北美将占据主要市场占有率

- 北美是市场占有率较大的关键地区之一,这得益于汽车和运输、製造、零售和医疗保健等许多行业广泛采用人工智慧和物联网技术,这也是该地区研究市场成长的原因之一。北美是研究新兴终端用户产业人工智慧和物联网应用开发的领先地区之一。据思科称,截至 2022 年,美国和加拿大的人均设备和连接数量将位居世界第一。

- 北美企业的製造平台正在进行数位转型,这为该国物联网製造领域的人工智慧解决方案提供者创造了机会。这使得这些公司能够控制其製造设施中的能源和水的使用,使其设备更具弹性同时减少废弃物,并在生产线上即时检查产品品质。提供可扩展的预测品质、预测性维护、控制发布和非接触式操作将有助于使整个地区的工厂生产更加永续性。

- 许多全球公司正在与市场供应商合作,将基于人工智慧的 IIoT 整合到他们的生产线中,从而推动市场成长。例如,2022年9月,宝洁与微软签署了一项多年伙伴关係协议,以实现宝洁数位化製造基础设施的现代化。根据伙伴关係关係,工业物联网 (IIoT)、数位双胞胎、资料和人工智慧将加速向客户交付并提高客户满意度,同时提高生产力并降低成本。

- 该地区是许多全球物联网和人工智慧供应商和提供者的所在地,主要来自美国。该国还拥有高科技生态系统,该地区的车辆越来越以软体为导向。当人工智慧与物联网结合时,设备可以分析资料、做出决策并根据资料采取行动,而无需人工干预。特斯拉的自动驾驶汽车就是人工智慧和物联网协同工作的一个例子。透过融入人工智慧,自动驾驶汽车将能够预测车辆和行人在不同情况下的行为。例如,它会评估道路状况、天气和最佳速度,每次旅程都会变得更聪明。

- 该行业在北美的成长潜力也体现在许多美国人工智慧平台和软体製造商正在与物联网解决方案供应商合作以增加市场占有率这一事实上。

物联网产业人工智慧概述

物联网人工智慧市场竞争激烈,国内外公司多。该市场由多家公司组成,包括微软、 销售团队、AWS、SAP SE、Oracle和 IBM 公司。每个公司的品牌识别对市场都有重大影响。由于强大的品牌意味着卓越的业绩,老字型大小企业有望占据优势。提供先进的人工智慧解决方案和持续升级的供应商可能会成为买家的热门选择。

2023年6月,亚马逊网路服务公司宣布了一项新计画-AWS生成式人工智慧创新中心,旨在帮助客户成功开发和部署智慧人工智慧解决方案。透过该计划,AWS 将投资 1 亿美元,将 AI 和 MLAWS 专家与全球客户联繫起来,以帮助他们构思、设计或推出新的生成式AI产品、服务和流程。

2023 年 5 月,SAP 和 Google Cloud 宣布推出广泛的开放资料产品,旨在简化业务资料格局并释放其强大力量。透过此产品,客户可以使用 SAP Datasphere 解决方案和 Google 的数据云来建立端到端资料云,从而在整个企业内提取资料,让企业即时查看其整个资料资产,并最大限度地提高其 SAP Cloud 投资的价值。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 产业影响评估

第五章市场动态

- 市场驱动因素

- 巨量资料量不断成长

- 透过有效管理物联网设备产生的资料获得有价值的见解

- 市场限制

- 资料安全和隐私问题

第六章市场区隔

- 按组件

- 平台

- 应用程式管理

- 连线管理

- 设备管理

- 服务

- 託管服务

- 专业服务

- 软体

- 资料管理

- 网路频宽管理

- 即时串流分析

- 远端监控

- 安全功能

- 边缘解决方案

- 平台

- 按行业

- 银行、金融服务和保险(BFSI)

- 资讯科技和电讯

- 能源和公共产业

- 卫生保健

- 製造业

- 其他终端使用者产业(交通运输、政府、零售)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Amazon Web Services Inc.(Amazon Inc.)

- IBM Corporation

- Autoplant Systems India Pvt. Ltd

- SAP SE

- Google LLC(Alphabet Inc.)

- Microsoft Corporation

- Oracle Corporation

- Salesforce.com Inc.

- PTC Inc.

- SAS Institute Inc.

- General Electric Company

- Hitachi Ltd

第八章投资分析

第九章:市场的未来

The AI In IoT Market size is estimated at USD 85.20 billion in 2025, and is expected to reach USD 124.38 billion by 2030, at a CAGR of 7.86% during the forecast period (2025-2030).

The need to efficiently process vast volumes of real-time data generated from IoT devices, the growing demand for performance management appliances, and the need to reduce downtime and maintenance costs are the primary factors driving the market's growth.

