|

市场调查报告书

商品编码

1690199

证书颁发机构:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Certificate Authority - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

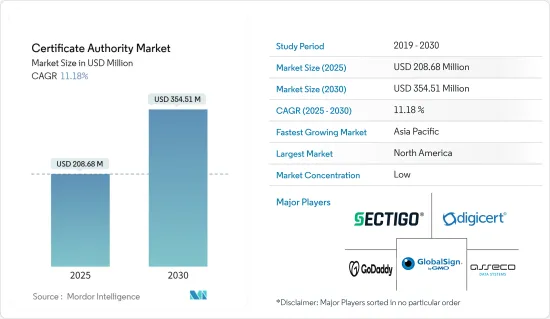

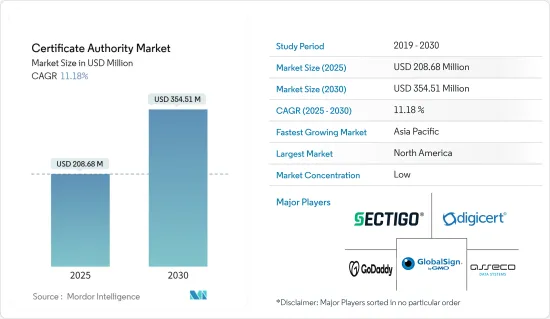

证书颁发机构市场规模预计在 2025 年为 2.0868 亿美元,预计到 2030 年将达到 3.5451 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.18%。

CA 市场的主要驱动因素包括:遵守严格的资料保护条例和法律的需求日益增加、最终用户行业数位转型日益加强、CA 在数位安全中的重要性日益增加以及跨行业资料外洩日益增多。

主要亮点

- 网路用户对于安全网路存取的意识不断增强、不断扩大的线上客户群对建立信任的需求日益增加以及严格的合规性和监管遵守是预计在预测期内推动所研究市场成长的关键因素。

- 此外,管理全球最终使用者组织中的严格法规和合规性,例如《健康保险互通性与课责法案》(HIPAA)、《一般资料保护规范》(GDPR)和《支付卡产业资料安全标准》(PCI DSS),是全球凭证授权单位市场的主要驱动力。此 CA 可协助企业 CA 维护其基础设施的安全并颁发符合行业标准和最佳实践的证书。

- 预计在预测期内,物联网 (IoT) 和 BYOD 趋势的日益普及将进一步推动凭证授权单位市场的成长。新的经营模式和应用,加上设备成本的下降,正在推动物联网的采用,最终推动连网设备的兴起。物联网设备在组织中的快速扩张凸显了利用凭证授权单位的数位凭证来维护连接设备和伺服器之间交换的资料的机密性和完整性的必要性。

- 然而,人们对安全证书认识的缺乏成为CA市场扩张的一大障碍。这表现为安全解决方案的需求下降、采用安全技术的障碍以及难以向市场宣传安全网路存取的重要性。为了克服这项挑战,透过有针对性的教育措施和宣传活动解决缺乏认识的问题至关重要。这样做将建立信任,增加安全证书的采用,并最终推动市场成长。

证书颁发机构市场的趋势

BFSI 产业是最大的终端使用者产业

- 考虑到银行业的隐私和安全法规,需要更安全、更有影响力的 SSL 证书,为客户提供安全的浏览和交易体验。

- 这就是为什么银行和保险网站需要额外的安全措施来保护它们免受网路窃盗的窥探。客户在这些网站上共用的任何机密资讯都必须安全保存。数位环境中的安全标准在新的图表上取得了进展。然而,骇客已经熟练利用复杂的垃圾邮件来规避安全措施。 SSL 凭证是保护您的网站安全的第一步。 SSL 凭证在公钥和私钥加密技术的帮助下加密资料。伺服器和您的浏览器之间发生的交易是加密的,并且可以识别个人身份。

- BFSI 产业正在经历快速的数位化变革,越来越关注行动银行、线上金融服务和数位付款解决方案。 SSL 凭证在保护行动银行应用程式、网路银行入口网站付款闸道发挥着至关重要的作用,确保透过智慧型手机、平板电脑和其他行动装置进行的交易的机密性和完整性。透过利用 SSL 证书,BFSI 部门将加强其安全态势,赢得使用者的信任,并推动产业进一步成长和采用。

- 数位凭证在 BFSI 领域广泛应用。数位证书是浏览器和伺服器之间的链接,透过加密技术保护。数位证书透过安全加密的通道传输您的讯息,以便其他人或系统无法篡改或查看。

亚太地区:预计大幅成长

- 预计亚太地区的 CA 市场将在未来几年内显着成长,这受到多种因素的推动,包括终端用户组织中网路安全措施的不断加强、物联网和 BYOD 趋势的不断发展以及不断变化的监管环境。

- 此外,技术进步导致中国等国家的连网设备数量增加。这增加了对数位凭证的需求,以保护网站的安全,因为网站可能被第三方操纵或欺骗,外国情报机构可以更容易拦截与网站通讯的敏感用户资料。

