|

市场调查报告书

商品编码

1690694

欧洲医药物流-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Europe Pharmaceutical Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

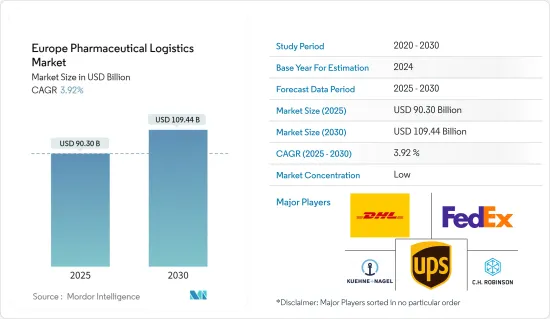

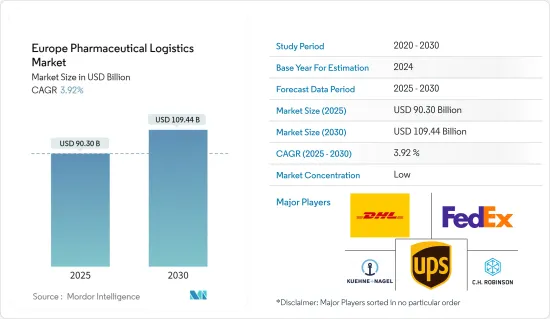

预计2025年欧洲医药物流市场规模为903亿美元,预计2030年将达到1,094.4亿美元,预测期内(2025-2030年)的复合年增长率为3.92%。

欧洲对医药物流的需求主要受到药品和疫苗需求不断增长的推动,这得益于新冠疫情以及大型製药企业的投资增加。研发製药业在恢復欧洲经济成长和确保在日益激烈的全球经济竞争中保持竞争力方面发挥关键作用。欧洲将在2022年投资445亿欧元(484.34亿美元)研发。此外,从上游到下游,直接僱用约86.5万人,间接创造的就业机会约为目前的三倍。

製药业对细胞疗法、疫苗和血液製品的需求不断增长,推动了该地区医药物流市场的成长。医药领域对逆向物流的需求不断增加、对温度敏感药品的需求不断增长以及 RFID 技术在医药物流中的使用不断增加是欧洲医药物流市场未来的趋势。

预计药品销售额的成长将推动医疗物流市场的成长。随着药品被储存并运输到药房、药局等,这将增加对运输和医疗物流的需求。

欧洲医学物流市场趋势

欧洲生物製药销售额成长

欧洲是全球第二大生物製药市场。人口成长和疾病的传播正在推动市场发展。接受度和开放度、用于治疗和治癒疾病的生物製药的易于获取以及与药物治疗相关的周到性正在推动欧洲市场的发展。为了确保全部区域患者能够获得安全且负担得起的药品,并帮助欧洲製药业保持创新和全球领先地位,欧盟委员会就拟议的欧洲药品战略启动了公众咨询。

製药商越来越重视产品品质和灵敏度。复杂的生物药物、荷尔蒙疗法、疫苗的开发以及复杂蛋白质的运输等因素需要特定的结果,而这些结果需要专门的运输和仓储。药品及医疗设备温控物流属于医药物流产业的一部分。此外,对有效的低温运输物流服务以维持货物品质的需求日益增长,推动了医药物流市场的成长。

製药业的低温运输供应链和物流正在不断发展,变得更加具有策略性和可靠性。高价值医药产品主要透过分销链中的低温运输解决方案运输,从而推动市场成长。

德国医药出口成长

据德国贸易投资署(GTAI)称,德国是欧洲最大、世界第四大医药市场。该国被认为是全球製药生产强国之一,其丰富的熟练劳动力使製药公司能够专注于其他复杂且具有挑战性的产品,例如生物仿製药,同时保持良好的製造品质。

2023年德国人口约8,450万,是欧盟人口最多的国家。德国市场表现优于义大利、法国和英国市场。德国在全球的医药总分配金额占全球製药业的5.9%。德国拥有超过510家製药公司和超过670家生技公司。疫情开始时,生产的药品和製药设备价值 311 亿欧元(331 亿美元)。