Key Highlights

- IoT technology is essential for various organizations to digitally transform, thus, empowering them to upgrade the existing processes by creating and tracking new business models. More and more companies view IoT as an important element for business success, thus increasing its adoption. AI and IoT, both technologies, when combined, are creating intelligent machines that simulate rational behavior and support decision-making with little or no human interference. The growing emphasis on effective management of data generated from IoT devices to gain valuable insights and real-time monitoring to curate an enhanced customer experience are the key growth drivers for the market.

- The retail industry is leveraging cloud AI in IoT-based services to augment customer experience programs and generate more customer-oriented products. For instance, in a smart retail environment, a camera system outfitted with computer vision capabilities can use facial recognition to recognize customers when they walk through the door. Suppose the system detects most customers walking into the store are Millennials. In that case, it can push out product advertisements or in-store specials that appeal to that demographic, therefore driving sales.

- Furthermore, most companies are shifting to the cloud from on-premise AI, owing to faster delivery time with low latency and real-time tracking, likely to foster the studied market growth during the forecast period. For instance, Amazon Echo Amazon has introduced Web Services IoT, a managed cloud platform and lets devices connect securely to cloud applications and other devices. In February 2021, IBM and Red Hat announced a new collaboration to use a hybrid cloud designed to deliver an open, flexible, and more secure solution for manufacturers and plant operators that will drive real-time value from operations data from industrial IoT.

- However, the lack of a skilled workforce and growing concerns regarding data security are some major factors restraining the studied market growth. It is crucial to ensure that the data is secure and in safe hands because AI and IOT collect sensitive and essential data from their users or clients. But since users have no idea when someone would attempt to access our private and sensitive data, security is always a concern with technology and restricting the market growth.

- During the spread of Coronavirus, the ability for organizations to access scalable, dependable, and highly secure computing power, whether for vital healthcare work, to help students continue learning, or to keep unprecedented numbers of employees online and productive from home are some of the critical factors owing to the growth of the market in this situation. Hospital networks, pharmaceutical companies, and research labs are using AI-enabled IoT devices to care for patients, explore treatments, and mitigate the impacts of COVID-19 in many other ways. All of the above factors have accelerated the market's growth rate in the short run and are expected to augment it further in the long term.

AI in IoT Market Trends

Healthcare Sector Expected to Witness Robust Market Growth

- Healthcare organizations can improve human performance on tasks such as diagnostic or therapeutic decisions, supporting clinicians in treating diseases, etc., by collecting and analyzing high-frequency Internet of Things (IoT) sensor data and computer vision (AI). Routine physical assessments of mobility and balance are usual healthcare activities with significant potential to be transformed by combining IoT and AI technologies (IoT). With IoT, care providers can simplify assessment using fewer steps while making the test quantitative, consistent, and reproducible.

- Hospitals, clinics, pharmaceuticals, and academic institutes testing and storing vaccines, such as COVID-19 vaccines, still lack visibility on their refrigerators' real-time state and performance. Due to this, there is an increasing need for IoT-based predictive maintenance for vaccine logistics and safety. IoT can also improve diagnostic accuracy and remote patient monitoring, reduce the need for follow-up visits, reduce wait times, identify critical patients, and track medical equipment.

- Furthermore, innovations in AI and IoT allow hospitals to take full advantage of data, like CT scans and records of patient vitals. These systems enable doctors to monitor patient health remotely, even when not in the building, and identify which patients need immediate attention. IoT can also boost the accuracy of diagnoses for certain diseases like breast and lung cancer.

- Smart hospitals are utilizing IoT-connected technologies and robotics to deliver a new age of health support and treatment. There is an emergence of various IoT devices and applications designed for the healthcare sector, including sensors and apps for telemedicine consultations and remote healthcare monitoring. In this regard, IoT is helping to improve healthcare via real-time patient monitoring (fitness trackers, smart wearables, panic buttons, etc.), advanced diagnostics through smart image analysis, and robotic surgery. These applications help collect data to provide preventive measures for a person, early detection, and drug administration.

- Smart healthcare trends are expected to grow significantly as a result of the rising adoption of IoT technologies. For instance, in December 2022, ASUS, a computer hardware manufacturer, unveiled smart healthcare solutions at the Taiwan Healthcare+ Expo. The ASUS Smart Healthcare theme encouraged digital change as various products were displayed at the ASUS exhibit. The community health management, precision health, and telemedicine trends which are driving the digitization of Taiwan's medical institutions were addressed. Moreover, AI algorithms and IoT devices also helped hospitals manage community health, allowing them to transition from community hospitals to modern hospitals through digital transformation.

