|

市场调查报告书

商品编码

1690708

铷:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Rubidium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

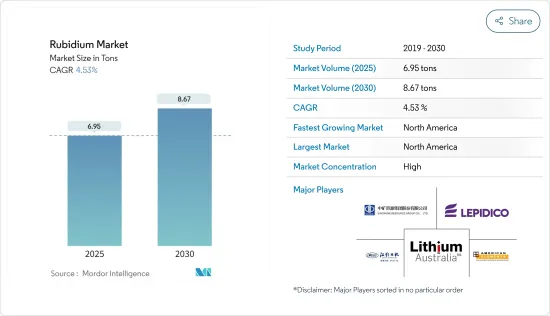

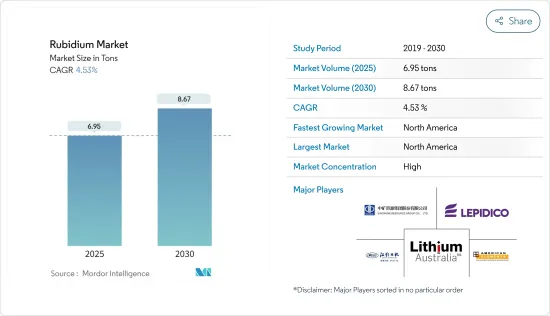

铷市场规模预计在 2025 年为 6.95 吨,预计在 2030 年达到 8.67 吨,预测期内(2025-2030 年)的复合年增长率为 4.53%。

新冠疫情对铷的需求产生了负面影响。生物医学研究领域因疫情受到不利影响,生物製药技术的新进展放缓。铷市场已从疫情中恢復并正在经历强劲成长。

主要亮点

- 短期内,推动所调查市场成长的主要因素是生物医学研究应用的成长。

- 然而,除了与运输和储存相关的安全问题之外,可用性和高成本是预计对研究市场产生重大影响的两个挑战。

- 然而,铷手錶日益增长的重要性代表着预测期内铷市场的巨大成长机会。

- 由于产量规模庞大,北美预计将成为铷的最大市场。

铷市场趋势

特种玻璃占市场主导地位

- 特种玻璃是铷的主要市场,铷用于光纤通讯系统和夜视设备。碳酸铷(Rb2CO3)作为此类玻璃的添加剂,以降低其电导率并提高其稳定性和耐用性。

- 碳酸铷用于降低电导率,提高光纤通讯网路的稳定性和耐用性。

- 根据欧洲资讯科技观察站 (EITO) 的数据,预计 2022 年通讯服务收入将达到约 488 亿欧元(519.9 亿美元),而 2021 年为 484 亿欧元(515.7 亿美元)。

- 根据电讯(ITU)的预测,到2021年,行动电话用户数将从2020年的83亿增加到86亿。

- 铷碲光电发射表面用于光电管并併入各种电子检测和启动装置中。它对从中紫外到可见光和近红外线的广泛频谱都有灵敏度。

- 碳酸铷也用于玻璃镜片和夜视设备。铷用作真空管中的吸气剂和光伏电池中的组成部分。铷也用于生产特殊玻璃。

- 预计所有上述因素都将推动特种玻璃的发展,从而推动预测期内对铷的需求。

北美占比最大

- 从市场占有率和收入来看,北美占据铷市场的大部分份额。预计该地区在预测期内将继续保持主导地位。

- 铷主要从美国盐湖的盐水中提取,卡博特是主要企业。此外,加拿大是世界五大铷矿和铷盐生产国之一。

- 加拿大马尼托巴湖上的伯尼湖矿区向美国和其他国家供应原始铷盐。该地区开采的矿石出口到多个国家。

- 美国是最早生产和使用铷的国家之一。在美国,铷主要用于高科技产业,其中80%用于创造高科技,20%用于电子、特殊玻璃和催化等传统领域。

- 然而,没有关于消费、出口或进口的资料。根据过去10年的产业资料,国内消费量每年约2,000公斤。美国完全依赖进口用于电子、医疗保健和特殊玻璃等各种应用领域的铷材料。

- 美国电子产品市场是世界上最大的市场。此外,它是所研究市场的主要潜在市场之一。此外,由于先进技术的使用、研发中心数量的增加以及消费者需求的不断增长,预计在预测期内它仍将保持领先市场地位。

- 由于电子产业创新、技术进步和研发活动的快速发展,对更新、更快的电子产品的需求庞大。

- 据消费技术协会称,美国消费性电子产品(CE)市场的零售额正在稳步增长。 2022年,美国消费性电子产品零售额将达5,050亿美元。到2022年,智慧型手机将成为收入最高的消费性产品类型,零售额将达到747亿美元。排在第二位的是视讯串流服务,第三位是游戏软体和服务。

- 美国医疗设备公司因其创新的高科技产品而受到全世界的认可。医疗设备产业依赖美国具有竞争优势的几个领域,包括微电子、通讯、仪器和生物技术。

- 因此,所有上述因素都可能在预测期内增加对铷市场的需求。

铷行业概况

铷市场正在整合,顶级公司在全球范围内占据了相当大的市场占有率。市场参与企业包括 American Elements、Sinomine Resource Group、江西特种汽车、Lepidico Ltd 和 Lithium Australia NL。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 生物医学应用的成长

- 特殊玻璃应用

- 限制因素

- 铷的可用性和高成本

- 运输和储存安全问题

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 生产流程

- 锂云母

- 铯榴石

- 其他製造工艺

- 应用领域

- 生物医学研究

- 电子产品

- 特种玻璃

- 烟火

- 更多应用领域

- 地区

- 亚太地区

- 北美洲

- 欧洲

- 世界其他地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- American Elements

- Ganfeng Lithium

- International Lithium Corp.