- 此外,印度和中国等国家的混合办公和在家工作趋势也增加了在家庭不安全环境中工作的不知情员工遭受网路钓鱼攻击的风险。这凸显了该地区的组织采用数位凭证进行身份验证和资料保护的必要性。

- 总体而言,由于领先市场供应商的不断增长、区域市场供应商的扩张、最终用户组织的技术进步以及最终用户组织广泛采用数位证书进行身份验证和资料保护,亚太地区证书颁发机构市场预计将在未来几年实现显着增长。

CA市场概览

CA市场竞争激烈且分散,由几家大公司组成,包括DigiCert Inc.、Sectigo Limited、GoDaddy Inc.、Asseco Data Systems SA(Asseco Poland SA)和GlobalSign。全球市场竞争日益激烈。然而,主要企业在市场上占有强大的地位。这些公司正在利用策略合作计划来增加市场占有率并提高盈利。随着全球化,大多数公司都积极进行併购。

- 2024 年 1 月 - WISeKey International Holding Ltd 作为创始成员加入新成立的全球併购与投资委员会 (GMAIC)。该计划制定了将人工智慧(AI)融入併购以实现永续的策略,重点是实现卓越业务和环境健康的低碳策略。

- 2023 年 12 月 - OneSpan 启动了一项新的合作伙伴网路计划,提供全面的优势以加速成长并使公司的合作伙伴能够提供安全的客户体验。合作伙伴网路成员可以透过财务奖励、培训、认证、技术和销售来扩大其安全和电子签章产品组合。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争程度

- 替代品的威胁

- 价值链分析

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 提高网路用户对安全网路存取的认识

- 严格的监管和合规控制

- 市场限制

- 缺乏对安全证书重要性的认识

- 使用自签名证书

第六章 市场细分

- 按组件

- 证书类型

- SSL 凭证

- 代码签署证书

- 安全电子邮件证书

- 认证证书

- 服务

- 证书类型

- 按组织规模

- 大型企业

- 中小型企业

- 按行业

- BFSI

- 零售

- 卫生保健

- 资讯科技和电信

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- DigiCert Inc.

- Sectigo Limited

- GoDaddy Inc.

- Asseco Data Systems SA(Asseco Poland SA)

- GlobalSign

- Entrust Corporation

- Actalis SpA

- SSL.Com

- Trustwave Holdings, Inc.(Chertoff Group)

- Network Solutions, LLC.

- WISeKey International Holdings Ltd.

- Swisssign AG(Swiss Post)

- OneSpan Inc.

- Camerfirma SA

- Buypass AS

- Zerossl GMBH(HID)

第 8 章 关键文件签名/基于电子签章和电子邮件身份验证的公司列表

第九章投资分析

第十章 市场机会与未来趋势

The Certificate Authority Market size is estimated at USD 208.68 million in 2025, and is expected to reach USD 354.51 million by 2030, at a CAGR of 11.18% during the forecast period (2025-2030).

The certificate authority market is primarily driven by the growing need to comply with stringent data protection regulations and laws, growing digital transformation across end-user industries, growing prominence of certificate authorities in digital security, and growth in data breaches across industries.

Key Highlights

- The rise in awareness among internet users about secure web access, the increasing need to build trust among the expanding online customer base, and adherence to rigorous compliances and regulations are the major factors anticipated to drive the market growth studied during the forecast period.

- In addition, managing strict regulations and compliance such as the Health Insurance Portability and Accountability Act (HIPAA), General Data Protection Regulation (GDPR), Payment Card Industry Data Security Standard (PCI DSS), etc., in end-user organizations across the world is a key driving force for the global certificate authority market. The CAs help businesses CAs to maintain the security of their infrastructure and issue certificates in compliance with industry standards and best practices.

- The growing adoption of IoT and BYOD trends are further analyzed to drive the growth of the certificate authority market over the forecast period. The emerging business models and applications, coupled with the reduction of device costs, have been instrumental in driving the adoption of IoT and consequently, the number of connected devices. This rapid expansion of IoT devices across organizations underscores the necessity of utilizing digital certificates from certificate authorities to uphold the confidentiality and integrity of data exchanged between connected devices and servers.

- However, the lack of awareness surrounding security certificates is a barrier to expanding the certificate authority market. This is manifested through diminished demand for security solutions, obstacles in adopting secure technologies, and difficulties in educating the market about the significance of secure web access. Addressing the lack of awareness through targeted educational initiatives and awareness campaigns is crucial to overcome this challenge. By doing so, trust can be fostered, leading to increased adoption of security certificates and ultimately driving market growth.

Certificate Authority Market Trends

BFSI Sector to be the Largest End-user Industry

- Considering the privacy and security regulations of the banking sector, it requires a more secure and impactful SSL certificate to provide safe and secure browsing and transactions to its customers.