North America Is Anticipated To Hold Major Market Share

- North America is one of the major regions with significant market share because of the wide-scale adoption of AI and IoT technologies in many industries, like automotive and transportation, manufacturing, retail, and healthcare, which is one reason for the growth of the market studied in this region. North America is one of the leading regions with research into developing AI and IoT applications in new end-user industries. According to Cisco, the United States and Canada have the highest average per capita devices and connections as of 2022.

- The manufacturing platform of North American companies has undergone a digital transformation which is creating an opportunity for the AI solution providers in the manufacturing of IoTs in the country, which has been enabling these companies to control energy and water usage in manufacturing facilities, boost equipment resilience while reducing waste, and check product quality in real-time on the production line. Providing scalable predictive quality, predictive maintenance, controlled release, and touchless operations would be helpful in increasing the sustainability of production in the region's plants.

- Many global companies are partnering with market vendors to integrate AI-based IIoT into their production lines, fueling the market's growth. For instance, in September 2022, P&G and Microsoft signed a multiyear partnership agreement to revamp P&G's digital manufacturing infrastructure. According to the partnerships, the industrial internet of things (IIoT), digital twin, data, and AI would accelerate product delivery to customers and boost customer satisfaction while increasing productivity and lowering costs.

- The region has many global IoT and AI-based vendor providers, especially in the United States. In addition, the country has a high-tech ecosystem, and the region's automobiles have become increasingly software-oriented. When AI is coupled with the IoT, the devices can analyze data, make decisions, and act on that data without human interference. Tesla's self-driving cars are examples of AI and IoT working in tandem. With the incorporation of AI, self-driving cars predict the behavior of cars and pedestrians in various circumstances. For instance, they can determine road conditions, weather, and optimal speed and get smarter with each trip.

- The industry's potential for growth in North America is reflected in the fact that many American AI platforms and software manufacturers collaborate with IoT solution providers to improve their market share in the area.

AI in IoT Industry Overview

The AI in IoT market is highly competitive owing to the presence of a large number of players in the market operating in domestic and international markets. The market comprises several players, such as Microsoft, Salesforce, AWS, SAP SE, Oracle, and IBM Corporation. The brand identity associated with the companies has a major influence on the market. As strong brands are synonymous with good performance, long-standing players are expected to have the upper hand. The vendors offering advanced AI solutions and continuous upgrades in their offerings may be the popular choice for buyers.

In June 2023, Amazon Web Services, Inc. announced the AWS Generative AI Innovation Centre, a new program designed to assist customers with their successful development and deployment of intelligent artificial intelligence solutions, has been announced. In the program, AWS will invest USD 100 million to connect AI and MLAWS experts with customers around the world so that they can imagine, design, or launch new generative artificial intelligence products, services, and processes.

In May 2023, SAP and Google Cloud announced an extensive offering of open data, intending to simplify the business data landscape and release its power. This offering enables customers to create an end-to-end data cloud that brings data from across the enterprise landscape using the SAP Datasphere solution and Google's Data Cloud so that businesses can view their entire data estate in real-time and maximize the value of their SAP Cloud investments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Big Data Volume

- 5.1.2 Effective Management of Data Generated From IoT Devices to Gain Valuable Insights

- 5.2 Market Restraints

- 5.2.1 Data Security and Privacy Issues

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Platform

- 6.1.1.1 Application Management

- 6.1.1.2 Connectivity Management

- 6.1.1.3 Device Management

- 6.1.2 Services

- 6.1.2.1 Managed Services

- 6.1.2.2 Professional Services

- 6.1.3 Software

- 6.1.3.1 Data Management

- 6.1.3.2 Network Bandwidth Management

- 6.1.3.3 Real-time Streaming Analytics

- 6.1.3.4 Remote Monitoring

- 6.1.3.5 Security

- 6.1.3.6 Edge Solution

- 6.1.1 Platform

- 6.2 By End-user Vertical

- 6.2.1 Banking, Financial Services, and Insurance (BFSI)

- 6.2.2 IT and Telecom

- 6.2.3 Energy and Utilities

- 6.2.4 Healthcare

- 6.2.5 Manufacturing

- 6.2.6 Other End-user Verticals (Transport and Mobility, Government, and Retail)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services Inc. (Amazon Inc.)

- 7.1.2 IBM Corporation

- 7.1.3 Autoplant Systems India Pvt. Ltd

- 7.1.4 SAP SE

- 7.1.5 Google LLC (Alphabet Inc.)

- 7.1.6 Microsoft Corporation

- 7.1.7 Oracle Corporation

- 7.1.8 Salesforce.com Inc.

- 7.1.9 PTC Inc.

- 7.1.10 SAS Institute Inc.

- 7.1.11 General Electric Company

- 7.1.12 Hitachi Ltd