|

市场调查报告书

商品编码

1690702

液体废弃物管理-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Liquid Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

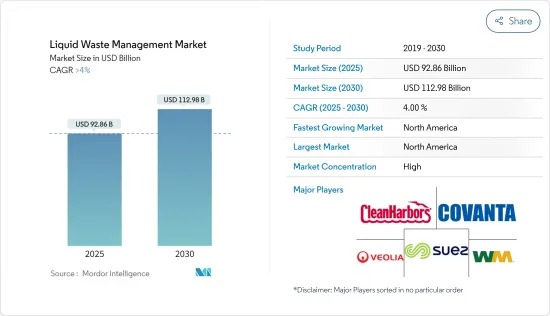

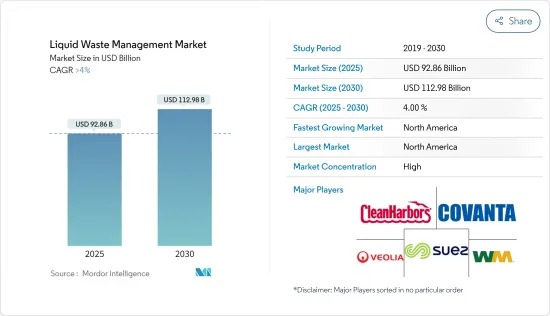

液体废弃物管理市场规模预计在 2025 年为 928.6 亿美元,预计到 2030 年将达到 1129.8 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 4%。

关键亮点

- 由于封锁期间精製减产,全球整体燃料需求下降了约 30%-40%,COVID-19 疫情对市场产生了负面影响。然而,疫情期间对各种药物的需求增加,刺激了废水的产生。目前,市场正从疫情中復苏。预计2022年市场将达到疫情前的水准并持续稳定成长。

- 预计产生有毒化学物质的製造活动的增加将加剧废物管理活动。此外,製药和医疗保健行业的成长也有望推动市场成长。

- 然而,日益增加的技术挑战和严格的废弃物处理法规预计将阻碍市场成长。

- 此外,对处理新兴污染物的日益关注可能为所研究的市场提供机会。

- 北美占据最大的市场,由于建立了与液体废弃物管理相关的严格规范以及与石油和天然气生产相关的活动,预计在预测期内将成为成长最快的市场。

液体废弃物管理市场趋势

石油和天然气领域占市场主导地位

- 石油和天然气产业是最盈利的产业之一。石油和天然气产业满足各行各业、家庭、运输和其他部门的所有能源需求。石油和天然气产业面临环境挑战,主要与污水有关。

- 炼油厂将原油提炼成汽油、柴油、喷射机燃料和煤油等各种馏分,因此耗水量非常高。炼油厂排放的污水包括原油预清洗过程中产生的脱盐水、与原油接触的汽提、分馏过程中产生的酸性水、产品清洗、催化剂再生、脱氢反应等製程用水。

- 此外,石油和天然气行业的耗水量很高,因为各种操作都会产生大量的污水,例如在对管道进行水压试验以确保其安全并检测可能的洩漏时会消耗水压试验水。该过程还涉及使用化学添加剂。因此,静水试验水在排入海洋或地表水之前必须经过处理。

- 此外,石油和天然气产业也利用水进行水力压裂等技术。该过程涉及使用高压水打开岩石緻密层中的裂缝和裂隙,使石油气和精製的石油流入井中进行开采。过程中使用的水通常受到污染,必须经过处理才能丢弃或再利用。

- 根据《BP世界能源统计年鑑2022》预测,2022年全球石油产量为9,390万桶/日,与前一年同期比较成长4%。

- 此外,中国正在增加其原油加工活动,这得归功于该国即将建成的多家炼油厂。例如,2023年3月,沙乌地阿美及其中国合作伙伴计画于2026年在中国东北地区启动一个价值100亿美元的炼油和石化计划,以满足中国对燃料和石化产品日益增长的需求。