- Therefore, banking and insurance websites need extra security to protect them from the prying eyes of cyber thieves. The sensitive information that the customers share on these websites must be secured. The security norms of the digital environment have seen new graphs of advancements; however, hackers are excellent at outdoing security with their weapon of sophisticated spamming. SSL certificates are the first step toward securing a website. They encrypt the data with the help of public and private key cryptography. The transactions that happen to and between the server and the browser are encrypted, thus making them personal.

- The BFSI sector is experiencing a swift digital evolution, marked by a growing focus on mobile banking, online financial services, and digital payment solutions. SSL certificates play a pivotal role in safeguarding mobile banking apps, online banking portals, and digital payment gateways, thereby ensuring the confidentiality and integrity of transactions conducted through smartphones, tablets, and other mobile devices. By leveraging SSL certificates, the BFSI sector enhances its security posture, instilling trust among users and driving further growth and adoption within the industry.

- Digital certificates are widely used in the BFSI sector. Digital certificates are a link between the browser and the server, protected by encryption technology. The digital certificate sends the user's information across a secure route in encrypted form, and no other person or system may tamper with or see it.

Asia-Pacific Expected to Witness Major Growth

- The Asia Pacific, certificate authority market, is analyzed to witness significant growth in the coming years, largely supported by many factors, including advancements in cybersecurity practices in end-user organizations, growing IoT and BYOD trends, and the evolving regulatory landscape.

- Moreover, Due to technological advances, the number of connected devices is increasing in countries like China. This allows websites to be manipulated and spoofed by third parties, and foreign intelligence agencies may more easily intercept sensitive user data that communicates with websites, thus driving the demand for digital certificates to safeguard websites.

- Further, the hybrid working and work-from-home trends in countries like India, China, etc., have increased the risk of phishing attacks on unsuspecting employees working from unsecured environments at home. This has highlighted the need to adopt digital certificates for authentication and data protection in regional organizations.

- Overall, the Asia Pacific certificate authority market is anticipated to experience substantial growth in the coming years owing to the growing presence of major market vendors, expansion of regional market vendors, technological advancements in end-user organizations coupled with the growing prominence of digital certificates in the end-user organizations for authentication and data protection.

Certificate Authority Market Overview

The certificate authority market is highly competitive and fragmented and consists of several major players, such as DigiCert Inc., Sectigo Limited, GoDaddy Inc., Asseco Data Systems SA (Asseco Poland SA), and GlobalSign. The market is gaining competition globally. Nonetheless, the market exhibits a strong presence of key international players. These companies leverage strategic collaborative initiatives to expand their market share and enhance profitability. Most companies are actively involved in mergers and acquisitions, owing to globalization.

- January 2024 - WISeKey International Holding Ltd declared an initiative and joined as a founder member of the newly launched Global Mergers, Acquisitions & Investment Council (GMAIC), which is expected to strengthen the expansion of the Asia-Pacific M&A Association (APMAA). This initiative strategized on integrating artificial intelligence (AI) for sustainable development in M&A and focused on low-carbon strategies for good business and environmental health.

- December 2023 - OneSpan launched a new partner network program that provides comprehensive benefits that will drive growth and help the company's partners deliver secure customer experiences. The partner network members can grow their security and e-signature portfolio with financial incentives, training, certification, technical, and sales.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Degree of Competition

- 4.2.5 Threat of Substitutes

- 4.3 Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Awareness Among Internet Users About Secure Web Access

- 5.1.2 Managing Strict Regulations and Compliance

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness About the Importance of Security Certificates

- 5.2.2 Using of Self-Signed Certificates

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Certificate Types

- 6.1.1.1 SSL Certificates

- 6.1.1.2 Code Signing Certificates

- 6.1.1.3 Secure Email Certificates

- 6.1.1.4 Authentication Certificates

- 6.1.2 Services

- 6.1.1 Certificate Types

- 6.2 By Organization Size

- 6.2.1 Large Enterprises

- 6.2.2 Small and Medium-Sized Enterprises

- 6.3 By End-user Vertical

- 6.3.1 BFSI

- 6.3.2 Retail

- 6.3.3 Healthcare

- 6.3.4 IT and Telecom

- 6.3.5 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 DigiCert Inc.

- 7.1.2 Sectigo Limited

- 7.1.3 GoDaddy Inc.

- 7.1.4 Asseco Data Systems SA (Asseco Poland SA)

- 7.1.5 GlobalSign

- 7.1.6 Entrust Corporation

- 7.1.7 Actalis S.p.A

- 7.1.8 SSL.Com

- 7.1.9 Trustwave Holdings, Inc. (Chertoff Group)

- 7.1.10 Network Solutions, LLC.

- 7.1.11 WISeKey International Holdings Ltd.

- 7.1.12 Swisssign AG (Swiss Post)

- 7.1.13 OneSpan Inc.

- 7.1.14 Camerfirma SA

- 7.1.15 Buypass AS

- 7.1.16 Zerossl GMBH (HID)