出口额从 2002 年的 500 亿欧元(535 亿美元)成长到 2022 年的 2,870 亿欧元(307 亿美元)。与 2021 年(2,350 亿欧元)相比,2022 年的总额成长了 22%。 2002 年至 2022 年间,进口额从 320 亿欧元(340 亿美元)增至 1,120 亿欧元(119 亿美元),从 2021 年(1,000 亿欧元)到 2022 年成长约 12%。

欧洲医药物流产业概况

欧洲医药物流市场竞争激烈,细分化程度较高,既有区域市场参与者,也有国际市场参与企业。该市场有几家大型企业,包括 DHL Supply Chain、FedEx、Kuehne+Nagel International AG、联合包裹服务公司和 CH Robinson。主要企业包括 Eurotranspharma、Center Specialties Pharmaceutiques、PostNL Pharma & Care 和 Trans-o-Flex Schnell-Lieferdienst GmbH。这些公司正在将自动化、人工智慧、机器学习(AI 和 ML)、区块链和运输管理系统等下一代物流解决方案引入其服务中,以提高供应链生产力、降低成本并避免错误。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

- 分析方法

- 研究阶段

第三章执行摘要

第四章 市场洞察

- 市场概览

- 政府法规和倡议

- 产业技术趋势

- COVID-19 市场影响

- 价值链/供应链分析

第五章市场动态

- 市场驱动因素

- 欧洲一般成药需求不断成长

- 製药公司扩大製造活动

- 市场限制

- 与运送订单相关的高成本

- 市场机会

- 医疗保健领域对居家医疗设备和即时援助的需求增加

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第六章市场区隔

- 按产品

- 学名药

- 品牌药物

- 按操作

- 低温运输运输

- 非低温运输运输

- 按应用

- 生物製药

- 化学品和製药

- 交通方式

- 航空

- 铁路

- 路

- 海运

- 按地区

- 德国

- 英国

- 荷兰

- 法国

- 义大利

- 西班牙

- 波兰

- 比利时

- 瑞典

- 其他欧洲国家

第七章竞争格局

- 市场集中度概览

- 公司简介

- DHL

- FedEx

- Kuehne+Nagel International AG

- United Parcel Service

- CH Robinson

- CEVA Logistics

- DB Schenker

- Agility Logistics

- Eurotranspharma

- CSP*

- 其他公司

第八章 市场机会与未来趋势

第九章 附录

The Europe Pharmaceutical Logistics Market size is estimated at USD 90.30 billion in 2025, and is expected to reach USD 109.44 billion by 2030, at a CAGR of 3.92% during the forecast period (2025-2030).

The demand for pharmaceutical logistics in Europe is mainly driven by the increasing demand for drugs and vaccines, fueled by the COVID-19 pandemic and increasing investments by leading pharmaceutical firms. In order to restore economic growth in Europe and ensure the continued competitiveness of an increasingly competitive world economy, the R&D pharmaceutical sector plays a vital role. Europe invested EUR 44,500 million (USD 48,434 million) in research and development in 2022. It also directly employs about 865,000 people and indirectly generates about three times as many jobs as it now does, upstream and downstream.

Increasing demand for cellular therapies, vaccines, and blood products in the pharmaceutical industry is driving the growth of the region's pharmaceutical logistics market. The increase in demand for reverse logistics in the pharmaceutical sector, the rise in demand for temperature-sensitive pharmaceutical drugs, and the increase in the use of RFID technologies for pharmaceutical logistics are upcoming trends in the European pharmaceutical logistics market.

The growing pharmaceutical sales are expected to propel the growth of the healthcare logistics market. Increasing sales of pharmaceuticals are expected to boost the demand for logistics as the pharmaceutical products or drugs should be stored and transported to pharmacies, drug stores, and others, thus increasing the demand for transportation or healthcare logistics.

Europe Pharmaceutical Logistics Market Trends

Biopharma Sales in Europe is Increasing

Europe is the second-biggest biopharmaceuticals market in the world. The increasing populace and persistent sicknesses are boosting market development. The reception and openness, accessibility of biopharmaceuticals for treating and concluding illnesses, and mindfulness connected with medication have boosted the European market. To ensure the availability of secure and affordable medicines throughout the region for patients and to support the European pharmaceutical industry's ability to remain an innovator and a world leader, the European Commission established a public consultation on its proposed European drug strategy.