- Lepidico

- Jiangxi Special Electric Motor

- Lithium Australia

- Merck Kgaa

- Sinomine Resource Group

- Thermo Fisher Scientific

第七章 市场机会与未来趋势

- 铷手錶的重要性日益增加

The Rubidium Market size is estimated at 6.95 tons in 2025, and is expected to reach 8.67 tons by 2030, at a CAGR of 4.53% during the forecast period (2025-2030).

The COVID-19 pandemic negatively affected the rubidium demand. The biomedical research sector is adversely affected because of the pandemic, which slowed down new advancements in biopharmaceutical technology. The rubidium market recovered from the pandemic and is growing significantly.

Key Highlights

- Over the short term, the primary factor driving the growth of the market studied is its growth in biomedical research applications.

- However, apart from transportation and storage-related safety difficulties, availability and high cost are two challenges expected to impact the market studied significantly.

- Nevertheless, the growing significance of the rubidium atomic clocks is a significant growth opportunity for the rubidium market over the forecast period.

- North America is expected to be the largest rubidium market due to the large-scale production in the region.

Rubidium Market Trends

Specialty Glass to Dominate the Market

- Speciality glasses, which constitute the leading market for Rubidium, are used in fibre optics telecommunications systems and night-vision devices. The carbonate (Rb2CO3) is used as an additive to these types of glass, reducing electrical conductivity and improving stability and durability.

- Rubidium carbonate is used to reduce electrical conductivity, which improves stability and durability in fibre optic telecommunications networks.

- According to the European Information Technology Observatory (EITO), telecommunications services generated revenue of around EUR 48.8 billion (USD 51.99 billion) in 2022, compared to EUR 48.4 billion (USD 51.57 billion) in 2021.

- According to The International Telecommunication Union (ITU), mobile subscribers will have exceeded 8.6 billion by 2021, compared to 8.3 billion in 2020.

- A rubidium-tellurium photoemissive surface is used in photoelectric cells and incorporated into various electronic detection and activation devices. It is sensitive to a broad spectrum of radiation from the mid-ultraviolet through the visible into the near-infrared.

- Rubidium carbonate is also applied in glass lenses and built-in night vision devices. Rubidium is used as a getter in vacuum tubes and as a photocell component. It is used in making special glasses.

- All the factors above are expected to drive specialty glass, enhancing the demand for Rubidium during the forecast period.

North America Accounted for the Largest Share

- North America holds a significant share of the rubidium market in terms of market share and revenue. The region will continue to flourish in its dominance over the forecast period.

- Rubidium was mainly extracted from salt lake brine in the United States, with Cabot as the leading company. Moreover, Canadian rubidium ore and rubidium salt production are in the world's top five.

- The Bernie Lake mining area in Lake Manitoba, Canada, supplies the raw materials to produce rubidium salt in the United States and other countries. The ore mined in this area is exported to several countries.

- The United States was one of the first countries to produce and use rubidium. In the United States, rubidium is mainly employed in the high-tech industry, with 80% used in creating high-tech and 20% used in traditional fields, such as electronic devices, special glass, and catalysts.

- However, data on consumption, export, and import are not available. According to industry data from the last decade, domestic consumption is around 2,000 kg per year. The United States entirely relied on imported rubidium materials used in different applications, such as electronics, healthcare, specialty glasses, etc.

- The US electronics market is the largest in the world in terms of size. Moreover, it is one of the leading potential zones for the market studied. Furthermore, it is expected to remain the top market over the forecast period due to the usage of advanced technology, increased number of R&D centers, and rising consumer demand.

- There is a significant demand for newer and faster electronic products due to the rapid pace of innovation, technology advancement, and R&D activities in the electronics industry.

- According to the Consumer Technology Association, the retail revenue of the consumer electronics (CE) market in the United States expanded steadily. Consumer electronics retail sales in the United States reached USD 505 billion in 2022. Smartphones were the goods with the highest retail revenue in the consumer electronics category, with USD 74.7 billion in 2022. Video streaming services came in second, followed by gaming software and services.

- Medical device companies in the United States are highly regarded globally for their innovative and high-technology products. The medical device industry relies on several sectors where the United States holds a competitive advantage, including microelectronics, telecommunications, instrumentation, and biotechnology.

- Thus, all the above factors will likely increase the rubidium market demand during the forecast period.

Rubidium Industry Overview

The rubidium market is consolidated, with the top companies capturing a significant market share globally. Some of the players in the market include American Elements, Sinomine Resource Group Co. Ltd, Jiangxi Special Motor Co. Ltd, Lepidico Ltd, Lithium Australia NL, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Biomedical Applications

- 4.1.2 Applications in Specialty Glass

- 4.2 Restraints

- 4.2.1 Availability and High Cost of Rubidium

- 4.2.2 Transportation and Storage-Related Safety Difficulties

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Production Process

- 5.1.1 Lepidolite

- 5.1.2 Pollucite

- 5.1.3 Other Production Processes

- 5.2 Application Sector

- 5.2.1 Biomedical Research

- 5.2.2 Electronics

- 5.2.3 Specialty Glass

- 5.2.4 Pyrotechnics

- 5.2.5 Other Application Sectors

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.2 North America

- 5.3.3 Europe

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 American Elements

- 6.4.2 Ganfeng Lithium

- 6.4.3 International Lithium Corp.

- 6.4.4 Lepidico

- 6.4.5 Jiangxi Special Electric Motor

- 6.4.6 Lithium Australia

- 6.4.7 Merck Kgaa

- 6.4.8 Sinomine Resource Group

- 6.4.9 Thermo Fisher Scientific

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Significance for the Rubidium Atomic Clocks