- 因此,预计上述因素将在未来几年对市场产生重大影响。

北美占据市场主导地位

- 北美是最大的市场,由于严格的法规的建立和与石油和天然气生产相关的活动的存在,预计北美将成为该时期增长最快的市场。

- 根据美国能源资讯署(EIA)的数据,2023年1月美国原油产量达1,246.2万桶/年,而2022年12月为1,211.5万桶/年。

- 此外,美国能源资讯署预计,2023年美国原油产量平均为1,240万桶/日,2024年为1,280万桶/日。美国是全球传统型原油蕴藏量探勘的主要国家之一,这意味着美国勘探市场存在巨大的机会。

- 汽车工业排放的废液包括废机油和废煞车油。根据OICA预测,2022年美国汽车产量将达到约10,063,390辆,与前一年同期比较增长约10%。

- 此外,液体废弃物管理市场受到美国环保署 (EPA) 和化学品註册、评估、授权和限制 (REACH) 等机构的严格监管。包括 1993 年《环境保护法》在内的多部法律都提到了企业应遵循的准则,例如进行环境影响评估 (EIA) 和编制环境影响声明 (EIS)。

- 因此,预计上述因素将在未来几年对市场产生重大影响。

液体废弃物管理产业概况

液体废弃物管理市场本质上是整合的。市场上的主要企业(不分先后顺序)包括 SUEZ、Veolia、CLEAN HARBORS, INC.、Covanta Holding Corporation 和 WM Intellectual Property Holdings, LLC。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 製药和医疗产业的成长

- 由于涉及危险化学品的製造活动增加,废弃物管理范围扩大

- 其他驱动因素

- 限制因素

- 日益严峻的技术挑战

- 严格的废弃物处理规定

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按来源

- 住宅

- 商业的

- 产业

- 服务

- 收藏

- 交通运输

- 处置/回收

- 最终用户产业

- 车

- 钢

- 石油和天然气

- 製药

- 纤维

- 其他终端用户产业(纸浆和造纸、食品和饮料等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- CLEAN HARBORS, INC.

- Cleanaway

- Covanta Holding Corporation

- Enva

- GFL Environmental Inc.

- Hulsey(a Blue Flow Company)

- Ovivo

- REMONDIS SE & Co. KG

- SUEZ

- Veolia

- WM Intellectual Property Holdings, LLC

第七章 市场机会与未来趋势

- 日益严重的全球水危机为液体废弃物管理创造了新的机会

- 更重视处理新兴污染物

简介目录

Product Code: 71005

The Liquid Waste Management Market size is estimated at USD 92.86 billion in 2025, and is expected to reach USD 112.98 billion by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

Key Highlights

- The COVID-19 pandemic negatively impacted the market as petroleum refinery units cut their production throughput, and the demand for fuel decreased by about 30% to 40% globally during the lockdown. However, the demand for various pharmaceutical products increased during the pandemic, thereby enhancing the production of liquid wastes. Currently, the market has recovered from the pandemic. The market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- The increasing manufacturing activities that generate toxic chemicals are anticipated to enhance liquid effluent management activities. Also, the growth in the pharmaceutical and healthcare industry is expected to drive the market's growth.

- On the flip side, increasing technological challenges and stringent waste processing regulations are expected to hinder the market's growth.

- Further, the increasing focus on treating emerging contaminates is likely to provide opportunities to the market studied.

- The North American region represents the largest market, and it is also expected to be the fastest-growing market over the forecast period due to the enactment of stringent norms pertaining to the management of liquid waste and the presence of activities related to oil and gas production.

Liquid Waste Management Market Trends

Oil and Gas Segment to Dominate the Market

- The oil and gas industry is among the most profitable industries. It meets all the energy demands across various industries, households, transportation, and other sectors. The oil and gas industry is facing environmental concerns, mainly with wastewater.

- In refineries, the water consumption rate is very high for distilling crude into various fractions, such as gasoline, diesel, jet fuel, and kerosene. Several wastewater streams are coming out of refineries, which typically include desalter water generated from washing raw crude before topping, sour water from steam stripping, and fractionating that comes in contact with crude, process water generated from product washing, regenerating catalyst, and dehydrogenation reactions.