Pharmaceutical manufacturers increasingly focus on product quality and sensitivity. Factors such as the development of complex biological-based medicines and shipments of hormone treatments, vaccines, and complex proteins require specific results that require specialized transportation and warehousing. Temperature-controlled logistics of pharmaceutical products and medical devices is a part of the healthcare logistics industry. Moreover, the increase in the need for effective cold-chain logistics services to maintain the quality of goods fuels the growth of the pharmaceutical logistics market.

Cold chain supply chains and logistics for the pharmaceutical industry are evolving to be more strategic and reliable. High-value pharmaceutical products are mainly shipped via cold chain solutions across the entire distribution network, thus driving the market's growth.

Pharmaceutical Exports From Germany Are Increasing

Germany is the largest pharmaceutical market in Europe and the fourth-biggest in the world, as per Germany Trade and Invest (GTAI). The country is considered one of the global driving points for pharmaceutical production, and its large skilled labor force allows pharmaceutical companies to focus on other complex and challenging products, such as biosimilars, while keeping up with good manufacturing quality.

The population of Germany in 2023 was almost 84.5 million inhabitants, making it the most populated country in the European Union. The German market is ahead of the Italian, French, and Great Britain markets. Germany's total global pharmaceutical value allocation accounted for 5.9% of the global pharmaceutical industry. Germany has more than 510 pharmaceutical companies and more than 670 biotech companies. The manufactured medicines and pharma equipment were valued at EUR 31.1 billion (USD 33.1 billion) at the beginning of the pandemic.

Exports increased from EUR 50 billion (USD 53.5 billion) in 2002 to EUR 287 billion (USD 30.7 billion) in 2022. Compared to 2021 (EUR 235 billion), the 2022 total represented an increase of 22%. Imports rose from EUR 32 billion (USD 34 billion) to EUR 112 billion (USD 11.9 billion) between 2002 and 2022, rising by almost 12% from 2021 (EUR 100 billion) to 2022.

Europe Pharmaceutical Logistics Industry Overview

The European pharmaceutical logistics market is highly competitive and fragmented and consists of regional and international market players. A few existing significant players in the market include DHL Supply Chain, FedEx, Kuehne + Nagel International AG, United Parcel Service, and CH Robinson. Some major domestic players include Eurotranspharma, Centre Specialties Pharmaceutiques, PostNL Pharma & Care, and Trans-o-Flex Schnell-Lieferdienst GmbH. These companies are implementing next-generation logistics solutions in their services, such as automation, artificial intelligence, machine learning (AI and ML), blockchain, transportation management systems, and others, to increase supply chain productivity, reduce costs, and avoid errors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Government Regulations and Initiatives

- 4.3 Technological Trends in the Industry

- 4.4 Impact of COVID-19 on the Market

- 4.5 Value Chain / Supply Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Over the Counter Drugs Across the European Region

- 5.1.2 Growing Manufacture Activity from Pharmaceutical Companies

- 5.2 Market Restraints

- 5.2.1 High Cost Associated with the Transportation Ordered

- 5.3 Market Opportunities

- 5.3.1 Increasing Demand for Home Healthcare Devices and Fast Track Assistance in the Healthcare Sector

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Generic Drugs

- 6.1.2 Branded Drugs

- 6.2 By Operation

- 6.2.1 Cold Chain Transport

- 6.2.2 Non-cold Chain Transport

- 6.3 By Application

- 6.3.1 Biopharma

- 6.3.2 Chemical Pharma

- 6.4 By Transportation

- 6.4.1 Airways

- 6.4.2 Railways

- 6.4.3 Roadways

- 6.4.4 Seaways

- 6.5 By Geography

- 6.5.1 Germany

- 6.5.2 United Kingdom

- 6.5.3 The Netherlands

- 6.5.4 France

- 6.5.5 Italy

- 6.5.6 Spain

- 6.5.7 Poland

- 6.5.8 Belgium

- 6.5.9 Sweden

- 6.5.10 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 DHL

- 7.2.2 FedEx

- 7.2.3 Kuehne+Nagel International AG

- 7.2.4 United Parcel Service

- 7.2.5 C.H. Robinson

- 7.2.6 CEVA Logistics

- 7.2.7 DB Schenker

- 7.2.8 Agility Logistics

- 7.2.9 Eurotranspharma

- 7.2.10 CSP*

- 7.3 Other Companies