- Further, the oil and gas industry has a high water consumption rate, as it generates a large amount of wastewater in various operations, such as in hydrostatic testing water, which is consumed in the hydrostatic testing of pipelines to ensure pipeline safety and find any possible leaks. The process also includes the usage of chemical additives. Hence, hydro-test water should be treated before disposal into the sea or surface water.

- Furthermore, in the oil and gas industry, water is employed in technologies like hydraulic fracturing. In this process, high-pressure water is used to open up the cracks or fractures into the tight formations of rocks, permitting petroleum gas and unrefined petroleum to stream to a well for recovery. The water used in the process often gets contaminated, and it needs to be treated for either disposing of or reuse.

- According to the BP Statistical Review of World Energy 2022, global oil production amounted to 93.9 million barrels per day in 2022, representing an increase of 4% compared to the previous year.

- Further, China is increasing crude oil processing activities, which will be supported by following various upcoming refineries in the country. For instance, in March 2023, Saudi Aramco and its Chinese partners plan to start a full 10 USD billion refinery and petrochemical project in northeast China in 2026 to meet the country's growing demand for fuel and petrochemicals.

- Therefore, the factors above are expected to show a significant impact on the market in the coming years.

North America to Dominate the Market

- North America represents the largest market, and it is also expected to be the fastest-growing market over the period due to the enactment of stringent norms and the presence of activities related to oil and gas production.

- According to the US Energy Information Administration (EIA), crude oil production in the United States reached 12,462 thousand barrels in January 2023, compared to 12,115 thousand barrels annually in December 2022.

- Further, EIA forecasted that crude oil production in the United States will average 12.4 million barrels per day (b/d) in 2023 and 12.8 million b/d in 2024. The United States is one of the leading countries globally in terms of exploration of unconventional crude oil reserves, indicating a huge opportunity for the studied market in the country.

- Some of the liquid waste produced by the automotive industry includes used motor oil and used brake oil fluid. According to OICA, in 2022, around 10,060,339 vehicles were produced in the United States, witnessing an increasing growth rate of about 10% compared to the previous year.

- Moreover, the liquid waste management market is very well regulated by agencies like the Environmental Protection Agency (EPA) and the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH). Several laws, including the Environmental Protection Act of 1993, mentioned guidelines to be carried out by companies, including undertaking Environmental Impact Assessment (EIA) and preparing Environmental Impact Statement (EIS).

- Therefore, the aforementioned factors are expected to impact the market in the coming years significantly.

Liquid Waste Management Industry Overview

The liquid waste management market is consolidated in nature. The major players in the studied market (not in any particular order) include SUEZ, Veolia, CLEAN HARBORS, INC., Covanta Holding Corporation, and WM Intellectual Property Holdings, L.L.C., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growth in the Pharmaceutical and Healthcare Industry

- 4.1.2 Increased Manufacturing Activities Containing Toxic Chemicals Leading to Growing Liquid Effluent Management

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Technological Challenges

- 4.2.2 Stringent Waste Processing Regulations

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Source

- 5.1.1 Residential

- 5.1.2 Commercial

- 5.1.3 Industrial

- 5.2 Service

- 5.2.1 Collection

- 5.2.2 Transportation/Hauling

- 5.2.3 Disposal/Recycling

- 5.3 End-user Industry

- 5.3.1 Automotive

- 5.3.2 Iron and Steel

- 5.3.3 Oil and Gas

- 5.3.4 Pharmaceutical

- 5.3.5 Textile

- 5.3.6 Other End-user Industries (Pulp and Paper, Food and Beverages, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 CLEAN HARBORS, INC.

- 6.4.2 Cleanaway

- 6.4.3 Covanta Holding Corporation

- 6.4.4 Enva

- 6.4.5 GFL Environmental Inc.

- 6.4.6 Hulsey (a Blue Flow Company)

- 6.4.7 Ovivo

- 6.4.8 REMONDIS SE & Co. KG

- 6.4.9 SUEZ

- 6.4.10 Veolia

- 6.4.11 WM Intellectual Property Holdings, L.L.C.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Rising Water Crisis Globally is Creating New Opportunities for Liquid Waste Management

- 7.2 Increasing Focus on Treating Emerging Contaminates

02-2729-4219

+886-2-2729-4219